Our Services

Month on month Performance - Since Inception

No Data Found

Multi Cap PMS With Consistent Compounding

How 700+ investors experience consistent performance with a multi cap PMS

Giridhar Krishnan

I joined Solitaire PMS in May 2021. I am extremely pleased with the overall experience. The performance has been very good as all would know. But more than that is their approach to investment.

They are in sync with their investors. They don't believe in increasing the corpus for growth's sake. Their call for additional investments have been cautious and well-meaning. They have the interest of the investor foremost. I would have no hesitation in recommending their name to anyone who would ask me.

Arunachalam Kumar

Proful Vaid

T. K. Ramkumar

Anshuman Srivastava

Viswanath

Flexicap PMS fund strategies for wealth growth

Investors want consistent performance, dislike volatility, and prefer investments that are easy on the pocket. Our flagship portfolio management service Solitaire resolves these issues. Solitaire uses the principles of value investing to deliver consistent and sustainable returns.

A typical Solitaire portfolio is focused, contains out-of-favour and forward-looking sectors, and invests in businesses that are superior capital allocators with higher growth metrics. Solitaire is a portfolio where every stock is a diamond in the rough.

Customized PMS Investment

Solitaire does not follow a model portfolio approach. Instead, it is committed to a philosophy of contrarian and value investing. Valuations are dynamic and require an approach that adapts to market conditions instead of following a template. Solitaire adds value to investors through cash calls – initial deployment is opportunistic and gradual. This superior investment experience instils confidence in investors to participate more. It brings out the right investment behaviour in every investor.

Risk management in multi-cap PMS investments

Solitaire has robust risk management processes in place. The scheme has weathered two waves of COVID-19, extreme market volatility, wars, an inflation spiral, and political uncertainty. The principles of value and contrarian investing ensure that investors participate in the best businesses at great prices. This limits the downside and frees up the upside.

Low Cost Investing PMS

Investors believe that without a performance fee, a fund manager isn’t incentivised to be aggressive. Solitaire does away with the performance fee because risky investing doesn’t always translate into high returns. What translates into high returns is good stock picking, clean portfolio construction, and longer gestation periods. Solitaire is a portfolio where the lion’s share of the profits stays with the investor. Solitaire charges a flat fee of 1.5% p.a. on assets under management and is among the most cost-effective options for a

Solitaire: PMS With Best Compounding

Solitaire is a steady state trusted by more than 700 investors as a vehicle for wealth creation. In April 2024, Solitaire ranked second in PMS Bazaar’s list of best-performing multi-cap PMS schemes.

The Solitaire process was built over a decade with iterative improvements for investors seeking superior risk-adjusted alpha in the long run. The most invaluable form of alpha is peace of mind. Solitaire is committed to making your investment journey profitable, peaceful, and productive.

Solitaire Investment Philosophy:

At Solitaire, we believe that risk management is return management. This allows investors to experience low risk investing deliver better returns. Solitaire PMS achieves this high-quality non-consensus and bottom-up investing. The focus is identifying industry leaders in out of favour sectors at attractive valuations. A Solitaire company typically is run by a strong leadership team with an excellent execution track record and operates in industries with high growth metrics. Contrarian investing ensures that the portfolio manages risk effectively by maintaining a long-term vision. Our approach to bottom up investing is value oriented. We believe that value investing can never go out of style and paying attention to valuations protects investors from the downside while capturing the upside. What we don’t do is as important as what we do. Solitaire avoids highly leveraged companies. Solitaire does not speculate or participate in IPOs.

For the long-term investor, their Solitaire portfolio would contain a few big winners, multiple optimum performers, and a few losers that are trimmed out. The investor’s participation determines the level of portfolio customisation. Solitaire buys investments in an opportunistic manner – this delivers better long-term results for investors.

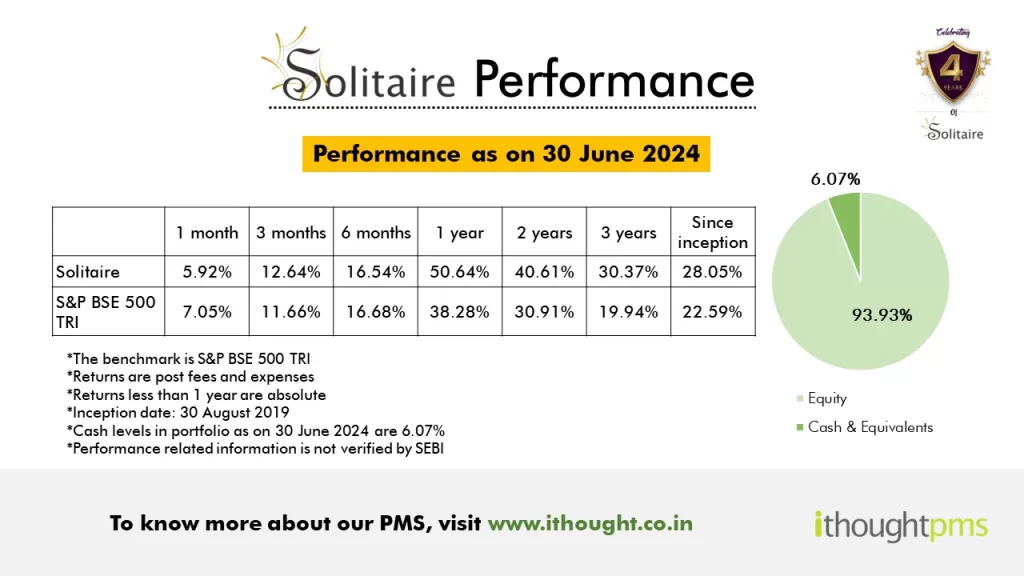

Solitaire Performance - June 2024

TERMS OF INVESTMENTS

|

|

|

|---|---|

|

Minimum investment

|

₹ 50,00,000

|

|

Suitability

|

For investors with moderate/high risk appetite and expectations over a period of 3 to 5 years.

|

|

Fees

|

Fixed fee of 1.5% p.a. of AUM computed on daily average portfolio value charged on a quarterly basis. All other expenses at Actuals. (Fees Excl. GST).

|

|

Exit Terms

|

Exit Load as prescribed by SEBI. First year exit load at 3%; second year 2%, third year – 1%. Performance Fee and other Charges will be calculated on a Pro-rata basis and charged.

|

|

Market Cap Focus

|

Multi-cap Fund

|

|

Benchmark

|

S&P BSE 500 TRI

|

Frequently Asked Questions

The fund is managed by Mr. Shyam Sekhar. Mr. Shyam Sekhar has 3 decades of investing experience in franchisee based high growth businesses. He follows a theme-based approach to investing. His past successes have been identifying emerging themes to the changing economic context, investing early and realising the full potential of the investment theme. His strengths include exposure to multiple industries as a research analyst and managing large sized proprietary portfolios across market cycles.

Exit load of 3% for the first year. 2% for the second year. 1% for the third year. NIL for after 3 years.

Solitaire will be driven by the core principles of value investing. We believe seeking early entrée into businesses of the future would capture intrinsic value early enough to generate superior returns. There will be low churn in the portfolio and a buy and hold strategy will be followed.

The investment framework we have created for Solitaire ensures that prudent portfolio management is sustained. We have tested this framework for an extended time period across the last market cycle. Its robustness and sustained risk mitigation has given us confidence that we will be able to create a low-volatility product for our investors. We avoid concentration risk by ensuring single sector restriction in the fund will be capped at 55% and single stock exposure will not be more than 25% at any given time.

Solitaire aims to invest in well managed, growth driven companies with proven business models which are good capital allocators.

The fund does not have a model portfolio. While majority of the portfolio will look alike, a few stocks may vary from one portfolio to another based on when an investor begins his investment and valuation comforts at the time.

There are no sectoral restrictions as we follow a bottom-up approach to stock picking. In terms of market capitalisation, the fund will not invest in companies with a market cap of less than Rs. 1000 crores.