Our Services

Month on month Performance - Since Inception

No Data Found

Who does TruBlu Suit?

TruBlu is meant for the disciplined investor who wants to experience high quality investing with lower drawdowns.

Dr T S Senthil Kumar

Blue chip funds India

How easy is it for conservative equity investors to find a true to label bluechip investment solution? In today’s investing climate, bluechip investing often contains elements of other investment styles. Investors find themselves in passive products, misleading ones, or expensive ones.

With TruBlu you own the bluest of blue chips and nothing else. Investors pay only for performance and benefit from active management.

Buying blue chips at any price or at any time doesn’t create wealth. This is a time-tested proof. TruBlu adds value to bluechip investing by maintaining a high active share. The endeavour is to buy the best companies at the right valuations. Following a disciplined approach with valuation delivers alpha. Fund manager discretion ensures that investors participate in the right bluechip ideas at the right time and in the right amount.

We believe that wealth creation and wealth preservation through bluechip investing should be enjoyable. TruBlu is designed for investors to experience lower drawdowns and better risk-adjusted returns. Classic buy and hold investing results in low churn and better post tax returns.

TruBlu: Low Risk PMS with Low Volatility

Trublu stands out from traditional large cap funds and portfolio management services for a variety of reasons. First, TruBlu has a well-defined investment universe of the best large cap stocks. This ensures that TruBlu portfolios score high on quality. Second, we follow a buy and hold strategy. This approach results in more tax efficient long-term returns. Third, the funds are actively managed both in terms of cash calls and position sizing. The aim is to deliver better risk adjusted returns which reflect in TruBlu’s lower beta and drawdown statistics.

No Performance Fee Or 0% Fixed Fees: Your Choice

TruBlu is designed for investors to choose how they want to reward performance. There are two fee options. One that allows investors to pay only for performance and another that charges only a flat fee and no performance fee. TruBlu has no exit load.

Option 1: 0% Fixed Fee + Performance Fees of 20% profit share above a hurdle of 6%, no catch up.

Option 2: 1.00% Fixed Fee (excluding GST and other expenses)

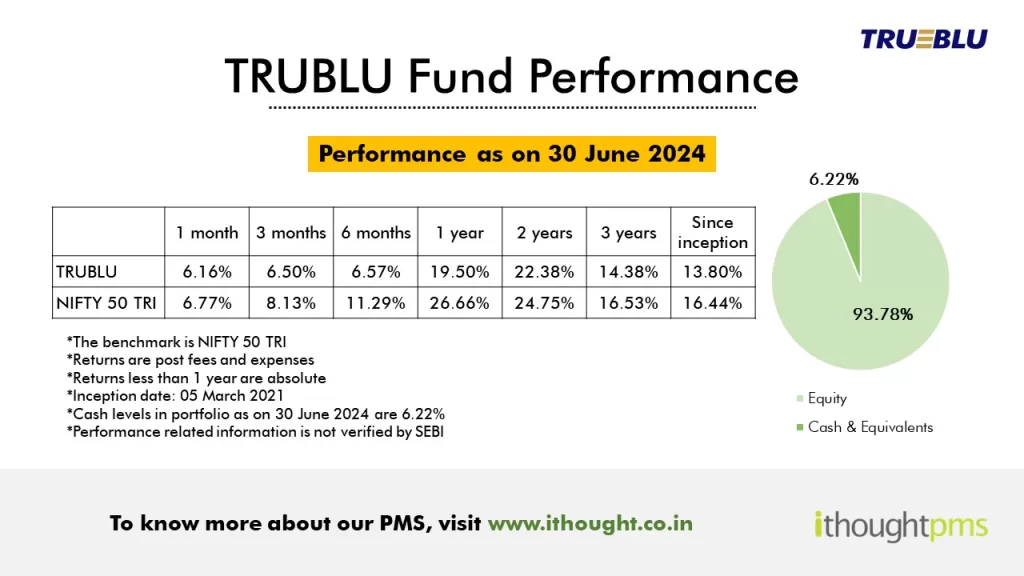

TRUBLU Performance - June 2024

TERMS OF INVESTMENT

|

|

|

|---|---|

|

Minimum investment

|

₹ 50,00,000

|

|

Benchmark

|

NIFTY 50 TRI

|

|

Exit Terms

|

NIL

|

|

Fees

|

Option 1: 0% Fixed Fee + Performance Fees of 20% profit share above a hurdle of 6%, no catch up.

Option 2: 1.00% Fixed Fee (excluding GST and other expenses) |

|

Single Stock Exposure

|

Not to exceed 25% of the total NAV of the portfolio.

|