DHFL was a housing finance company established and incorporated in Mumbai by Rajesh Kumar Wadhwan on 11th April 1984. The company was established to provide affordable housing finance for lower and middle-income groups in semi-urban and rural India. On June 5th 2019, almost a year after the high profile IL&FS default, DHFL’s short term commercial papers worth 850 crores were downgraded to ‘D’ by the rating agency ICRA. This meant that ICRA did not expect DHFL to meet their obligations. DHFL is a non-banking finance company. They don’t have a banking license nor do they have access to the RBI’s liquidity. After the failure of IL&FS, banks became more careful and almost hesitant to lend to NBFCs. A lot of NBFCs borrow money for the short term to finance their long term lending. This creates an asset-liability mismatch. This used to work when NBFCs had regular access to liquidity, but when banks stopped lending, the bad practice of keeping an asset-liability mismatch led to a liquidity crunch.

Allegations of Fraud & Misconduct

There were also a number of allegations that accused DHFL of being involved in a scam to the tune of about 31,000 crores. These allegations involve dubious loans made to shell companies with ties to the promoters of DHFL. The complex nature of these transactions made it difficult for authorities to track. Furthermore, the money had been lent without adequate securitization. Usually, when giving loans, assets of the borrower are pledged as collateral and promoters give a personal guarantee. The loans were given to these shell companies and these companies had links to the promoters of DHFL. In effect, DHFL had given unsecured loans to their own promoters. The sanctioning of these loans did not follow due process.

ICRA Reports

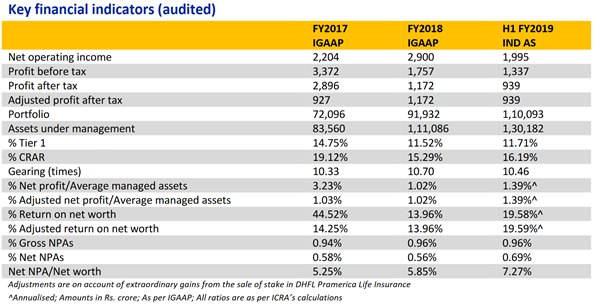

On May 13th 2019, ICRA downgraded DHFL’s short term paper rating to A3 from A4+. This was on the back of deterioration in the liquidity profile of the company. The liquidity buffer had declined from ₹ 3,982 Crores on April 11th 2019 to ₹ 2,775 Crores on April 30th 2019. They also mention the concentration risks involved in DHFL’s loan book with around 17% exposure to the construction sector. DHFL had also started giving out more project loans and lesser housing loans. From March 2018 to December 2018, housing loans had declined from 55% to 48%. The project loan book was recent and a large portion was under moratorium.

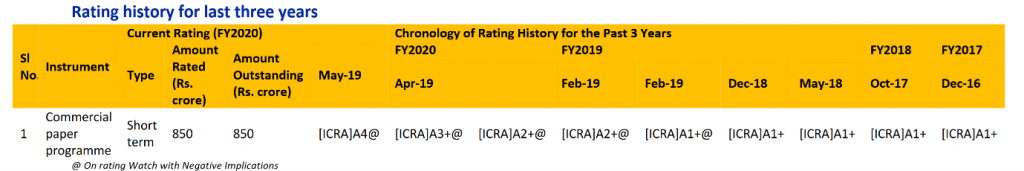

The tables above show the deterioration in the quality of financials and the credit ratings of the company.

| AMC NAME | DHFL DEBT EXPOSURE (₹ CRORE) | % OF TOTAL INDUSTRY EXPOSURE |

| UTI Mutual Fund Total | 1,736.68 | 33.16% |

| Reliance Mutual Fund Total | 1,182.02 | 22.57% |

| Axis Mutual Fund Total | 408.91 | 7.81% |

| DHFL Mutual Fund Total | 230.58 | 4.40% |

| DSP Mutual Fund Total | 207.34 | 3.96% |

Source: Value Research; The Figures are as of April 30.

In fixed income, purely chasing yields can lead to devastating results. The NPA saga which started with IL&FS in 2018 has proved that. The table above shows the debt exposure that AMCs had in DHFL. UTI and Nippon MF (Reliance) alone had more than 56% of the industry’s total exposure. When it comes to fixed income investing, it is of paramount importance to keep asset quality in mind and just not purely chase yields.

Sources

• Annual Reports

• Management Study Guide

• ICRA Report

• Economic Times and Value Research