Gone are the days where men were sole breadwinners and financial decision-makers. Today, gender-based financial are roles are breaking and couples are choosing a more collaborative approach towards designing their financial futures. For couples to succeed in life and money, we’ve identified three things they need to:

Communicating Openly

Money Dates

When is the right time to talk about money? Is it after a long day at work or at the dining table? For newlyweds talking about money can seem awkward and intimidating. But it certainly beats the alternative. To have a productive conversation about your finances, schedule money dates. Give it the time, space, and seriousness that it deserves. And this isn’t a one-off conversation. Here is a questionnaire that could help you get started. Let us know how your conversations go.

Financial Habits & Money Values

Of late, newlyweds Sheila and Madhav have been walking on eggshells. Almost every conversation escalates into an argument. They’ve gone from wanting to spend every minute together to avoiding each other. The culprit? Money.

Sheila is a diligent saver and hardly spends on herself. Meanwhile, Madhav is more indulgent and loves to own the latest gadgets. She views his indulgences as a waste of money. Whereas Madhav sees Sheila as too tight-fisted and is unable to enjoy his hard-earned money. There’s no right or wrong perspective. Their clashes on overspending and saving too much are surprisingly common affecting nearly 40% of all couples. Sheila and Madhav can reclaim a happy marriage by respecting each other’s money values, agreeing on boundaries, and leaving room for liberties. This means that after meeting their basic expense and savings target, Shiela should be allowed to save and Madhav to spend without any judgment.

Financial Goals & Priorities

It’s not fair to assume that our partners will take on our debt, fully support our lifestyle, or share the same priorities. At some point in your marriage, your spouse will lean on you for financial support. This could be because they want to upskill themselves, take a career break, branch out of a traditional career path, or take off to be a more involved parent. Don’t take your partner for granted – talk to them about what matters to you and make an effort to understand their financial goals and priorities. You will have individual targets and combined ones.

A lot of personal decisions are financial. Here are a few for newly married couples to think about:

1. When should you have children?

2. When should you buy a house?

3. Should you lend to a friend in distress?

4. How much should you support your parents or siblings?

5. What would you prefer to spend on this year: a vacation or a vehicle?

Financial Infidelity

Sometimes we lie about money with the best intentions – we may not want to upset or worry our partners. Other times we’re lying to save our skin. Whatever our intentions, financial infidelity has the same effect: you break your partner’s trust. Honesty is the best personal financial policy. You’re in this together for good. Relying on your partner for financial or emotional support in the decisions you make is easier when they know the whole picture. Together you can tackle debt, kick bad habits, take calibrated risks, and achieve your goals. Lying about your situation or decisions is a clear sign of disrespect to your family’s money and needs.

Marriage stirs all kinds of aspirations. We want a bigger wedding, a fancier car, and a posher house. But living life king size could cost you heavily. Here are some Financial Mistakes To Avoid Before Your Wedding.

Joint Account Versus Single Account

Another big decision you want to talk through with your spouse is whether you want to manage your money jointly or individually.

| Joint Account | Single Account | |

| Tracking expenses | Convenient | Depends on each individual |

| Scope for Conflicts | High | Minimal |

| Distribution of Financial resources | Equitable | Based on savings potential |

| Protection of an individual’s assets | Limited | High |

| Estate Planning | Easily transferrable | Requires documentation |

| Independence | Limited | High |

Seek Professional Help – Hire a Financial Planner

There’s no shame in seeking professional help. In fact, you could be doing your partner a favour when you outsource the work.

4 advantages of hiring a financial planner:

Financial Awareness

Most of us lank row on financial awareness. We have little formal exposure to how taxes, investments, or insurance work. We don’t know which financial habits to cultivate and which ones to ditch. A financial planner can help you smoothly navigate this world of personal finance. Most of us lank row on financial awareness. We have little formal exposure to how taxes, investments, or insurance work. We don’t know which financial habits to cultivate and which ones to ditch. A financial planner can help you smoothly navigate this world of personal finance.

Trust & Accountability

A silent partner is a recipe for disaster. Dividing financial responsibilities ensures better outcomes. It can be tricky for a couple to decide themselves. Having an objective outsider split the responsibilities and create a system of accountability works for the couple. Financial planning can assign tasks to specific individuals and measure progress. Through planning, couples become more accountable and reliable.

Advice Based On Your Financial Goals

Suppose one person’s risk profile is aggressive and the other’s conservative. Should they both compromise and follow a balanced approach? Or could there be a better solution? Financial planning ensures that couples look beyond their differences and focus on the bigger picture. This kind of goal-based advice can only be found through financial planning.

Retirement Planning

Do you and your spouse want to retire at the same time and to the same place? How much and where is each partner saving? If you want children, one partner will likely spend fewer years in the workforce. It is also likely that your expenses will increase. What goals will you prioritize over retirement?

Thinking about retirement can seem premature for newlyweds. The one thing we know about retirement planning: better early than late. After all, we know that someday we’re going to be old and wouldn’t want to rely on a job to support us financially.

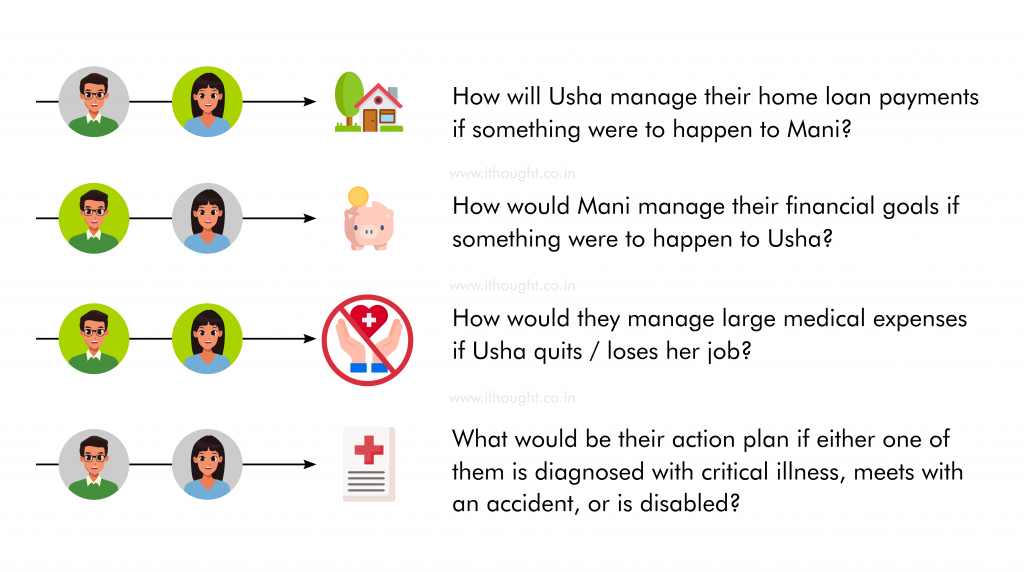

Insurance & Emergency Funds

Your responsibilities after marriage increase. This means you need to be more prepared to fight against the risks that could materialize. Insurance and emergency funds are the strongest risk management tools for young couples.

Five insurance policies that every couple should have:

1. Term life

2. Health

3. Critical illness

4. Personal accident

5. Disability

Couples can conquer their financial fears and achieve their financial goals together. The key is communication, financial planning, and managing risks effectively. Get started with a customized financial plan. If you’re newlywed, request an elder to gift you a financial plan.

If you’re newlywed, request an elder to gift you a financial plan. Contact: [email protected] for more details.