APT TIME FOR MULTI-ASSET STRATEGY

2023 was a rollercoaster ride! Markets rallied, tight monetary policies left many feeling the pinch, while a global slowdown added to the uncertainty. It was a year that kept everyone on their toes and the markets buoyant! A month past the new year, the world is still concerned about higher inflation, central bankers haven’t backed down on their stance, and a slowdown seems imminent. When uncertainty is the only certainty, having a diversified investment strategy is all that you need. And that’s exactly what multi-asset funds offer – a superhero cape for your portfolio.

THE MULTIVERSE

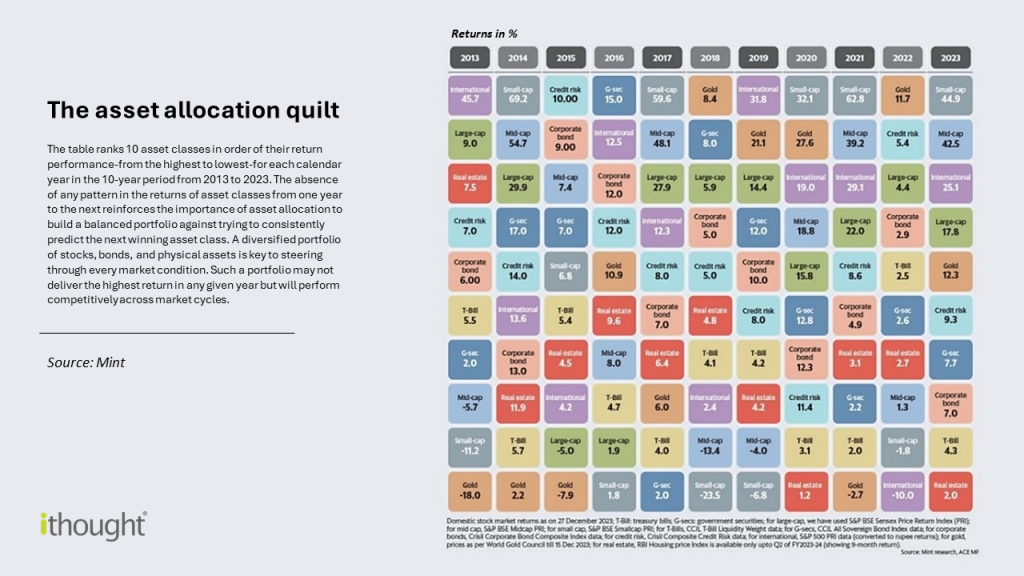

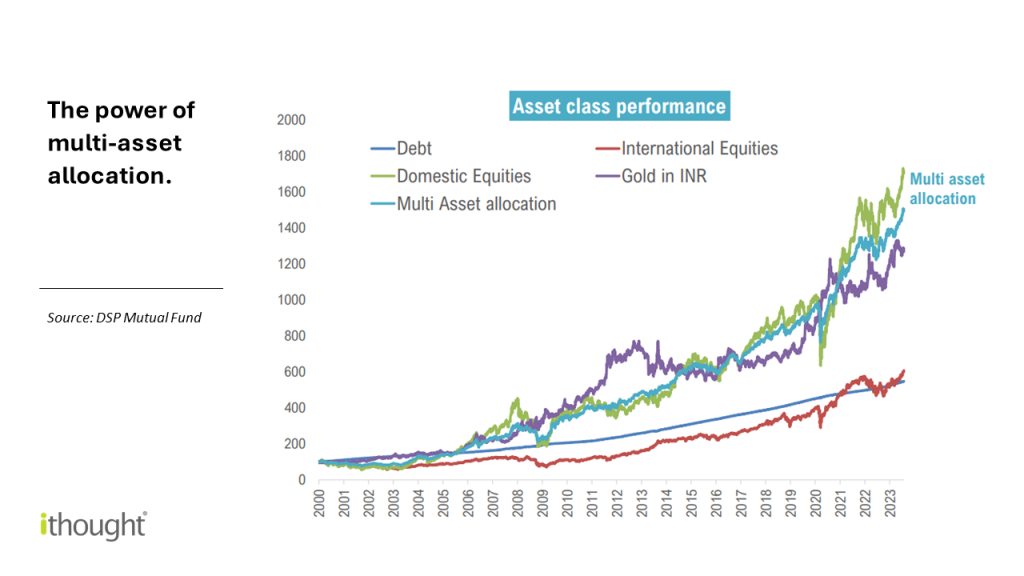

Did you know that every asset class delivered positive returns last year? Even during years of mixed returns, the basket approach has worked well all along the cycles of the market. Each asset class has different characteristics, making the strategy less vulnerable to the volatility of any one asset. For example, a multi-asset strategy combines the high-growth power of equities, stability of fixed income, and hedging qualities of gold. The portfolio becomes stronger when various asset classes come together with the right amount of exposure. Here’s how different asset classes performed in the last ten years:

EASY ACCESS TO DIVERSIFY RISK

Asset allocation offers the advantage of leveraging distinct market conditions. Different economic environments uniquely affect each asset class. For instance, during periods of economic growth, stocks tend to perform better, while bonds are generally more stable in economic downturns. By having a diversified portfolio, you can potentially benefit from market growth while reducing losses during downturns.

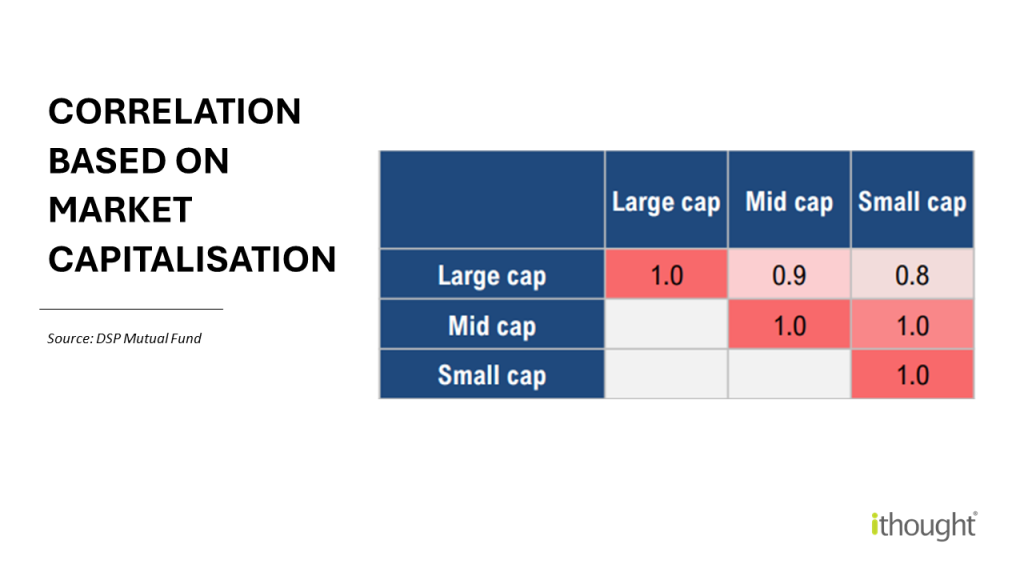

Effective diversification requires asset classes to have a low correlation with each other. However, funds within the same asset class tend to correlate positively.

CORRELATION BASED ON MARKET CAPITALISATION

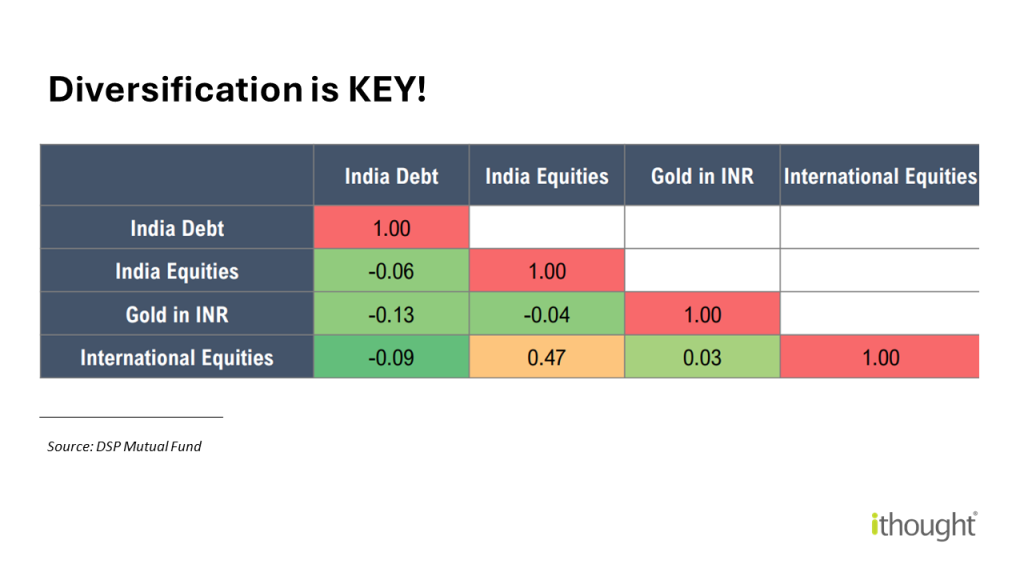

A well-diversified portfolio is created by adding in negatively correlated asset classes. So that when one underperforms, the other will have the capacity to stay stable. In short, you have safety! This approach improves the risk-adjusted returns by reducing the risk associated with any single asset class.

CORRELATION AMONG DIFFERENT ASSET CLASSES

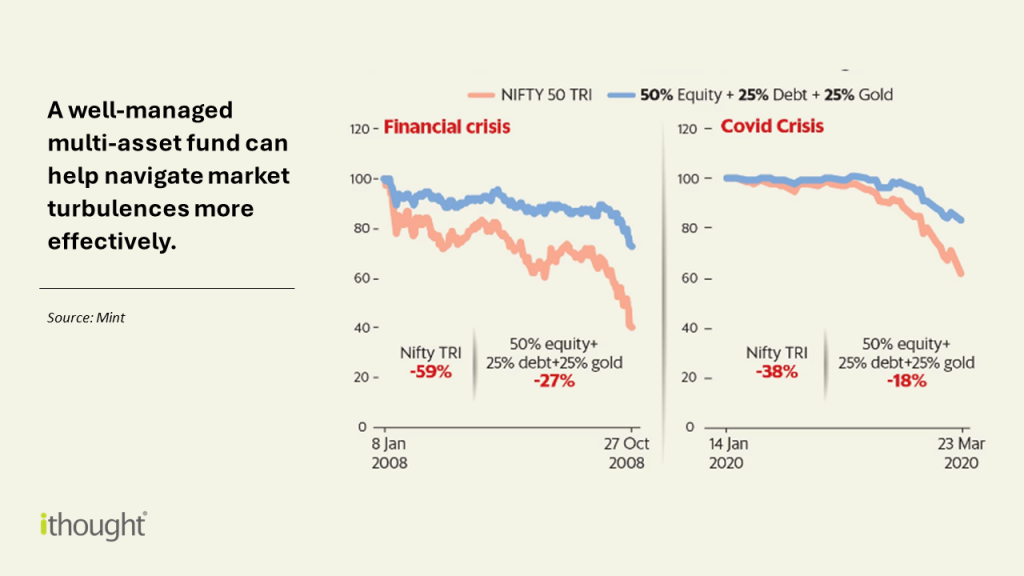

DRAWDOWNS IN CHECK

Let’s look at the drawdowns when asset classes like gold and debt are added to equities.

The Nifty TRI index showed a maximum drawdown of 59% during the 2008 financial crisis, whereas a multi-asset portfolio experienced a drawdown of only 27% during the same period. Similarly, during the pandemic, the Nifty TRI had a drawdown of 38%, while a multi-asset portfolio saw a drawdown of 18%. A well-managed multi-asset fund can help investors glide through a smooth investing experience by reducing the overall volatility in their portfolio.

According to a study by Vanguard, asset allocation contributes to nearly 90% of a portfolio’s long-term returns. In contrast, individual security selection and market timing had relatively less impact on the returns ( http://tinyurl.com/2jnwe5pk ). Best-performing asset classes change frequently, but an active asset allocation can generate alpha if timed well!

VOLATILITY: YOUR ALLY

One of the most misunderstood concepts in finance is that risk = volatility. It is viewed to be the ultimate risk factor. When the idea of volatility can be intimidating for investors, it can prove to be an ally to long-term investors when leveraged correctly through the bucket of multi-asset investing.

TAX TREATMENT

| Exposure | Holding period | Taxation |

| 35%-65% domestic equity | < 3 years | STCG at slab rate |

| > 3 years | LTCG taxed at 20% with indexation benefits | |

| 65% or more domestic equity | < 1 years | STCG taxed at 15% |

| > 1 year | LTCG above 1 lakh taxed at 10% |

The FY24 Budget scrapped indexation benefits for mutual funds up to 35% exposure to domestic equity. However, funds that maintain a minimum equity exposure of 65% are treated as equity funds for taxation. In such cases, taxation is lower than the slab rate for fixed income.

THE MULTI-ASSET WAY

Sure, small and midcaps had their moment in 2023, but history teaches us that the investing landscape is ever-changing. What’s on top today may not necessarily stay there tomorrow. This cyclicality underscores the importance of diversification and multi-asset allocation strategies.

Prudent investors recognize the importance of not putting all the eggs in one basket. By embracing a multi-asset allocation approach, investors can position themselves to navigate the ups and downs of the market and achieve their long-term financial goals with greater confidence.