Welcome to this month’s Finesse blog, where we’re studying inflation trends, what the Fed is so worried about, and market expectations around RBI’s impending policy. We also explore how savers can approach investing when the yield curve is flat and what to do when the markets are at all-time highs.

Flat Yield Curves & Investment Decisions

One of the market’s favourite mantras is that higher risk should be rewarded with higher returns. Fixed-income investors primarily focus on liquidity, credit, and duration risk. Respectively, these relate to the risk of being unable to access savings on demand, losing money because the issuer defaults, and investments losing value due to the changes in interest rates.

Despite rate hikes, the Indian yield curve has been flat. Credit spreads haven’t widened meaningfully. And the yield differential between long and short-term bonds is at a historical low. So, investors are not being compensated enough for risks.

The way to approach such a situation is to manage risk well. One does this by sticking to quality and managing duration risks effectively. One way to manage duration risk is to follow a goal-aligned approach and match bonds with your financial goals. Another way is to add duration risk when spreads widen.

As we head into more inflation uncertainty, bond markets could become volatile. This could present investors with more opportunities to participate.

Investing At All-Time Highs

When markets are at all-time highs – investors are pushed into an echo chamber of success stories. But there’s little steam left in the success stories. The success stories of the future are less discovered and may even be lurking in other asset classes.

Fixed income valuations are attractive – making it the perfect asset class for waiting and investing. There is more to navigating all-time highs. Discover more:

Inflation: A Mixed Bag?

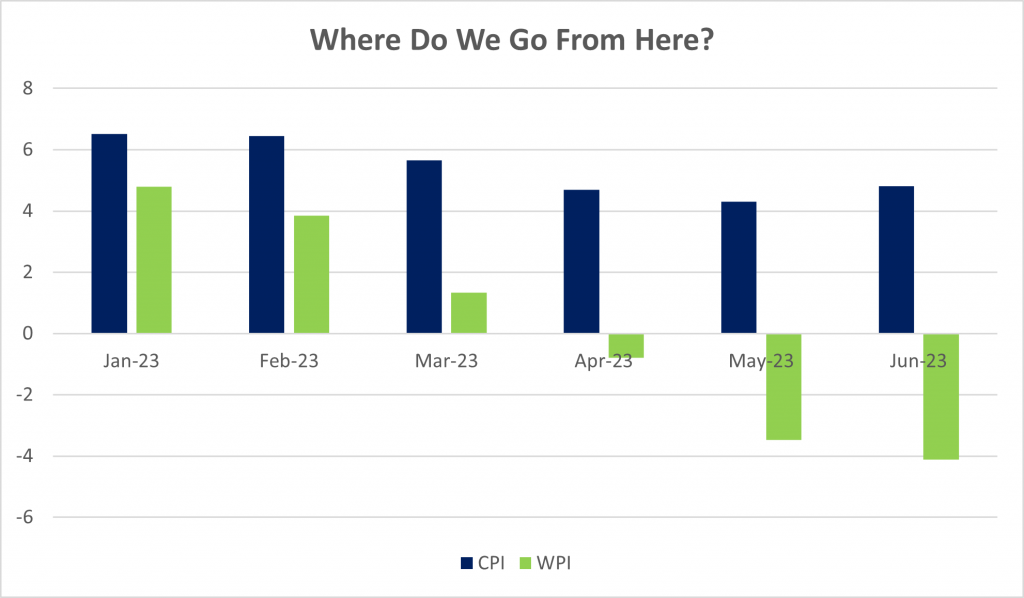

Inflation trends are full of noise. For most of 2023, CPI numbers trended towards RBI’s target of 4%. From January until June, CPI fell consistently. June marked a turning point as CPI rose for the first month this year, albeit within the RBI’s comfort zone. Oddly, WPI inflation for the last three readings has been negative – signalling deflation.

But is that where we’re heading? Food inflation has knocked on everybody’s door. In the last month, tomato prices skyrocketed. The disruption in rain patterns interfered with sowing. It may be months before we feel the full impact of an erratic monsoon. Fiscal slippages are common in election years. They add to inflation woes. From an external perspective, rising oil prices upset the fiscal math.

There are enough risks to warrant a watchful approach. Even in earlier meetings, the RBI has warned of the upside risks to inflation.

RBI August Policy: Decisions In The Absence of Data

Inflation is the only macro indicator sending mixed signals. By and large, our trade deficit has improved, and oil is trading within a range. We’ve had a stable rupee and growing foreign exchange reserves.

The August policy will throw light on the RBI’s approach to decision-making in the absence of data. So far, data has preceded meetings allowing the RBI to follow a data-driven approach. The June CPI print concerned markets being the first rise in inflation this year. July data comes out on August 14th, much after the policy meeting. The question is whether the RBI will interpret June as the start of a new trend or as a one-off reading.

With the Fed’s last rate hike, the yield differential between India and the US stands at a historic low of 1%! Surprisingly, FII and FPI flows have remained robust. Net inflows in July closed at Rs. 76,000 Crores.

India’s growth trajectory remains strong. Capital flows into the economy have been robust this financial year. Our trade deficit has narrowed. The rupee is stable. Foreign exchange reserves have grown. Oil has been within range.

Fed Monetary Policy

We covered the Federal Reserve’s monetary policy actions in detail last week. In summary, inflation is keeping the Fed up at night. In previous inflationary cycles, it has taken more than 5 years for inflation to come down from 10% to 2%. The path towards normal inflation has had its ups and downs. So for the sceptics, the smooth journey from peak inflation in 2022 to today seems a little too good to be true. The Fed doesn’t want to call it a day until the battle against inflation is over. The labour market has been supportive of the breakneck pace of interest rate hikes. The sustained inverted yield curve seems more like the new normal than a harbinger of recession.

Of late, it seems like the Fed likes to put out one fire at a time. Before COVID, it was about unwinding quantitative easing measures. During COVID, it was about ensuring citizens had access to money. Now,the priority is getting inflation to 2%. Will there be another fire for the Fed to put out?