We’re familiar with the animal spirits of equity market cycles. We know that bulls rage on, while bears hibernate leaving market activity in a lull. But what about fixed income markets? The animals of debt markets are hawks and doves. Hawks soar high, leaving room for massive gains. Doves lay low, waiting for an opportunity to rise.

Here’s what we’re exploring this month:

-

-

- Is the interest rate cycle about to turn?

- Who wants debt when there’s equity?

- Returns look promising, what am I missing?

-

Interest Rate Cycles

The fixed income cycle is a function of the interest rate cycle. A dovish stance is one where interest rates remain low or fall. Low/negative growth and moderate inflation characterize low interest-rate regimes. The RBI reduced interest rates by 1.15% in 2020. As growth improves and inflation heats up, interest rates begin to normalize (we could be at this juncture). Interest rates keep rising in tandem with growth and inflation. When growth begins loses momentum and inflation becomes benign, it’s time for interest rates to fall. So, the question is are we at the turn of the cycle?

Macroeconomic signals provide clues to help us assess where we stand in the interest rate cycle. Through 2020, inflation was persistently high and growth was worrisome. However, the December inflation number of 4.59% was in line with expectations and growth has fared better than expected. But one can’t rely on one number to judge the trajectory monetary policy. There are more subtle cues beyond growth and inflation. The RBI resumed normal hours for liquidity operations in the middle of January. Almost immediately short-term yields spiked by 0.15%-0.35% and have remained elevated since. The second clue is that SBI increased its 1-year Fixed Deposit Rates by 0.10%.

Monetary Policy

We know that the RBI has committed to an accommodative stance until the end of the financial year. This means rate hikes are off the table. In all likelihood, the February policy will be free of interest rate surprises. Yet, the February policy will be an important one. We’ll get to see how the fiscal policy (Budget) and monetary policy complement each other.

Don’t Stick With Mistakes

Have you been hit by the defaults of IL&FS, DHFL, Yes Bank, or LVB? Do you worry about the SREI moratorium? Are you considering equity instead of debt? You don’t need to change your asset choice. You just need better risk management. We can help.

Equity For The Win?

Fixed income has never been as glamorous as equity. 2020 and 2021 are solid proof. There’s no equivalent of Game Stop in the fixed income space. The expectation in a crisis is that assets like debt and gold would hog the limelight. Yet, bad news floods debt markets. And equity is gloating not just over past performance but also present continuous performance. Should you worry that you’ve missed the bus?

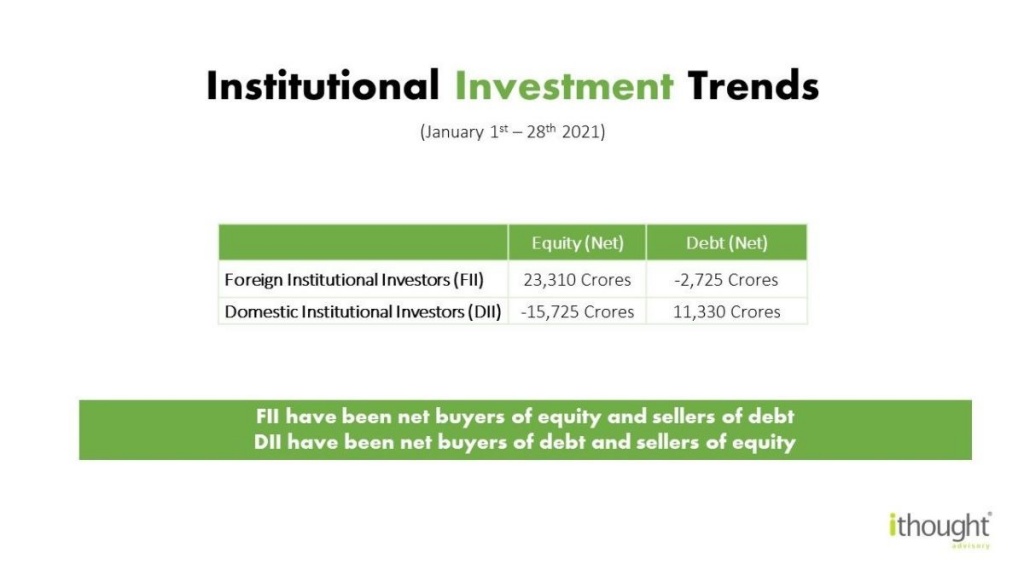

By and large, liquidity is driving this market. Institutional investment data shows that DII bought debt and sold equity and FII did the opposite. A lot of institutional money is sloshing around the market and retail investors have no idea that they are playing with fire. When this liquidity reverses, it’s the smaller investors who will pay. It’s not too late to choose the road less taken. The time is ripe to assess your asset allocation. Start with an investment review.

Returns Look Promising, What Am I Missing?

Consider both aspects – returns and risks. The risk of equity is higher. We’ve previously talked about why Lakshmi Vilas Bank (LVB) deposit holders were spared, whereas those owning AT1 bonds or shares were not. DHFL is in the news again. How DHFL got here is a saga of red herrings and red flags. Currently, Piramal is poised to takeover DHFL. They plan to delist the company (meaning shareholders get nothing) and lenders are expected to take a loss of ~60%. Unfortunately, before this deal was struck many retail investors bought DHFL shares hoping that they would get something out of a resolution plan.

We invest in equity and debt for different reasons. There’s a return ceiling for fixed income, so it makes sense to limit risk-taking. You can also minimize risk-taking in equity, as we’re doing with our latest PMS product, COIN. Your fixed-income investments should be more stable, generate income, and help you sleep better at night. Here’s a list of low-risk special investment options for senior citizens. Get in touch to know what your investment options are!