In this month’s fixed income outlook, we’re going to explore a tale of two yields. Within the same global macro environment, Indian government bond yields are falling while US treasury yields are climbing. Why the stark divergence? And what does it spell for investors?

The 25 Billion Dollar Question?

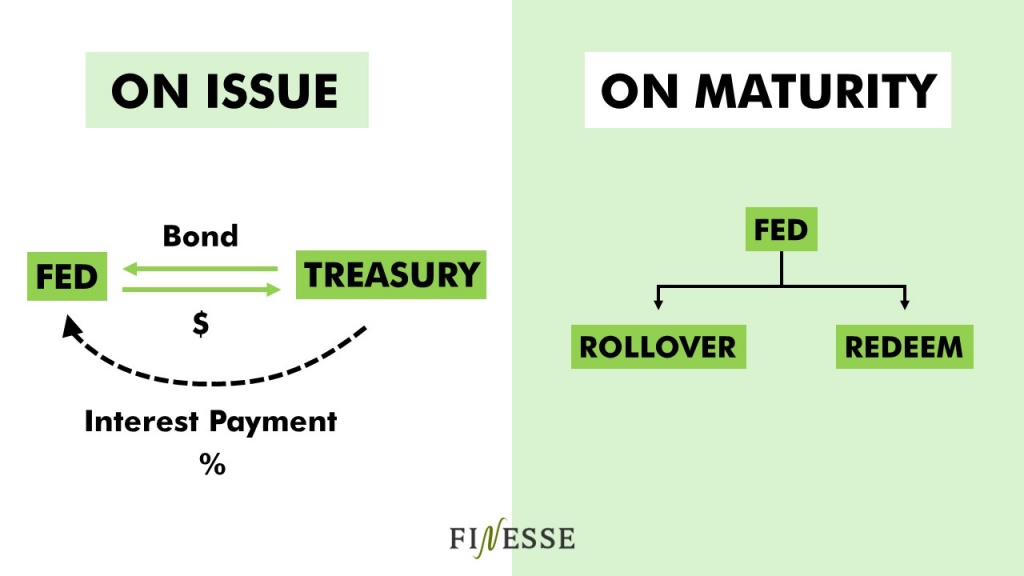

June 2024 will be a landmark month for fixed income. On the Indian side of things, Indian sovereign bonds will be included in JP Morgan’s global bond index. This will trigger net inflows of $ 25 billion dollars through this financial year. Meanwhile, in the US, the Fed will begin dialling down its balance sheet shrinkage activities. In the last meeting, Fed Chairman Jerome Powell announced that they would slow down the pace of balance sheet reduction. Treasury rollovers will reduce from $ 60 billion dollars per month to $ 25 billion dollar per month.

Elections & Bond Markets

2024 is an election year in India and the US. Investors are visibly nervous about India’s election outcomes. We talked about how to ride the election rollercoaster this season. Whatever the outcomes for equity markets, Indian debt markets have reasons to celebrate. First, regardless of who comes into power, the RBI’s record dividend of 2.1 Lakh Crores puts the government on a great financial wicket. Second, the government can expect revenues from the telecom and mining sector from the sale of assets. Finally, markets have cheered fiscal consolidation, so that could become a trend that’s here to stay. It’s too early in the US election season to paint a clear picture on the fiscal front. What is clear is that the Fed is vocal about framing longer-term policy that is independent of political outcomes.

The Effect of Sovereign Ratings

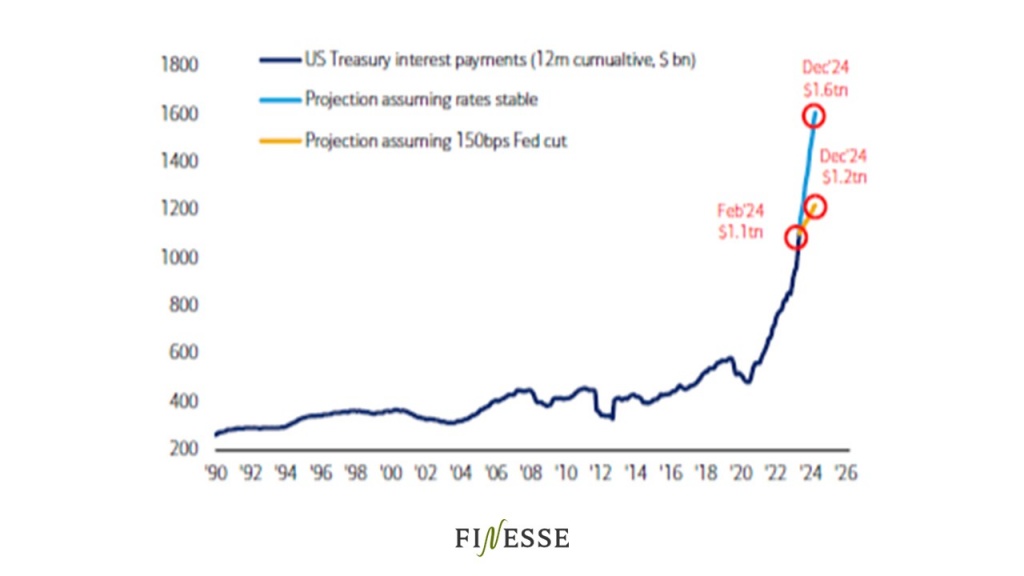

In August last year, Fitch downgraded long-term US government debt from AAA to AA+. The one-notch downgrade didn’t cause a spike in yields, but perceptions have changed. The fact that the US is already paying $1.1 Trillion on interest payments over a twelve-month period is concerning. The “high for longer” stance of the Fed is going to put more pressure on the US treasury to repay high-interest rate debt. According to a report from BofA, if the Fed maintains its status quo on rates, the 12-month cumulative interest payment could shoot up to $1.6 trillion by December.

Back home, S&P raised the outlook for India’s sovereign debt from stable to positive. The outlook factors all the structural changes in India’s macro and fiscal environment. S&P sees a potential for re-rating in the next couple of years. India’s sovereign debt rating is at BBB- the lowest of the investment grade variety.

Investment Strategy

There’s never been a better time to allocate to fixed income. While inflation risks persist, we appear to be at the peak of the interest rate cycle. Thanks to a flat yield curve, allocating to both long-term and short-term debt makes sense. Moreover, those who used fixed income to beat market volatility will find themselves in a better position to capture opportunities.