As a doctor, Smriti was constantly juggling emergency cases, webinars, and patients’ concerns. But that didn’t prevent her from planning her life with surgical precision. Smriti prided herself in being organised and on top of things. Her house was always in order, she never spent time looking for things, and had all her meals planned.

Yet somehow her financial affairs were all over the place. Every year she promised herself that she’d plan out her taxes and investments. But whenever January rolled in, she was slapped with a large tax bill. And to top it off she would have to make tax-saving investments in the following three months. And then claim a refund later in the year. It was always a vicious cycle.

With one little introduction, Smriti’s life changed for good.

The key to Smriti’s happiness lay in financial planning. She untangled and streamlined her finances, spread out her commitments, and made the best use of her tax benefits. Smriti realized that planning, just like running a house, was an ongoing process. Every once in a while, she’d have to revisit her plan and check that she was in good financial health and make a few adjustments.

Why is a financial review important?

Smriti realized that reviews are crucial because of three reasons – they allowed her to take stock, embrace change, and prepare for the road ahead. Taking stock meant that Smriti knew if she was procrastinating. It also meant that she could reward herself when she was ahead of schedule and didn’t spend any mental energy on items she had crossed off from her to-do-list. Smriti enjoyed a neatly planned life, but 2020 taught her that many things were outside her control. She learnt the hard way to embrace change. Initially, she felt guilty whenever her aspirations changed. After she began planning, she felt confident about making way for new goals and shedding old ones. This process of readjustment ensured that she was ready for all things that lay ahead.

Financial Education

“I did then what I knew how to do. Now that I know better, I do better.” – Maya Angelou

Smriti recognized that the world of personal finance was dynamic. While she was preoccupied at the Operation Theatre, the economy was imperceptibly shifting. Some events that influenced how the economy would grow – like the RBI’s monetary policy or the Government’s Budget. And some regulations that would change the way financial products were presented or sold.

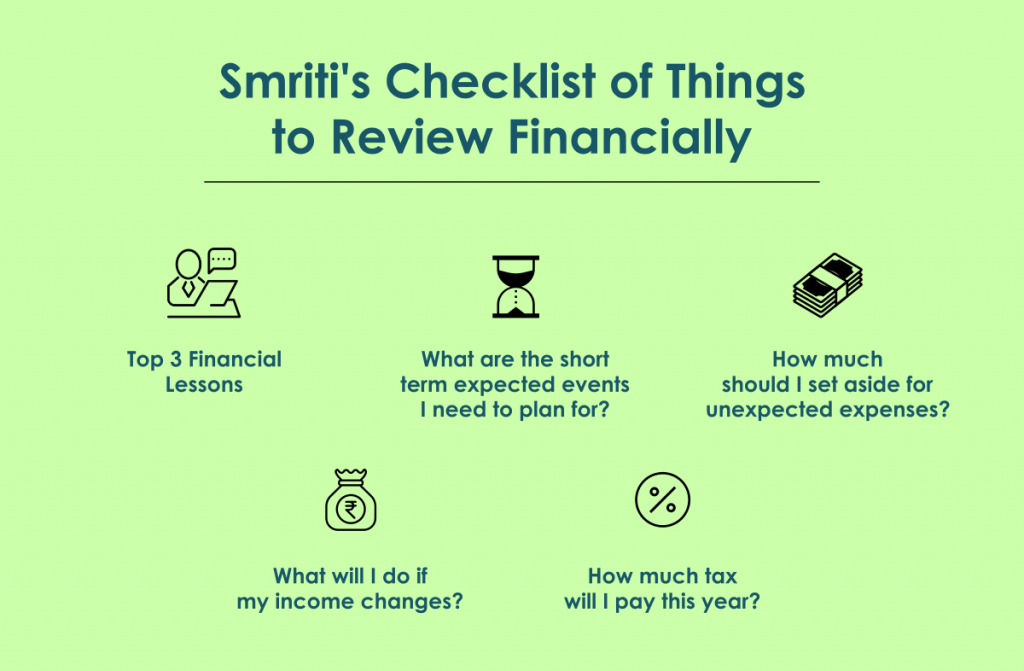

The first item on Smriti’s annual checklist was financial education. She committed to attending webinars, reading books and articles, listening to podcasts, and engaging with professionals to understand the world of personal finance better. After all, the more she knew the better she could do!

Smriti’s financial planner recommended that she write down her top 3 financial lessons from 2020.

-

-

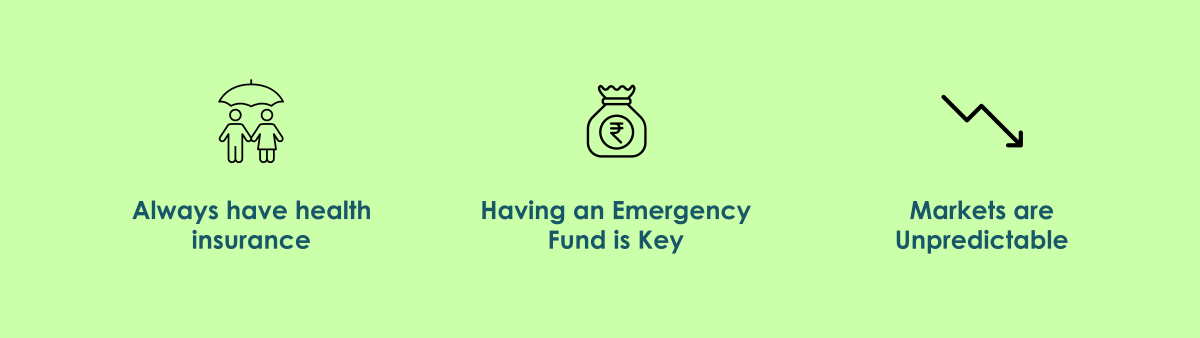

- Always have health insurance!

- When I have an emergency fund, I don’t have to worry about losing my job and can pace my work through stressful conditions.

- Markets are unpredictable and different assets perform well under different conditions.

-

What are your 3 investment lessons from 2020? Write to us!

Short Term Expected Events

The second item on Smriti’s checklist was short-term expected events. With her husband, Raghav, working from home and the kids attending classes online, their home needed a few upgrades. They were going to buy a bigger television set to make Friday movie nights more memorable. They were also considering adding a dishwasher unit to their kitchen. Smriti and Raghav planned to buy another car in 2020 but realized that they could shelve it. Even the money they set aside to travel lay unused.

She liked to set aside the children’s school fees in January so that they didn’t have to take out of their monthly income. Every year, Smriti and Raghav would pen down their big expenses for the year and budget for them accordingly.

Have you planned your big expenses for 2021? Here is a free budgeting template just for you to help you get started!

Unplanned Financial Events

As much as Smriti believed in planning, she also knew it was impossible to anticipate all her expenses for the year. For instance, she had consciously chosen not to buy her younger daughter a laptop. But with classes moving online and everyone working from home, a laptop became an essential expense.

In her budget, Smriti always left a buffer to provide for these unplanned financial events. In some sense, this complemented her emergency fund. It allowed her to handle larger expenses without worrying about how they affected their financial health.

The third item on Smriti’s checklist was setting aside money for unknown expenses. But how do you plan ahead for turbulent times? Here is how!

Income Changes

Smriti believed that expenses and income held equal importance when it came to personal finance. When Raghav took a pay cut last year, they went back to the drawing board. It helped that they hadn’t purchased the car or spent their vacation money. But they also decided to trim down their expenses and made a list of things that they could immediately let go of.

Thankfully, Raghav’s pay cut had been reversed. And he began freelancing and consulting during the pandemic. Smriti also created a supplementary source of income by conducting webinars. They both felt that they could sustain these practices in 2021.

Now that they had more income than they anticipated, they had to decide what they would do with the surplus. Some of it would be spent on the house and the balance would go into their retirement kitty.

Smriti ticked off the fourth item on her checklist because she knew what she would do if her income changed for the better or worse!

Income Tax Planning

2020 was the year Smriti emerged victorious after fighting her biggest financial demon – income tax returns. Since they were keeping a close eye on their income, they talked to an auditor and financial planner early in the year. It turned out that for both Smriti and Raghav the new income tax regime was better. They had no loans and weren’t in the habit of making tax-saving investments.

Do you know which regime you’re opting for this year? Here is everything you need to know to help you make an informed decision.

This was the last item on Smriti’s checklist! She had a separate folder on her laptop with all her proofs, declarations, and bank account statements. She even paid her advanced tax on time. This was a first for Smriti, and certainly a milestone worth celebrating!

Trouble Managing Your Money?

Do you have trouble managing your money and keeping track of financial commitments or investments? Smriti got to a better place with financial planning, and it can work for you too! For most of us, the trouble stems not because we’re incapable but because we don’t have the time, inclination, or expertise. Most of us are prepared to do the work once, but not on an ongoing basis. That’s where a financial adviser can add value. We’ve outlined certain situations where you should hire a financial adviser.

Reviewing your plan is just as important as making it! We’ve empowered more than 500 families through financial planning. Yours could be next.