As investors, we all want to be ahead of the cycle. For obvious reasons, this is one of the hardest things to achieve. To be ahead of the curve, we should have a keen sense of where we are now, where we’re going, and what could happen along the way. There is no playbook for the markets. While history rhymes, it doesn’t repeat exactly. Wealth is created by responding to opportunities. This month we’re looking at how to respond to a rapidly changing world.

High Inflation

Inflation was always a problem for India. In the past, all it took for inflation to spiral out was a shift in oil prices, a deficit monsoon, global headwinds, or FII flows. Today, despite these factors being in play, India fares well on the inflation front. It is too early to assume that the worst is behind us. Oil could still play spoilsport.

Through 2023, the Fed has been waiting for the other shoe to drop. Inflation was the problem at hand, but other macro factors could easily take center stage. The Fed was worried about whatever else could escalate. In past cycles, the return to normal inflation was non-linear. The 1980s was a classic case. The Fed’s biggest concern was that the trend of falling inflation might be short-lived. But, so far, so good.

For the last few decades, Japan has tried to stoke inflation through monetary policy actions to little effect. This time around, inflation is welcome.

We are heading into an era where we must coexist with inflation. Perhaps it is not as problematic as it once was.

Higher for Longer

Jim Rogers famously said, “Bottoms in the investment world don’t end with 4-year lows, they end with 10 or 15-year lows.” This is true of cycles as well. Take US interest rates. The 1970s and 1980s were a period of high inflation. US interest rates rose to 20% in that era. From then till the late 2000s, interest rates steadily declined till they touched 0% in 2008. More than a decade elapsed from the global financial crisis to the coronavirus pandemic. Another cycle, another 0%.

Now that the tide is turning, interest rates are on the way up again. This time, inflation isn’t the same beast that it was. Most central bankers seem comfortable with having a certain level of inflation. Interest rates drive the value of money. And money, like goods, will become scarcer.

Ray Dalio’s explanation of how the economic machine works introduces the idea of the short-term and long-term credit cycles. To know where we are today, we need to zoom out. We’re at the start of a new long-term debt cycle.

Volatility

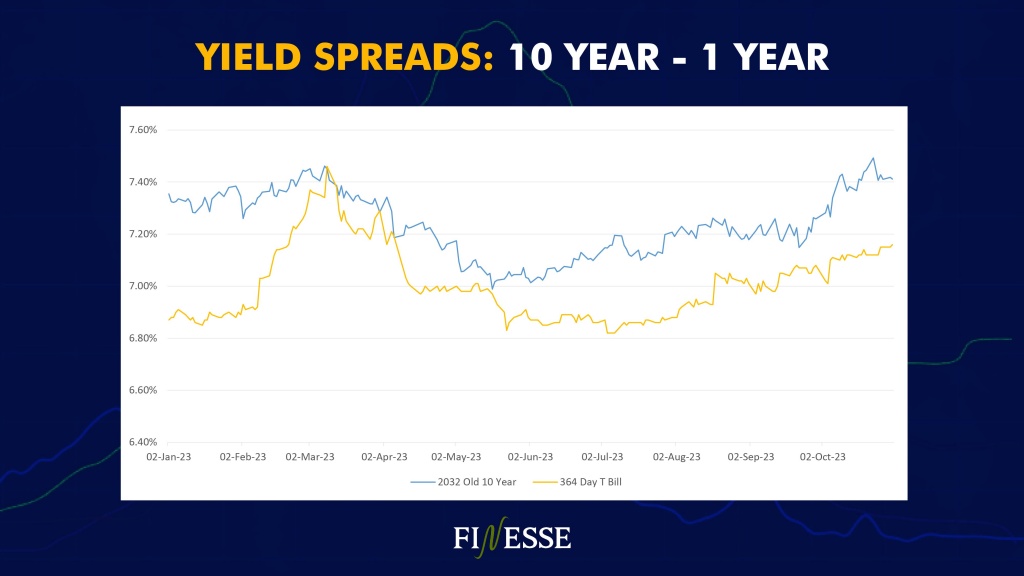

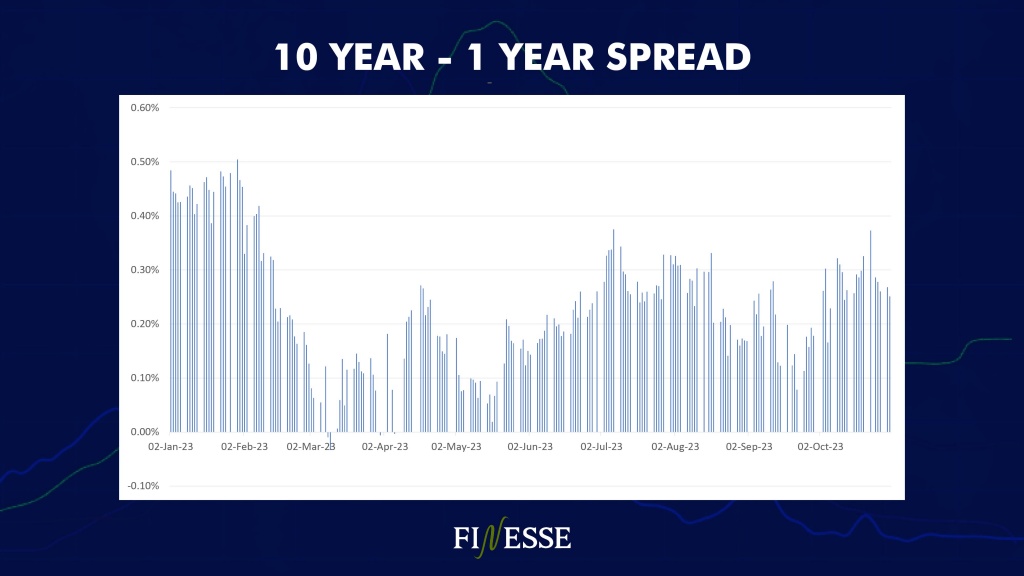

For most of 2023, the Indian yield curve has been flat. As spreads widen, the yield curve will begin to take shape. For the first time, India is issuing a 50-year bond (at 7.5%). The 10-year has moved roughly 0.05%-.10% in the last month. What investors should keep in mind is that peak interest rates don’t imply peak yields. Transmission takes time. Remember rates are one of the many factors that contribute to yield dynamics.

With a sound investment strategy in place, volatility can become your friend.