2023 Highlights – Bank of England

The Bank of England has raised interest rates in 4 out of 7 policy meetings this year. Interest rates have remained constant at 5.25% since August 2023. This is in stark contrast to the previous decade. Interest rates were at 0.50% from March 2009, reaching 0.75% in 2019, and going to near 0% in 2020. The Bank of England follows an inflation-targeting mandate with a target of 2%. Inflation peaked at 11.10% in November 2022, the highest in multiple decades, with inflation moderating from that point. In November 2023, inflation stood at 4.60%. Although an improvement, this is still more than two times the BoE’s target. The Monetary Policy Committee of the BoE estimates CPI to fall over the next few quarters to 3.75% by Q2 2024. GDP is expected to be flat for Q3 2023. Output PMI has been below the “No Change” point for several months and the new order book and export order book have been weak.

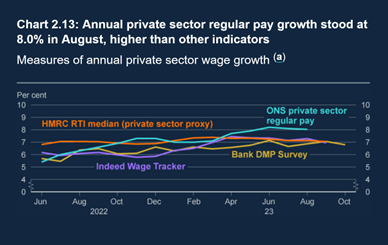

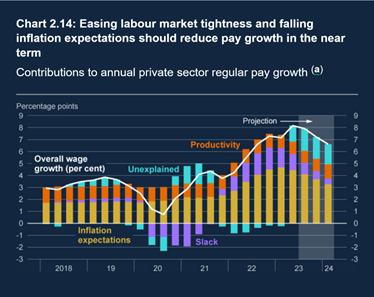

Forward-looking estimates indicate that output expectations in the next 12 months are just a bit below the long-term average. Nominal wage growth remains high despite a loose labour market.

Falling inflation and the loose labour market are expected to contribute to moderation in wage growth and forward-looking indicators suggest wage growth will fall back.

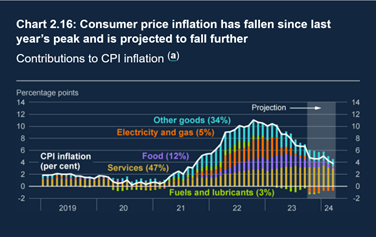

CPI Inflation

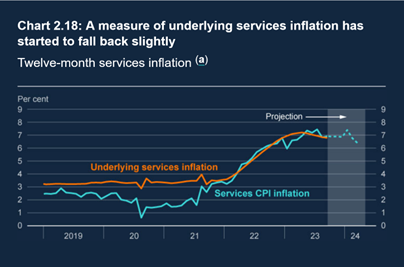

CPI inflation is falling but still above the 2% target. CPI inflation fell to 6.80% in July and 6.70% in August and September largely driven by lower energy prices.

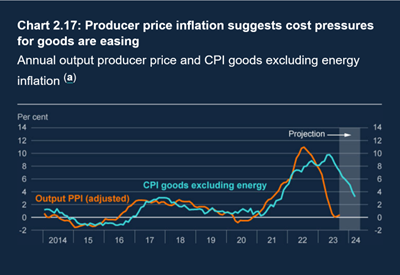

CPI inflation is expected to fall further to 4.4% in Q1 2024. This mainly reflects lower goods price inflation as firms are expected to pass on lower costs, and services expectation which is expected to moderate as pay growth and input costs fall.

2023 Highlights – European Central Bank

Inflation has dropped considerably across Europe but is still much higher than the ECB’s target level. Although inflation is expected to come down further over the next few quarters, rising geopolitical tensions in parts of the world are risks to the estimate. The European economy has remained weak in 2023. Less demand, higher interest rates, and lower investments are cooling the economy. Although unemployment is at its lowest in many decades, few newer jobs are being created across sectors.

The ECB expects inflation expectations to stay higher for longer although most measures of inflation are continuing to ease. The transmission effects of prior rate hikes are curbing demand and lowering inflation. The current view of the ECB is that the current rate of 4% if maintained for a sufficient period will substantially achieve its goal of lowering inflation to 2%. Further interest rate decisions will be based on incoming data, particularly inflation, economic data, and the strength of policy transmission.