Peter Lynch: An Approach To Picking Winning Stocks

How do you find your next winning investment idea? According to legendary investment manager Peter Lynch, all you have to do is look around you! Have you ever thought about how much of your day is wrapped around consumer brands? Consumer brands touch upon our lives every single day. Could you go through your morning routine or stock up your kitchen without them? What about the wheels that get you to work? Even the computers and phones we are glued to all day count!

The Peter Lynch Approach emphasizes the power of familiarity. Lynch advocates investing in what we know and understand better. Amidst our busy lives, why should we break our heads trying to understand communication satellites when we can leverage our own experiences from what we use daily? Cars, toothpaste, electronic gadgets, clothes, A/C, refrigerators, washing machines, and what are easy businesses to understand. They could also be winning businesses to invest in!

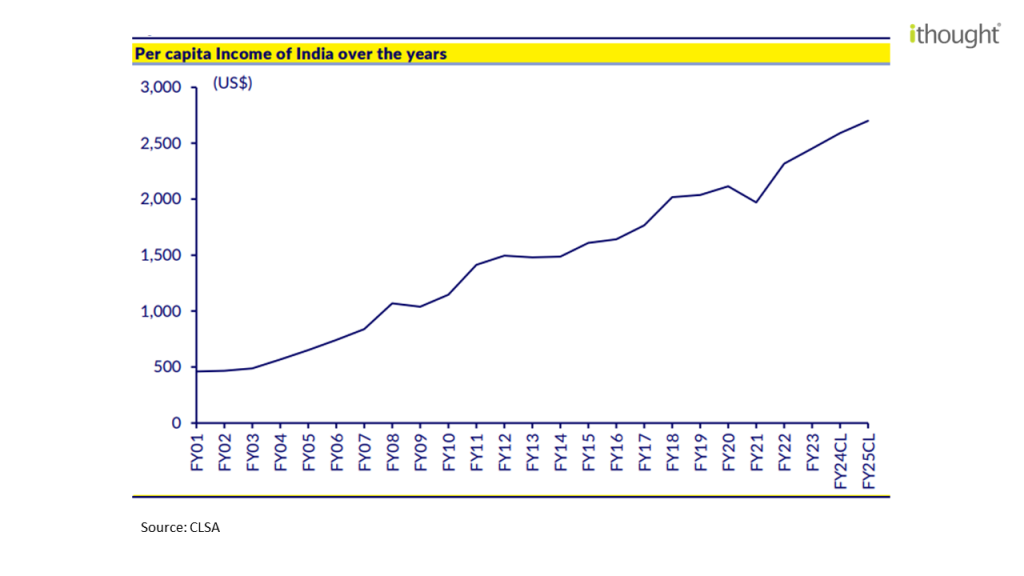

Per Capital Income

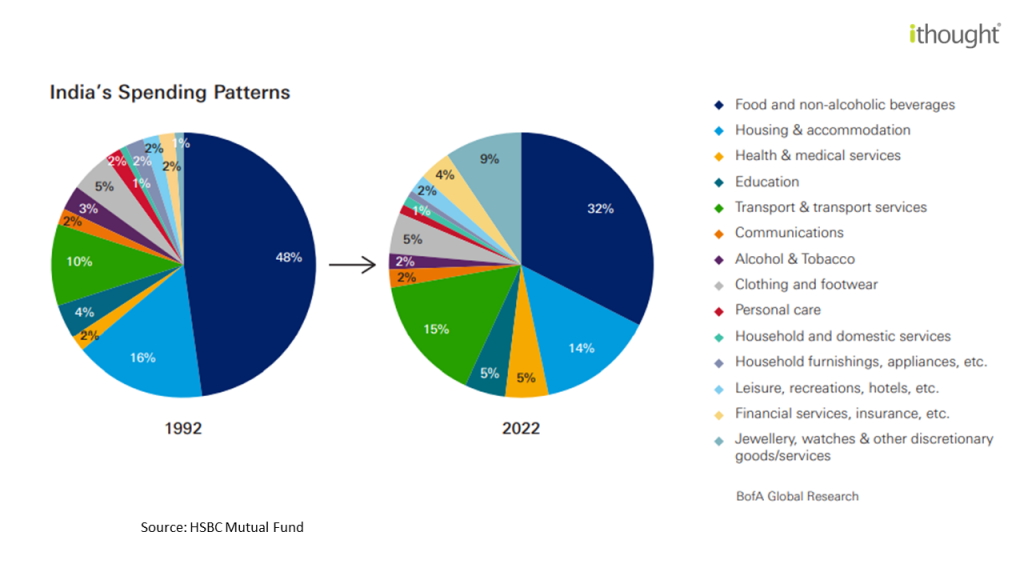

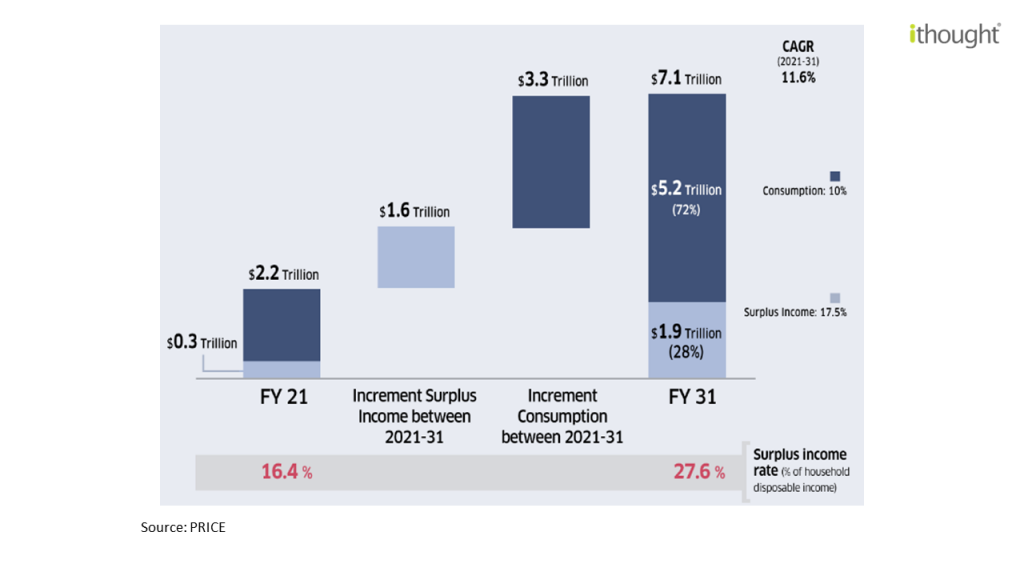

When the economy thrives, so does discretionary spending. With higher disposable at hand, people can spend beyond their basic needs. One might decide to treat themselves to something special, like a fancy dinner or a new gadget—that’s discretionary spending.

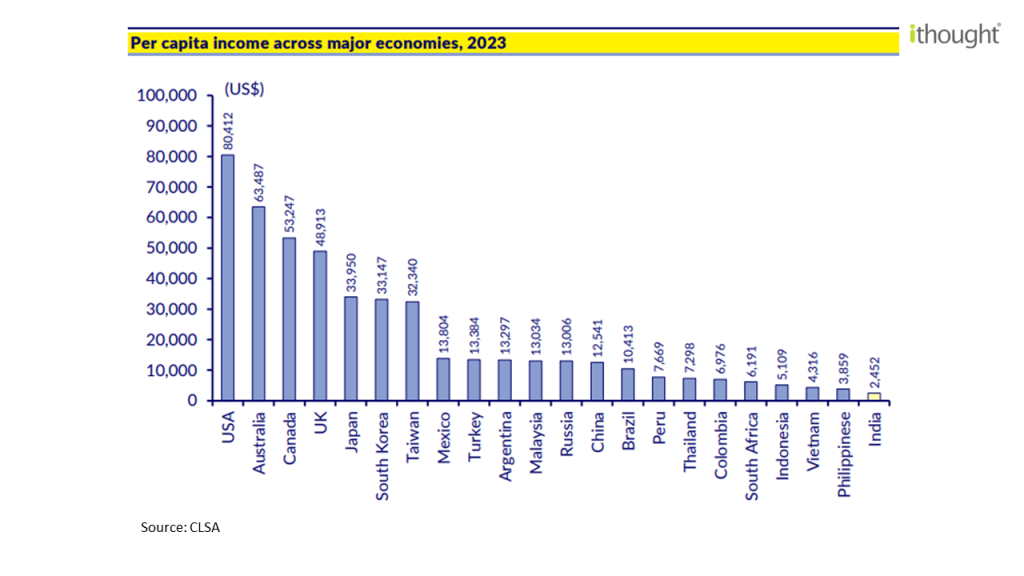

The Indian economy shot an impressive 7.6% growth in the first seven months of this fiscal year 2023-24 and our per capita income recently crossed the $2,000 mark. Did you know that India is not even in the top 100 countries with respect to per capita income and HDI (human development index)?

We may have made a lot of progress but India still has a long way to go compared to major economies.

Demographics

India’s consumer market is set to become the world’s third-largest by 2027. India proves to be one of the most dynamic consumption environments in the chart below. Private consumption contributed 60% to GDP. Clearly, we are a consumption-driven economy.

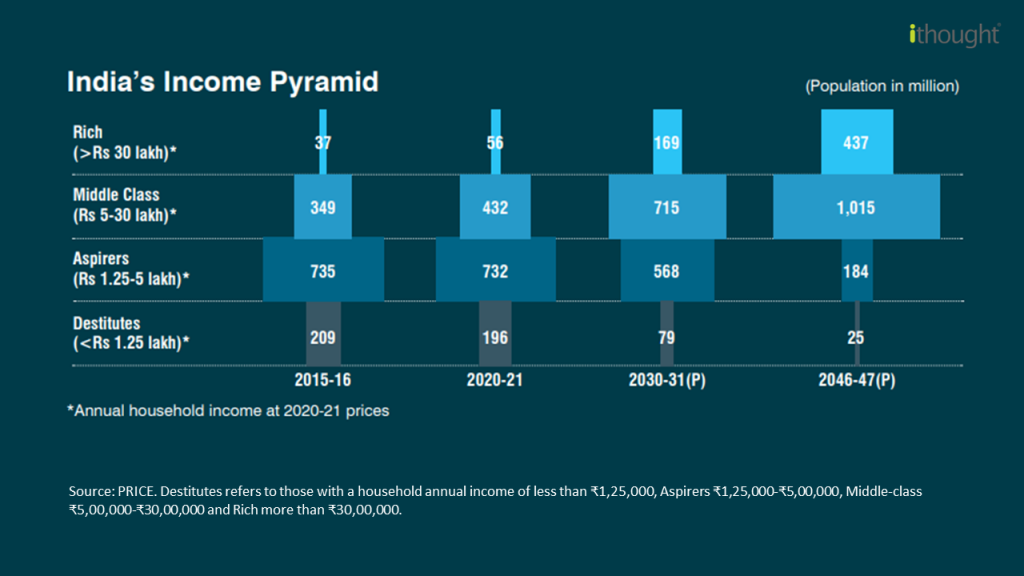

India is now the world’s most populous country with 1.4 billion people. The growing population was once a worry but not anymore. Population growth has always been an important driver of emerging market consumption. The fast-growing middle class will play the hero in India’s rise, while it represents 31% of the population today, it is expected to be at 38% by 2031.

And that’s not all, India will become a $5 trillion consumption economy by 2031, with the Middle Class driving 53% of the incremental consumption!

Consumption Trends

E-commerce & Digitization

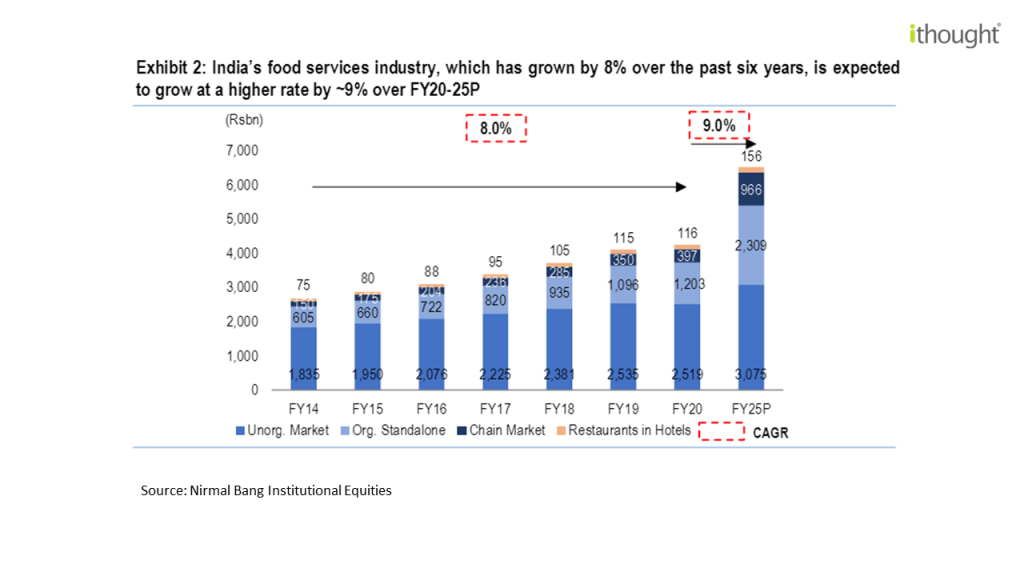

Let’s talk about the impact of innovation on specific sectors. Noticed how online food delivery has been shaking things up lately? With a huge market potential, it’s set to go beyond home deliveries and grab a bigger slice of the food services pie. Imagine a 21% yearly growth for food delivery, reaching a whopping US $41 billion by FY32!

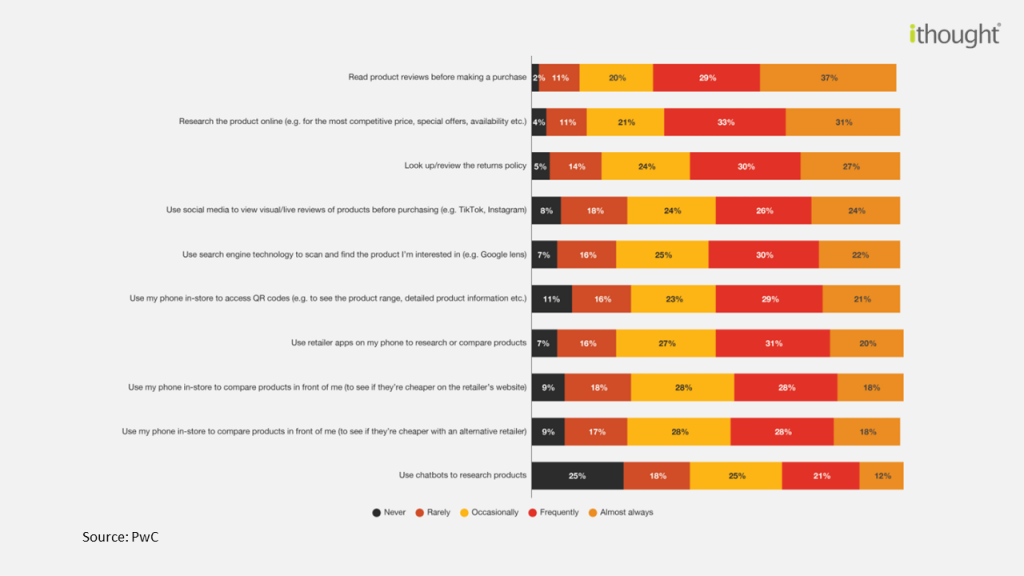

Consumers took a major pivot to digitization right after the pandemic and this has altered the business world permanently. In the last 4 years, people have been forced to live differently like never before – staying indoors left behind some time for users to retrospect. This led to some rapid changes in consumer behaviour that would have otherwise taken years.

The 21st century has become an era of digitization. Remember the times when we used to purchase groceries in-store? Nowadays amid our bustling lives, it’s become more convenient to get things delivered with a click of a button to our doorstep. To spare time and energy to travel long distances to shop has become a thing that belongs to the past.

As a matter of fact, throughout the year no matter what season it is, online products are cheaper than offline ones. For the cost-conscious middle-class consumer digitization and e-commerce are changing the rules of the consumption game! Customers don’t have to sweat browsing aisles during peak hours instead they can just view all the product reviews, ratings, and descriptions and make a quick choice. The data shows that consumers are willing to research products online and make tech-enabled decisions for better bargains. Improved net banking facilities and e-wallets have made the process of online purchasing much easier for consumers to adapt as well. Needless to say, UPI has been revolutionary in the payment ecosystem. It crossed 11 billion transactions for the second month this November!

Auto In Full Gear

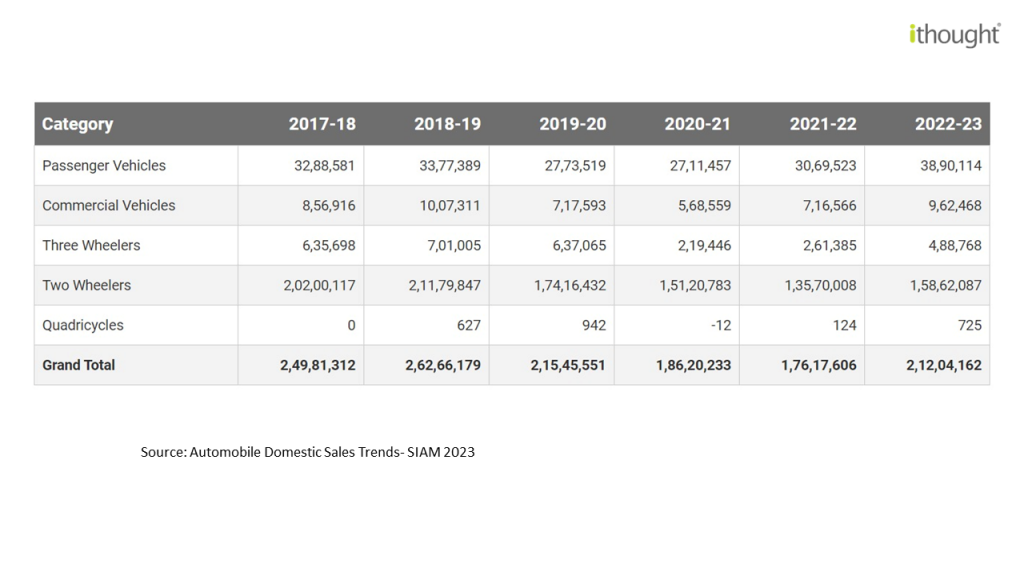

Revving up next is the auto industry. As income levels rise along with the need for personal mobility, we’re in for a ride! Electric vehicles are taking center stage, thanks to the government’s push for cleaner fuels through favourable policies to reach its net zero emissions target by 2070. The passenger vehicle industry has a strong growth potential, with penetration at just 25 vehicles per 1,000 people, compared to way higher numbers in nations worldwide. Buckle up because we’re on the road to big changes!

FY23 has been a year of consolidation since Covid 19, started with supply chain disruptions, from the Ukraine conflict. Favorable policy initiatives, logistics, and foreign trade policies augur growth for the sector.

The industry sold 38 lakh passenger vehicles as of March ‘23 as against 31 lakh vehicles registering a y-o-y growth of 22.5%.

To complement the growth, the government has approved a PLI scheme for the automobile and auto component industry in India in September 2021 for Rs. 25,000 crores to provide financial incentives to green hydrogen/ EV manufacturers and auto component manufacturers as well.

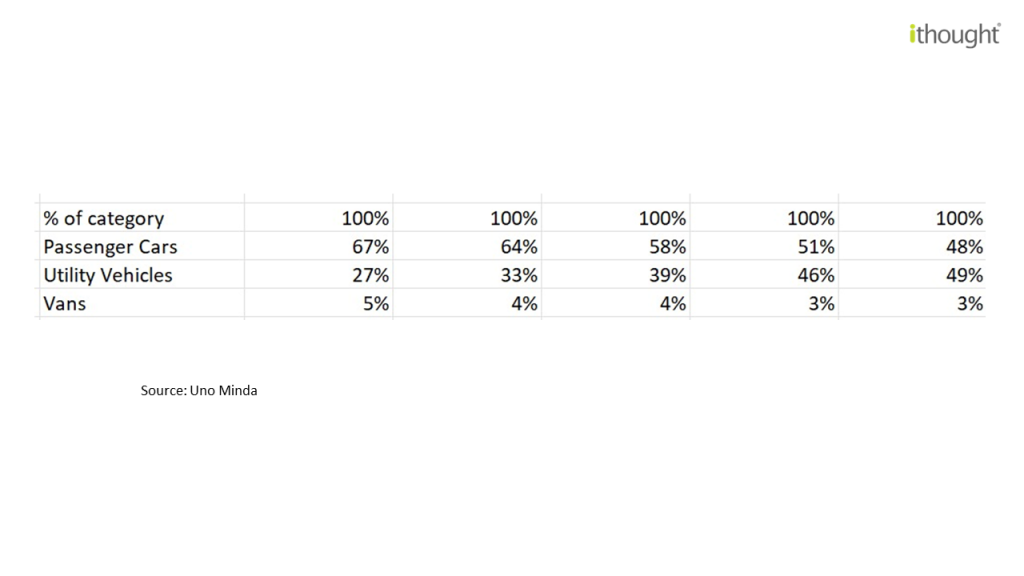

Premiumization: more disposable income = better cars. Consumers are migrating from passenger cars to Sports Utility Vehicles (SUVs) with the introduction of compact SUVs.

Keeping Time With Watches

Onto the next discretionary spend – watches! Before 2019-2020, the watch segment in India was just seen as a functional wearable. With rising affordability and discretionary consumption and spending on the rise, individuals have understood the increasing importance of wearing good timepieces.

The average selling price per watch of one of the biggest timepiece resellers in India has increased from a mere Rs. 84,000 per watch to Rs. 1.87 Lakh per watch. This data augurs well for discretionary consumer spending and premiumization.

QSR

One of the bigger trends that we notice with premiumization is a shift to the organized segment. This is observed in most consumption-oriented sectors like QSR, jewellery, food grains, etc. The shift to organized consumption increases product quality and realization for the producer. For example, chain restaurants are expected to lead the growth in QSR (quick service restaurants). This is largely driven by competitive pricing, more touchpoints, and increased marketing spending.

Economists often warn about the perils of consumption-driven growth. They believe that it is unsustainable in the long run. So, it is important to balance consumption with investment and savings.

Financialization of Savings

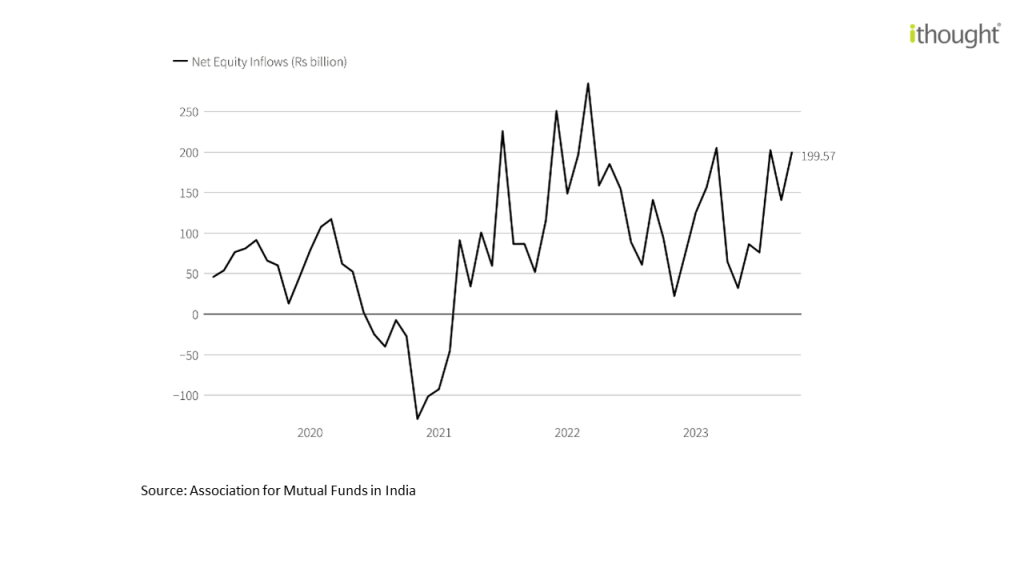

Consumption is a consequence of increased disposable income. Indians have always been savers and continue to be so. We are prioritizing consumption but not at the cost of savings and investments. In August 2023 alone 31 Lakh demat accounts were opened (the highest since January 2022). More people are exploring avenues beyond traditional savings like gold and real estate to grow their wealth.

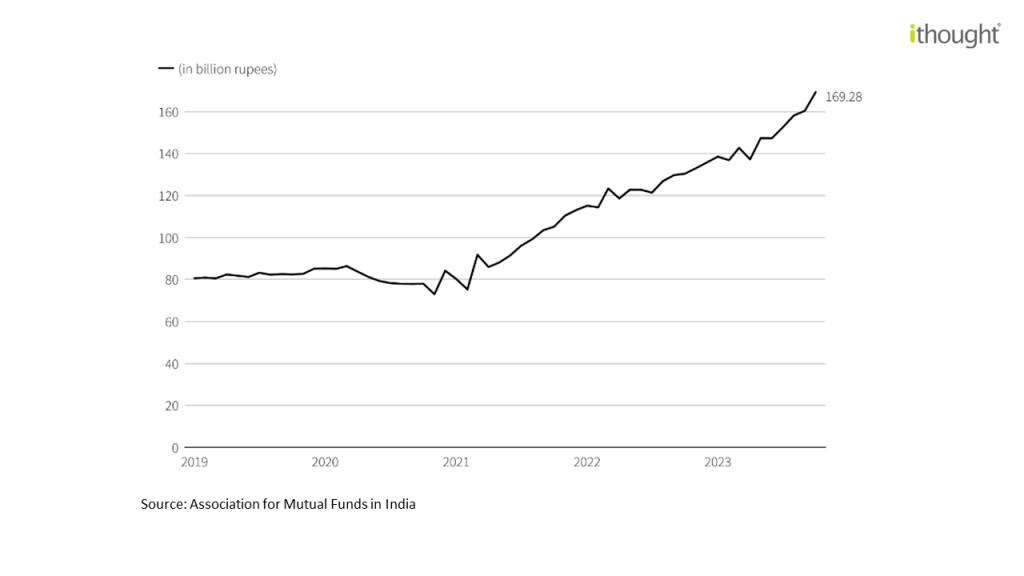

And it doesn’t stop there! SIP contributions hit a record high of 169.28 billion rupees in October this year. These shifts in investment patterns could foster economic growth while offering individuals a path towards financial freedom and security.

Wealth Through Consumption

The virtuous cycle of consumption is a positive loop where consumer spending drives demand, pushing businesses to expand and innovate. This growth in turn creates jobs and boosts income further fuelling consumer spending. This is the next chapter in India’s Consumption story.