No matter what your other financial goals are, retirement is the one thing common to all of us. We explore 4 reasons why there’s an urgent need to plan your retirement now!

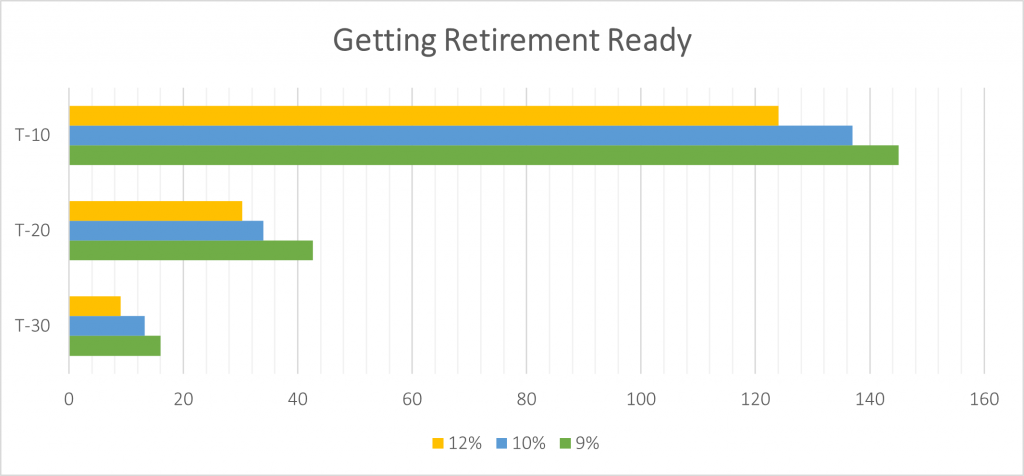

The Power of Compounding

Retirement is meant to be an enjoyable and stress-free part of your financial journey. To make the most of your retirement, you need to take advantage of time. When you start earlier, you can be more aggressive in your investment approach and your money does a lot of the heavy lifting. When you start later, you wind up saving much more to reach the same target.

Let’s say you’re 30 and your life expectancy in 85 and you want to retire at 60 with an income of Rs. 1.5 Lakhs per month (adjusted for inflation). You would need to save ~ Rs. 22 Crores. If you start investing towards retirement at 30, you’d invest roughly Rs. 16 Lakhs per year. If you wait until 40, you end up investing Rs. 42.5 Lakhs per year. And if you start only at 50 you end up investing Rs. 1.45 Crores per year.

Medical Needs

Your health may take a toll as you age, but your healthcare shouldn’t. Both longevity and medical care costs are rising. The financial stress of a large medical expense could feel more painful when you are not an earning member. Having the right medical reserves and insurance policies will give you more financial security in your golden years.

The number one problem senior citizens face today is the lack of a comprehensive health insurance policy. Once you cross 60, getting a comprehensive health cover is tough. You may have to deal with exclusions, long waiting periods, exorbitant premiums, or co-payments.

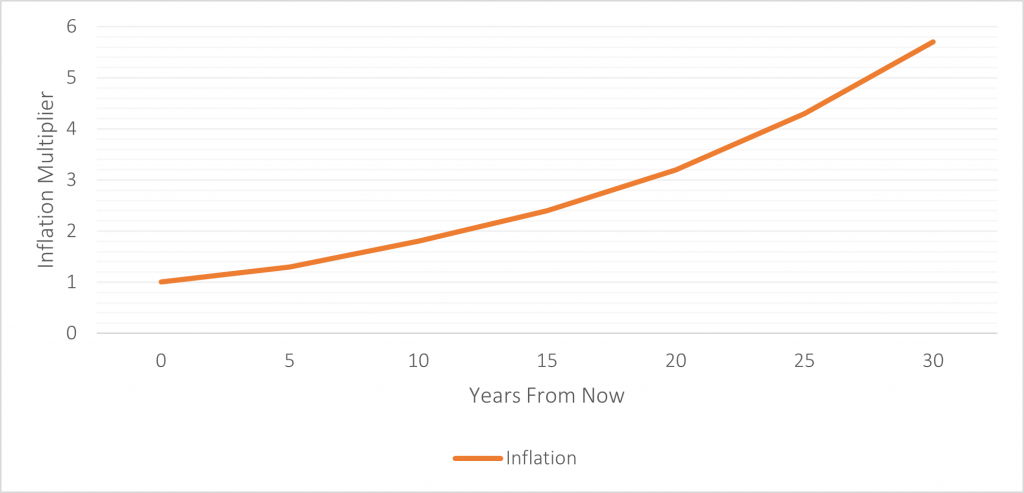

Inflation

Let’s assume inflation is at 6% and you spend Rs. 1 Lakh every month. How much would you spend ten years down the line?

The most common mistake in retirement planning is underestimating inflation. The cost of Rs. 1 Lakh in ten years is close to Rs. 1.8 Lakhs. With inflation, at 6% your expenses double nearly every 12 years. Retirement usually spans 25+ years. It’s difficult for most people to think and plan their finances that far into the future.

This is why you should get a retirement plan!

Create a Retirement Budget

Retirement planning isn’t a one-time exercise. It’s important to remember that there are twenty or thirty years of life after retirement. There’s no doubt that your lifestyle will change significantly through your years in retirement.

With financial planning, you could remain financially independent throughout. That means you’d have both time and money at your disposal. Most people assume that they would spend less after they retire. However, you may end up spending more for a few years! Pursuing a hobby seriously, doing philanthropy, travelling, etc could be a part of your retirement plan. These are personal choices that are likely to alter your spending habits once you retire.

Retirement Planning

The best retirement plans are made by using the runway to retirement well. Deeply understanding the life you want to lead, the legacy you want to leave behind, and the challenges you could face will guide you towards making the right choices.

The choices that you make in the years preceding retirement play a crucial role in determining the quality of your golden years. Planning makes you take a close look at your commitments, needs and wants. Priorities could vary from one family to the next, but retirement is a universal priority. The dynamics of post-retirement life are shifting. Life expectancy is improving, aspirations are evolving, and family structures are changing.