Here’s what we’re exploring this month:

How to beat low FD returns?

Conservative investors have a common enemy: low returns. And this isn’t a near-term phenomenon. They’ve been grappling with this problem since demonetisation when FD rates plunged. We’re sharing three options to beat low Fixed Deposit returns. Always consult your financial adviser before making investment decisions.

Corporate Bonds

Transmission in the credit (non-AAA) segments of the market are lagging. So even marquee conglomerates are borrowing at rates that are 4% above the repo rate. From a return perspective, corporate bonds exceed expectations. From a risk perspective, one must vet balance sheet health, credit history, and business prospects. More importantly, the Indian bond market is illiquid for retail participants. Consider corporate bonds if you are willing to hold your investment until they mature and if you fully understand the risks.

SIP in Mutual Funds

Channel your interest income into a systematic investment plan in mutual funds. Equity mutual funds are a winning option for three reasons:

1. Asset allocation

2. Better long-term returns

3. Gradual exposure to equity

Alternatively, you could consider SIPs in debt and gold if you’re uncomfortable with equity as an asset class.

Play the Interest Rate Cycle

Even fixed-income markets work in cycles. A paradigm shift could go a long way. The advantage of accepting lower near-term returns is being prepared for investment opportunities. Fixating on a three-year horizon is harmful. We expect interest rates to be benign in this time frame. The scope for mark-to-market gains from long-term securities is limited. But when the cycle turns, you’ll have another chance.

Lakshmi Vilas Bank

Bad banks are bad news. Investors often leave with scars. Even when the situation is managed well, there’s a loss of confidence. We’re going to breakdown how the Lakshmi Vilas – DBS Bank merger affects investors. From 27th November, Lakshmi Vilas Bank ceased to exist. All of its assets and liabilities have been transferred to DBS Bank India Limited (DBIL). You can read the RBI’s gazette notification here.

Lakshmi Vilas Bank Fixed Deposits

There’s only good news for investors on this front. The quick take:

1. No more moratorium or withdrawal limits.

2. Fixed deposits will be honoured by DBIL.

3. The interest rate on the deposits is at the same rate as before until maturity.

4. New deposits/ renewals will happen at DBIL’s rates.

Lakshmi Vilas Bank Bonds

Normally, bonds are liabilities and receive the same treatment as fixed deposits. However, Basel III Tier I and Tier II bonds are quasi-equity instruments. The RBI recommended that LVB write off its Tier II bonds. If you own LVB Tier II bonds, you won’t get anything back for the following reasons:

1. These bonds are not backed by any assets or securities.

2. Banks are not obligated to pay interest on these bonds unless they are financially stable. In LVB’s case, its financial health has been deteriorating steadily in the last few years.

3. Per Basel III norms, there is no guarantee on the principal and interest. The bonds have loss absorption features intended to protect the bank.

4. Interest is non-cumulative (i.e. if the bank skips an interest payment, they don’t have to make up for it in the future).

Worried about your investments in bonds? Schedule an investment review with our financial advisers!

Lakshmi Vilas Bank Shares

As on September 30th, retail investors owned nearly 24% of the share capital. Per the scheme of amalgamation, LVB shares will be written off to zero. When you own shares of a business, you participate in the profits and losses of the company. The bank’s net worth (assets – liabilities) is negative. Naturally, shareholders are last in line. With a negative net worth, there will be nothing to distribute to shareholders.

Watching one’s shares go to zero is painful. Fortunately, these situations can be prevented. Get started with an investment review.

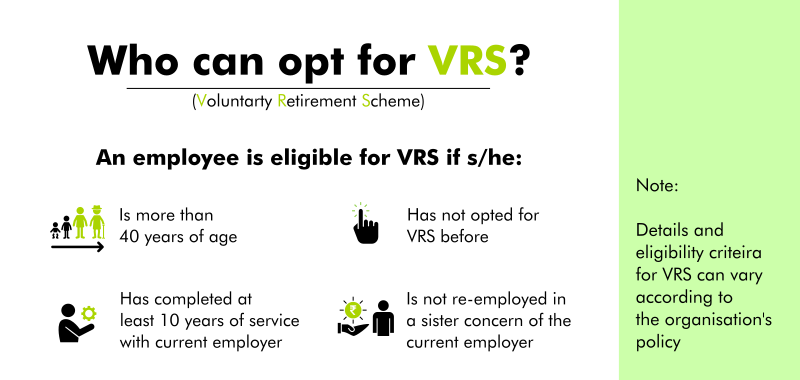

Navigating the Voluntary Retirement Scheme

Today more companies are relying on the VRS to make their workforce more cost-effective. Companies offer the VRS to a cadre of employees who are more than 40 years old. Ashok Leyland recently made a VRS announcement. BSNL and BPCL made VRS announcements earlier this year.

Make a more informed decision about retiring early!

Watch this video or read this blog to know more about the Voluntary Retirement Scheme, its benefits, and computing the tax-free component.

What should you do with your VRS settlement?

If you’ve already opted for VRS, you should have a plan for your VRS settlement. A maximum of Rs. 5 Lakhs will be exempt from tax. Where you should invest this money depends on your asset allocation, financial goals, and return expectations. The best person to help you through this is a financial planner. Click here for more information on our team and process.