2021 continued the strong trend set by 2020. The S&P 500 is up nearly 27% from the beginning of the year and has more than doubled since the lows of March 2020. The federal reserve continued its accommodative stance till November 2021. Liquidity has been injected into the markets via open market operations with weekly purchases of $80 billion in treasury securities and $40 billion in mortgage-backed securities. The big event in January, Joe Biden taking over the US presidency from Donald Trump was followed by a $1.9 trillion Covid 19 stimulus plan. This plan had $1400 stimulus cheques, extended unemployment benefits, and a vaccine rollout. He also mentioned the fact that Wall Street does not reflect the pain of the real economy saying that the recovery has been ‘K’ shaped. This is a term used by economists to describe the rich getting richer and the poor getting poorer.

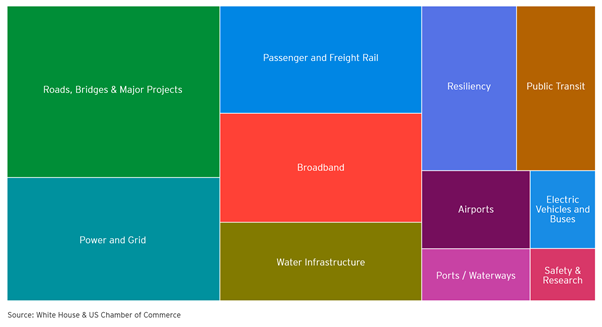

The US government has passed an Infrastructure Bill known as the Infrastructure Investment and Jobs act. This would provide for $1.2 Trillion in spending over the next five years. The money provided would seek to improve existing infrastructure like roads and broadband and to reframe the future of infrastructure with investments also going to clean energy and electric mobility. The transportation targets include all forms of transportation including railways and public transit and seek to improve surface transportation like roads and bridges. $40 billion is allocated to improve and fix the existing roads and bridges. The spending is spread over five years with not more than $20 billion expected to be spent by the end of FY22. Advancing major projects and construction takes time. Manufacturing and labour markets need to ramp up on the back of Covid 19. It is also important for the states and the private sector to take part and support the projects through additional investment. We think its safe to say that this is not the last we’d hear about this. Keep a close eye on this space. This bill will be revolutionary.

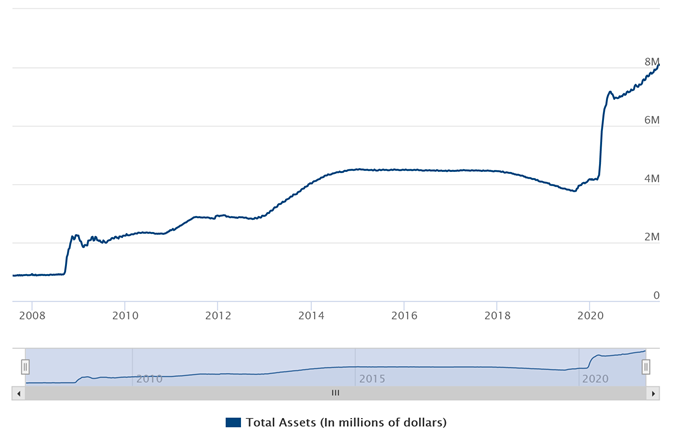

The federal reserve continued to keep interest rates at 0% to 0.25% and interest rates accommodative throughout 2021. The liquidity tap was kept open with $80 billion in treasury securities and $40 billion in mortgage-backed securities being bought by the Fed every week. Inflation was volatile throughout the year and the committee shifted focus towards achieving maximum employment while achieving the inflation rate of 2% over the long run. The sectors most severely affected by Covid have shown signs of improvement even though recovery has been slow. In the most recent monetary policy, the federal reserve has decided to slow down asset purchases gradually and wind down asset purchases by the summer of 2022. The reduction would be to the tune of $10 billion in treasury securities and $5 billion for mortgage-backed securities. The committee is prepared to adjust the pace of asset purchases depending on the prevailing economic situation.

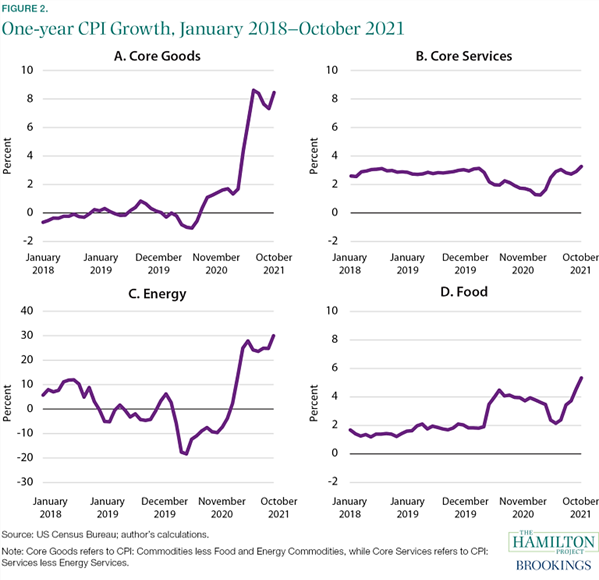

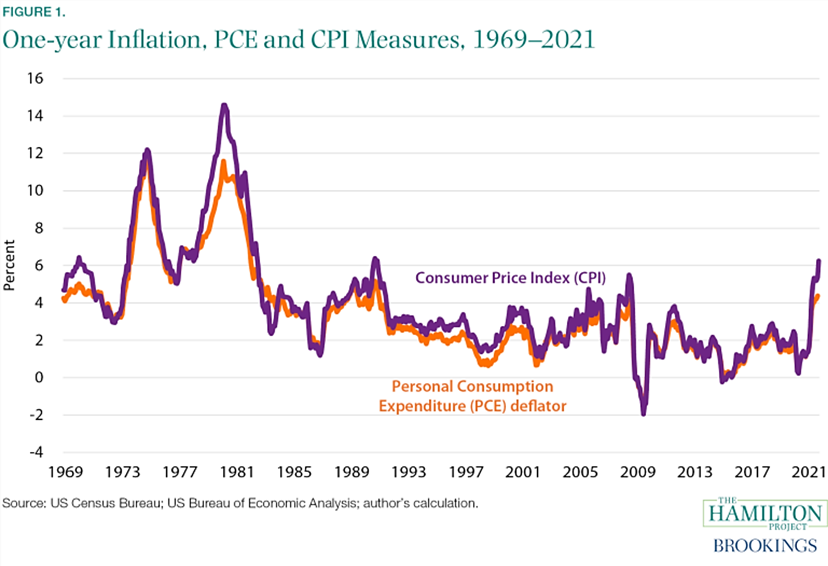

The abnormally high inflation numbers this year has largely been labelled transitory. October 2020 to October 2021 YoY CPI inflation number was at a multi-decade high of 6.1%. No doubt, the base effect has had some part to play in the surge in consumer goods prices. If we pick this number apart, we would find that the core goods are the culprits in this situation. Core services have been muted in comparison and have not recovered to the pre-pandemic peak. Energy and food inflation (not included in CPI) are both elevated as well.

This will eventually balance out as the recovery progresses. Demand has recovered with some force and this was not expected. Supply chains will catch up soon enough. The surge in spending has put pressure on suppliers and they have not been able to keep up with demand. Supply chain issues will also be ironed out in the coming fiscal. Households will also gradually rebalance their spending towards services which has been depressed.

As consumer spending for services increases, demand for labour in the services will rise. According to recent reports, September job openings in the hospitality sector were 530,000 higher than the trend but employment was 1.5 million below its pre-pandemic level. If demand for services increases, labour demand will also increase significantly. The biggest risk is that this large increase in demand will not be met by an immediate increase in supply.

Sources

-

-

- Ernst and Young

- Federal Reserve

- Brookings

- Reuters

- Trading View

-