Welcome to our last outlook for 2023! We have much ground to cover. This month is a wrap-up of looking at regulatory changes, flows, monetary policy and much more. We invite you to join us live to wrap up 2023. Register here to have all your questions answered!

Regulatory Changes: The Tax Overhaul

What’s the one thing that defined the landscape of fixed-income investing in 2023? The sea change in tax treatment for fixed income!

Market Linked Debentures

Until this year, Market Linked Debentures or MLDs enjoyed a tax arbitrage over other investments like bonds and deposits. The profits on these products were taxed as capital gains rather than income. Essentially, they attracted lower tax rates of 10% for long-term investments (after a year) and 15% for short-term investments (within a year of purchase).

Naturally, MLDs were the ideal instrument for the performing credit space. Many AIFs used MLDs to generate attractive post-tax returns. With the shift in tax regulations, the performing credit space is forking out into either products that offer modest post-tax returns or products with enhanced risks.

Insurance Proceeds Taxed

The 2021 Budget changed the tax rules on unit-linked insurance products. Maturity proceeds from all insurance products with an aggregate annual premium above Rs. 5 Lakhs will be taxed. Proceeds received upon the death of the insured person are exempt from tax.

Post office savings schemes compete on a level playing field with money back and endowment policies. After all, safety first!

Does the combination of investments and insurance even work? This video explains it all.

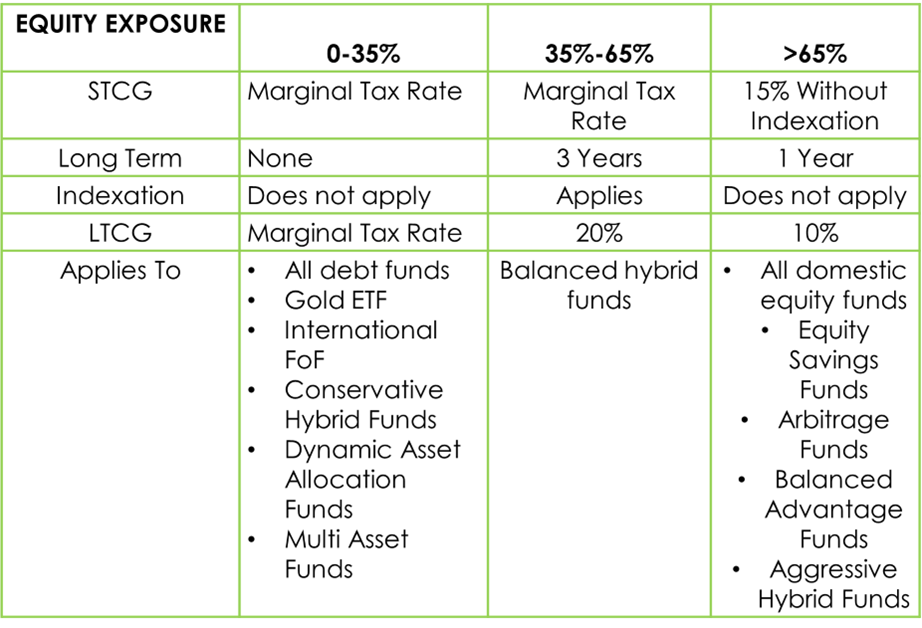

Mutual Fund Taxation

The most surprising tax change of the year concerned debt funds. Investments in debt mutual funds made after 31st March 2023 would no longer be eligible for indexation benefits. Indexation benefits ensured that investors paid tax only on the inflation-adjusted profits. Going forward, all realised gains from debt funds are taxed at your income slab rate.

Debt funds weren’t the only ones impacted by the change in taxes. Here’s a look at how different categories of funds will be taxed in 2023:

Want to know who debt funds work for? Register here!

Flows

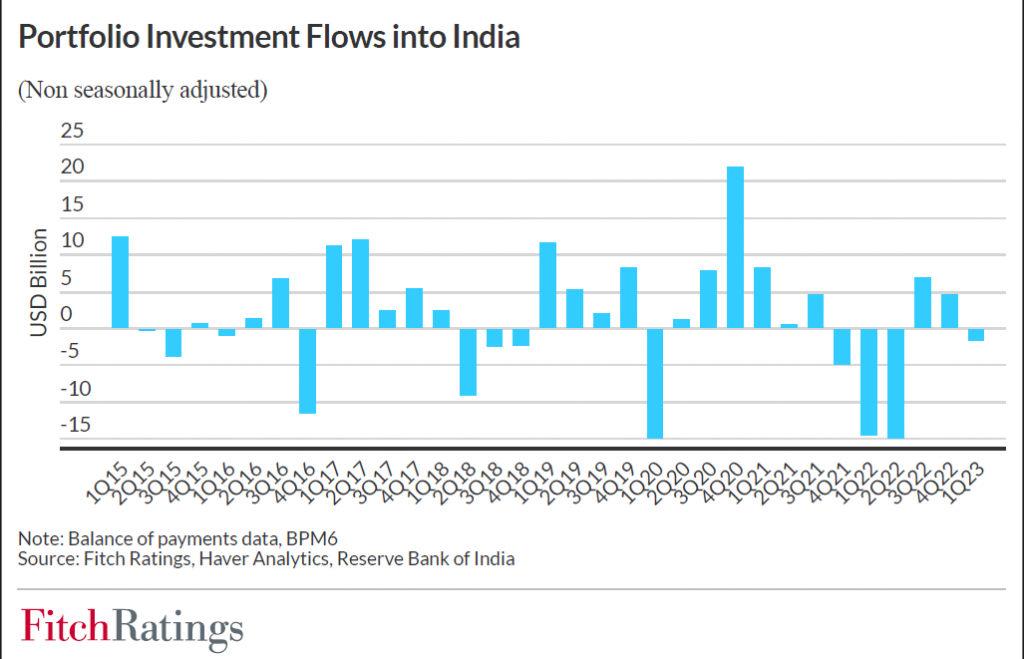

November was a great month for FII flows into fixed income with a net inflow of more than Rs. 12,000 Crores. The last time domestic bond markets gathered so much foreign capital was nearly two years ago. In fact, 2023 has been brilliant for FII flows into fixed income. Almost Rs. 48,000 Crores of net capital has hit the Indian bond market year to date.

Let’s put this in context with data from Fitch:

Global Index Inclusion

After much speculation, Indian government bonds have finally been included in JP Morgan’s Emerging Markets Bond Indices. This will allow foreign capital to flow into India.

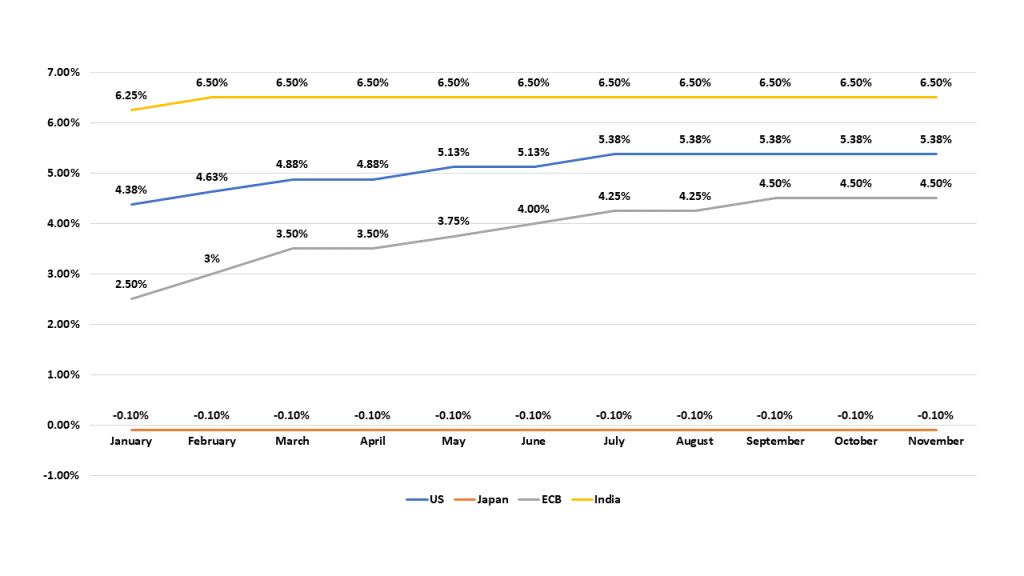

Global Monetary Policy

2023 has been a year of rate hikes. Central Banks have finally taken a breather. This will give monetary policy actions time to percolate down to end users. Inflation concerns have moderated, but it’s too soon to put it behind us. 2024 will be an interesting year for monetary policy as it moves beyond rate hikes.

Wrapping Up 2023 With Finesse

A lot can happen within a year. We’ve covered the highlights. Do you feel like there’s more to discover and talk about?