It’s time we understood the mechanics of fixed-income markets.

How do the fixed-income markets work? What makes bond investors tick? Why is everyone banking on an interest rate cut? And will rate cuts finally give investors what they want?

While everyone believes that interest rates influence investors, it’s yields that call the shots. We believe that there are enough reasons for yields to remain elevated. This means, 2024 is a great year for fixed-income investments.

Yields: Breaking it Down

Think of a bond’s yield as the expected return at the time of investment. For simplicity’s sake, let’s say ABC Corp issues a 1 Year Bond at 8% today. All investors of the bond earn the same coupon (8%). However an investor’s yield changes depending on what price they buy ABC.

| Price | Coupon | Payment | Maturity | Yield |

| 980 | 8.00% | 80 | 1,000 | 10.20% |

| 1,000 | 8.00% | 80 | 1,000 | 8.00% |

| 1,020 | 8.00% | 80 | 1,000 | 5.88% |

Bond Prices

Here are a few things that could influence a bond’s price:

-

-

-

- Supply and demand

- Bond structure

- Credit quality

- Default

- Bond’s liquidity

- New issues

- Current rates

- Term of borrowing

- Macroeconomic Environment

-

-

The current level of interest rates is just one of the many factors that affect bond prices. From a logical perspective, longer-term bonds carry more risk and should offer a higher yield. Similarly, bonds issued by less credible institutions should pay more for the additional risk involved. The last few years for bond markets have been unusual in the sense that neither of these statements has held.

In 2023, all we talked about was how flat the yield curve was in our November, September, & August 2023 Fixed Income Outlook. We even talked about how to invest in a flat yield curve.

Mean Reversion

Flat yield curves are not normal. When the yield curve gets back to its “normal shape” one of two things could happen. Short-term rates could drop, or long-term rates could rise. Short-term rates respond swiftly to interest rate changes. Whereas long-term rates respond more to supply-demand conditions as well as the macroeconomic environment.

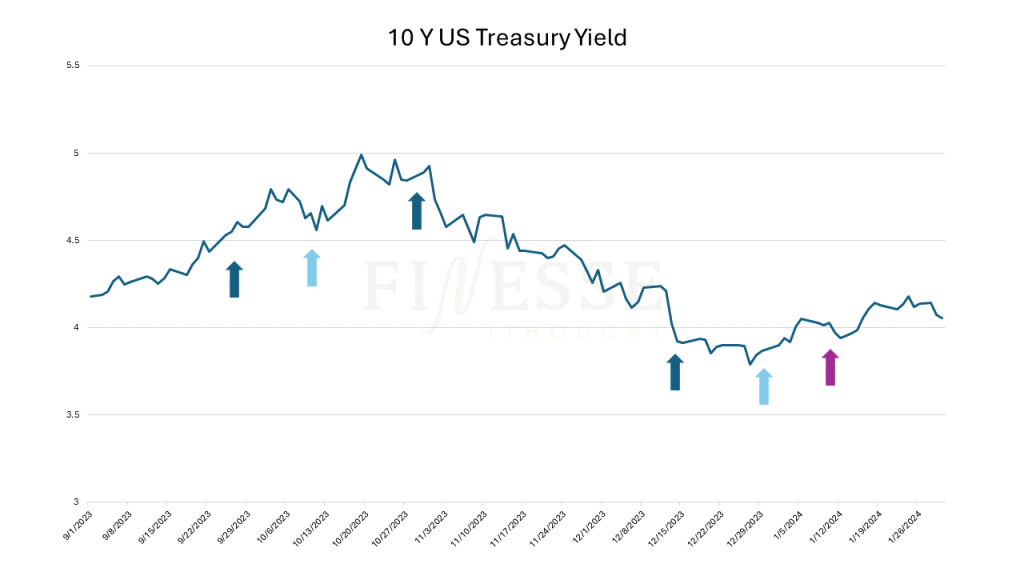

Long-term rates respond to policy changes when there are shifts or expectations of a shift. Study the long-term US treasury yields over the last few months and this should give you a sense of how yields respond to expectations and changing realities. Until December, the Fed’s tone was hawkish and indicated more rate hikes to come in 2023. By the time the December policy occurred, the market reacted to incoming data on unemployment and inflation anticipating a softer tone. Events have also influenced the yield curve. Look at how bond yields responded to the Israel-Hamas conflict or the turmoil in the Red Sea. Macro data also affected the yields: January data was promising enough to cause a dip.

Monetary policy communicates more than just rate cuts and hikes. There’s a lot of commentary on the direction of interest rates, the central bank’s stance, and risks to the outlook. Here’s a quick summary of the Fed’s policy:

Click Here: Fed Policy Updates

Want to know more about what the RBI has in store for 2024?