Notice how investor preferences have moved from fixed deposits to bonds? In this month’s outlook, let’s study how the bond market works and how to make bonds work for you! You could also catch up on our webinar where we broke down everything you need to know about bonds.

Why do investors like bonds so much?

There’s a lot more going on here than meets the eye. For starters, a wave of regulatory changes has made bond markets more accessible and attractive for retail investors. The RBI’s Retail Direct Platform allows retail investors to participate in the government securities market without any intermediaries directly. At the same time, SEBI has been pushing to reduce the face value of bonds so that the minimum ticket size is down from Rs. 10 Lakhs a few years ago to Rs. 10,000. The biggest nudge came from taxation. Once the indexation benefit for mutual funds removed, investors wanted to maintain the same post-tax returns they were earning. So, there’s been a risk-on sentiment in fixed income with investors searching for higher yields outside of safer avenues like bank fixed deposits and mutual funds.

How does the bond market work?

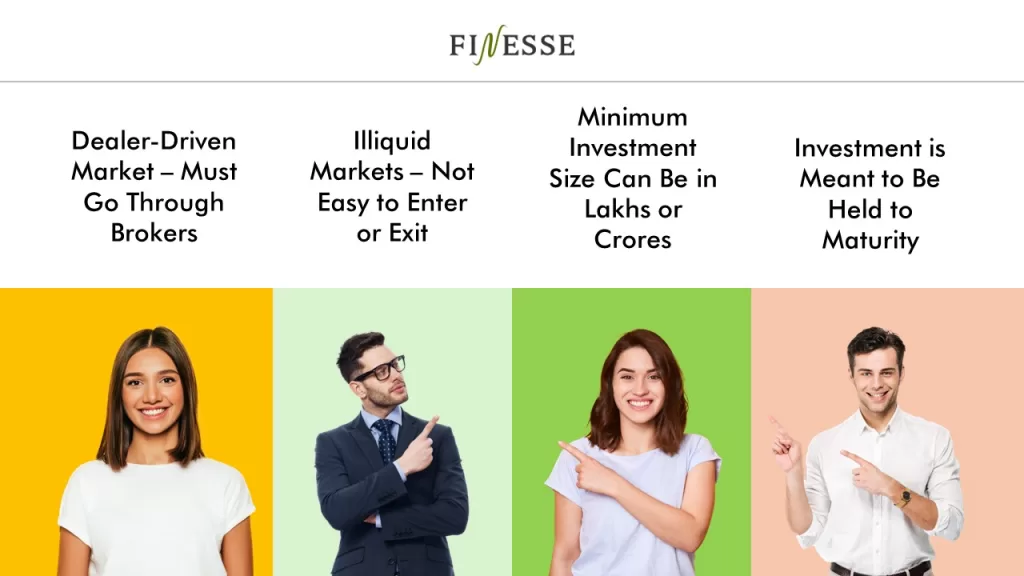

There are a lot of finer details investors should be aware of before they participate in bonds. Firstly, the bond market is dealer-driven. Unlike stocks, only a fraction of bonds trade on exchanges and the remaining are held with broker-dealers on their books. For an investor to participate in the bond market, it’s easiest to go through a broker-dealer. Second, the bond market is not liquid. It’s not easy to trade bonds the same way one trades stocks. Often there is a higher cost to trade bonds when one goes through regular channels. Third, some deals come with a minimum lot size that may be unfeasible for retail investors to participate in. Lastly, most investors buy bonds with the intent of holding them until they mature.

What should I know about bonds before I invest?

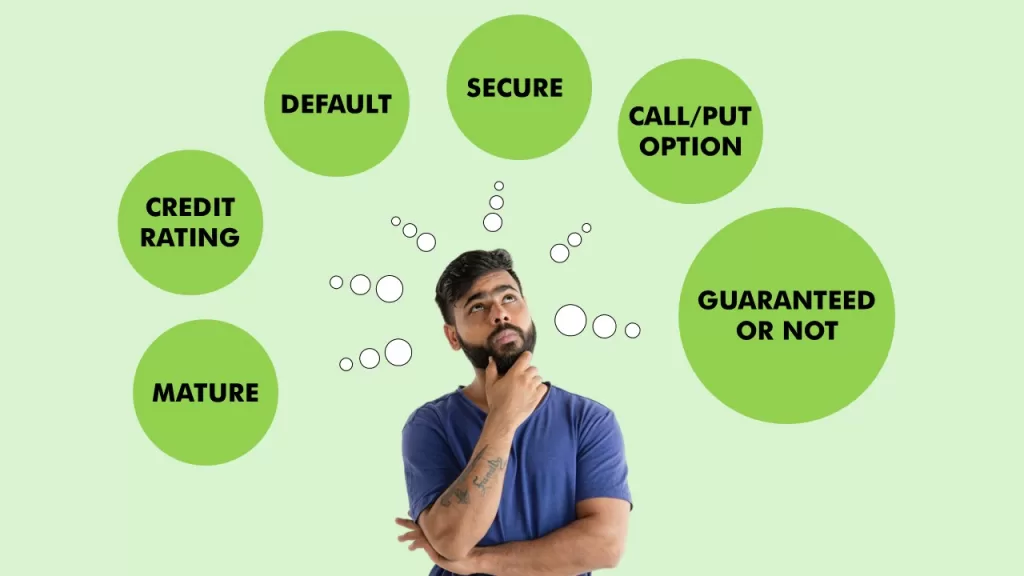

Bonds are issued by borrowers who may be the government, corporations, municipalities, Banks, and NBFCs. When a company issues a bond, it typically also discloses other important details like the credit rating of the issue, when the bond will mature, what happens in the event of a default, whether the bond is guaranteed or not, how secure the bond is, and if there is a call/put option. Investors must pay attention to the finer details and not just the yield or interest rate.

Who do bonds suit?

Like any other investment, bonds may not suit every type of investor, but they can play an important role in your portfolio. Here’s a quick look at who bonds work for:

There are many ways to invest in bond markets, what route will you choose?