This month marks one year since Franklin Templeton closed the doors on six of its fixed income schemes. In this blog for Finesse, we are going to look at exactly what happened. This blog is divided into five parts:

-

-

- Introduction to Franklin Templeton

- What happened?

- What went wrong?

- Who is to blame?

- What’s the situation now?

-

Who Is Franklin Templeton?

Franklin Templeton is one of the oldest and most well-regarded investment management firms globally. Globally, they have been around since 1947. They established their presence in India in 1996. As of January 2021, they are the eleventh largest AMC in India with an AUM size of around 86,000 Crores and 77 funds.

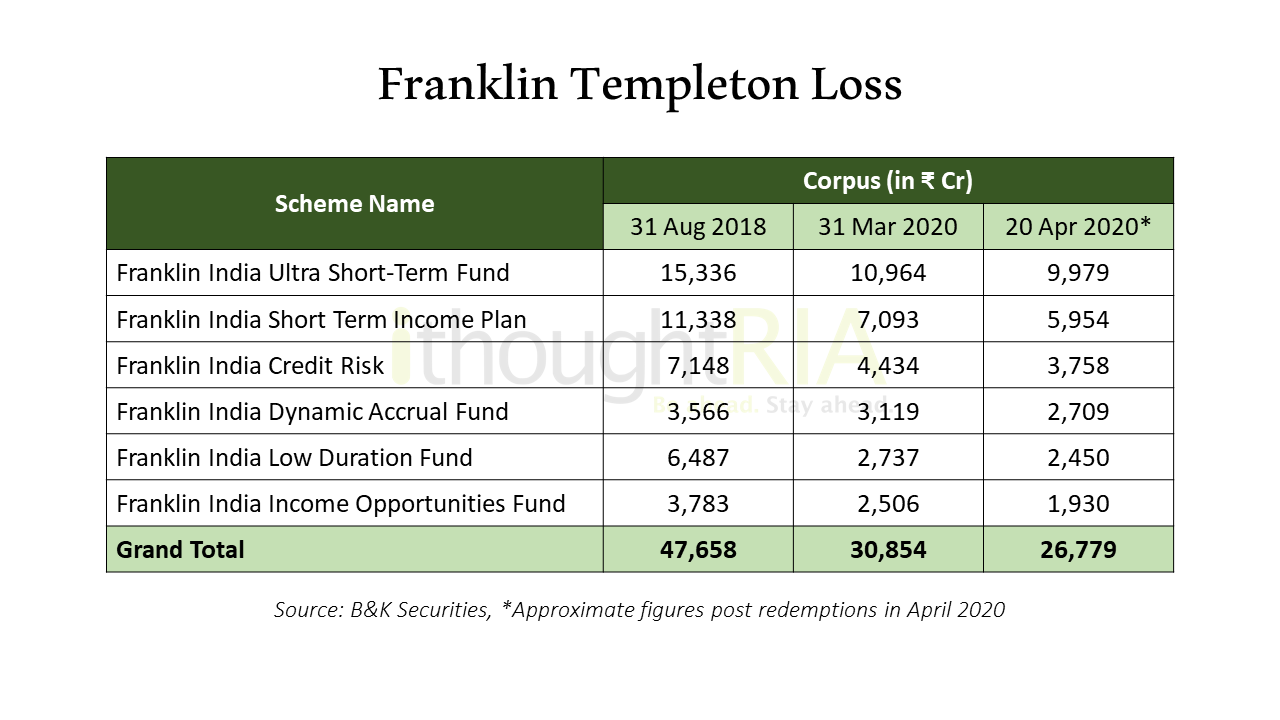

In April 2020, the AMC announced that it would wind down six of its fixed income schemes. Fixed Income investments are generally viewed as safe and stable, so where did it all go wrong?

What happened to Franklin Templeton Mutual Fund?

April 2020 was an eventful month by any financial market standards. Equity markets had crashed, oil futures treaded into negative territory in the US, and a well-established AMC decided to unwind not one, but six of its schemes. Franklin Templeton’s decision came as a rude shock to investors, distributors, and advisers.

The six schemes followed an aggressive credit strategy. In India, bond markets are illiquid. There is a significant appetite for government securities and AAA-rated bonds. But bonds below AAA don’t attract many investors. Mutual funds are designed to be liquid investments. They are under obligation to return an investor’s money on redemption. When they have too many illiquid securities, meeting redemption requests is a challenge. The situation is further aggravated by the fact that a scheme will sell its more liquid assets first. This is exactly what happened with Franklin Templeton’s Debt Mutual Funds.

The AMC faced relentless redemption pressure and tried its best to liquidate positions. Franklin Templeton had exhausted cash positions, borrowing limits, and its supply of fairly traded bonds in these six schemes. What remained were lower-rated bonds trading at deep discounts. Portfolios were illiquid, and further sales would hurt both the investors who remained and those who left. To protect investor interest, they shut down the schemes and banned further redemptions.

What caused Franklin Templeton Mutual Fund to close these debt funds?

This is a classic case of risk management gone awry. Out of the six funds (Low Duration, Ultra Short, Credit Risk, Short term, Dynamic accrual, and Income opportunities), two of them were to mature within a year. An Ultra short-term fund has a duration of six months and a low duration fund has a duration of one year. It is ill-advised to take credit exposures in these schemes as investors view them as a safe, liquid, and efficient alternative to fixed deposits. With the other funds, Franklin’s record was showed exposures to DHFL, Vodafone, Yes Bank, and Anil Ambani’s Reliance (ADAG).

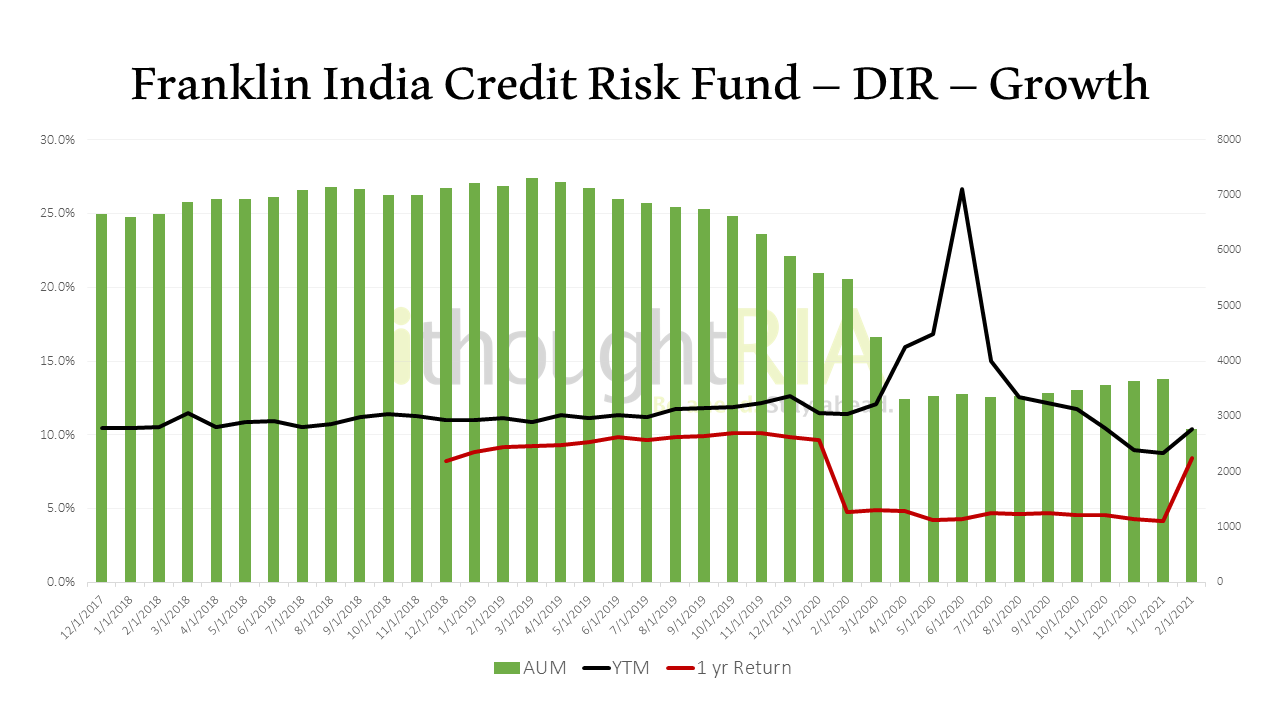

Fixed Income mutual funds are meant to compete against fixed deposits and similar instruments. One must ask themselves what the risk is when investing in abnormally high yielding debt mutual funds. The hunt for higher YTMs burnt investors, distributors, and the AMC.

If debt fund A and B are identical in category and duration, but A offers 7% yield and B 10%, their portfolios must be different. It is more likely that B is a riskier fund than that it is a better-managed one. B could be exposed to lower quality credit. B projects but does not guarantee higher returns. The market failed to acknowledge this and was punished accordingly.

We’ve talked about why yields tell only half the story and how YTMs are a bad measure for returns. Yet, time and again investors rely on the YTM to make investment decisions.

Franklin Templeton Crisis Explained

Let’s think about who is responsible for this situation. Surprisingly, everyone. Let’s look at why. There were three parties to this debacle: the AMC, distributors, and the investor.

Investing Based On Star Ratings

Star ratings – the single most important metric for retail investors. What most fail to realize is that star ratings are issued based on past performance. So, it’s all in hindsight. If you already own the fund, you’ve done well. But you have no idea if the fund will continue to do well.

Mutual funds are amongst the most transparent and well-managed options available for retail investors. Fact sheets are monthly disclosures from the AMCs that contain updated metrics and portfolios. One look would have thrown out multiple red flags. Unfortunately, most debt investors just go by past performance and YTM and don’t look into the fact sheet.

Is this judgement of retail investors harsh? Probably, but it is not totally unfounded. Most investors think fixed income investing is easy. But this debacle proves that a little bit of due diligence and prudent advice can go a long way.

Franklin Templeton AMC

Moving on to the AMC. Honestly, we don’t know why they opted for such an aggressive investment management style across multiple funds. Certainly, there is a sophisticated audience for high-yielding instruments. The average mutual fund investor is not it. Perhaps the funds could have been packaged or structured better as an alternate investment fund or a closed-ended scheme, but hindsight is 20-20. Essentially, a more dynamic or diversified approach could have worked in the evolving market context.

Mutual Fund Distributors

Distributors are agents who sell mutual funds. Mutual funds should ideally be sold based on the investor’s requirements and investment horizon. Distributors do not charge their customers fees. Instead, they receive commissions from the AMCs. Imagine there is pressure or incentive from the AMC to push a particular product. Isn’t the conflict of interest clearer now?

Relative to equity mutual funds, debt mutual funds have lower expense ratios. This is primarily because the expected returns are lower. The distributor’s commission is a part of the expense ratio. When Franklin Templeton’s debt mutual funds came up with 9%-11% YTM and fat commissions to match, distributors were ecstatic. It seemed like a win-win situation all around – the AMC got higher sales, distributors were paid more, and investors got high returns.

The problem? Sustainability and lack of fiduciary responsibility. The AMC should have shifted to a more conservative stance as the crisis in credit markets brewed. Distributors should have highlighted the risks and educated customers. Investors should have done their due diligence instead of turning a blind eye to where their high returns were coming from.

What Will Happen To Franklin Investors?

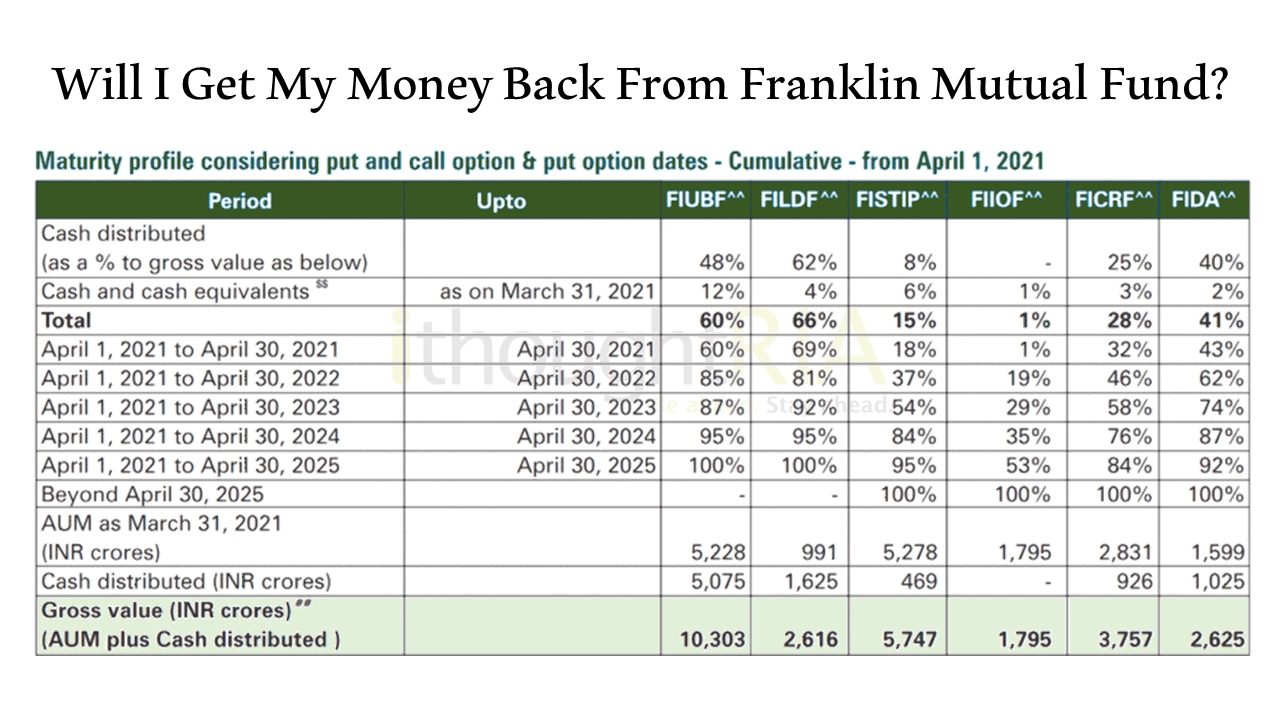

It’s not all been that bad though. Franklin Templeton has been consistently re-paying their investors from the cashflows received and the maturity of the bonds.

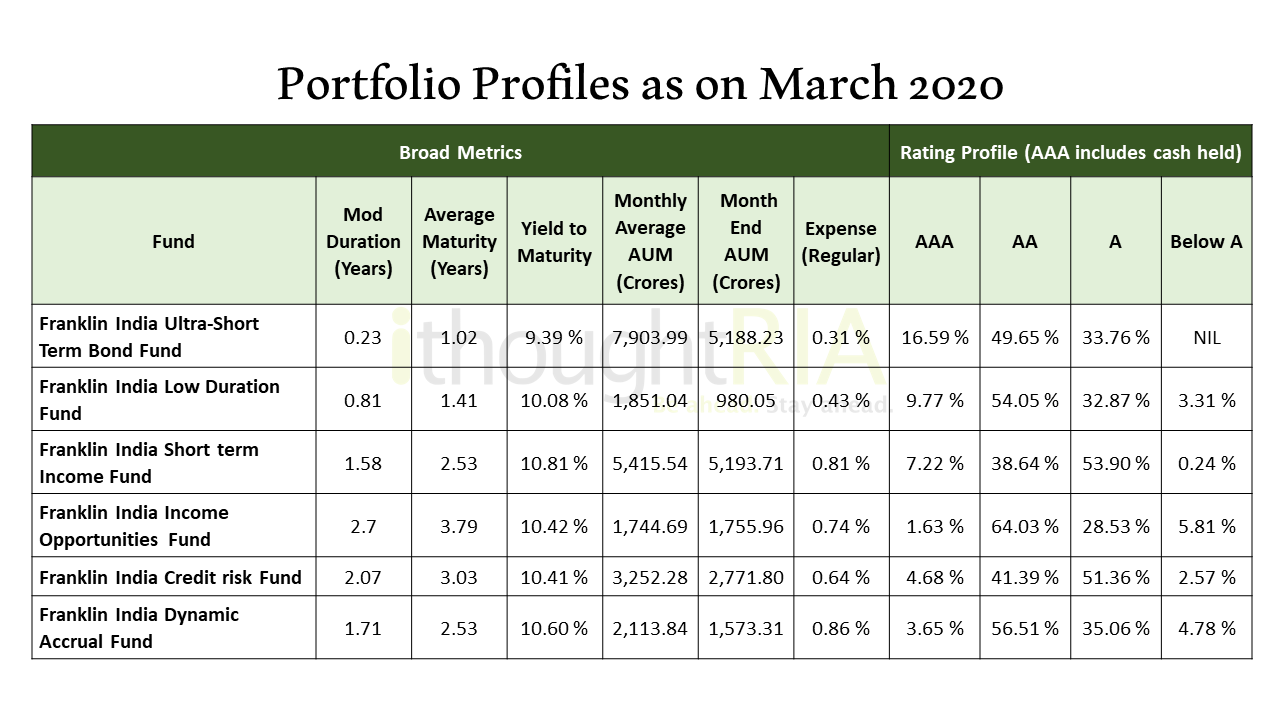

Portfolios as on March 2020

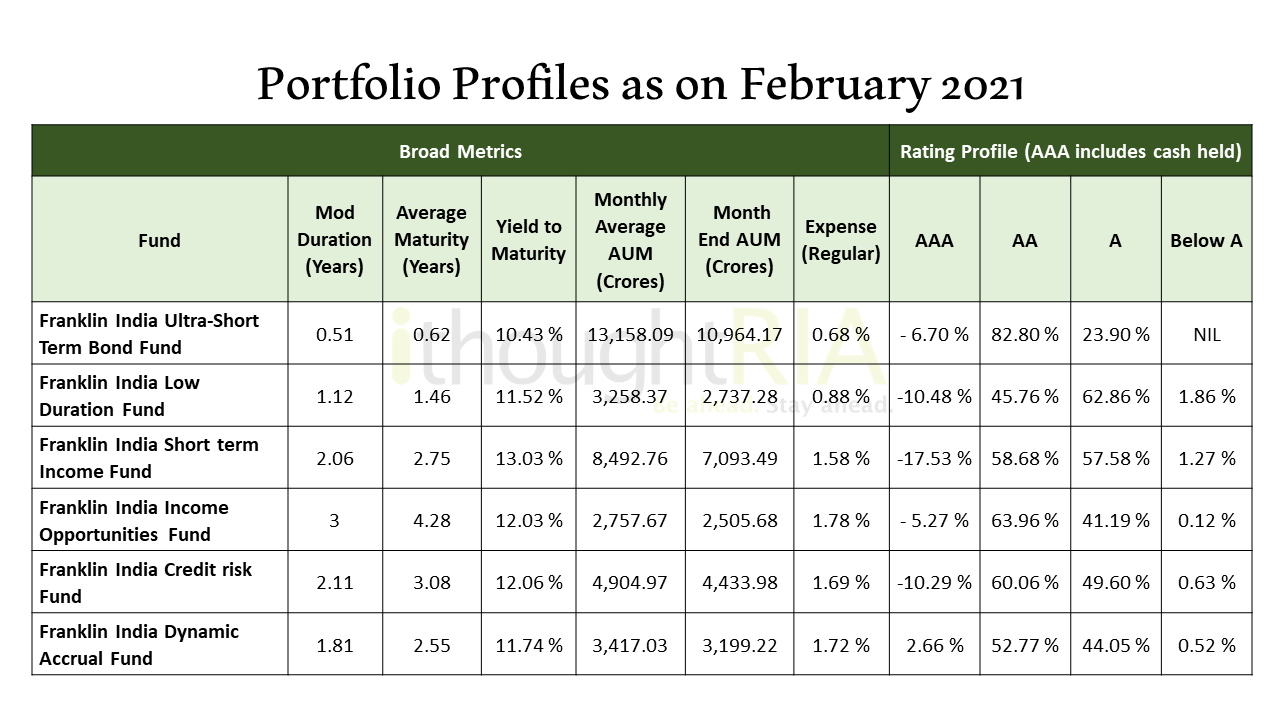

Portfolios as on February 2021

What kind of company is Franklin Templeton?

Shockingly, this isn’t the first time FT has acted against investor interest. Let’s rewind to 2016. In February 2016, debt papers of Jindal Steel and Power limited were downgraded to below investment grade (BBB). As the name implies, these papers were now, not investment-worthy and couldn’t remain on mutual fund portfolios. Franklin Templeton (the parent company) then bought one tranche of these papers from their funds at a 25% discount below face value. Subsequently, the ratings were lowered to ‘D’ (Default) a few days later. Franklin decided to re-value the papers on their books to reflect the downgrade. However, there was no set guidance on the method to value ‘D’ rated securities. They decided to mark down these papers by a further 10%, thereby valuing them at 67.5% of their face value.

On March 10th 2016, Franklin bought the final tranche at the mentioned discount from their own funds. JSPL was re-rated in subsequent years and paid back the bondholders. It is suspected that the AMC held the bonds to maturity. One tranche already matured and is believed to have been redeemed at par, giving the AMC an approximate 30% on capital gain in a situation where investors made a loss.

So, is it any surprise that there are reports of some Franklin Templeton staff withdrawing their investments before the fund closures in April 2020? Trouble didn’t brew overnight. In fact, the funds collected SIP instalments as of April 2020. This is equivalent to employees participating in Insider trading. SEBI was not too pleased about it and probed into the issue and served them notice. Templeton’s response was arm-twisting instead of rectifying. Top senior management from Franklin Templeton’s India and global divisions approached India’s Ambassador to the US (Mr Taranjit Singh Sandhu) to complain about the regulator. Reports stated that they had also threatened to exit their Indian business as well. Shortly thereafter, Templeton representatives clarified that they had no plans to exit the Indian market.

In its India endeavour, Templeton disregarded risk management, neglected its fiduciary responsibility, avoided punishment, and has resorted to blackmail. This has led to some people claiming that one should exit all Templeton Mutual Funds. Shyam Sekhar shares an objective analysis for investors of their equity fund performance.

What can investors learn from this?

As an investor, one must always do their due diligence before picking an investment. Be it fixed income with YTMs or equity with past returns. It is important to figure out if your investment matches your horizon and risk appetite. Hiring an advisor who works for your best interest triumphs being stuck with an inferior investment product.