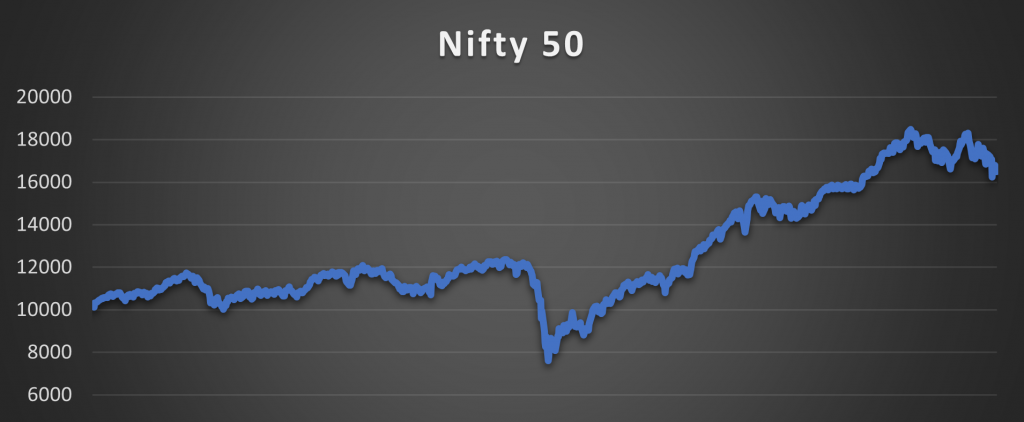

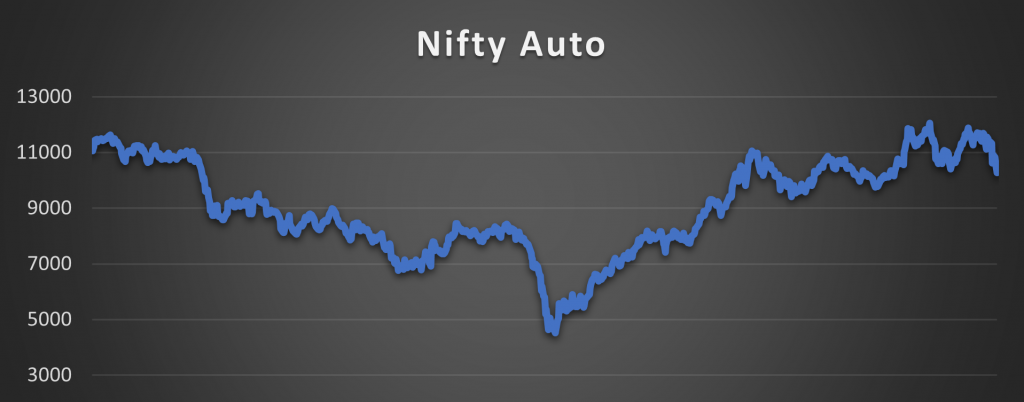

The Nifty Auto Index has been lagging the Nifty 50 for the last five years. The five-year return of the Nifty Auto Index has been 7% whereas, during the same time, the Nifty 50 has delivered close to 85%. There is no question that the auto sector has been in a cyclical downturn.

In this blog, we will take a closer look at the auto sector, explore what happened and break down the cyclical nature of this industry.

The Crisis

The past few years have seen the Indian automotive industry go through a crisis. This included production cuts, unsold inventory despite the cuts, factory shutdowns and layoffs. This included heavyweights such as Maruti Suzuki and Mahindra. There were a few reasons for this, let’s take a closer look.

-

-

- GDP – From 2014 to 2016, the GDP grew between 7.40% and 8.26%. In 2017 and 2018, GDP growth fell to 6.80% and 6.50% and in 2019 a measly 4%. This was the lowest in 11 years. The auto industry is one which is closely linked to the growth of the economy and consumer spending. The industry contributes to 7% of the country’s GDP. It is a discretionary product. This led to sales plummeting to multi-decade lows and increased pressure on the manufacturers to take drastic measures to cut costs.

- The Credit Crisis – The woes of the auto industry were further amplified by the credit crisis which started in the second half of 2018 with IL&FS collapsing. This jarred banks and financial institutions. Lending was tightened and credit collapsed. As the easy flow of money in the economy tightened, this further exacerbated the difficulty in buying a vehicle in an already slowing economy.

- The Change in Standards – In 2020, the Bharat Stage 6 (BS6) emission standard was introduced, modelled after the Euro 6 standard. This forced automakers into revamping their entire portfolios for both petrol and diesel vehicles. The BS6 engine standard added more complexity in 4 wheelers and 2 wheelers. Airbags and fuel injectors were made mandatory. Particulate filters grew more complex with and effort to reduce harmful emissions. This added to the pain by increasing production costs and prices of vehicles.

-

Looking Forward

Growth looks bright in the medium term. With the credit crisis behind us and credit growth back underway, access to loans should ease going forward. Manufacturers bringing in new models, improving technology and a further improvement in EV infrastructure, range and reliability will increase consumer appetite. Gradually building a position in this industry can yield favourable results. The next year will be crucial in seeing where the auto industry goes.