Infrastructure Leasing and Financial Services or IL&FS serves as a holding company and is at the core of several infrastructure and finance themed subsidiaries. It was founded in 1987 and was funded with equity from the Unit Trust of India, Central Bank of India and HDFC. Over the years, several institutions such as LIC (a substitute for UTI), ORIX Corporation of Japan (Mitsubishi), SBI and the Abu Dhabi Investment Authority had become major stakeholders in the company.

The failure of IL&FS opened the eyes of many investors to the fact that credit ratings are not the be-all-and-end-all of fixed income investing. In this blog, we explore what caused IL&FS to fail and the reaction it caused in the markets.

The Fall

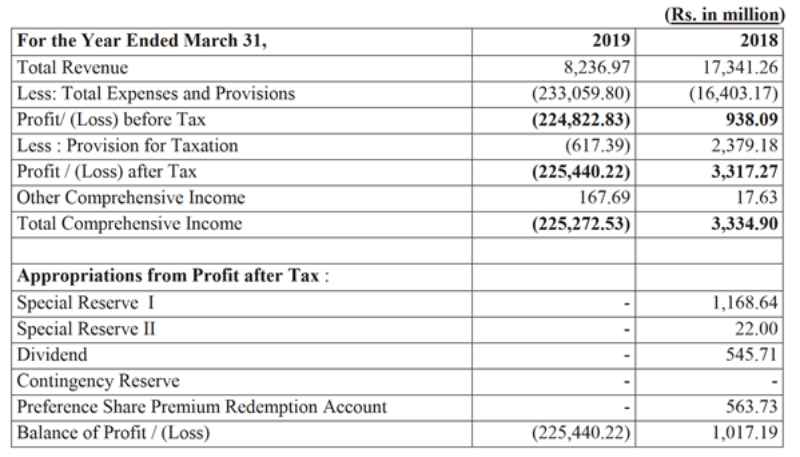

Like all stories of financial failure, it starts with complacency and negligence. The mandate of IL&FS when started in 1987 was to finance the building and maintenance of commercially viable infrastructure projects such as roads and ports. As a core investment company, it could look at private sector ventures as well. The company had reinvented itself and had become an infrastructure player, becoming a major part in a project’s execution. The operating model was facilitated by an amalgamation of SPVs (Special Purpose Vehicles) set up around each specific project. There were over 200 subsidiaries and the IL&FS group became extremely complicated in its architecture. A majority of the subsidiaries and SPVs were unlisted and the state of their financials made them difficult to scrutinize. From FY15 to FY18, consolidated debt rose to $13 billion. In FY19, net loss was at Rs. 220 billion. There are several factors that make infrastructure a tough business to do. Heavy financing requirements, long gestation periods, regulatory approvals, escalation of costs and unforeseen contingencies and changes in business environment are some of the few. On September 8th 2018, ICRA released an updated report on IL&FS.

The ICRA Report

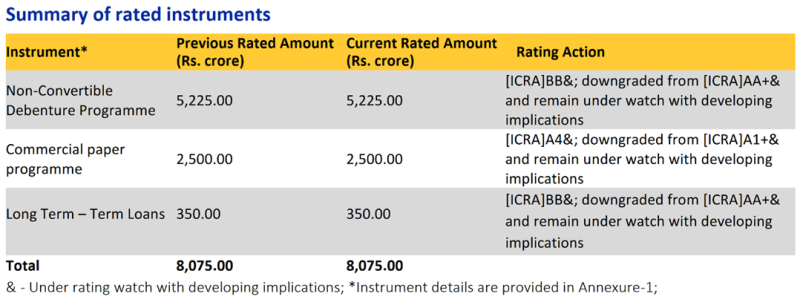

ICRA released a revised rating of the IL&FS instruments. Their long-term debt was downgraded from AA+ to BB and the short-term debt was downgraded from A1 to A4. The downgrade was due to the concerning lack of liquidity at the group level. The rationale also mentions the company’s elevated debt levels, slow pace of asset monetization and the deterioration in the credit profiles of some top investee companies.

Classifications

The entities were classified into three baskets.

-

-

- Green Entities – Where there are no defaults/overdues and the cash generated by the entity and the available cash balances are sufficient to meet all payment obligations of the entity.

- Amber Entities – Entities that are not able to meet all obligations but can meet the operational obligations and obligations to senior secured financial creditors.

- Red Entities – Entities that cannot meet their respective payment obligations.

-

Ratings Downgrade

Financial Results

What Did We Do?

At ithought, we always focus on risk management. The fall of IL&FS triggered a spike in yields across the fixed income market. AAA debt mutual funds were trading at close to 9% yields. AAA Fixed Maturity Plans were introduced at 9%+ yields. We identified this disconnect as a great opportunity and advised our clients to invest in this space if it suited their risk profile. This has yielded an annualized return of 8.5% to 9% in three years which would have comfortably beaten 3-year fixed deposits locked in at the time.

“The Chinese use two brush strokes to write the word ‘Crisis’. One brush stroke stands for danger; the other for opportunity. In a crisis, be aware of the danger – but recognize the opportunity”. ~John F. Kennedy

Source: Economic Times, ICRA, IL&FS Annual Reports