2024 is the year for fixed income investing. Last month, we talked about the 4 types of investors who need to allocate to fixed income today. The window of opportunity is open, and investors shouldn’t spend too much time contemplating over their choices. The time to act is now.

So far, the most pivotal element in the monetary policy framework is inflation. While inflation has cooled significantly from 2021, there are some signs of stickiness. Now, central banks are looking beyond inflation. The Fed has an eye on unemployment, the ECB has raised concerns about a slowdown in economic activity, and will the RBI shift focus to other priorities? Come and revisit the inflation story with us this month!

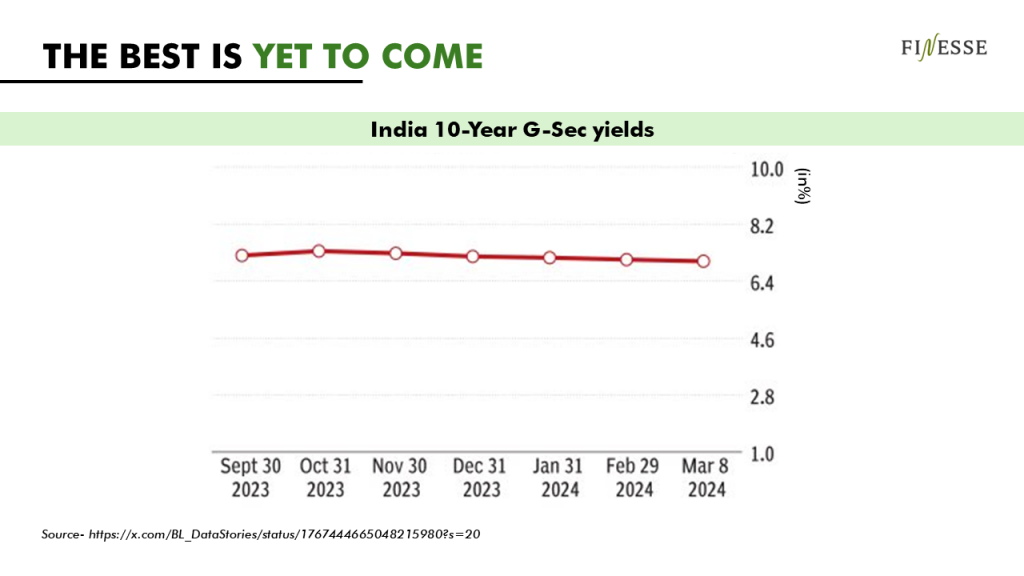

Building A Case For Fixed Income: The Best Is Yet To Come

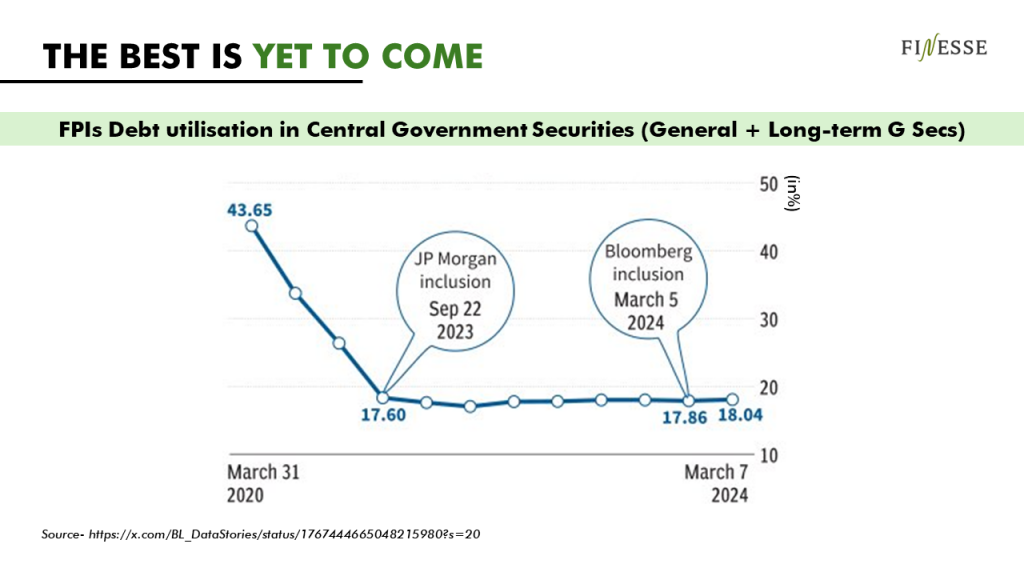

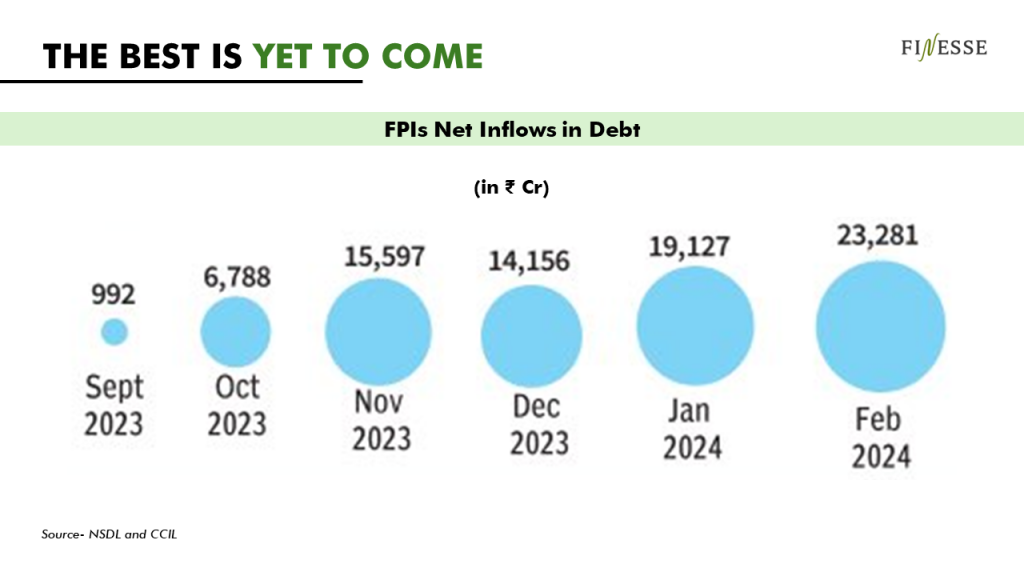

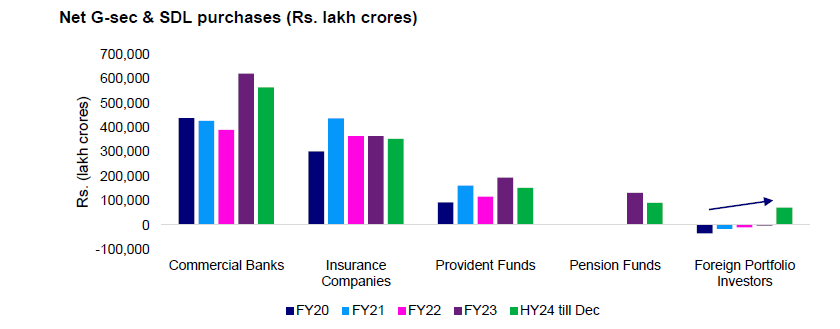

The demand for Indian government securities is growing. Businessline published an analysis on how the best is yet to come. Despite bond index inclusion, growing FII participation in government securities, and low debt utilisation for FII and FPI, yields haven’t moved at all. Both Invesco and DSP as Mutual Fund Houses expect the demand for government securities to grow as Life Insurance Companies, Provident Funds, and Pension Funds participate more in the last leg of the financial year.

Monetary Policy: Challenging Times Ahead

The Fed is prepared for more challenging times ahead. While Chair Powell has always been committed to tackling the inflation problem head on, unemployment has been on the backburner. With unemployment numbers looking less promising, the Fed will be combatting two powerful forces that are pulling interest rates in opposite directions.

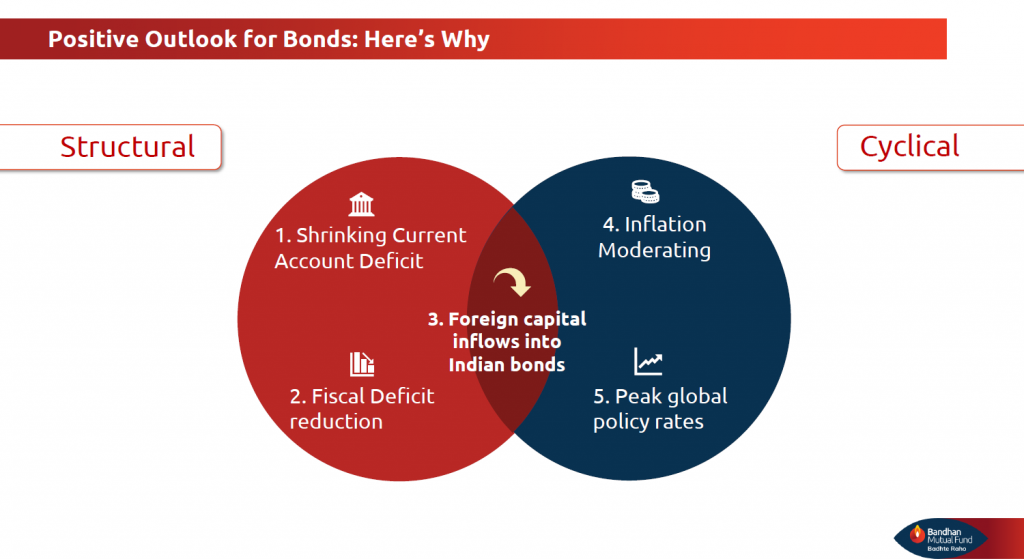

The RBI has a comparatively easier task on hand. Inflation has been cooling. Macros look more supportive: the current account deficit is narrowing, oil prices have been stable, and growth is beating expectations. You can tune into our monetary policy update this month.

What investors must remember is that structural and cyclical factors are coming together to create this sweet spot for fixed income investing. This could be a once in a lifetime opportunity to make a safe investment.