Happy New Year and welcome to our first outlook for 2024!

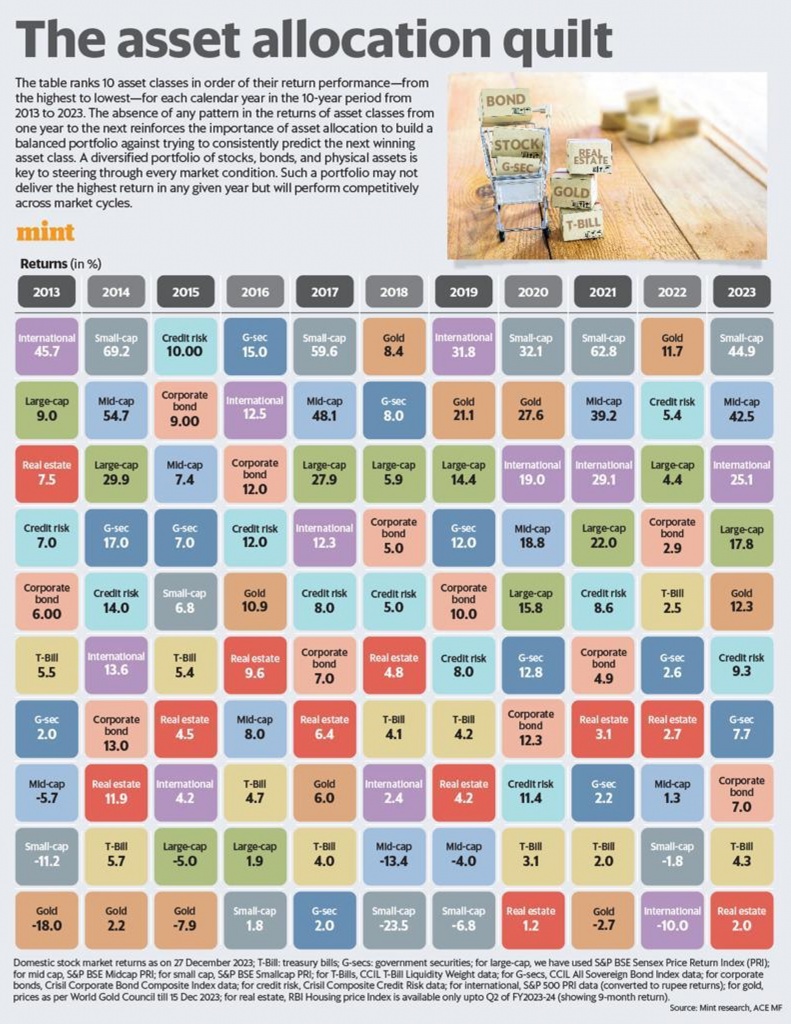

2023 turned out to be quite the year for multi-asset investing. LiveMint publishes an annual asset allocation quilt containing the top ten asset classes. 2023 was remarkable, in the sense that all asset classes did well. On an absolute basis, fixed income didn’t shine. But on a relative basis, it was a good year for fixed-income investors. So, will 2024 promise another spell of good news?

Fixed Income Investing In 2024

As far as fixed income is concerned, 2024 won’t be more of the same. The landscape of fixed-income investing has changed. We analysed these trends in our last webinar.

Debt Mutual Funds: Back In Fashion?

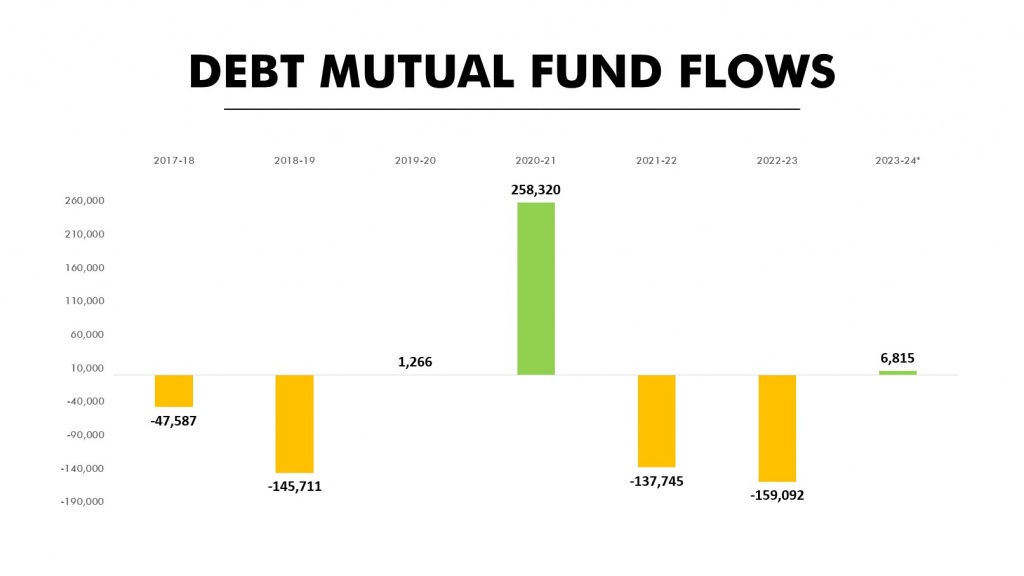

The sudden change in tax treatment for mutual funds dampened sentiment in 2023. Investors front-loaded their debt allocations for the year, rushing to complete them before April 1st. Despite this, flows to debt in this financial year have been positive.

Ready Player Two: Retail Investors Can Change The Game

To deepen the debt markets, SEBI reduced the minimum face value for bonds from Rs. 10 Lakhs to Rs. 1 Lakh. A working consultation paper proposes further reducing it to Rs. 10,000. So, an investor with just Rs. 10,000 could become a bond owner!

A lower minimum ticket size can encourage more retail participation. Have you noticed how fixed income investors are looking beyond deposits, mutual funds, and AIFs to fulfil their fixed income needs? Bonds sit in the sweet spot of higher fixed returns and compete directly with fixed deposits.

Spreads Are Finally Widening

Corporate bond spreads are responding to the increased supply in markets. NBFC spreads are also widening based on the RBI regulation on changes in risk-weighted assets for unsecured loans. What this means for investors is fairer risk-reward compensation.

With widening spreads and the talk of interest rates peaking, is this the time to trade in gilt? We address this in our upcoming webinar on 13 January 2024 at 12:00 PM IST. Click here to register!

Monetary Policy: Shifting Gears

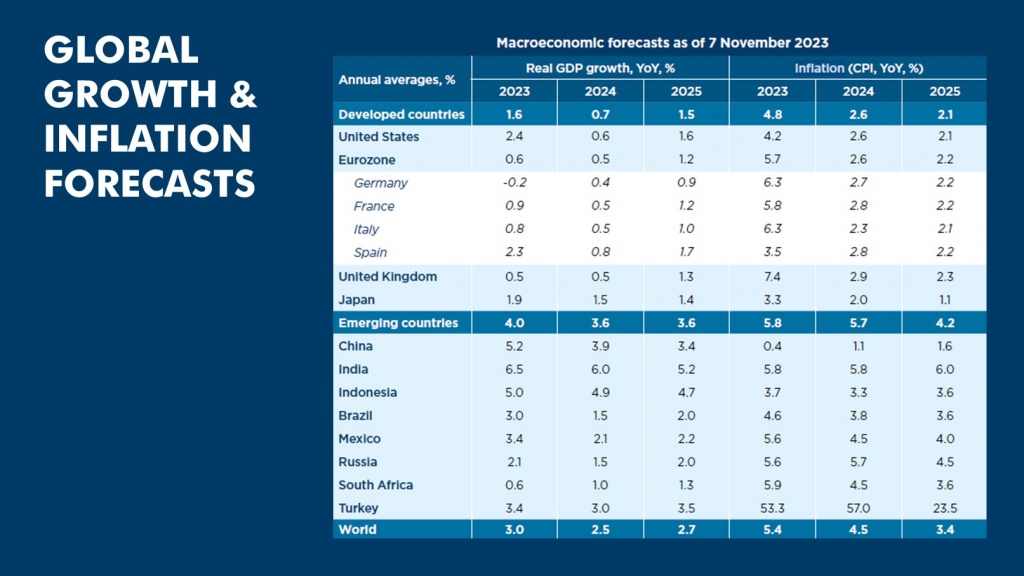

Central Banks had a challenging year ahead of them in 2023. They needed to pick their battles and had no option but to win. Choosing between inflation management, supporting growth, unwinding excess policy measures, and curbing unemployment is no small ask. Yet, Central Banks have managed to win their chosen battles of 2023.

Inflation may continue to be a battle in 2024 for India. The RBI has highlighted the need for a hands-on approach. Not to forget all the behind-the-scenes work that has gone into containing inflation.

For the Fed, growth has already begun to slow down. Financial markets are exuberant. They are discounting all the bad news and relying on the miracles of a rate cut. The Fed’s dot plot shows how much the committee has changed between September and December.

2024 could be a year of neutral monetary policy. Going forward, interest rate hikes are not the star in the battle against inflation. Preparing for market volatility will transform crisis into an opportunity.