All About Small Caps

Hello, investors! If you’ve been watching India’s stock market, you’ve probably noticed the excitement around small-cap stocks. The recent surge in these stocks has been a wild ride. But what’s behind the buzz? And what does this mean for you? Well, let’s break it down.

The Nifty 250 Smallcap index is trading at an all-time high with a PE multiple of over 28. This means investors are ready to pay more to squeeze every rupee of profits that these companies make. Small caps have been sprinting ahead, which is fantastic but also nerve-wracking. Why? Rapid growth can mean both big opportunities and significant risks.

Small cap companies though smaller in size, often make it up in their potential room for growth. Given the volatile nature of small-cap stocks, the fluctuations influenced by market sentiments can be steeper. But it’s crucial to understand that volatility also means opportunity. When the economy is booming, small-cap stocks ride high on the wave of growth. However, accurately pinpointing the start and end of these economic cycles is not easy.

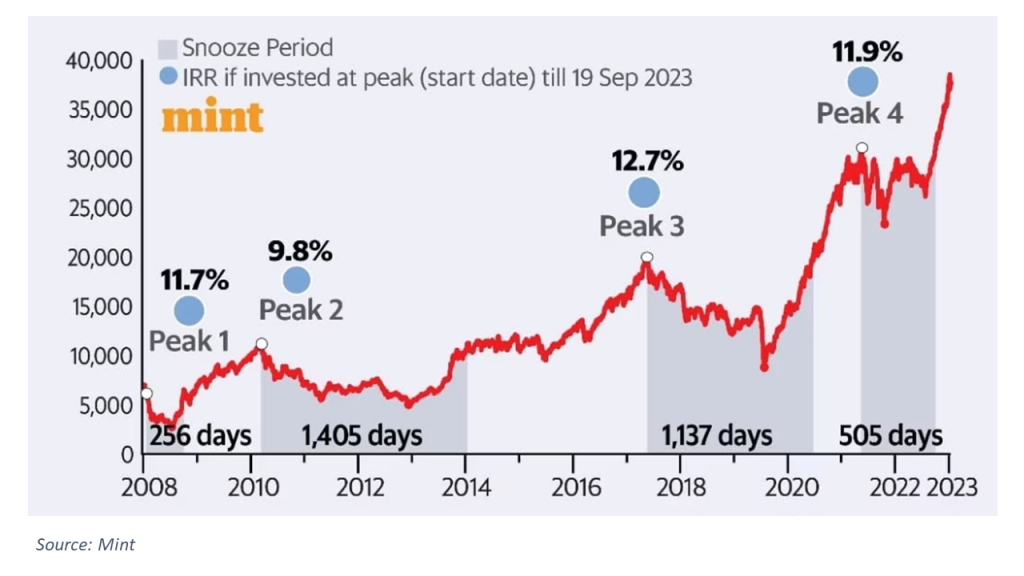

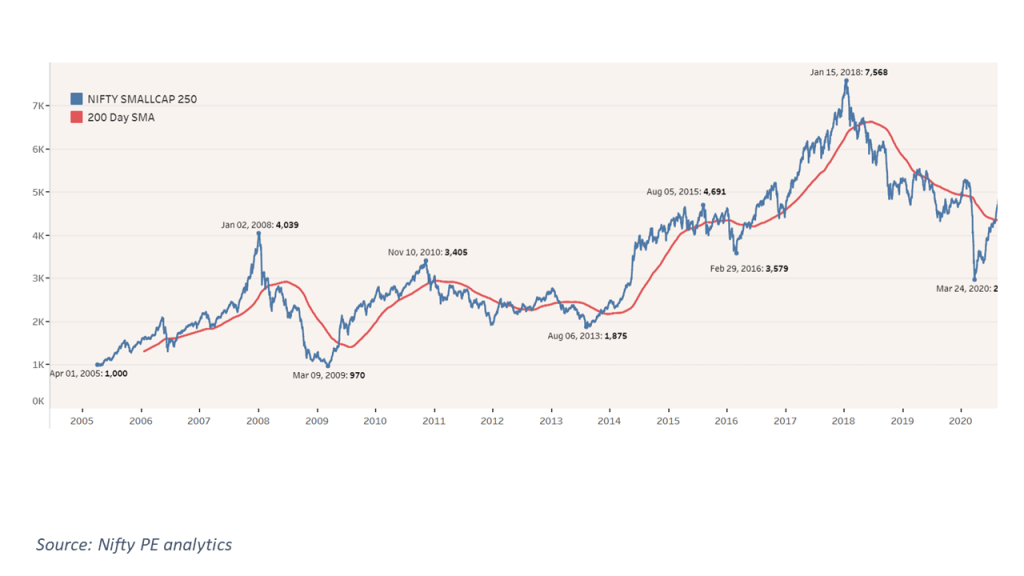

For small-cap investors, corrections can be more pronounced. This emphasizes the need for a balanced approach considering the company’s growth potential and the investor’s risk tolerance. The below chart shows the snoozing period where investors must patiently hold their investments in small-caps after entering the market at its peaks.

Navigating India’s Small Cap Surge

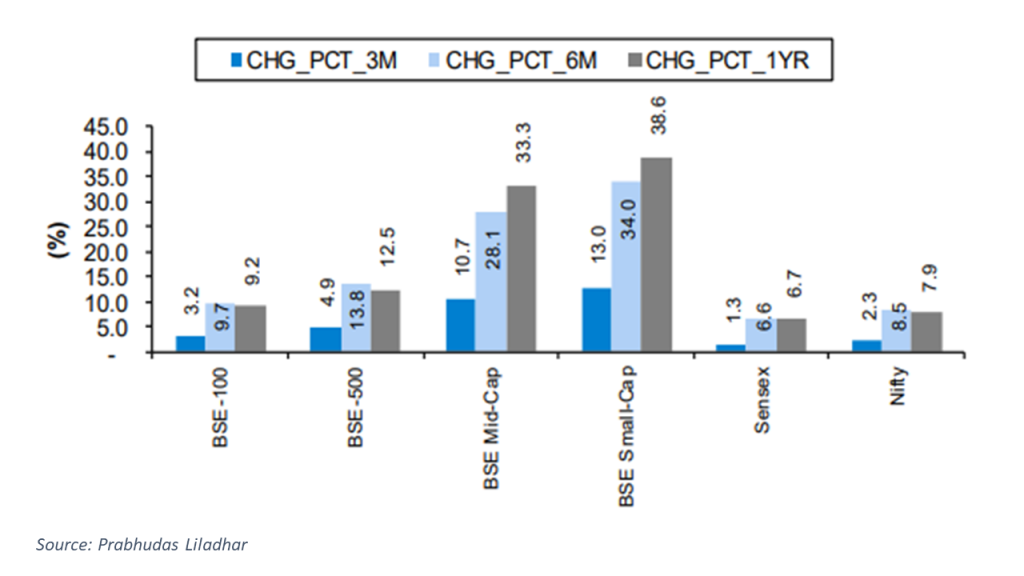

The BSE small-cap index has moved up by 38.6% in the last 12 months, which is significantly higher than the performance of Nifty 50.

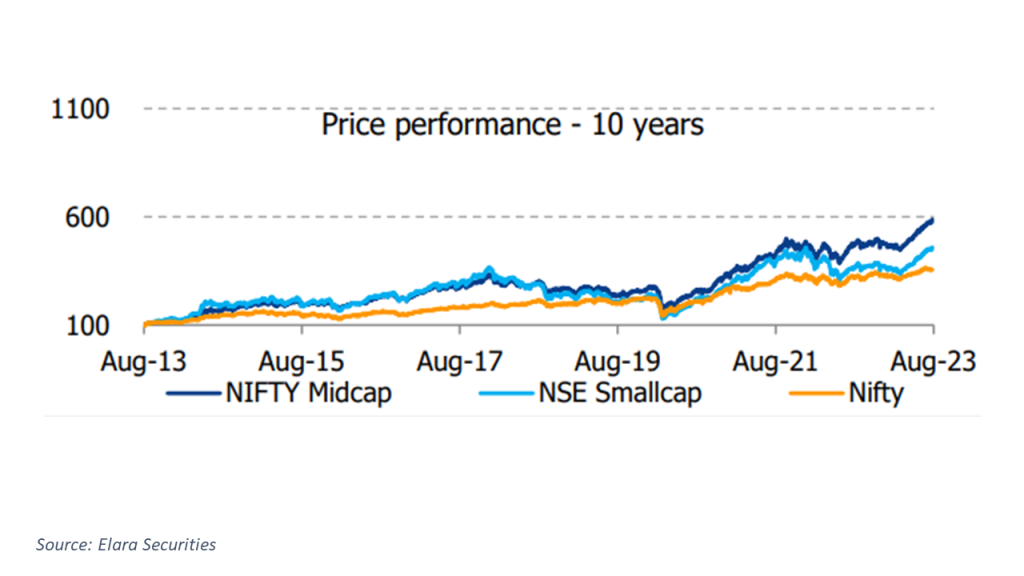

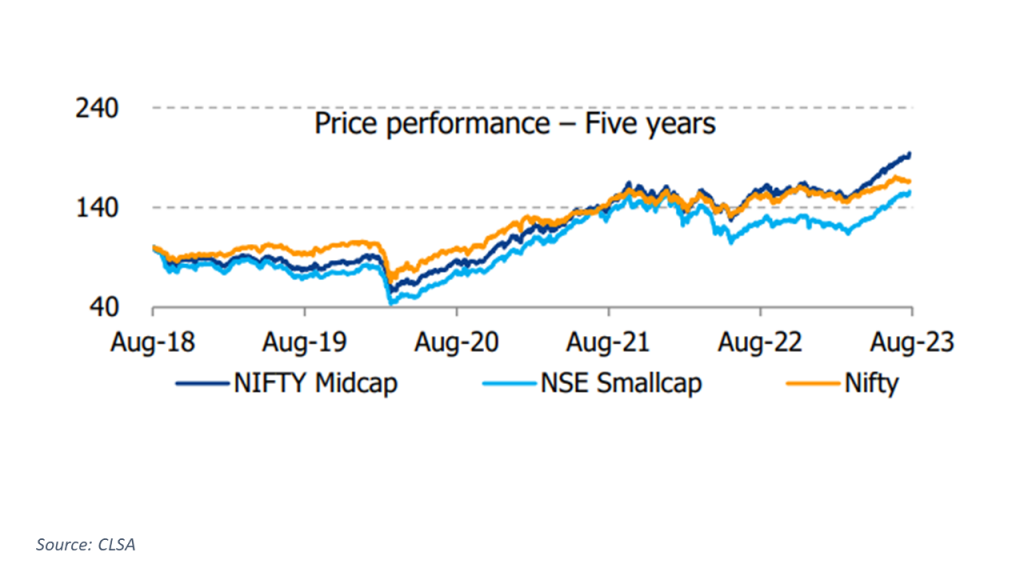

Small-cap indices have a long-term history of significant outperformance over the Nifty 50 index in over 10 years.

But this recent large outperformance may be a swing-back from the extreme underperformance seen through 2018-2022.

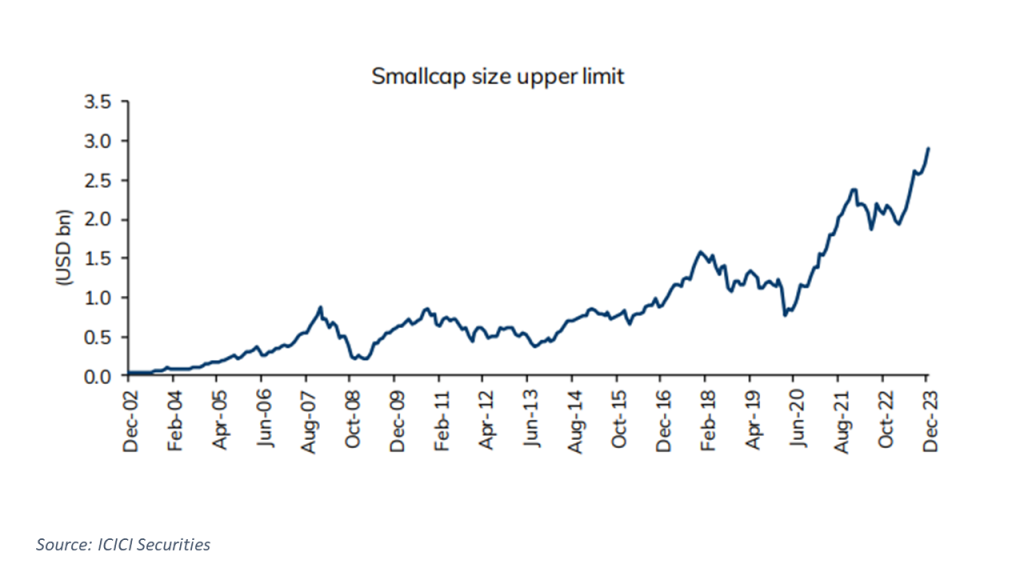

On that note, small-cap valuations continue to be on the higher side as their upper threshold approaches $3 billion in 2023.

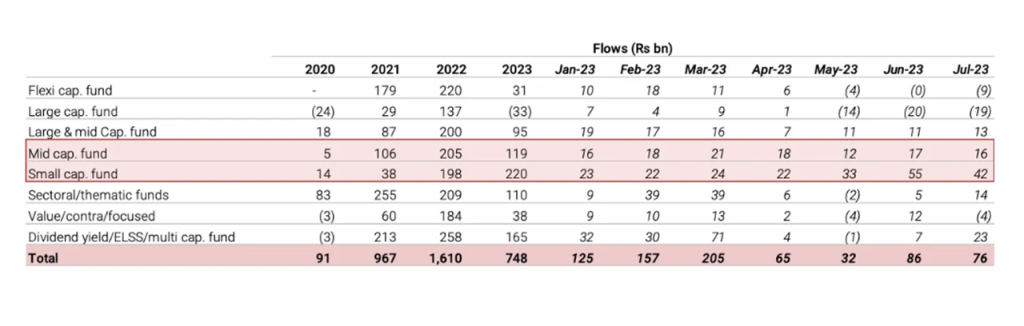

Small-cap funds also recorded their highest inflows in 2023 from the last 4 years.

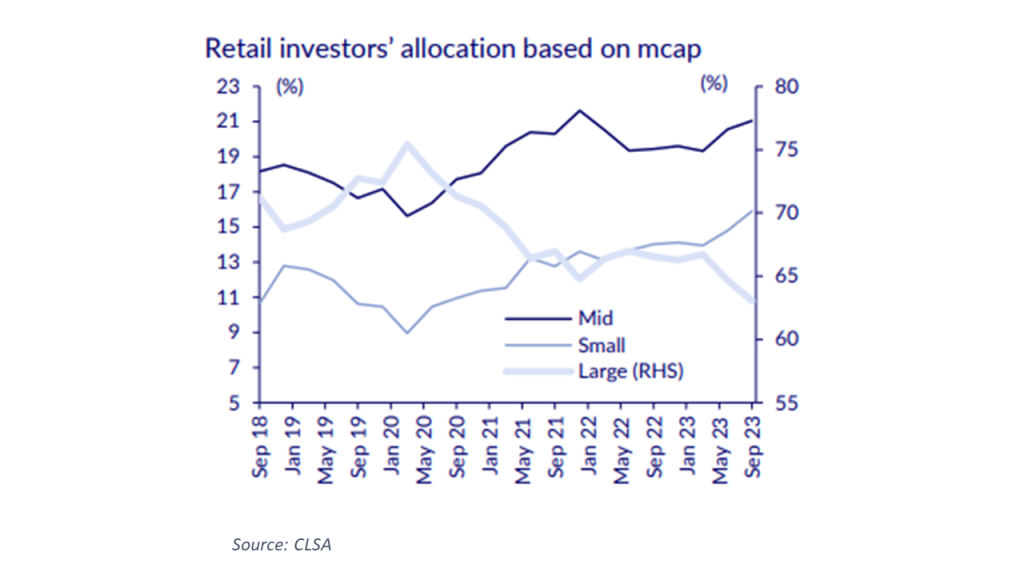

Domestic investors are pouring funds into small caps backed by the positive outlook for the Indian economy. So, what’s working in favour of small caps? It’s the domestic investor’s confidence! This year saw a jump in their allocation to small caps to a multi-year high of 15.9%.

Economic Outlook and Small-Cap Prospects

India’s GDP is expected to grow at 7.3% in the next fiscal year and it’s all set to be one of the fastest-growing economies in the world. With the growing PLI incentives, healthy corporate earnings, and high retail participation this is no surprise! The robust economic performance will translate into superior earnings for small caps. Mid and small-cap stocks’ market capitalization to GDP ratio is at an all-time high, as market cap expansion exceeds economic growth.

Short-Term Challenges and Long-Term Confidence

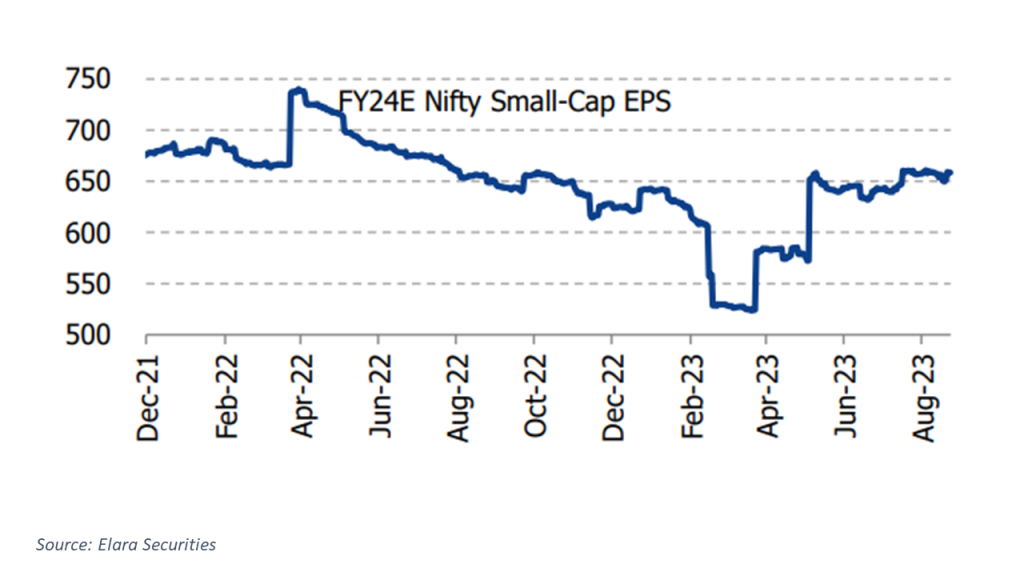

The overall market is expensive, with small caps becoming even pricier, erasing the margin of safety in this category. This will make small caps more susceptible to price corrections during market corrections. But despite short-term challenges, the enduring belief in the long-term prospects of small-cap stocks will remain unwavering. The recent increase in small-cap earnings estimates since April 23 might bolster and sustain the upward momentum of small-cap stocks. The point to note is that, despite strong earnings, valuations are still very high.

On the other hand, one should also be careful of excessive investor optimism.

Following the global financial crisis of 2008, there was renewed investor interest in small-cap stocks, expecting them to rebound strongly as markets recovered. However, many small-cap companies faced struggles in adjusting to the changed economic landscape and didn’t perform as robustly as anticipated.

Here’s the deal, successful investing in these smaller companies isn’t just about knowing the market’s ins and outs. It’s about having a solid game plan, sticking to it when things get shaky, and picking your investments wisely. Like they say, slow and steady often wins the race!