What happens when a borrower runs out of all options and is on the verge of financial collapse? Nobody wants to bail them out. Their only hope is a ‘Lender of last resort. Usually, the lender of last resort s a Central Bank. Rana Kapoor, the co-founder of Yes Bank was infamously known by this moniker for his knack of lending to and extracting what he was owed from anyone.

A classic case of flying too close to the sun, Yes Bank’s story is inseparable from its co-founder’s. In this blog, we look at what exactly happened to the bank that never said no.

The Lending Frenzy

In 2004, Rana Kapoor and Ashok Kapur, long-time friends and brothers-in-law, started Yes Bank. Their lending styles stood out like chalk and cheese. Ashok Kapur was a conservative banker and Rana Kapoor was a risk-taker. Ashok Kapur tragically died in the 2008 Mumbai terror attacks and the bank became Rana Kapoor’s to run.

Under Kapoor’s leadership, the bank had a meteoric rise. It went public in 2005 for Rs. 12-13 per share. At its peak in 2018, the traded price was approximately Rs. 393. The CAGR return from the IPO to the peak was 30%. By this time, Yes Bank had attracted some of the best banking clientele. It also earned its reputation as an aggressive lender. Aggressive lending can paint a better picture when the tide is in your favour, but it comes with risks.

Those risks gradually materialized as non-performing assets (NPA). An NPA is a loan account where the interest receivable has not been paid for more than 90 days. Yes Bank’s loan book contained various defaulters, including DHFL, Anil Ambani’s Reliance Group, and Jet Airways. This reckless lending eventually led to the NPA catastrophe and the RBI’s moratorium.

| Company | Loan Amount (Rs. in Crores) |

| Reliance (ADAG) | 12,800 |

| Essel | 8,400 |

| DHFL | 4,375 |

| ILFS | 2,500 |

| Jet Airways | 1,100 |

| Kerkar Group | 1,000 |

| Omkar Realtors & Developers | 2,710 |

| Radius Developers | 1,200 |

| CG Power | 500 |

Under Rana Kapoor’s direction, it is suspected that some loans bypassed RBI guidelines. The Enforcement Directorate (ED) kept Rana Kapoor in judicial custody in connection with the DHFL Loan. According to the ED, Yes Bank bought DHFL debentures worth Rs. 4,300 crores (as seen above), while DHFL issued an Rs. 600 Crore loan to a company owned by Kapoor’s daughters. This was one of the many irregularities found in the books of Yes Bank.

They reported severe deterioration in financial conditions in the years leading up to 2020. The table below has some of the key financial ratios.

| Ratio | FY 15-16 | FY 16-17 | FY 17-18 | FY 18-19 | FY 19-20 |

| ROE | 19.90% | 21.50% | 17.70% | 6.50% | -113.10% |

| ROA | 1.70% | 1.80% | 1.60% | 0.50% | -7.10% |

| Net Interest Margin | 3.40% | 3.40% | 3.50% | 3.20% | 2.20% |

| Capital Adequacy Ratio – Basel III | 16.50% | 17.00% | 18.40% | 16.50% | 8.50% |

| Tier 1 | 10.70% | 13.30% | 13.20% | 11.30% | 6.50% |

| Tier 2 | 5.80% | 3.70% | 5.20% | 5.22% | 2.00% |

| Gross NPA | 0.76% | 1.52% | 1.28% | 3.22% | 16.80% |

| Net NPA | 0.29% | 0.81% | 0.64% | 1.86% | 5.00% |

| CASA Ratio | 28.10% | 36.30% | 36.50% | 33.10% | 26.60% |

Instead of acknowledging their financial stress, Yes Bank began under-reporting their NPAs. The RBI caught on and warned them about this practice. However, the bank continued to underreport NPAs. In FY19-20, their Tier 1 Capital fell below regulatory requirements and their Tier 2 Capital was restricted to 2% from 6.37%. Financial conditions didn’t improve at Yes Bank and NPA’s continued to weigh on the balance sheet. Finally, in 2020, the RBI levied a moratorium on Yes Bank and wrote off its AT-1 (Additional Tier-1) Bonds.

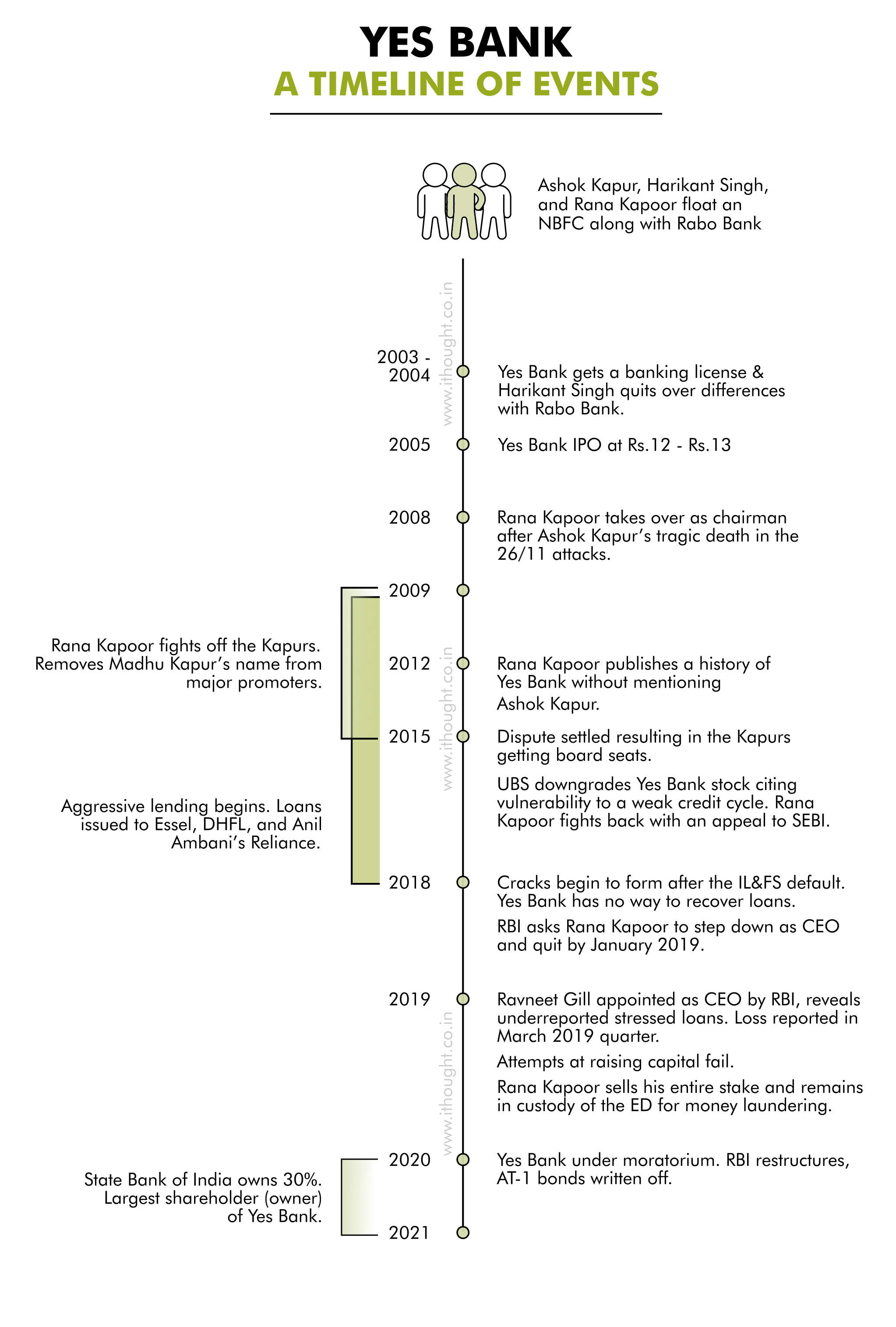

Yes Bank – A Timeline of Events

Yes Bank Moratorium

The RBI gave Yes Bank enough time to come up with a credible revival plan instead of going through the regulatory restructuring route. Yes Bank failed to entice market participants with their offering. As there were no takers, the RBI stepped in. On 5th March 2020, the RBI released a statement saying that Yes Bank was now under moratorium since it couldn’t raise sufficient capital. This triggered bond covenants and the withdrawal of deposits.

A moratorium on the bank meant that the withdrawals were capped at Rs. 50,000 per account (emergencies exempt up to 5,00,000). The bank’s board was suspended. SBI and a consortium of investors infused capital into Yes Bank to keep it afloat and help it run daily operations.

Part of the shareholding pattern as of 31st March 2021 is given below:

| Entity | Holding % |

| State Bank of India | 30.00% |

| Life Insurance Corporation of India | 4.99% |

| ICICI Bank | 3.99% |

| Axis Bank | 1.96% |

| HDFC Life Insurance Company Limited | 1.37% |

| Bandhan Bank | 1.20% |

| IDFC First Bank | 1.15% |

Yes Bank AT-1 Bonds & Super FDs

After the global financial crisis, the international standard for banks was to move to Basel III norms. These norms stated that banks needed more capital for financial stability. Under the Basel norms, new instruments were issued. The primary purpose of these instruments was to preserve financial stability. Investor protection came second. AT-1 bonds formed a part of Tier-1 Capital and could be converted to equity or written off.

According to SEBI, Yes Bank misrepresented these risks and marketed their AT-1 bonds as ‘Super FDs’ to retail customers. According to the regulator, more than 97% of AT-1 bondholders were customers of Yes Bank. Hundreds had prematurely withdrawn their fixed deposits and reinvested them in the AT-1 bonds. SEBI also noted that the lot size (minimum investment size) for the bonds was substantially reduced to accommodate retail investors. Most investors had no clue how AT-1 bonds were different from bank fixed deposits.

Here’s why AT-1 bonds are nothing like other bank bonds or bank fixed deposits:

-

-

- They are perpetual – Unlike a fixed deposit, they do not have a set maturity. They have a non-enforceable call option. It is often taken for granted that banks will call the bond on the set date.

- Reinvestment risk – Banks can also choose to call the AT-1 bonds before their call option date at face value. This could lead to reinvestment risk for the investor.

- Skipping Interest – Banks can choose to skip interest payments of AT-1 bonds without being labelled as defaulters. If their Common Equity tier-1 ratio falls below 8%, it is up to the banks to pay/partly pay/skip interest payments for that financial year.

- Capital Loss – If the bank’s Common Equity tier-1 ratio falls below 6.125%, the bank can write down the face value (principal) either temporarily or permanently.

-

Remember when we talked about Basel III norms? And how these new instruments protect the bank’s financial stability over the investors’ interest? When Yes Bank was stuck between a rock and a hard place, the RBI followed regulatory protocol and wrote off its AT-1 bonds. Retail investors were shellshocked. They couldn’t fathom why they wound up losing all their bank FD money, little realising that they never owned FDs in the first place.

How did we avoid Yes Bank?

Time and again, history proves that protecting your capital is more important than anything else. Looking at a 30% CAGR on a stock or 10.5% yield on a bank’s AT1 bond is not the best way to make an investments decision. So, what is a better way?

At ithought, we follow a research-driven approach. Our research showed us that the financial stress in Yes Bank’s balance sheets was mounting over the years. We understood and highlighted the risks with Basel III bonds in 2017. Yes Bank’s lending practices as well as their disregard towards regulatory warnings were red flags.

All it takes is one bad cycle for the market’s euphoria to turn into despair. We aim to avoid getting caught in this flood of emotions by focusing on risk management.

If you believe that risk management will get you better results, ithought is the right fit. Get in touch with our advisory team today!

References

-

-

- https://www.yesbank.in/pdf/annualreport_2016-17_pdf

- https://www.yesbank.in/pdf/annualreport_2017_18_pdf

- https://www.yesbank.in/pdf/annual_report_2019_2020_pdf

- https://trendlyne.com/equity/share-holding/1535/YESBANK/latest/yes-bank-ltd/

- https://economictimes.indiatimes.com/yes-bank-ltd/shareholding/companyid-16552.cms

- https://www.indiatoday.in/news-analysis/story/yes-bank-rana-kapoor-1653955-2020-03-09

- https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49476

- https://www.bloombergquint.com/law-and-policy/yes-bank-represented-at-1-bonds-as-super-fds-says-sebi

-