Man is a creature who adapts to a healthy lifestyle in a specific circumstance. A slight variation in temperature, negligible change in atmospheric composition, a minute change in the suitability of food bridges the gap between being healthy and being sick! Suitability is a prime principle of sustenance! When it comes to investing, suitability plays a larger role than we assume!

There are two prerequisites for investment. Your financial goal and the product of investment. It’s agreed, there must be a proper sync between your financial objective and the investment product, to realize your goal. A suitable investment is defined as one that is appropriate in terms of the investor’s willingness & ability to take on a certain level of risk. This suitability brings us to the various factors that decide your investment. You will find a few below:

-

-

- The age factor. One who is close to retirement can have his savings locked in a much safer asset class such as debt, compared to being in the derivative market.

- The corpus that you need & the corpus that you have. If you are earning consistently, you will be able to systematically invest across different time periods. You must allocate your savings accordingly to generate the desired returns.

- Investment tenure. You are saving for your daughter’s higher studies in the US, and it’s a significant corpus. You still have 15 years to build your current corpus into your desired amount. This would require you to allocate your investments accordingly so that you don’t exceed those 15 years to reach the desired corpus.

-

IS SMALL-CAP INVESTING SUITABLE FOR ALL?

Let’s take two individuals, Ramesh & Suresh. Ramesh is a 25-year-old man working as a salaried employee, with no dependents and won’t be thinking about marriage until he is 35. He starts saving consistently in the small-cap index fund. Say, he holds it for 10 years, until his marriage, which I assure you, will be glamourous with the corpus built through the small-cap strategy! Here we assume there are no other commitments or emergencies arising out of Ramesh’s wallet. This would have been a wonderful strategy to Ramesh as his timeline is free from any other disturbances.

On the other hand, Suresh a 42-year-old is an entrepreneur. He is married and has kids who will go to college in another few years. After that, he must spend for his daughter’s marriage. His wife is suffering from stage 2 diabetes and must do regular check-ups to keep it under control. His timeline is crowded with so many commitments and can’t afford to lose out on his accumulated corpus. Heading a startup too does require him to possess a certain percentage of liquidity to support its operations during turbulent times.

Before jumping into small-caps, one must question whether he or she is equipped to take on the volatility and the hard phases of the journey. It does not include only the monetary attribute but also the psychological hits that one sustains due to volatility.

HISTORICAL PERFORMANCE- SMALL CAP Vs LARGE CAP

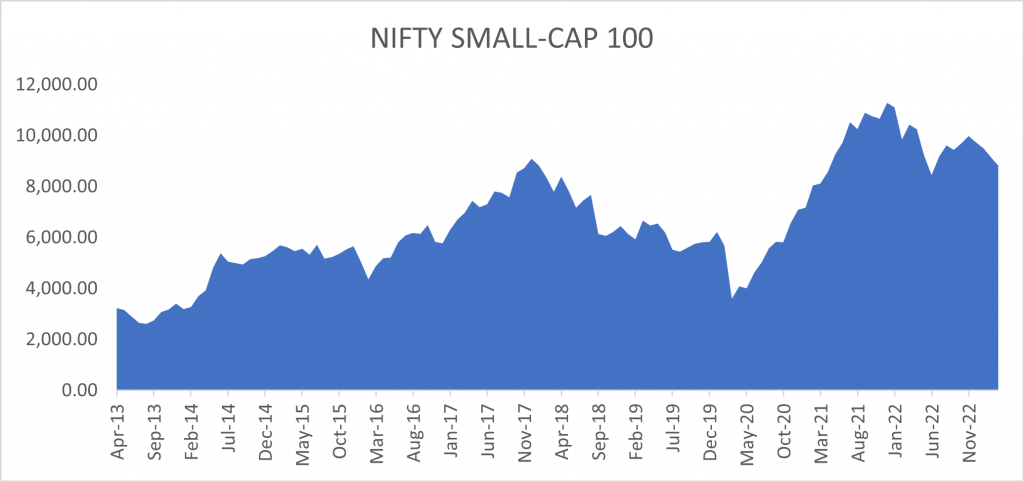

In April 2013, the Nifty small cap index stood at 3,224.75 & it stands at 9,672.55 as of April 2023. That’s 10 years in between. The CAGR that is offered is approximately 10-12%, which beats inflation and is a perfect pace of beat to build your wealth in the long term, provided you don’t pull out your funds in the middle, for other commitments.

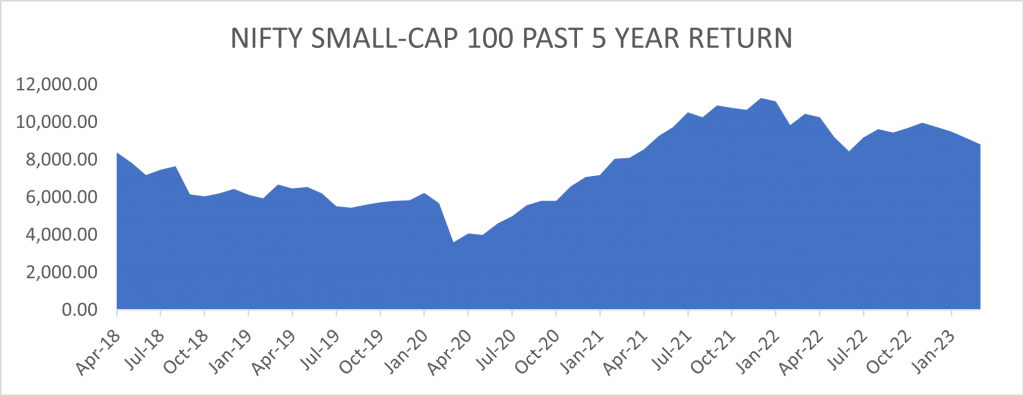

The above chart shows the return of nifty small-cap 100’s 5-year stance. In April 2018, it shoots off with 8,389.85 and trailed at 9,672.55 as of April 2023. The CAGR stalls between 2-3%! For those who would have invested in 2013 this period would have been the major pull down for their returns! For those who invested in small-caps in 2018, I’m sorry as the performance is below mediocre!

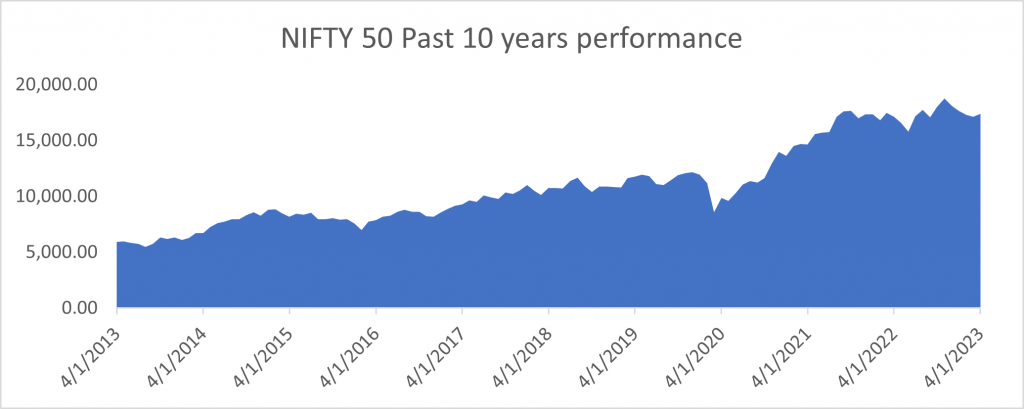

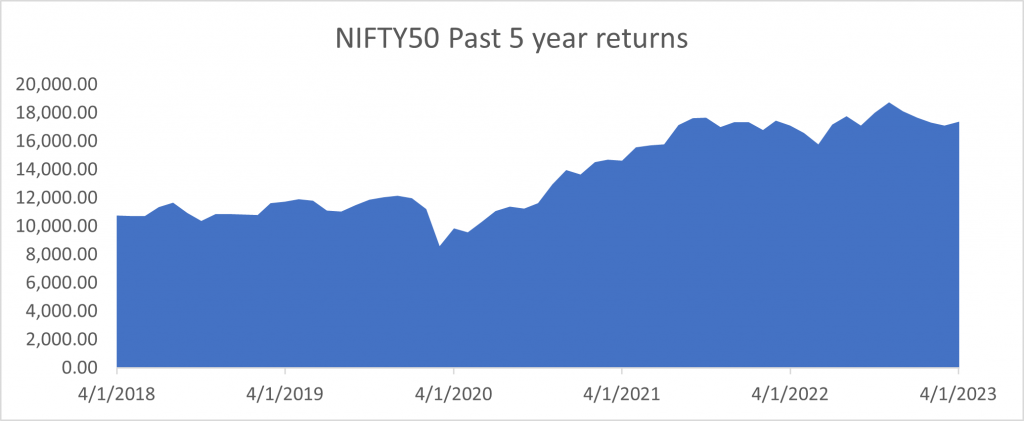

This chart shows you the rally of NIFTY 50 for the past 10 years! It gives a CAGR of 11-12% per annum. It’s almost the same as of small-cap. Now let us see the past 5-year return of Nifty 50.

The CAGR is 4-5 %, beating that of small-cap! One must understand his ability to take risks and factor that into his investment journey to have a fruitful experience. The bear market during 2019-2020 was on account of the COVID pandemic. During a bear market, it’s seen historically that the segment that gets crunched the most would be the small-cap space, because of its size. People often miss out on this and chase small-cap stocks for high returns. And most importantly their stock picks are swayed by social influence!

When one can accomplish his financial goals by opting for investments in the large-cap, why take the excess risk by investing in small-caps? If a retail investor is equipped to invest in small-cap, I’m all in, but if he/she is not, then why? Why go for small caps at all? ‘When’, you invest matters a lot, as you see the Covid phase is a rough one for all companies due to many regulatory curbs. During this time, small-cap is not an appropriate venue for Suresh’s money, due to his risk profile. But Ramesh can still take the excess risk and invest in small-cap, as his risk appetite can help him survive the turmoil of the small-cap space.

WHAT ABOUT THE SMALL-CAP SUCCESS DURING THE COVID PERIOD?

After the COVID crash, the markets took a diversion and started to give heavy returns for those who bought it at the bottom. This rappelling of the market was on account of the economy opening up post-COVID and has nothing to do with the fundamentals of the company. The higher demand in the economy propelled the rise of many small-cap companies and gave multi-bagger returns. One must not get influenced by the returns during this period and plunge head-on into small-cap investing.

THE NEED FOR INFORMATION!

Large-cap companies are proven business models, where retail investors usually don’t question corporate governance, leadership, mission statement, vision, operations of the company etc. They are widely talked about and debated because of their huge market capital and the years of existence. When it comes to small-cap one must follow the ‘scuttlebutt concept’ of investing to know about the workings of the company as information & research on small-cap stocks are lesser.

And this digging up of information takes a lot of time and effort from the retail investors, which they might not have! Having thought of only the return expectations in a multi bagger opportunity, is not going to bode well for the investors, as they must stand the test of volatility.

INFLUENCE THAT NEEDS TO BE RESTRAINED!

Have you heard of the framing effect? Framing refers to, presenting a situation or news, in such a way that influences the perspective of the reader, the way you want it to. When the headlines read- ‘Multibagger stock under Rs 50’, it sure sounds like a jackpot to the investor when you frame it that way. But what one should really peel out of this news is-

-

-

- What’s the probability of that happening?

- What are the fundamentals of the company?

- How long should one stand the test of volatility in the small cap segment?

- Are the valuations nominal? And many more.

-

Never let the framing of headlines affect your decision-making! When you are buying small caps, they are often under-researched, so you should try and gather as much information as possible, before you invest a sizable corpus for a stake in them.

Note: Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.

The above data is sourced from Google Trends. During Jan 9-15 of 2022, the searches for ‘Multibagger’ have been the most. Prior to this date, the Nifty 100 small-cap index was rallying between 10,500-12,000. This was a time when the momentum was building up for small-cap investing, and there was a lot of speculation in the market. People started running behind the idea of multi-bagger returns! But post Jan 2022, the market was rallying between the 8,000-10,000 range taking a drop from its previous highs.

People see results and then chase them. An investor must see an opportunity, chase it, and then should capitalize on the result! Instead of running behind past performances, an investor must time his deployment, so that he gets maximum results.

One unmuted source of influence is your social reference group! You might get stupefied with their past returns and you too would quickly rejig your allocation to match theirs. Investors should understand a few things, then they wouldn’t make the mistake of following their social reference group.

-

-

- The timeline of your investment journey is starting now, but your friend/family already has a history with the current option at hand and has capitalized on the opportunity. There is no guarantee that you might get the same returns as the stock might fall or even stagnate at the same level.

- Your friend/family might possess the risk appetite to take over the small-cap segment. Analyse if you have the appetite to do so. If not, you should stick to less volatile bets.

- A multi-bagger opportunity might take time to realize. Do you have the time to lock in your funds and have an excess corpus to meet all other commitments and emergencies arising out of your wallet during that tenure?

-

These are a few points to ponder before getting on top of the small-cap bandwagon.

Hence it’s time to mute the influence arising out of your social reference groups. Time to see things in their intrinsic form and not the way headlines frame it for you. Time to weigh your risk profile to see whether it matches that of the small-cap space. Time to go ‘scuttlebutt’ when it comes to small-cap investing. And remember to not flinch when it’s time to stand the test of volatility!