“Details create the big picture.” – Sanford I Weill

There is a stark contrast in investor sentiment between fixed income and equity. Equity investors are quick to digest negative news and eager to participate in the asset class. On the other hand, fixed-income investors are taking their time to process even the best news and seem hesitant to raise allocations. So, what are fixed-income investors so worried about?

This month on Finesse, we’re looking at the impact of rising oil prices and the effects of bear steepening.

RISING OIL PRICES

Oil is a crucial macroeconomic factor for India. After all, we import 80% of our oil needs. Since the Ukraine war, Russia has become our number one supplier, accounting for 40% of our oil imports. The price of oil affects our import bills. Import bills link to the current account deficit, India’s cost of borrowing (government yields), and the rupee’s stability.

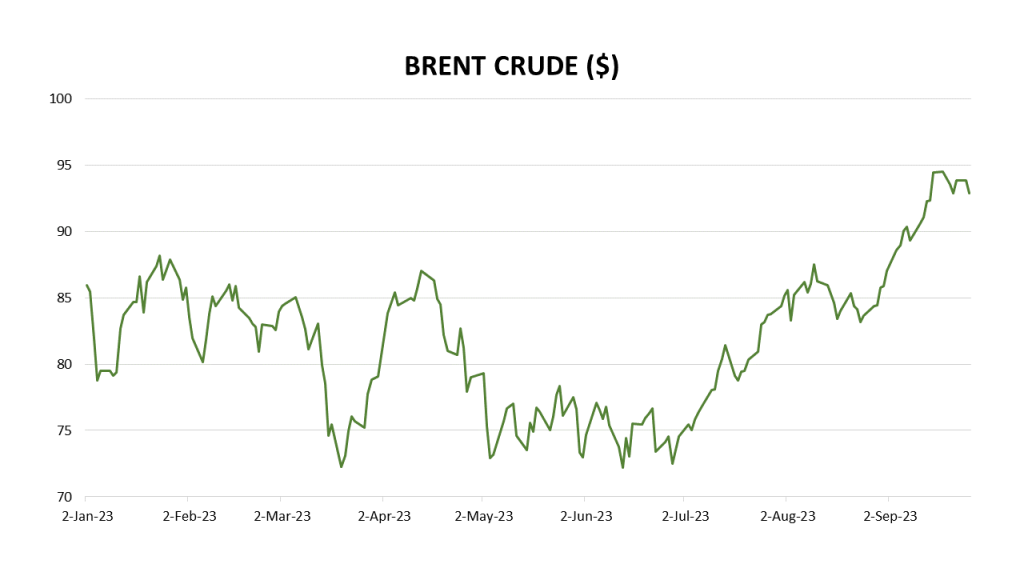

In August, we highlighted an unusual inflation trend. CPI was showing signs of inflation and WPI deflation. This is where the details matter. The divergence in inflation trends traces back to oil prices. Over the last few months, crude oil has become more expensive. But it’s still cheaper than where we were last year.

Oil prices and inflation expectations are intertwined. The RBI’s estimate for crude oil this year was $85 per barrel. We’ve been well above that figure with crude oil touching the $97 mark in the last week of September. The RBI’s October policy will be an interesting one to track – tune in for our updates. Join our WhatsApp Community to stay up to date!

BEAR STEEPENING

Fixed-income investors believe that the worst is yet to come. Inflation is still a problem. A global slowdown is on the cards. There is no playbook for the situation we are in today. Naturally, bond investors are being cautious.

Over the last few months, we’ve talked about a flat yield curve and what it means for you. The changing shape of the yield curve is worrying investors.

Globally, macro observers have noticed a steepening of this flat yield curve. Take Callum Thomas’s Chart of The Week where he talks about how the inverted yield curve is just the beginning of tough times. Inverted yield curves flatten out and then steepen. The steepening indicates that long-term and short-term prospects are likely to be challenging.

Optically, the Indian yield curve is still flat. Yet, we’ve had a silent steepening. For over a year, bond market investors have waited for JP Morgan to announce the inclusion of Indian bonds in the global bond index. But the announcement caused no rally in government yields. Bond index inclusion seems to have assuaged fears rather than instilled optimism.

Yields have been relatively benign this year. It looks like volatility is on the cards. Investors should prepare to invest as opportunity will knock on new doors.