In 2021, the Nifty 50 is up nearly 20% and has doubled from March 2020. The RBI has continued with its accommodative stance while maintaining the repo rate at 4%. Real GDP for the 2nd quarter expanded by 8.40% YoY and for Q1FY22 expanded 20.1%. All constituents of aggregate demand are in the expansion zone. The momentum of economic growth has been gaining traction as the vaccination coverage is expanding. Urban demand and contact intensive service activities are expanding on improving consumer optimism, supported by festive demand. Production of capital goods remained above pre-pandemic levels for the third month in a row during September, while import of capital goods rose at a double-digit pace over two years ago.

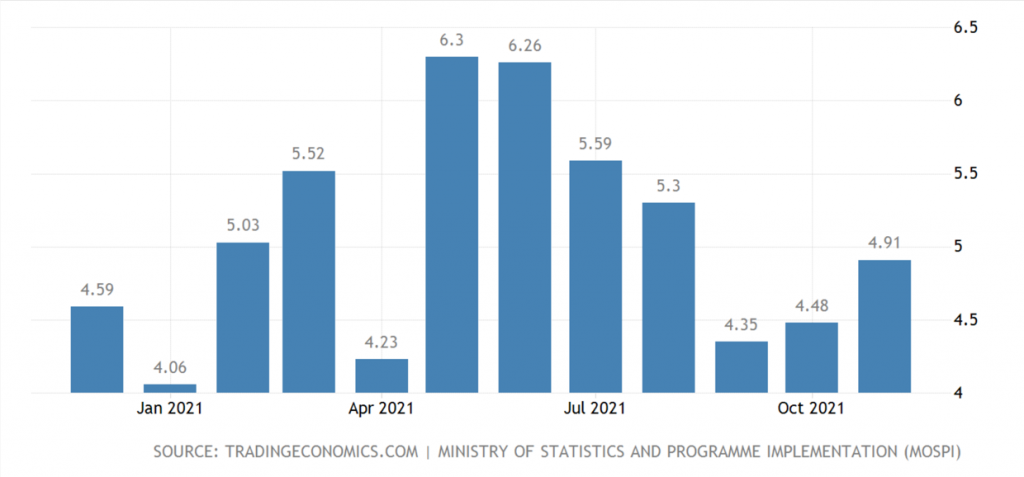

Headline inflation has been on a downward trajectory since June 2021. A spike in vegetable prices was seen in October due to crop damage from excessive rainfall. Fuel inflation surged to an all-time high in October due to the rise in international prices of LPG and kerosene.

Market Performance

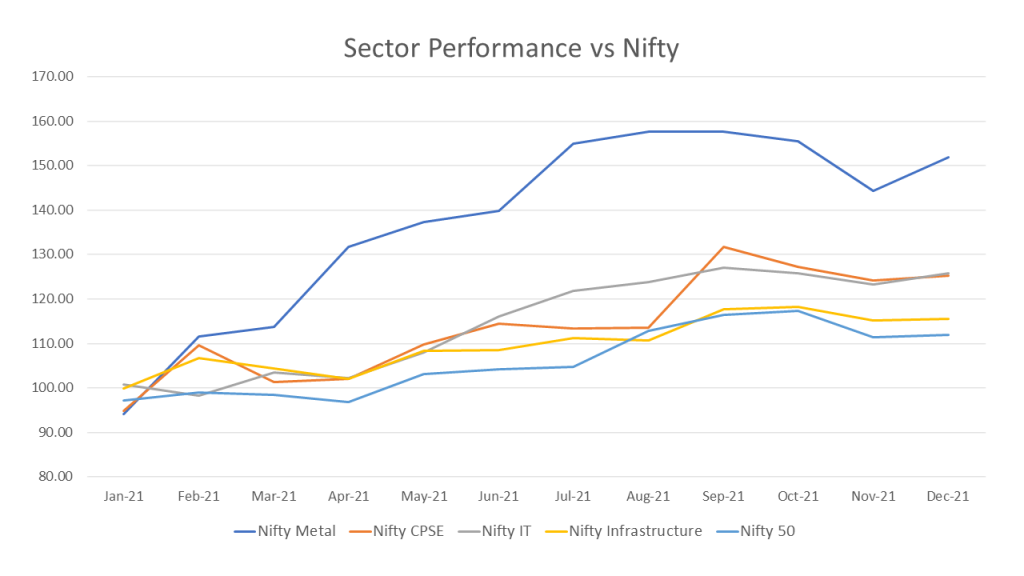

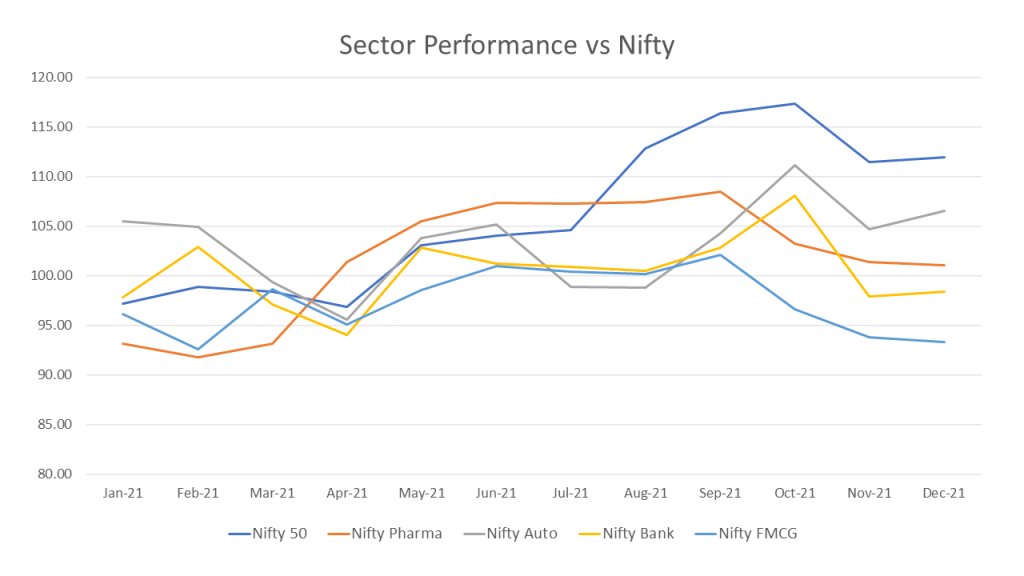

In this section, we will be seeing a select few sectors and how they have moved with relation to the Nifty 50. Please note that the Nifty 50 may not be the most suitable comparison for every sector and has just been used as a point of reference for relative performance.

Metals have steadily outperformed the index this year with nearly 60% gains since January. The public sector index has done 32% with IT coming in at 25%. Nifty Infrastructure has performed in line with the Nifty 50 with both coming in at around 15%.

After a stellar 2020, pharma has disappointed many investors with an 8% return for the calendar year. Nifty auto and the banking index have been rocky with auto-closing at 1% and banking breaking even for the year. Nifty FMCG is 3% down in the calendar year being the only sector with a negative return.

Initial Public Offerings

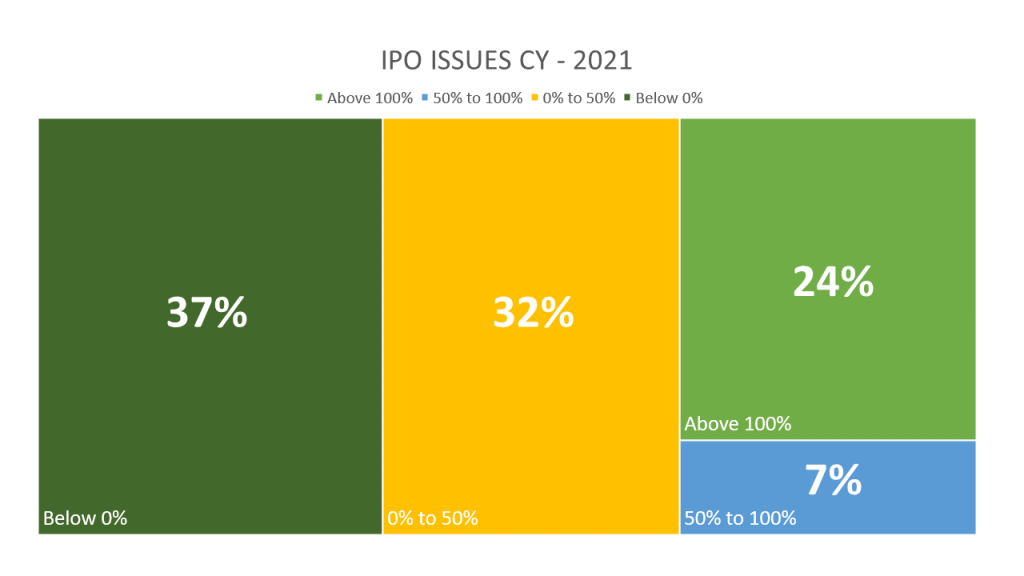

This year we have seen 98 IPOs. A lot of people invest in IPOs looking for listing gains. Let’s see how they’ve done.

IPOs that have doubled or have had returns more than double from their issue price make up 24% whereas IPOs that have had negative returns from their issue price constitute 37%. For the issuers, coming out with the IPO in a bull market is preferred as the market sentiment at that point would enable them to get a higher valuation. Investors must be very careful when investing in IPOs and should consider valuations before making a decision.

The next major event the markets are preparing for is the Union Budget which will be presented in 2022. Follow us for more news and insights.