Financial Decisions

You are sitting at the bank manager’s desk poring over different home loan options, wondering which one is the best. Your phone dings with a notification – buy ABC stock potential upside 15% with stop loss! Simultaneously, an email crops up from your auditor who suggests that it’s time to make those tax-saving investments. The bank manager returns with a proposal to buy a life insurance product linked to your home loan. And you think to yourself – there must be an easier way to get things done.

What does a financial advisor do?

A financial advisor’s role is to make your life easier! They do this by guiding you through financial decisions, planning your investments, protecting your assets, and optimising taxes.

Situational Concerns

Did you feel a sense of dread at the start of this blog, or were you at ease? Some people experience more anxiety when making financial decisions. Each person reacts differently to the same set of choices. And often in personal finance, there’s more than one correct choice and one wrong one. Studies also illustrate that we are biased. We tend to anchor our expectations, become fatigued by too many options, and follow the herd. So a financial advisor can add immense value to your decision-making process by highlighting behavioural biases and blind spots.

Investment Planning

No matter how hard we try, we can’t escape investing. Stashing money away in our savings bank account doesn’t count. In the long run, that strategy loses to inflation. Choosing an investment that works for your goals and suits your risk appetite is challenging. An investment advisor assists in deciding:

-

-

- What investments suit you

- How much you should save for your goals

- Where you should save

- What your ideal asset allocation is

-

Read more about the different types of financial assets.

Insurance Coverage

The most effective financial risk management tool is insurance. Insurance allows you to limit monetary damage from uncertainties at an affordable price. Your most precious assets are your life and health. How do you assign a financial value to that? You could also insure other assets like your vehicle and home. Financial advisors can determine how much of each kind of insurance you need.

Does insurance intimidate you? Here is a where we demystify insurance just for you!

Here is another video for you – Where do people go wrong with life insurance?

Minimize Taxes

An investment’s merit rests not only in its suitability but also its tax efficiency. An advisor will identify ways to optimize your tax outflows while choosing smart investment avenues. For instance, you must select either lower tax slabs or higher deductions, when computing your taxable income.

Should you opt for the new tax regime? Click here to know!

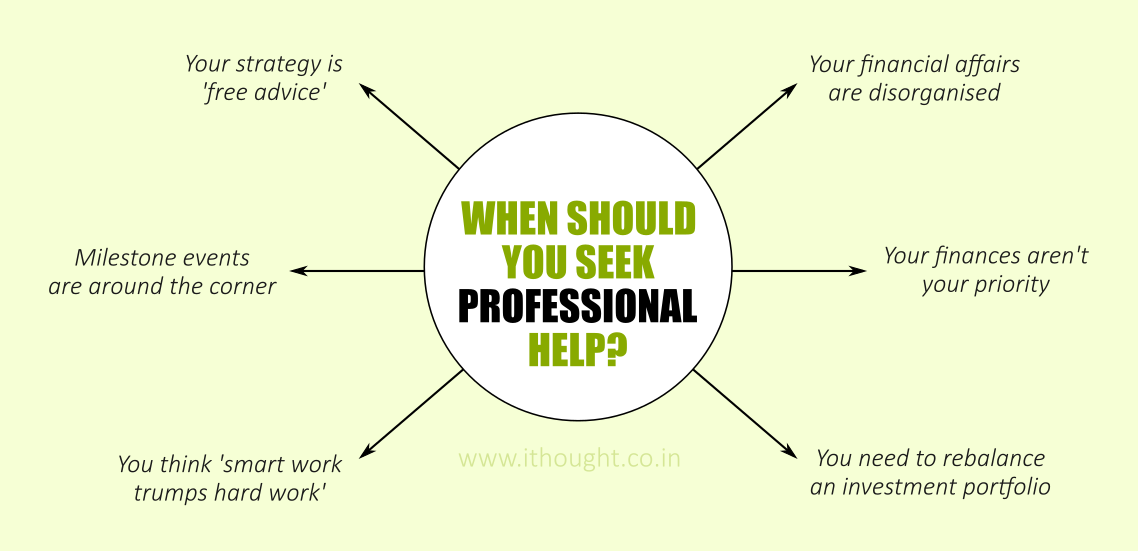

When should you seek professional help?

Now that you know what a financial advisor does let’s get into when professional help creates a positive impact on your financial future.

Your Strategy Is ‘Free Advice’

If you rely solely on Google and FinTwit for investment advice, it’s time to rethink your strategy. Free advice seems like a good deal. After all, the best minds are sharing their perspectives at no cost to you. However, there’s a fine line between information and misinformation.

Here are a few reasons why free advice doesn’t work:

For example, someone may declare that stock ABC is a multi-bagger based. But you don’t know what the underlying assumptions are, what the investment horizon is, or what risks could materialise. So, even if you buy the stock you aren’t investing, you’re speculating. Now, suppose stock ABC underperforms in the next quarter. Is this a sign to grow your position because valuations are more attractive? Or is it a cause for concern? An advisor needs to stay with you through the course of the investment journey. You’re a successful investor if you sleep well at night and your money compounds at a reasonable pace. Imagine stock ABC is volatile and regularly loses value. It’s the one stock in your portfolio that keeps you up at night. There may be another stock that meets your return expectations without all the drama, which is an objectively better investment for you.

Ad-hoc and generalised advice won’t work for sincere investors. What is worrisome is that there’s no accountability in free advice, so you have no recourse when things go south. Free advice focuses entirely on the action and pays no heed to the behaviour. And managing investment behaviour is central to better investment outcomes.

Your Financial Affairs Are Disorganised

We like to believe that we’re on top of our finances. But there are so many details that we overlook. These questions can help you assess how organised you are:

-

-

- When are your insurance premiums due?

- How much is your tax liability for the year?

- Are all your investments mapped to your goals?

- Do your nominees match your beneficiaries in your will?

- Do you have a dedicated emergency fund?

-

Milestone Events Are Around The Corner

Life is full of milestones like moving into your own house, getting married, becoming a parent, or switching jobs. You want to stop and smell the roses at such points. When you are financially prepared, you can enjoy every milestone. Comprehensive financial planning can prepare you for life’s many milestones.

Here’s a quick guide to financial planning at every stage of life. Planning also works when you’re looking at specific life events like taking VRS. Financial planning gives you an overview of your options. This allows you to stress test scenarios and make informed decisions.

Your Finances Aren’t Your Priority

Are you willing to dedicate Sunday afternoons to taking care of your personal finances? Can you keep an eye on market opportunities and juggle a day job? Can you commit to learning about personal finance through your life? Most of us would prefer to spend time with family and friends or hone a skill. Our careers consume a large chunk of our time. Unless personal finance is something that interests you, hiring a financial advisor is a sensible choice. Ultimately, you stand to lose the most if you neglect your finances.

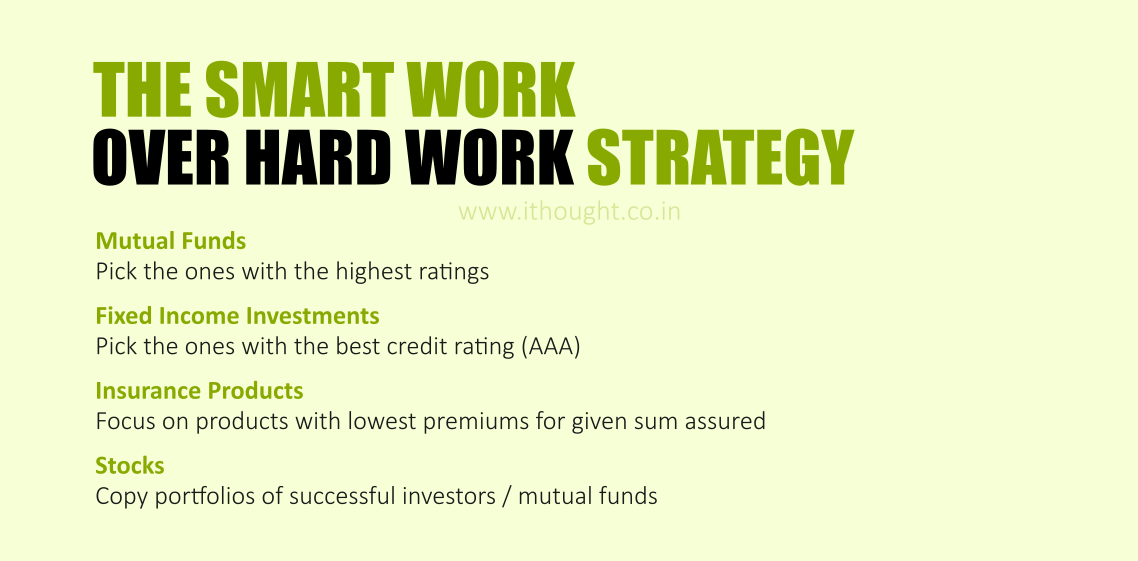

You Think Smart Work Trumps Hard Work

The smart work over hard work strategy looks like this:

The problem with this strategy is that so much could go wrong.

Past Performance

Star ratings reflect past performance and not future performance. Historical trends show that investing in a high rated product tends to be underwhelming. On the other hand, products with low ratings have gone on to become popular in the next cycle. A financial advisor could help you identify better opportunities.

Credit Ratings

There is more to fixed income than credit ratings. In fact, AAA-rated companies like IL&FS and DHFL have defaulted on their debt. A competent advisor would study the balance sheets and cash flows before recommending an investment strategy.

How did we know DHFL was risky?

Kinds of Insurance

Judging the worth of an insurance product based on its premiums alone is misguided. Reading the policy documents, understanding the benefits, features, and limitations can help you make a more informed decision. Most people are unfamiliar with insurance jargon. Whereas a financial advisor understands the consequences of the fine print.

Individual Stocks

When it comes to stocks copying leading investors or managers can do more harm than good. You lack insights into when to scale up or scale down your position. You don’t know the motivation behind the leading investors’ actions or comments. And you won’t know if they’ve changed their minds on the potential for that stock to perform.

We have already discussed the risks of free advice in this piece. Making financial decisions is hard work. In this case, smart work is full of pitfalls.

You Need To Rebalance An Investment Portfolio

When the market context changes, you need to rebalance an investment portfolio and align it to the emerging context. An advisor can draw your attention to risks you ignored and provide an objective view of where you stand.

We’ve helped more than a 100 people restructure their portfolios. You could be next!

How do you choose a financial advisor?

Here are six ways to find a financial advisor:

As a bonus, here are some questions to ask before hiring a financial advisor.

Ask Friends & Family

If you are comfortable talking to friends, colleagues, and family about this subject, ask them for referrals. The people closest to you may be able to point you in the right direction. This is different from seeking financial advice from friends, family, and colleagues. Typically, you want to work with a SEBI Registered Investment Advisor or an entity that will act in your interest.

Online Financial Advisor

If you’re not comfortable tapping into your network, don’t worry. We live in the day and age of search engines and social media. Looking for financial advisors on these platforms could lead you to their website, Google business profile, or social media handles. You can check their ratings and reviews on Google. Visiting their website will give you some idea of how to find a fit. Their social media presence should also shed some light on their approach and competence. Specifically, look for testimonials and reviews for an outsider’s perspective.

Another great quality filter to apply is to go through LinkedIn. LinkedIn is a professional platform – you can assess their qualifications, connect with their employees, and engage with the business digitally before you commit to working with them.

If you’re looking for financial planning services, then visit https://india.fpsb.org/cfp-certificants-directory/ to find a CFP professional. You can then run the LinkedIn filter to find your fit.

Before hiring an advisor always verify their SEBI RIA status. Their website should explicitly state their registration number and will display the status of complaints if any.

Are financial advisors worth the money?

Previously, the term financial advisor was widely used. SEBI now mandates that only SEBI Registered Investment Advisors (RIA) can call themselves financial advisors. So, wealth managers, distributors, agents, IFA, etc. can no longer use the term ‘financial advisor’ to describe themselves. This is an important distinction because SEBI RIAs must act in a fiduciary capacity (i.e. keep your interests at heart), cannot receive commissions. They must also disclose any conflicts of interest. On the other hand, these regulations don’t bind the other players.

Working with a SEBI Registered Investment Advisor can benefit you and may well be worth the money. Regulatory compliance is in the investor’s favour.

If you find the right fit, the advice will be worth its weight in gold and you could have the best investment outcomes. Working with a trusted financial advisor could build a sense of security and investment confidence.

How do financial advisors get paid?

The compensation for financial advisors is transparent in India. SEBI allows advisors to charge fees in two ways.

Fee-Only Investment Advisor

A fee-only advisor charges a one-time fee. This fee is independent of the portfolio size and is based on the scope of work. Per SEBI guidelines, the flat fee cannot exceed Rs. 1,25,000 per year.

Fee-Based Model

A fee-based advisor charges a % based fee on the assets under advice (AUA). The fees could vary based on portfolio size. Per SEBI guidelines, the % based fee is capped at 2.5%.

Commission Structure

SEBI mandates that financial advisors act only in a fiduciary capacity and collect compensation only from clients. This ensures that there is no conflict of interest as the advisor cannot receive commissions, brokerages, etc. Further, investment advisors must disclose any conflict of interests.

Role of A Financial Advisor

Ultimately, the role of a financial advisor is to improve your journey to wealth creation. They can do this by assisting you with your financial decisions. This includes constructing an investment plan, minimizing taxes, and fulfiling your insurance needs. The relationship between a financial advisor and a client is both professional and personal. Work with an advisor who pays attention to your specific needs and situational concerns.

ithought is a SEBI Registered Investment Advisor. We’ve worked with more than 600 clients across the globe over the last decade to create a sense of financial wellness. We’ve also consistently ranked amongst India’s top 5 wisest advisors since 2016. We’d love to be part of your wealth story!