Fed Policy Until 2023

Over the last few years, the Fed has had to put out many fires caused by its policies. During the pandemic in 2020, the priority was to put money in the hands of people. The paycheck protection program provided financial security at a time when jobs could not. In 2021, the Fed continued its fiscal policy path and believed that any inflation pressures were only transitory. In 2022, the tune changed – combatting inflation became the number one priority. So, the Federal Reserve entered 2023 with the sole objective of reining inflation (and inflation expectations) back to 2%.

2023: Federal Reserve Raises Rates

Chair Powell’s refrain in almost every press conference this year was “Without price stability the economy does not work for anyone.” Why was controlling inflation so important? First, the US is not used to inflation. For the better part of the last two decades, inflation has been modest at 1% to 2%. To suddenly see it double put a lot of financial stress on households and borrowers. Second, wealth inequalities combined with high inflation tend to hurt the weakest sections of the economy. Price stability allows households and corporates to manage their expenses. Third, monetary policy tools could target only some effects of inflation. For instance, no monetary policy intervention could have stabilized oil prices when the Russia-Ukraine war broke out. Fourth, growth can no longer be financed by easy money. For twenty years, advanced economies have been riding on the low interest rate wave. Growth has been easy because money was cheap. With cheap financing out of the window, growth needs a bit of reinvention.

2023 US Economic Highlights

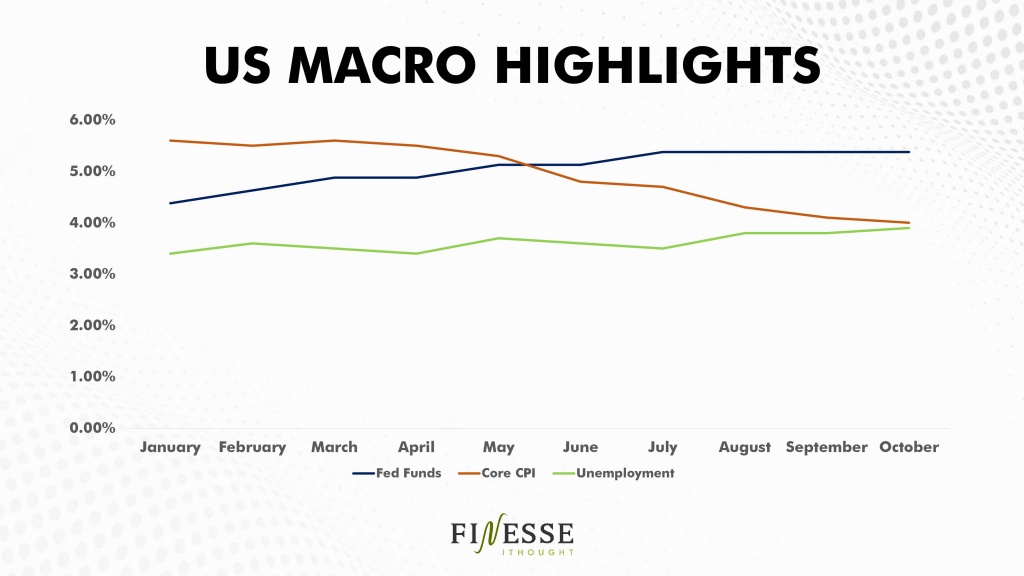

The US economy has been fairly resilient in the face of rate hikes. Here’s a quick look at unemployment, inflation, and interest rate trends in 2023.

This time around the labour market has been tight, allowing the Fed to prioritize rate hikes over moderating unemployment numbers. Strategists believe that wage growth peaked this year. Clearly, 2024 will be different for labour markets.

High Inflation

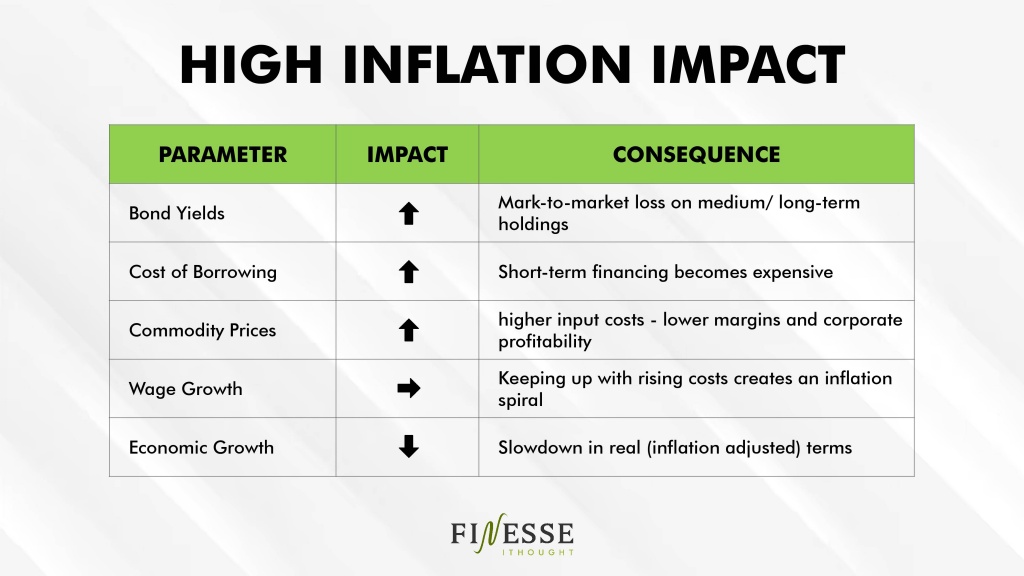

Some inflation is desirable for growth. High inflation is now. Here are some of the economic consequences of high inflation:

When inflation is out of control, it can harm financial assets like stocks and bonds. It could also slow down economic growth. A slowing economy is on the cards for the Fed in 2024.

Inflation: Is The Worst Behind Us?

In past cycles, it’s usually taken much longer for inflation to normalise (typically around 4-5 years). The jury is divided on whether this time will be different. For most of 2023, the Fed didn’t want to bet on 2023 being an exception.

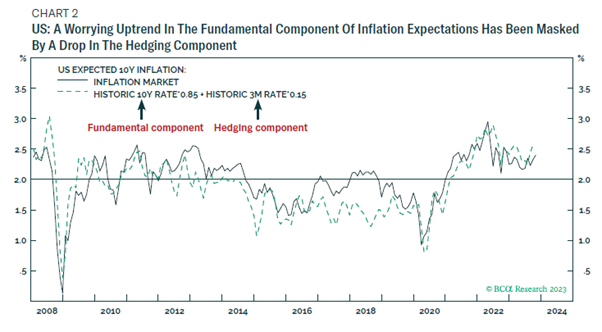

While Core CPI has been dropping, there are worrying trends that inflation isn’t going back to 2%. The interesting thing about inflation expectations is that the past informs the present. Inflation expectations are based on the long-term average as well as the most recent prints. This chart shows that the historic long-term average has moved up. So, it’s possible that the Fed won’t be able to anchor inflation expectations at 2%.

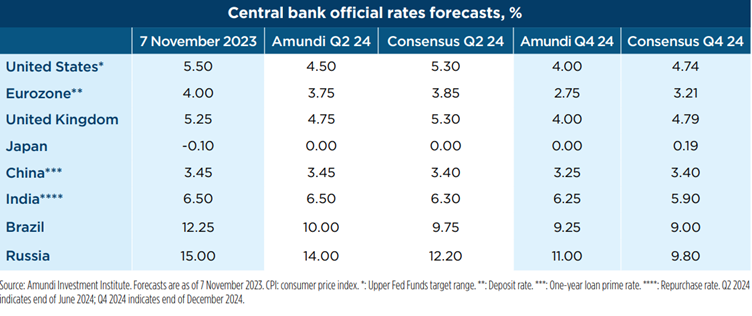

On the whole, core inflation has been trending downwards. The Fed believes that rates are in restrictive territory. Often monetary policy comes into effect with lags. Which means that the full force of rate hikes isn’t visible yet. According to Amundi Research, US interest rates are expected to fall by 1.50% next year.

The question remains: Is it too soon to call it a day?