Mr Sanjeev, the CTO of a boutique tech firm has been closely watching the market and investment trends since the COVID-19 pandemic began. He had a surplus of Rs 50,00,000 to invest and was hunting for investment opportunities.

He noticed that each asset class responded differently to the new economic reality. Gold, often touted as a haven, gained investor interest. Following the Franklin incident, fixed income flows flooded short-term high-quality papers. Returns appeared modest. Real estate prices were expecting a slump as distressed deals rose. Meanwhile, equity valuations hit extreme lows and had shown steady recovery since.

Sanjeev has sufficient exposure to physical gold in his portfolio. He also maintained large contingency reserves to combat any financial emergency. He is quite secure in his job and is even expecting a raise. With the near-term taken care of, Sanjeev’s primary goal for the Rs 50,00,000 is long term capital appreciation. He would certainly not need the money for at least the next 5 years.

He narrowed in on real estate or equity as long-term assets with high return potential. So, Sanjeev decided to dig deeper and decide which one would be more lucrative.

Reasons to Invest in PMS Versus Real Estate

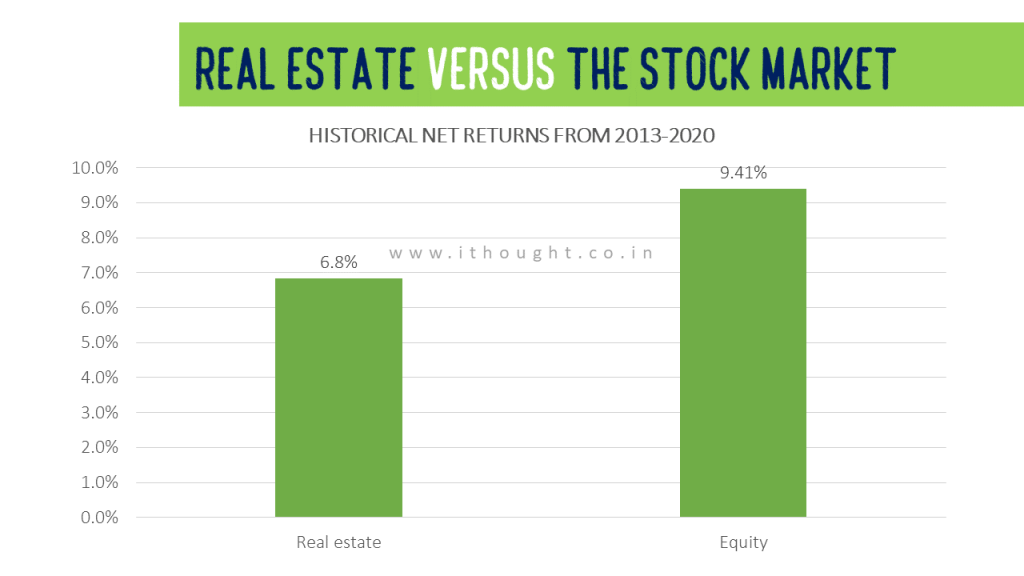

He started off by seeing how these asset classes have fared in the past.

Based on his findings and applying simple math, he found that had he invested Rs 50,00,000 in 2013, his investment value today, post taxes would have been Rs 79,24,000. Whereas, an investment in a simple index fund – Nifty 50 would have compounded to Rs 93,77,000 post taxes.

He realised that over the last 7 years, equity investors made around Rs. 14,50,000 more than real estate investors and enjoyed a whopping 29% higher absolute return on investment.

Sanjeev kept in mind that these numbers were based on passive index investing. Active investing in equity through expert stock selection could beat benchmarks and produce an even higher return on investments. Amongst the available equity investment options, his best fit would be a quality portfolio management service.

Which is better – Real Estate Investment or PMS (Portfolio Management Services)?

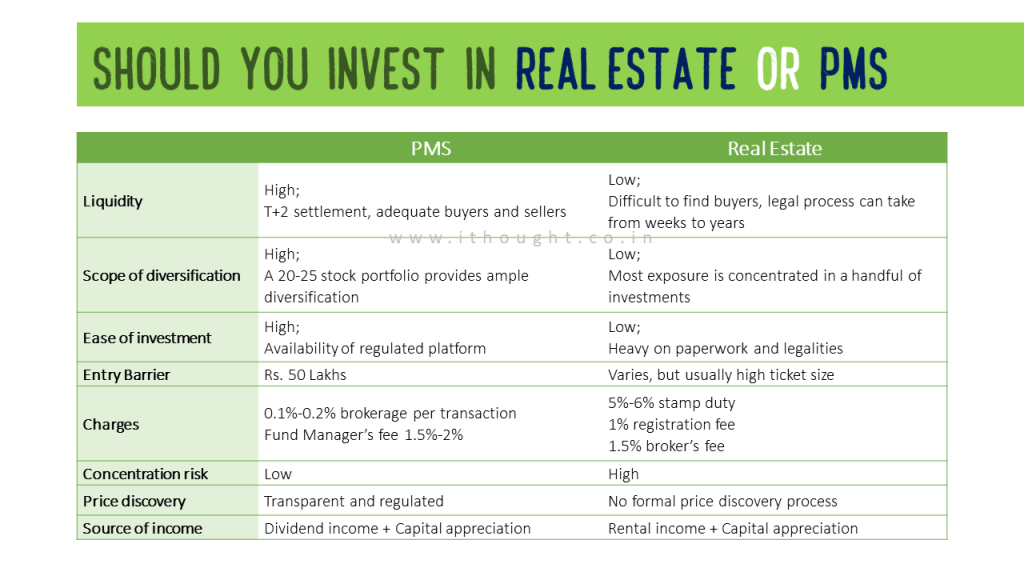

Real estate had its own charm. So many investors swore by it. So, he decided to look beyond returns and delved further into comparing Real Estate with a Portfolio Management Service.

On many parameters, a PMS scored better than real estate. But Sanjeev wasn’t convinced – there was more comfort in owning a tangible property than owning stocks. So, he decided to speak to his CEO, Manav. Manav dabbled in purchasing houses and office spaces as investments. He was also an active equity investor.

Challenges faced by Real Estate Investors

Sanjeev was shocked by Manav’s experience as a real estate investor. He had no idea that owning properties could be this challenging.

Legal and regulatory headwinds

Manav found investing in real estate time consuming and full of various legal and regulatory requirements. The absence of a regulated platform also made it difficult to connect buyers and sellers and determine the right price. He was always anxious of getting short-changed or overpaying for his purchase.

Return On Investment

Manav didn’t factor in the hidden expenses in buying a house. He had to pay stamp duty which ranged from 5%-6% of the property guidance value, a separate registration fee (usually around 1% of property guidance value), and surcharges and cess. Manav opted to use a broker for a smoother process and shelled out an extra 1.5% for the broker’s commission. This, of course, did not include costs like maintenance, repairs or property taxes.

Manav also expressed his disappointment with the rent he was earning on his residential properties. Rental yields in India fall on the lower side within 3-4% as opposed to developed markets where the average is 8%-10%. Investing in real estate as a source of regular income is not yet an attractive option in India. Manav also highlighted the hassle he faced while searching for prospective tenants. Of late, rental inflows had become irregular as his tenant has been struggling with cash flows.

Limited Diversification

Manav pointed out to Sanjeev that he was already overweight on real estate exposure by way of owning a house and some farmland. The value of Sanjeev’s real estate holdings already formed 70% of his total savings and investments. Concentration risk is also higher as diversification in real estate is tougher due to the high-ticket size requirement for each investment. Such investments are suited for investors with high-risk appetites or if the assets are deployed for regular use.

Real Estate Investment Trends

Upon comparing the house rent he earned with the rent he paid for his office premises, Manav felt that investment in commercial real estate had higher rental yields. Sanjeev, however, was wary of investing in commercial real estate. The future of commercial office spaces seemed uncertain as the work from home trend caught fire.

Tax Implications

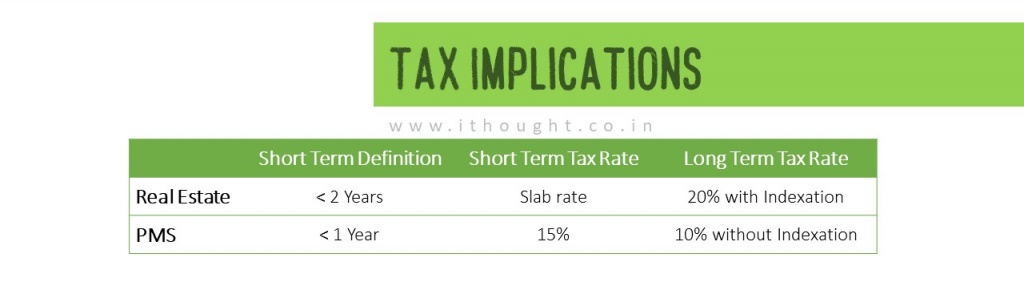

Due to the low rental yields coupled with a higher tax outlay, net returns in real estate are significantly lower than equity benchmarks. Taxation of real estate is higher than that of equity.

Advantages of Investing in Portfolio Management Services (PMS)

Transparent Holdings

Investors in a portfolio management service are furnished with periodic transparent holding statements. They can view their portfolio and ascertain their exact value of the investment as on the date of the statement.

Ease of investment

An investor requires only basic identification proof (PAN, Aadhar) to get started on a portfolio management service. Account opening is a matter of 1-2 weeks. Following which the process is more regulated and streamlined.

Portfolio Performance

Investing in good quality, well managed, active equity PMS can provide scope for higher returns as opposed to real estate. The reduced long-term tax rate is also a huge boost to overall net returns. A portfolio of companies with strong cash flows and a history of issuing dividends can create income.

Lower fee and transaction charges

Investing in a PMS has no upfront charges. Most PMS charge a fixed fee between 1.5%-2% of the total invested amount. When you choose a PMS with no performance fee, you take home more of the pie. Brokerage and transaction charges are also on the lower side usually ranging from 0.1% – 0.2%.

Expert stock selection

A PMS is managed by a fund manager who is qualified in equity investing and has expert knowledge in doing the same. A fund is only as good as its fund manager. As Sanjeev did not have much expertise in investing in equities, Manav strongly recommended opting for a PMS. Fund managers with adequate investing experience, industry expertise, a notable track record, and skin in the game could make all the difference!