Fixed Income Investment Strategy

Medium-term bond yields are elevated compared to their short-term counterparts. If interest rates remain lower for longer, selective medium-term strategies could work well. However, these strategies could become volatile when the interest rate cycle turns. Investors will reap the benefits only if they stay invested through the cycle. This is where an adviser could add immense value.

Even though yields are compressing, credit still looks attractive. The spread over AAA assets is pronounced. Economic growth will be widespread when credit is available to all players. The biggest risk with a credit strategy is default (loss of capital). Working with a competent investment adviser could help you identify opportunities in the credit space.

Searching for a safe investment opportunity in an uncertain market? Make a difference to your investment by scheduling a conversation with our investment advisory team today!

RBI Monetary Policy – October 2020

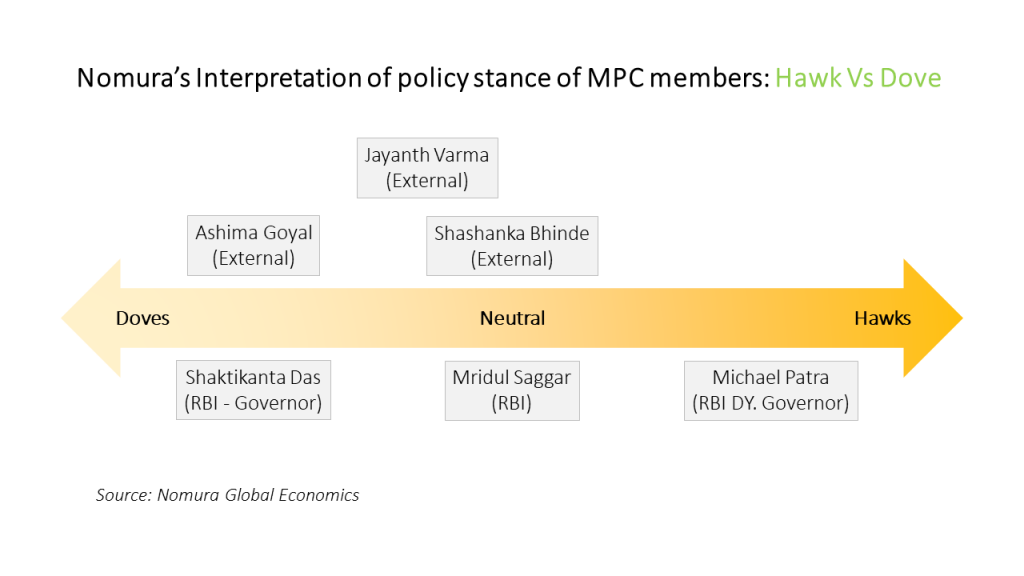

Last month’s Monetary Policy sets the tone for the next two quarters. The new faces in the MPC indicate that interest rates could remain low for the foreseeable future. The tone of the monetary policy and minutes are dovish (leaning towards keeping interest rates low).

Although policy rates remained unchanged, the RBI relieved several pain points. Here’s what the RBI did in its October monetary policy:

-

-

-

- Committed to an accommodative stance through this financial year and possibly into the next one

- Increased the size of OMO (Open Market Operations) and encouraged more participation

- Created room for more Targeted Long Term Repo Operations (TLTRO)

- Provided forward guidance on inflation and growth

-

-

Open Market Operations

Despite the repo being at all-time lows, G-sec yields remained elevated. Few auctions in September were undersubscribed. The Governor highlighted that market participants were getting a good deal on government securities and shouldn’t haggle for better prices. They also increased the OMO size from Rs. 10,000 Crores to Rs. 20,000 Crores.

Consequently, market sentiment has taken a positive turn. Those who were shying away from G-Secs a month ago are oversubscribing now. In early October, the 10-year yield was close to 6%. By the end of the month, it was 5.85%.

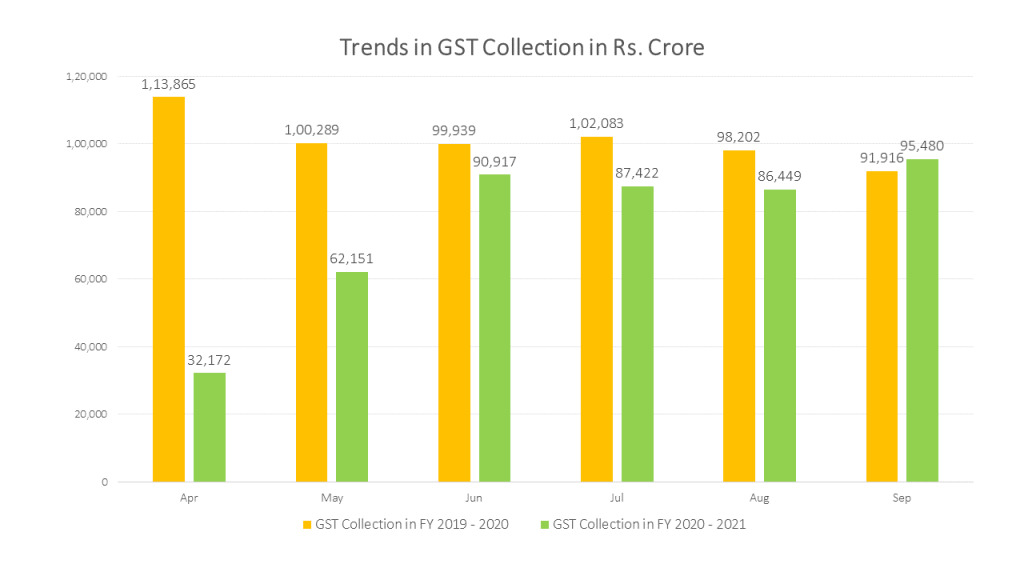

Financing the GST Shortfall

This financial year will witness a wider fiscal deficit. Both State and Central Governments are grappling with lower revenues and higher expenses. The lockdowns meant lower consumption of luxury and sin goods. This led to the question of how to finance the GST shortfall. The initial proposal was for States to borrow under a special corridor with the RBI or by raising capital in the market. The final solution is that the Central Government will borrow on behalf of the States. This works better because there’s no change in the total borrowings. More importantly, it puts to rest any optical differences in the sovereignty of States and the Centre.

On a positive note, GST collections are rising.

Source: https://pib.gov.in/PressReleasePage.aspx?PRID=1660608