Dear Reader,

It’s a new year and we have a fresh outlook on fixed income markets. Here’s what we’re exploring this month:

-

-

- The Pitfalls of Past Performance

- When Credit Risk Works

- Beating Inflation in Retirement

-

Mutual Fund Past Performance

Investors often take comfort in a fund’s performance track record. We prefer to invest where the results are tried and tested. However, investment is one arena where results can be misleading. Instead of looking and what fund performed the best, we need to analyse why a particular category did well.

| FUND CATEGORIES | 1 YEAR RETURN |

| Liquid Funds | 4.00 % |

| Ultra Short Duration Funds | 5.17 % |

| Credit Risk Funds | 0.40 % |

| Gilt Funds | 10.94 % |

| Long Duration Funds | 11.88 % |

Source: Value Research & LiveMint

Data show that long-duration and gilt funds were the star performers in 2020. How did they manage to deliver double-digit returns in a year where most funds and deposits were offering returns in the range of 4%-6%?

The answer lies in interest rate cuts. Whenever the interest drops, existing bonds gain value. The longer the duration of the bond, the more value it gains. Naturally, in a year where the RBI cut interest rates by a steep 1.15%, these categories were bound to do well.

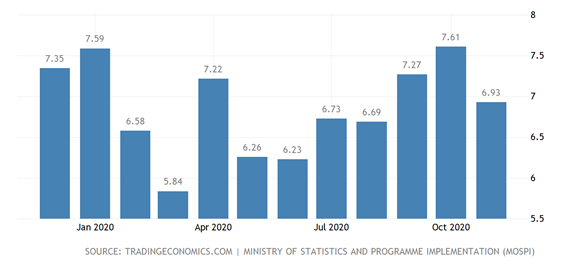

What most investors don’t know is that the opposite will happen when interest rates reverse. Meaning, all the returns they made could be erased when interest rates turn. Staying at a historical low repo rate of 4% isn’t sustainable. Especially because inflation has been above the upper target of 6%.

Investors who pursue duration risk because of higher yields or past performance are bound to get hurt when the tide turns. Worried about navigating the mutual fund maze on your own? Sign up for our debt mutual fund advisory services!

When does credit risk work?

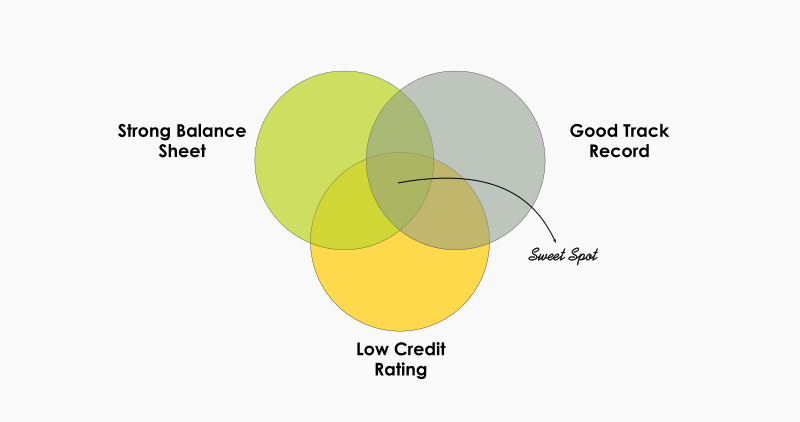

Credit has a bad reputation and the last few years have been rough. First SEBI insisted that the category should be renamed to Credit Risk from Credit Opportunities. Then marquee names like IL&FS and DHFL defaulted on their debt. Then Yes Bank was forced to default on its perpetual bonds. And in April 2020 Franklin Templeton announced the winding up of 6 mutual fund schemes. It’s hard to have faith in a strategy when the recent past is fraught with so many incidents.

The first thing we must acknowledge is that there are no risk-free investments. Even with a bank fixed deposit, only Rs. 5 Lakhs is guaranteed. So, conservative investors are also taking risks, just different ones. The key is to be selective. The advantage of a credit portfolio is a better yield or accrual. The disadvantage is the risk of losing capital or having lower liquidity. Clearly, some funds beat the category average hollow. They manage to do it by hitting the sweet spot.

Locating the sweet spot is harder than it looks. And investing in credit isn’t a buy and hold affair. One needs to keep a close eye on the evolving context and must be swift in responding to changes. Investors can choose between mutual funds, FMPs, and AIF.

| PARTICULARS | OPEN-ENDED MUTUAL FUNDS | FIXED MATURITY PLAN | ALTERNATIVE INVESTMENT FUND |

| Liquidity | High | N/A | Varies |

| Fees | Moderate | Moderate | High |

| Returns | Varied | Range-Bound | Moderate to High |

| Volatility | High | Moderate | Moderate |

| Term | None | Fixed | Fixed |

| Exit Load | Applies | N/A | Applies |

Beating inflation in retirement

The post-retirement challenge is to live well without worrying about inflation or depleting your retirement corpus. We know that inflation isn’t linear. Some years are particularly rough while others are worryingly benign. Some inflation is good for the economy and your investment returns.

RBI Inflation Targeting Mandate

The RBI started following an inflation-targeting mandate in March 2016. It is up for review later in March this year. There was initial concern that the RBI might alter the mandate or scrap it altogether. Inflation in 2020 was consistently outside the RBI’s mandated target of 4% +/-2%. However, publicly available commentary from the governor and the RBI’s report indicates that the mandate is unlikely to change.

Return Expectations & Asset Allocation

This is good news for retirees. Because inflation in the medium term at 4% is manageable. But it also means that returns will moderate. So, retirees need to re-anchor return expectations. Instead of fixating on a number, retirees need to look at positive inflation-adjusted returns. A reasonable target is 2% over inflation. The best way to achieve this is through asset allocation.

Your retirement corpus should be diversified across different asset classes and different instruments. Want to know where you stand? Get an ithought investment review.