Arbitrage funds are on a roll this year! In just two quarters, they’ve already pulled in Rs 52,000 crores, closing in fast on last year’s total of Rs 59,000 crores (Source: AMFI Database)

Clearly, it is becoming the investor’s favourite! But before we address why it is so, let us look at what arbitrage funds are.

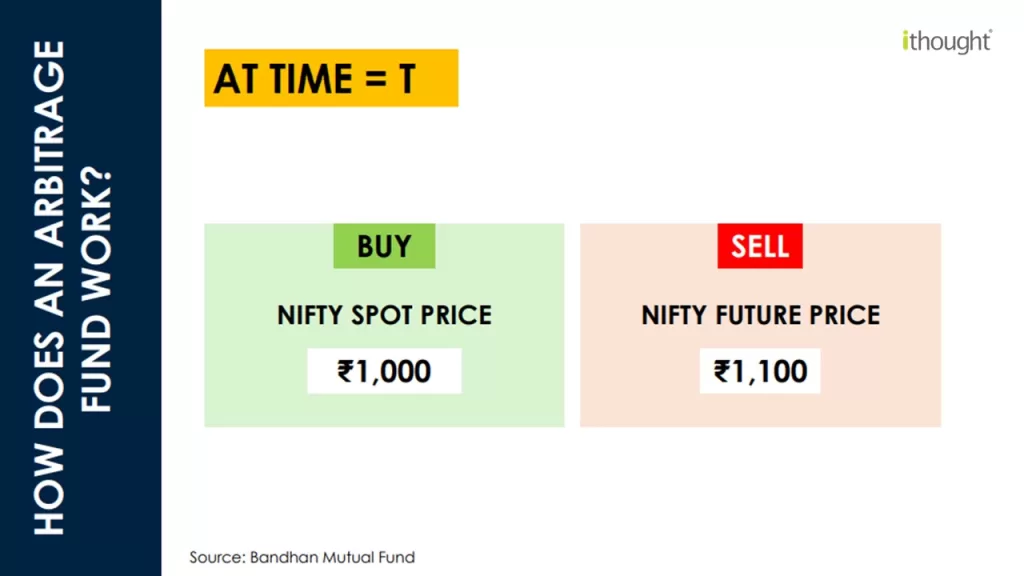

An arbitrage means a risk-free profit. In financial markets, where there are typically two markets- the spot and the future, security can trade at two different prices, which the arbitrageur looks to cash on. These can be a pricing mismatch between two exchanges or different pricing in the two markets due to market inefficiencies, volatility, and corporate actions.

Creating Alpha in Arbitrage Funds:

Alpha refers to the excess returns a fund can earn over and above what the general market earns. Fund managers can create alpha in arbitrage funds primarily through two methods:

Dividend Arbitrage: Since futures do not earn dividends, their prices tend to be discounted by the dividend amount. If a fund manager anticipates a higher actual dividend compared to the historic dividend, they can profit from this current spread.

Market Volatility: During periods of market volatility, spreads in many stocks become negative due to aggressive short selling. Fund managers can proactively unwind arbitrage positions to earn extra returns.

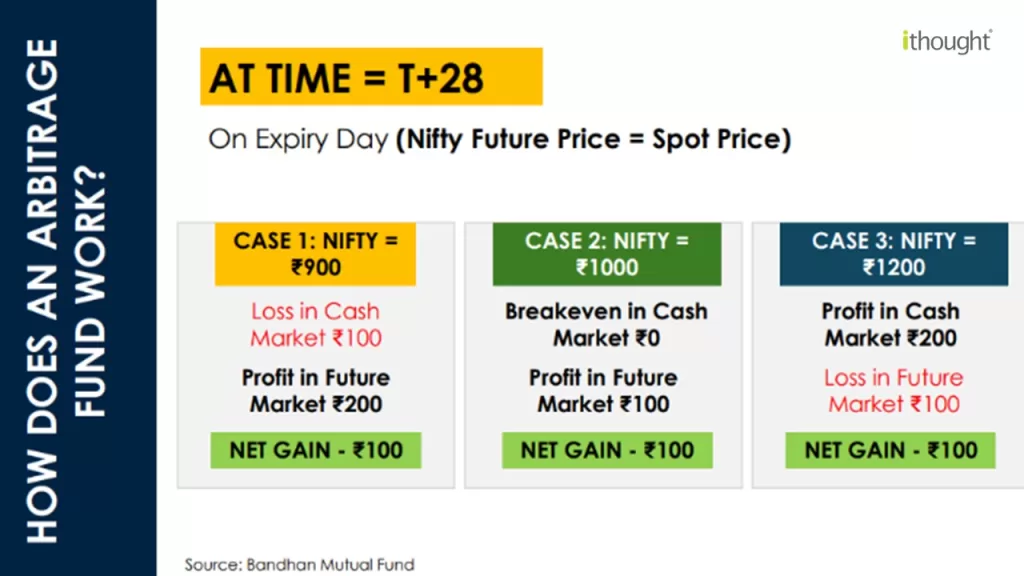

A simple illustration of this can be seen below:

Source: Bandhan MF

Arbitrage funds differ fundamentally from traditional investment strategies in a way that arbitrage sees quick and immediate profits whereas traditional investments usually must wait to see long-term growth. In India, arbitrage funds are equity-oriented hybrid funds that leverage arbitrage opportunities in the market. They typically maintain 65%-75% of investments in arbitrage opportunities and the remaining in fixed income.

Why Arbitrage Funds?

Low Risk: These funds are considered low risk as they rely on the certainty of price convergence. Moreover, there is net zero equity exposure, protecting the investor from market volatility. Refer illustration above – arbitrage profits are locked in regardless of whether prices move up or down.

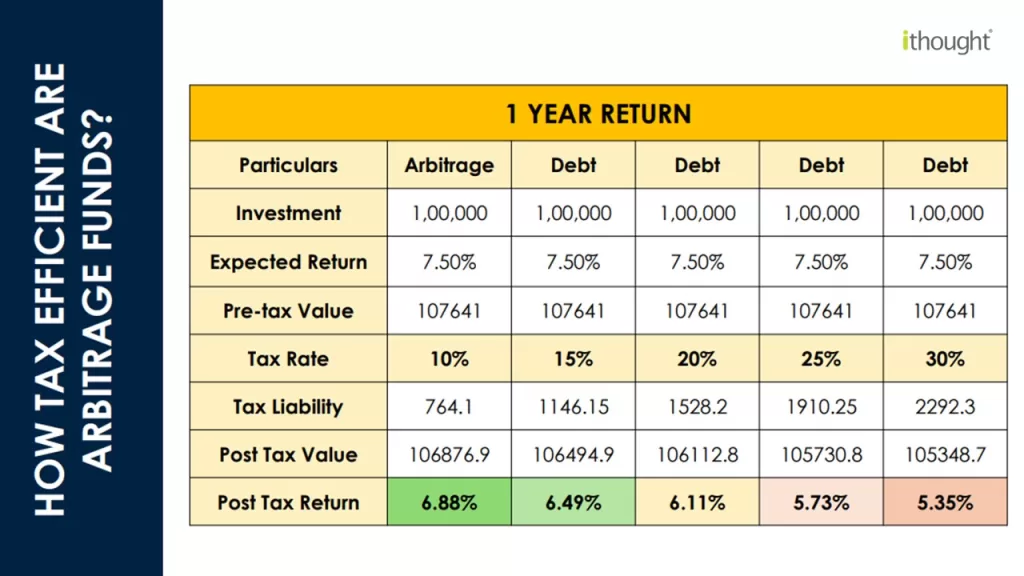

Tax Efficient: These funds have the potential to outperform debt funds in terms of post-tax returns. The calculations are illustrated below:

Source: Bandhan MF

Suitable Across Market Cycles: They perform well in various market conditions, providing stable returns over a 6–12-month period.

Alternative to Debt Funds: For investors without fixed income mandates, arbitrage funds offer a viable alternative, often with better post tax returns.

What/Who is it suitable for?

This investment is ideal for investors with moderate risk appetite who are looking to achieve the following:

Emergency/ Contingency Reserve– offer low-risk, stable returns, making them ideal for funds needed unexpectedly.

Short-Term Liquidity Needs– provide easy access to money with minimal risk, suitable for short-term financial requirements.

Temporary parking – to switch to other asset classes

Recurring goals – school fees, vacations, etc.

What should you know before investing in Arbitrage funds?

There is a requirement of a minimum investment horizon of 6-12 months

Unpredictable payoffs: In rare cases, the investment experiences negative returns. If arbitrage spreads are low, returns can be lower, and the fund manager may look at other sources of investments such as fixed income. So, the payoffs maybe unpredictable, making the spreads narrow and the payoffs, non-linear as well.

High expense ratios: Arbitrage funds offer significant profit potential, especially in volatile markets. Their high trading volumes present exciting opportunities for substantial returns. To optimize your investment strategy, it’s beneficial to diversify your portfolio, which helps balance the higher costs and occasional inconsistencies associated with arbitrage funds.

In conclusion, arbitrage funds provide a low-risk, tax-efficient investment strategy suitable for various market conditions. By leveraging price discrepancies and market volatility, these funds offer an alternative to traditional debt funds with potentially higher post-tax returns. For investors seeking stable returns with minimized risk, arbitrage funds present a compelling choice. By understanding and utilizing these funds, investors can benefit from a unique approach that balances low risk with tax efficiency, making arbitrage funds a compelling addition to a diversified portfolio.