Imagine you’re driving late into the night on a foggy road. There’s limited visibility, you slow down and stay on high alert. You can’t afford mistakes and you have less time to respond to changes on the road. You want to get to your destination without any accidents. Is investing in 2021 really that different?

This time we’re talking about:

-

-

- Which fixed-income investment strategy should you pick?

- What are your best bets?

- How is Finesse solving this problem of low returns?

-

Fixed Income Investing Strategy

Ideally, we’d love a ‘no risk’ investment with decent guaranteed returns. Of late, returns are modest and risk more prominent. So how can one generate fixed income returns? Returns in fixed income, come from four distinct styles: duration, credit, accrual, and target maturity. In this market context, which one could be the winner?

Duration Strategy in Debt Funds

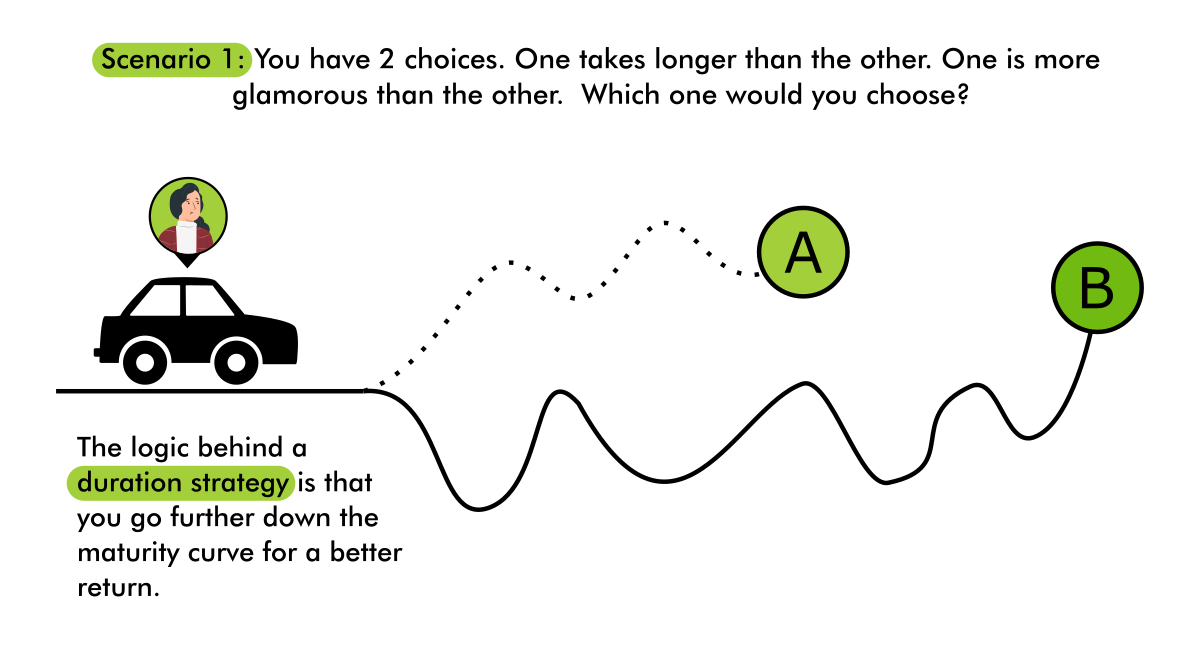

Let’s go back to our analogy of driving on a dim foggy road. Now, assume you have two options, destination A is closer and not particularly attractive; destination B is further away and a lot more glamorous. Which road would you take?

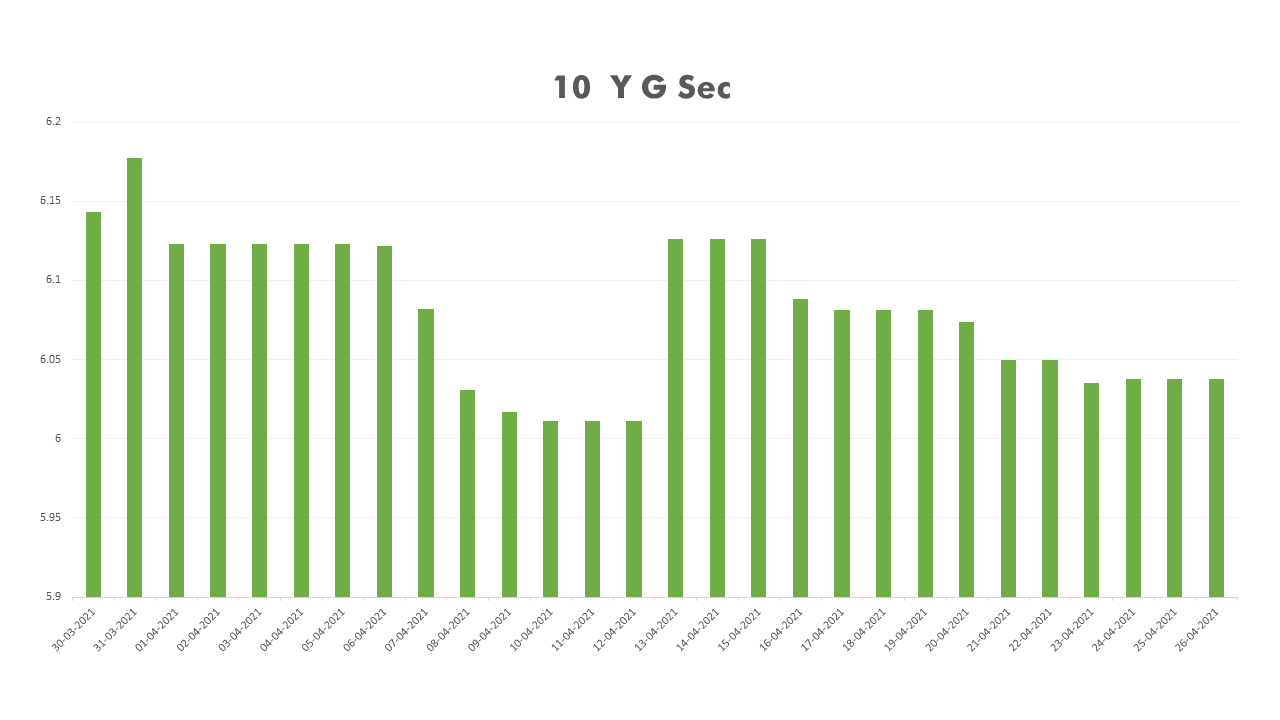

The logic behind a duration strategy is that you go further down the maturity curve for a better return. This is why a 3-year FDs typically return more than 1-year ones. Advocates of the duration strategy will point out that spreads (difference in yields) are in your favour. Today, the repo is at 4%, and the 10-year G-sec is hovering between 6%-6.2%. The current spread is 2%-2.2% while the historic spread is 1%-1.5%. If spreads revert to mean, there’s an opportunity to make profits (Mark-To-Market gains) by investing now. Alternatively, one could assume that there’s no reversion to mean and accept that 6% is a good return in this market context.

Be careful because if you take a duration call now there’s no going back. The key assumption in duration is that even if rates rise either spreads will compress, or the interest accrued will balance it out. But we’re heading into a period of higher fiscal deficits and more borrowing. So, spreads may not compress. Since we don’t know when the cycle will turn, even the accrued interest may not be enough to offset MTM (Mark-To-Market) loss. Living with a duration call means stomaching all the volatility that lies ahead. And there will be plenty. Few investors would be willing to exit their debt investments at a loss when more attractive opportunities appear.

Are Credit Risk Funds Worth It?

Credit risk is only worth it when spreads are attractive, and the future looks promising. And even then, you are taking a calculated risk. In 2020, we saw merit in credit risk funds as a category – because yields shot up on the back of lockdown concerns and one AMC winding up six of its debt funds. At the same time, the system was flush with liquidity and the economy couldn’t afford to let businesses go bankrupt. The risk-reward today is not the same as it was in 2020.

The key with credit is selectivity. You minimize risk by being more selective.

| SPREADS | PROSPECTS | OUTCOME |

| High | Bright | Category outperformance |

| High | Weak | Potential loss of capital |

| Normal | Bright | Low-risk compensation |

| Normal | Weak | Potential loss of capital |

| Low | Bright | Low-risk compensation |

| Low | Weak | Potential loss of capital |

The market misprices assets and that’s where the opportunity for credit risk lies. AIFs could be a better route to entering this segment than credit risk funds because there’s less liquidity risk.

Returning to our analogy, what happens if you accelerate when visibility is limited? Your Experienced drivers know that sometimes risks are worth it. The same applies to credit risk – the payoff is better when you understand the risks and have enough safety mechanisms in place.

Is Accrual A Good Strategy?

Accrual as the name suggests is a strategy where you allow the profits to accumulate. Credit risk funds and short-term funds follow an accrual strategy. The idea here is not to trade the bonds but to capture their returns by holding them. In our driving analogy, this is equivalent to taking things one step at a time. You’re also aiming for destination A which is closer to you.

As an investor opting for accrual could mean investing in money market funds, short-term deposits, or maintaining cash. It could also mean accepting credit risk and holding to maturity.

Passive Mutual Funds: Fixed Income

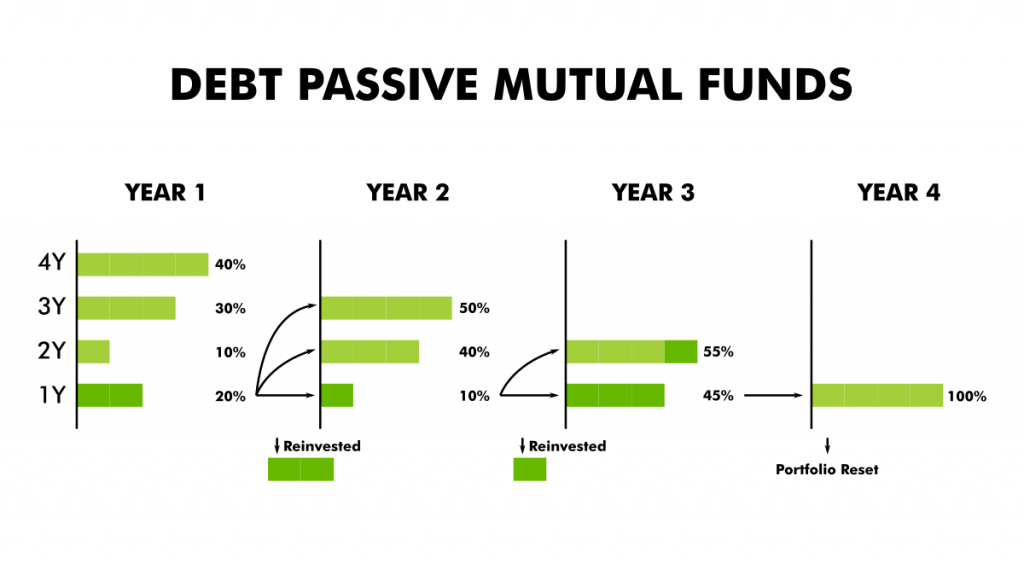

A passive debt investment strategy is a buy and hold strategy. Of late, a wider range of debt funds and ETFs are following a target maturity or roll down strategy. This is a passive investment strategy for fixed income. The idea is you fix a maturity date and invest in securities that mature on or before this date. Any new securities will match the residual maturity. In some sense, the underlying logic is similar to the accrual strategy.

Long-term target maturity funds carry duration risk. And short-term target maturity funds aren’t that different from accrual funds. More importantly, in a dynamic market, passive strategies come at a price. The price could as hefty as ignoring market opportunities and following an outdated strategy. Passive strategies can work wonders when everything is in your favour and there’s no need for heavy lifting. In fact, we advised on passive strategies when AAA yields were close to 9% in the aftermath of the IL&FS default.

On a tough road, no sensible driver would choose to leave their vehicle in cruise control. The question is, should you opt for a passive strategy in a challenging investment environment?

Duration vs Accrual: Which is the ideal strategy?

From a fixed income perspective, each of these strategies has a drawback. A duration strategy will be volatile with notional losses. Credit risk without the right filters could mean permanent loss of capital. Accrual strategies currently offer low returns. And target maturity strategies come at an opportunity cost.

We believe that low returns are better than no returns/negative returns. We designed a barbell SIP that tackled volatility and provided better returns than pure duration or accrual strategy. The barbell SIP combines the best parts of accrual and duration strategies.

Safe Investments With High Returns in India

Surprisingly, the safest investments (backed by the government or RBI) are still offering the best risk-adjusted returns. They beat bank FDs and other traditional favourites. There’s no credit risk because these investments are sovereign in nature. The only risk is that returns could fall or that these instruments are illiquid with long lock-in periods.

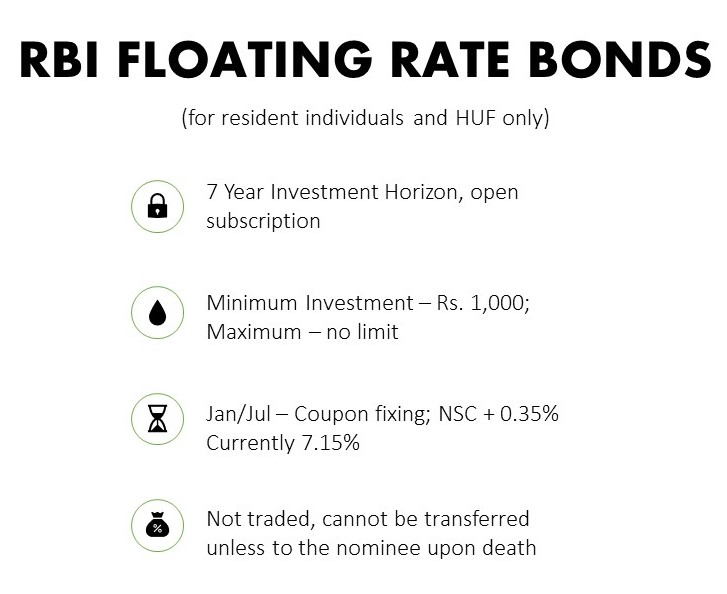

RBI Floating Rate Bond

The RBI issued a floating rate bond in 2020. Here are the key features:

The RBI floating rate bond is a great way to invest in bonds. Unlike other bonds, the minimum investment is Rs. 1,000 and not Rs. 5 Lakhs or Rs. 10 Lakhs. Interest is paid every 6 months. The bond matures in 7 years. The only reservation an investor could have is liquidity. The bonds cannot be traded or redeemed prematurely. 6.8% is the lowest the NSC has been in the last 5 years.

Provident Funds

Interest on income in provident funds was tax-free. This was one of the reasons the PPF, EPF, and VPF were popular investment choices. Risk and tax-adjusted returns were superior to all other products available in the market. From this financial year, the interest on EPF and VPF may be taxed if the contribution exceeds Rs. 2.5 Lakhs in a year. Click here to know about the other changes coming into effect this financial year.

The current EPF/ VPF rate is 8.5% and the PPF rate is 7.1%. These rates are significantly higher than the yields on tax-free bonds. Talk to our financial advisors to calculate the effective post-tax rate on your provident fund contributions.

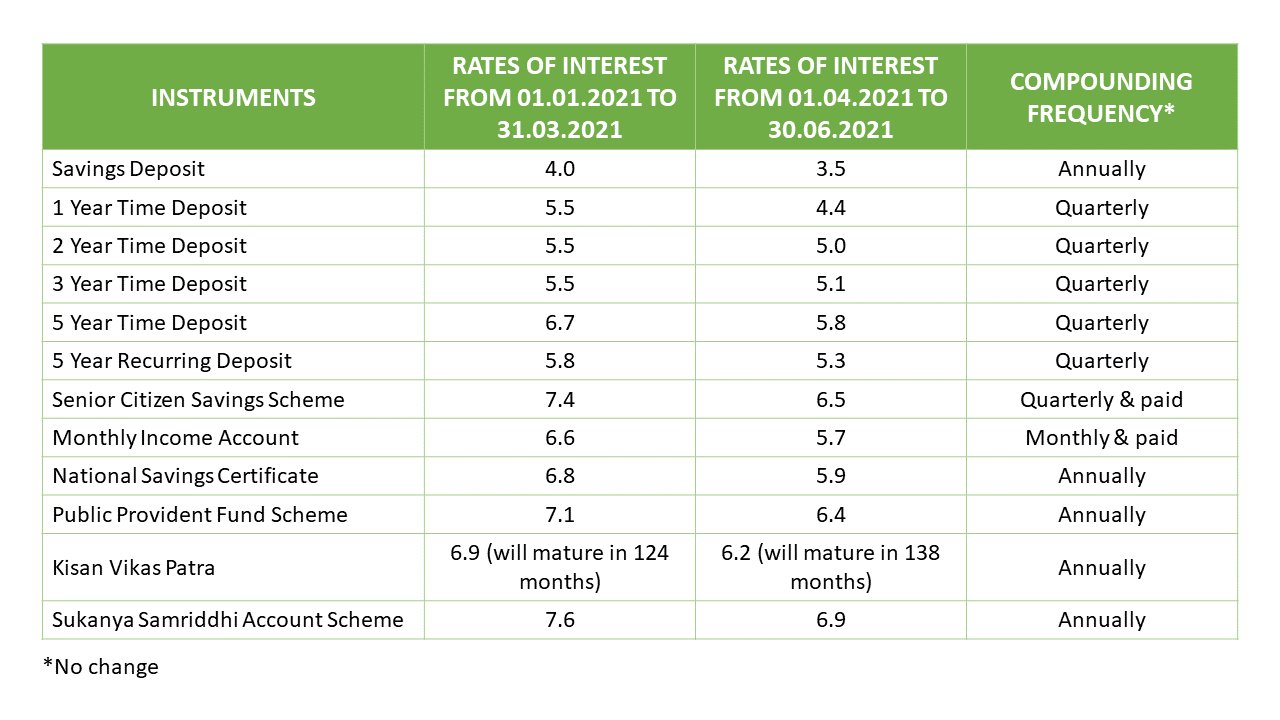

Post Office Savings Schemes

Small savings schemes are competitive compared to other alternatives. We published a piece on the special fixed deposit schemes for seniors. Amongst the best investment options for seniors are the SCSS and the PMVVY. You can invest up to 15 Lakhs in each of these schemes at a return of around 7.4%. The investment horizon is 5 years for SCSS and 10 years for PMVVY.

Returns from these schemes are decoupled from the market. The Finance Ministry announced slashing these rates at the start of the financial year. They quickly withdrew the circular and restored the old rates.

How Is Finesse Solving The Problem of Low Returns?

Low returns are here to stay and so is the need for conservative investments. Our fixed income investment advisory service, finesse aims to add an edge to your investing. Here are four lessons we’re using to solve the problem of low returns:

Ideal Investments Don’t Exist

We’ve reconciled ourselves and investors to the idea that ideal investments don’t exist. In investing, there will always be a trade-off – anything that looks too good to be true probably is too good to be true. Much of the mis-selling and mistakes in fixed income boils down to overpromising and underdelivering.

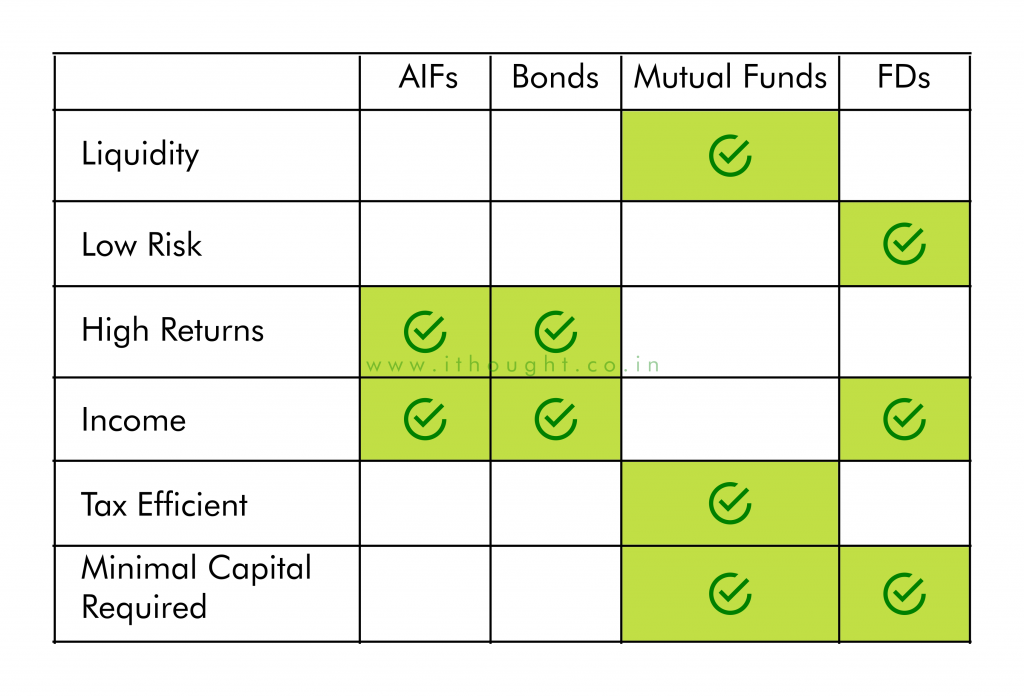

While the perfect investment is elusive, there could still be a suitable investment. Think about what you want most from your investment and prioritize that. Are high returns a priority, or tax efficiency? Or are you the kind of investor who needs access to capital at the drop of a hat? This handy matrix could help you pick the product that works best for your requirements. Or talk to our advisory team to structure your investments.

Systematic Investment Plan or SIP in Debt Funds

The 10 Y G-sec has been oscillating between 6% and 6.2% this last month. Bond yields are changing and responding to market events. When markets are volatile, the best strategy is to invest consistently. This strategy averages cost and capture opportunities. As we move up in the interest rate cycle, yields will also rise. In such a context, SIPs benefit more. Lump sums are subject to more mark-to-market changes.

The power of a SIP in debt funds is tax-efficient compounding. Low YTM is not a reason to shy away. We talked extensively about YTM vs Returns last month. A low YTM doesn’t correspond to a low return. Investing at every level in the market averages your cost and minimizes mark-to-market (MTM) loss in an upward interest rate cycle. On a 3-5 year horizon mutual funds have the potential to outperform fixed deposits by 0.5% to 1%. The challenge is picking the right products, and that’s exactly what we do at Finesse.

Accept Lower Returns or Higher Risk and Follow Asset Allocation

Surprisingly, seasoned investors don’t worry about periods of low returns. They understand and accept that it is part of the investment journey. If you consciously choose a low return high liquidity strategy now, you’re positioning yourself well to take advantage of future opportunities.

Alternatively, prepare to take more risk to achieve your investment objectives. We’ve talked about how AIFs are a sophisticated higher risk product for fixed income investors. Some investors are comfortable with financial risk, but not in fixed income. If you belong to this category, consider moving assets temporarily to another asset class. Our equity advisory service, ACE, aims to adapt, curate, and excel.

It’s time to do more with your investments and Finesse is one way to add an edge to your investing.