When we talk about the cyclicality of different assets, the first thing that comes to mind is equity. Everyone knows that metals, automobiles, and financials may have up-cycles and down-cycles, but what if I told you there is a cyclical aspect to fixed income? In this blog, we explore the cyclicality of debt. There are two major ‘drivers’ of cyclicality in fixed income. They are – the Interest Rate Cycle and the Credit Cycle. Let’s take a look at the two.

Interest Rate Cycle

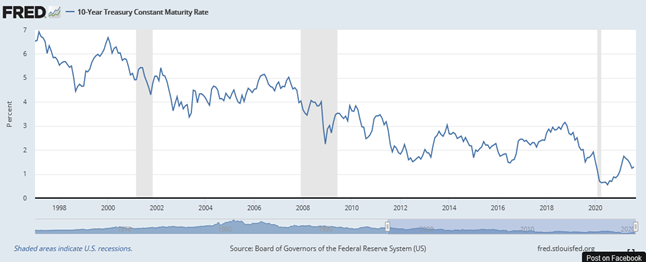

A central bank uses interest rates to control an economy. Not too dissimilar to the temperature knob in a water pipe. When the economy gets too hot for its benefit and things need to be reined in, the central bank will increase interest rates and reduce liquidity from the system through an open market operation.

An open market operation is when a central bank buys or sells fixed income securities in the market. When liquidity needs to increase, the central bank buys and vice versa for when liquidity needs to reduce. When growth is slowing or when the economy is in flux (GFC, COVID), the central bank decreases interest rates to ease the cost of borrowing. Which, in turn, encourages borrowing and investments.

As businesses start investing, employment increases, disposable income increases, and inflation return to healthy levels. This will eventually bring economic growth back on track. As growth returns and the central bank sees sustainability, they will tighten the liquidity in the system by selling treasuries in the market (open market operation) and slowly raise interest rates back to normal levels.

The chart above shows the 10 Year US Treasury Yield (line) and the various periods of recession (shaded portions).

The chart above shows the Effective Federal Funds Rate (line) and the various periods of recession (shaded portions).

Credit Cycle

A major aspect of the cyclicality in fixed income is the credit cycle. The credit cycle is linked closely to the business cycle and the interest rate cycle. This focuses on the ease of access to credit for borrowers.

When business is doing good, and the economy is booming, lenders are more willing to extend credit to the borrowers as they are confident in the ability of the borrower to fulfil their obligation. When growth slows down, the credit in the system tightens, and the borrowing rates increase. This increase in rates makes it more difficult for lower-rated entities to borrow and, in turn, affects their business. During this phase, corporate defaults are most likely to occur. The credit cycle lasts longer than the business cycle as it takes more time for weakening fundamentals to show up.

Investors need to be aware of the cyclical nature of fixed income when making a decision. Not all fixed income strategies are equal. Knowing what works best for certain situations can make all the difference. Connect with our advisors to understand what would work best for you!