Patience is a virtue, but how long can you wait? It’s been almost a year since the repo rate fell to 4%. And it looks like rates aren’t in any rush to rise. Do you feel like you’ve been backed into a corner with nowhere to go? It’s time to navigate fixed income markets with Finesse.

This time we’re talking about [click on any point below to jump to that section]:

The Lure of Equity and Real Estate

Almost anything looks better than a bank FD at these levels. Should you take money out of debt now?

Here are some reasons to stay invested in debt:

Asset Allocation

If you’re working with an asset allocation strategy, stick to it. At this juncture, prospective long-term returns from all asset classes look anaemic. So, don’t switch out of debt because of underperformance. What you may want to do instead is shift out of duration strategies and into accrual ones. We’ve talked about the pitfalls of past performance before.

Asset allocation is an all-weather strategy! [IRE Creative]

Short-term goals

Trading is trending in 2021. This TikTok couple made a great case for momentum trading. Trading seems fun and thrilling. It can be tempting to ditch a low-yield debt investment for a high upside in the market. We really need to say this, don’t risk what you can’t afford to lose. Momentum strategies are swing strategies. Meaning you could see a huge upside or lose everything. If you’re toying with futures and options, you could lose everything and then some.

Chase your goals instead of returns!

A sneak peek of one of our top secret trading strategies. h/t @ryanfeller_ pic.twitter.com/V2PFee7vu4

— TikTok Investors (@TikTokInvestors) January 17, 2021

Liquidity Needs

The biggest blind spot in investing? Liquidity. For conservative investors, liquidity doesn’t just mean the ability to sell your investment. It means being able to sell the investment without taking a big hit. Return of capital is more important than return on capital. Connect with us if you want safe passage in a volatile market.

Real Estate vs SEBI Registered AIF

Real Estate Investment

Real estate is an attractive option because:

-

-

- It’s a traditional investment avenue

- Home loan rates are low

- Property prices have fallen

- RERA means better regulatory measures

-

However, there are risks to investing in real estate too. Lower property prices could either mean that a property is returning to its fair value or that it’s a bargain. RERA is still in the early stages. As it becomes more robust, you could see further adjustments in property prices. Debt is a tool, so use it responsibly. Consult a financial planner and run different scenarios before settling on a home loan. You need to figure out how much to borrow, what kind of loan to take, stress test your prepayment plan, and parallelly work out a savings strategy.

Alternative Investment Funds

An alternative investment fund (AIF) is a privately pooled vehicle. The investment manager decides how to deploy the investments according to the fund’s mandate. AIFs are different from mutual funds because they may invest in unlisted or foreign securities. AIFs are meant for more sophisticated investors. The minimum investment limit set by SEBI is Rs. 1 Crore. Here is a video that explains everything you need to know about AIFs in just 3 minutes!

Category II AIFs are an interesting space. They may either invest in real estate or in debt instruments. And they can’t employ leverage strategies. So, amongst the AIF investment categories, this one is relatively more conservative.

Category II AIFs have some advantages over credit risk funds:

-

-

- Wider investment universe

- No liquidity/redemption pressure

- Robust research teams

- Continuous risk monitoring

- Regular return / payouts

-

Selecting an AIF is a task. You need to understand the fund’s risk management strategies, expense, return, investment horizon, and investment objective. And who better to help than a SEBI Registered Investment Adviser?

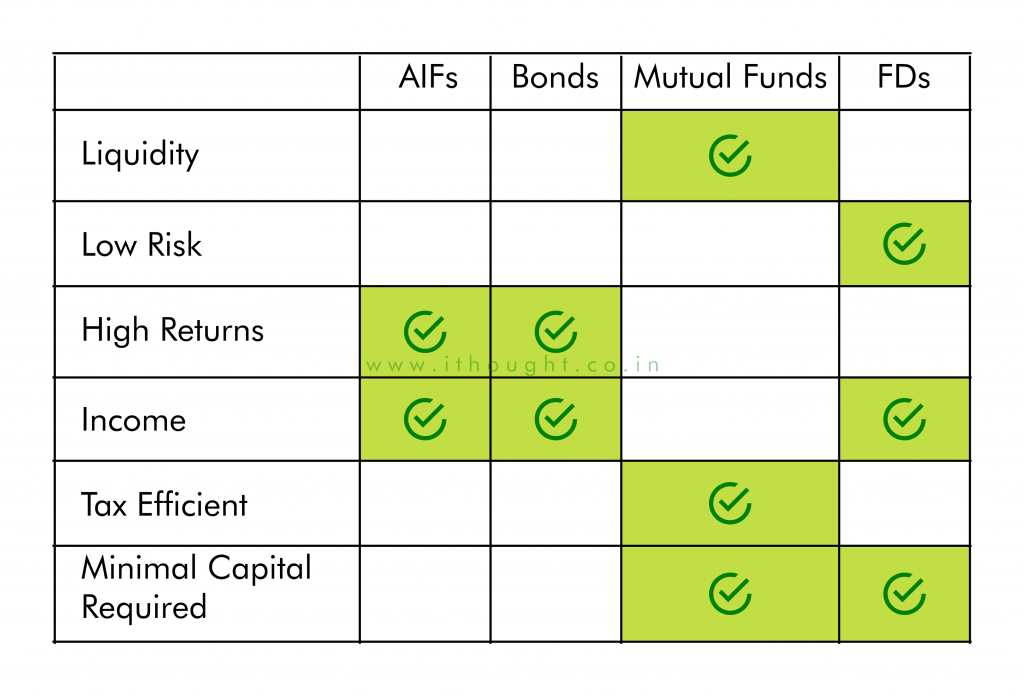

Perfection is a myth

Looking for the perfect investment? Most investors are hitting dead ends. There’s always a flaw – either it’s too expensive, or it’s too risky, or the returns are too low, or there’s no income, or it’s tax inefficient. Unfortunately, you can’t have it all. Here’s what you can have though:

No investment is going to tick all your boxes. But you can find something that works for your goals. In a world full of tough choices, we can help you make the right ones.

RBI Monetary Policy

Economic indicators show that we’re beating growth expectations and falling short on inflation ones. Food inflation softened through December and January, but the RBI remains watchful. It takes more than two months of data to establish a trend. The RBI has committed to an accommodative stance. So, if inflation remains tame then we could see lower interest returns for longer. Naturally, that means investors need to be more selective.

India will soon be one of the few nations in the world that allow retail investors to directly participate in G-sec purchases. The RBI plans to facilitate this through a platform called “Retail Direct”. This is a win-win all around. Retail investors will have access to an otherwise illiquid government security market. The appetite for government securities will increase.

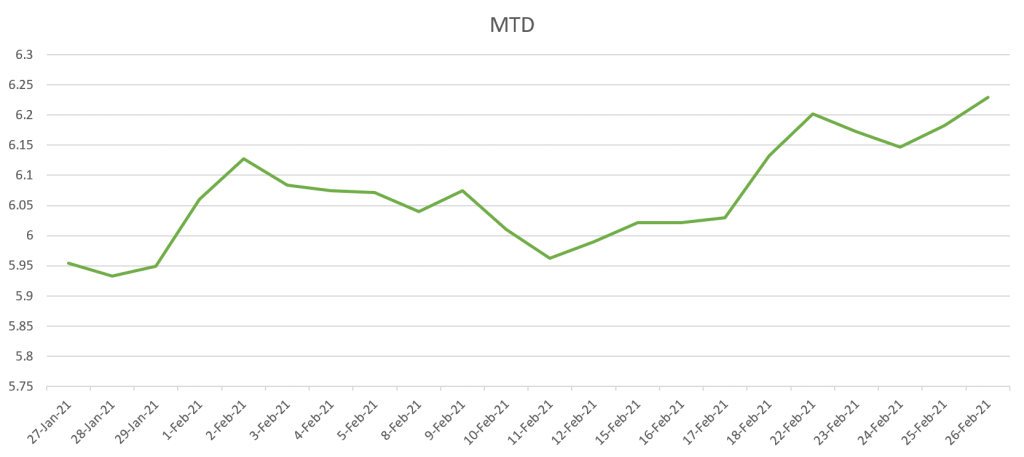

The Yield Curve

The ups and downs on the yield curve are sharp and surprising. But these movements can largely be attributed to the Union Budget and the RBI Monetary Policy. The government intends to borrow more and spend more. And the RBI has committed to implementing a smooth non-disruptive borrowing program. However, 12 Lakh Crores still seems like a large number for the markets to digest.

The RBI’s taken a slew of measures to whet appetites for bonds. Some of these include:

-

-

- Accommodative liquidity and policy stance

- Retail Direct in the pipeline

- Increased underwriting commission for primary dealers by 40X

- Extended Hold to Maturity (HTM) limit for SLR investments from March 2022 to June 2023

-

It’s not just India’s yield curve, even the US yield curve was acting up. Volatility is here to stay. The upward journey in an interest rate cycle is nearly not as fun as the downward one. So, buckle up!