We have seen a slew of IPOs this year as the markets recover from the covid shock. An IPO or Initial Public Offering is the process through which a private company offers its shares to institutional and retail investors. For well-anticipated IPOs, there is a lot of noise around the issue. An overload of information can often mislead people. Investors in an IPO, unless they are large institutions are usually not well informed and their decision might be easily influenced and not completely rational. Retail investors are more likely to invest based on their fear of missing out (FOMO) rather than their understanding of the business and financials of the company.

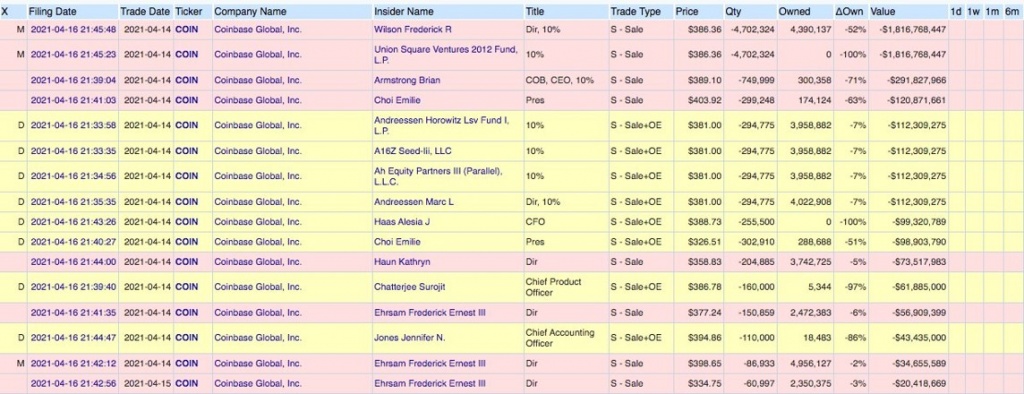

A good example of this FOMO is the recent IPO of the cryptocurrency exchange platform, Coinbase. There was an immense buzz surrounding the issue as cryptocurrency had performed extremely well post the pandemic. The bullish view on the valuation of Coinbase during listing was around $100 billion. This is more than the market capitalization of Nasdaq ($25 billion) and the Intercontinental Exchange ($65 billion) combined. The IPO price for Coinbase was $250 and on listing the stock hit a high of around $340 on the 15th of April. On the day of writing this blog (25th August), the price is around $260. On listing, there were rumors of insiders and top executives dumping the stock.

The Valuation Argument

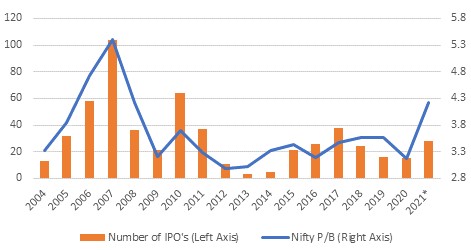

A lot of IPOs are launched at peak market valuations. When the stock market is buoyant, it is easier for companies to raise capital as there is increased participation by institutional and retail investors compared to a normal market scenario. The chart below compares the number of IPOs with the price to book valuations of the Nifty 50.

The blue line indicates the price to book ratio of the Nifty 50 and the orange bars indicate the number of IPOs in that year.

Performance

Some IPOs tend to perform well initially, then the euphoria tends to cool off. A recent example is the Zomato IPO which did 12% in the first three days, 10% in two weeks and -2% till date (One month). Another example is IRFC which is underwhelmed at listing as well. The issue price was around Rs. 26 and listed on the exchange for Rs. 25. The stock’s lowest point was in May where it was down 20% from listing. The stock currently trades at Rs. 23, a decline of 11% from listing. Although these observations do not reflect the underlying business scenarios, we learn that not all IPOs are immediately successful and investing with the sole goal to gain on the listing can be risky.

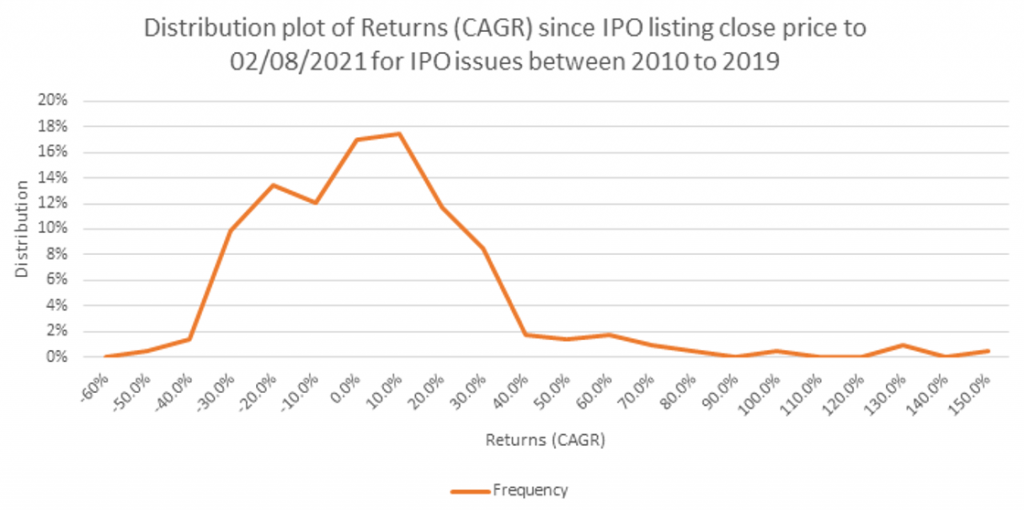

The chart shows the annualized returns of IPOs from listing day till the 2nd of August. As shown, there are no extraordinary performers here. Money is better invested in spaces where there is potential value unlocking in the future. To know more about the best place to invest your capital in the current market context, get in touch with our advisors today!