In this blog, we look back at what happened in 2023. Higher interest rates define the new macroeconomic regime today. The coming decade will be very different from what we have seen after the GFC. Expanding production capacity helped central banks stabilize the economy and fuel growth through loose monetary policy. This stoked bull markets in stocks and bonds. In the last decade, investors could rely on broad asset allocations and keep them static while still achieving stable returns.

Today, the US is faced with high-interest rates, production constraints, high-although moderating inflation, a structural shift to low carbon, and a revolution in technology. In this scenario, greater volatility and dispersion have created a space for investment expertise. Investors must take an active approach to portfolio construction and take deliberate portfolio risks.

US Economy

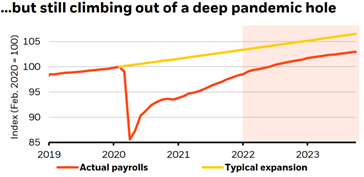

The US economy experienced robust growth in the 3rd quarter of this calendar year. 7 million new jobs have been created since 2022.

Source – Blackrock Investment Institute

Actual payrolls have just increased from pre-pandemic levels, much below the typical expansion scenario. Looking at broader economic growth, since the pandemic, the US has grown by less than 1.80% p.a. well below the pre-pandemic trend of nearly more than 3%. The shift in consumer spending post-pandemic, combined with the production mismatch drove high inflation. America is also facing a labour shortage. The Labour Department has projected total employment to grow by 0.30% p.a. until 2032, much slower than the 1.20% over the past decade.

US Economic Shifts and Adjustments

The US is clearly on a weaker growth path owing to higher inflation and interest rates over the last year and rising debt levels. The key now is focusing on how the economy and markets adjust to this new reality and adapting to the situation.

Source – Blackrock Investment Institute

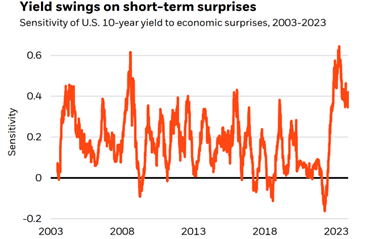

Data surprises are driving sharp, sustained swings in the US 10-year treasury yields reflecting greater uncertainty among investors, still trying to adapt to a structural shift in the markets. While inflation still remains above the US central bank’s long-term target of 2%, The Fed has issued a cumulative hike of 1% in 2023, with no rate hikes since July, driving hopes of a rate cut as soon as sometime next year.

US Stock Market Performance

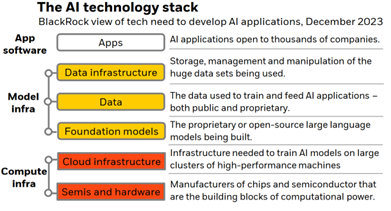

The US stock market rebounded dramatically in 2023, with top performers being from the high growth, cyclical technology, and consumer discretionary sectors. The buzzword in 2023 was AI, and this might indeed continue for the foreseeable future.

Global Technology Landscape

Today, we are somewhere in between the bottom two layers of this stack. The fact that Nvidia, a company heavily involved in hardware and cloud infrastructure was one of the top-performing stocks in the US in 2023 corroborates this view. Investors are ascribing high economic value to emerging AI patents, yet not all patents lead to profitability. The future of successful companies in this space is up in the air, but the future of the technology is not.

India’s Economic Outlook

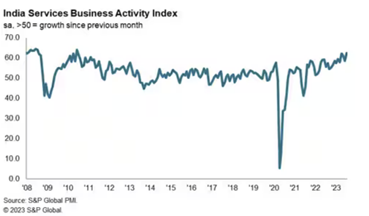

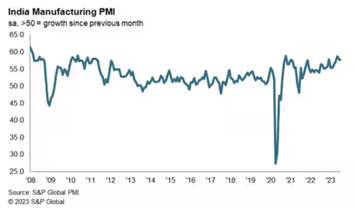

Now, let’s shift our focus to the domestic market. India’s economy will be the 3rd largest with a GDP of $5 trillion by 2047, according to IMF estimates. India is also expected to be the fastest-growing economy among the G20. After a 7.20% growth in FY23, the first and second quarters of FY24 recorded 7.80% and 7.60% respectively. Amid rising geopolitical uncertainties and a slowing global economy, India will have to look inward in the near term, specifically investment spending and consumption. High-frequency indicators continue to remain strong. The services sector boosted economic growth to a likely 6.50% for the 2nd quarter as signaled by PMI, capacity utilization, credit growth, and infrastructure indices.

Manufacturing firms have also reported better export demand despite weak global growth.

Inflation and Monetary Policy in India

India’s retail inflation clocked in at 4.87% for October 2023. The RBI has kept interest rates unchanged recently, sticking to 6.50% for the repo rate while slightly shifting the medium-term inflation target to a hard 4% from the prior 2% to 6% band, where inflation was anchored to 4%, with a 2% leeway allowed on either side. Inflation for November is expected to rise to around the 5.20% mark due to higher food prices and an expected weak harvest.

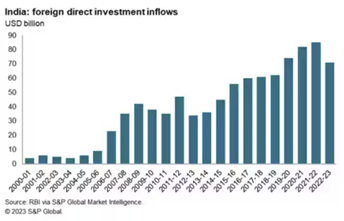

Foreign Direct Investment (FDI) in India

Foreign direct investment has picked up sharply when compared to the early 2000’s and 2010’s. With India emerging as one of the most important growing economies, this is bound to only increase.

In 2020, Google established the “Google for India Digitization Fund” where it plans to invest $10 billion into India over 7 years through equity, partnerships, and operational infrastructure and ecosystem investments. Meta has also invested $5.70 billion in Jio Platforms. By source of inflows in the recent FY, Singapore, Mauritius, UAE, and the US are the top 4. This highlights the growing importance of India in the global economy and the importance of building investment relationships with emerging market powers. The growing number of Indian unicorns has also become a major focus of FDI inflows. By September 2023, there were an estimated 108 unicorns in India, with 44 new unicorns established in 2021 and 21 in 2022, according to Invest India.

Keep an eye out for our 2024 Investment Outlook, coming soon!