Evergrande

Evergrande’s default has been the talk of the town for the past few days. The situation has sparked fears of a major crisis which is feared to be as intense as the 2008 US housing crisis and the 2018 IL&FS crisis (for Indian context). In this blog, we explore what exactly happened with the real estate giant.

Evergrande was founded in 1966 in the Guangzhou province in China. This was a period of the rapid urbanization of the Chinese economy and in 2009 the company raised around $770 million in the Hong Kong exchange.

Evergrande has grown to become the largest real estate developer in Mainland China and the second largest in China. They own 565 million square meters in 22 cities. A notable project that is currently under construction is the Ocean Flower Island which is an artificial group of islands with a total area of 940 acres. The investment in the project is $24 billion. Some of the contents of the island include a 7-star Peninsula hotel, a 1.37 million square-foot marine world with a water park, 28 characteristic museums, 40 kilometers of coastline, 58 modern hotels, European style castle hotel and wedding manor, a Luxury shopping mall and residential housing and the world’s largest conference centre.

Other Ventures

Sports

Sports

They own a football club in the Chinese Super League, Guangzhou Evergrande F.C. Alibaba owns a 50% stake in the same club. In April 2020, they started the construction of a new football stadium.

Automotive

In 2018, they acquired a 45% stake in Faraday Future, an American start-up electric vehicle company for $2 billion. In 2019 it was announced that they would invest 45 billion yuan over three years to develop new energy vehicles and set up manufacturing locally and launched a partnership with the State Grid Corporation of China to develop charging stations.

Health

They operate a health and wellness park called Evergrande health valley.

Entertainment

HengTen Networks was formed in 2015. In October 2020, they announced that they’ll acquire Ruyi Pictures for HKD 7.1 billion.

Finance

In 2015, Evergrande acquired a stake in Sino-Singapore Great Eastern Life Insurance company for $617 million.

Food & Agriculture

In 2014, Evergrande group launched its mineral water brand and invested 5.54 billion yuan. In 2016, after a 4 billion yuan loss, it sold its agribusiness units including daily, mineral water, grain and oil business for 2.7 billion yuan.

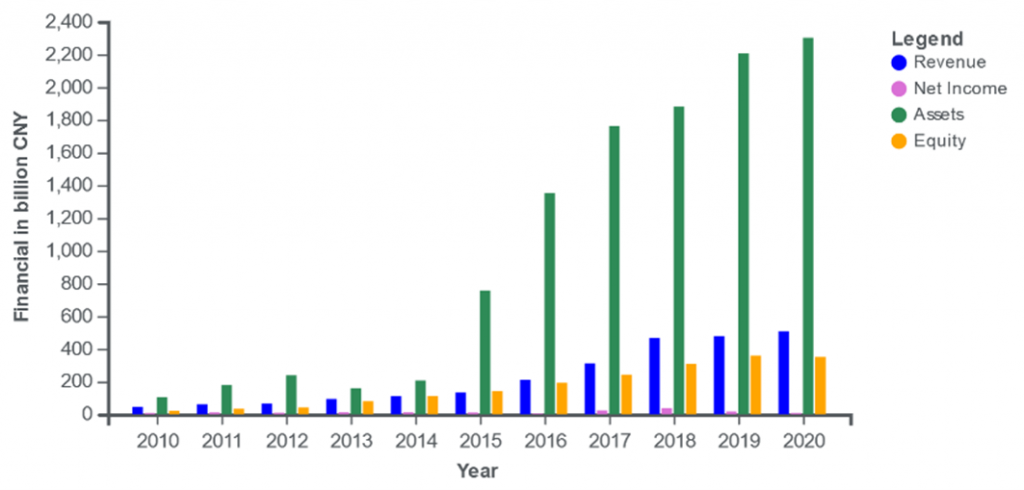

Financial Data in CNY

Liquidity Crisis

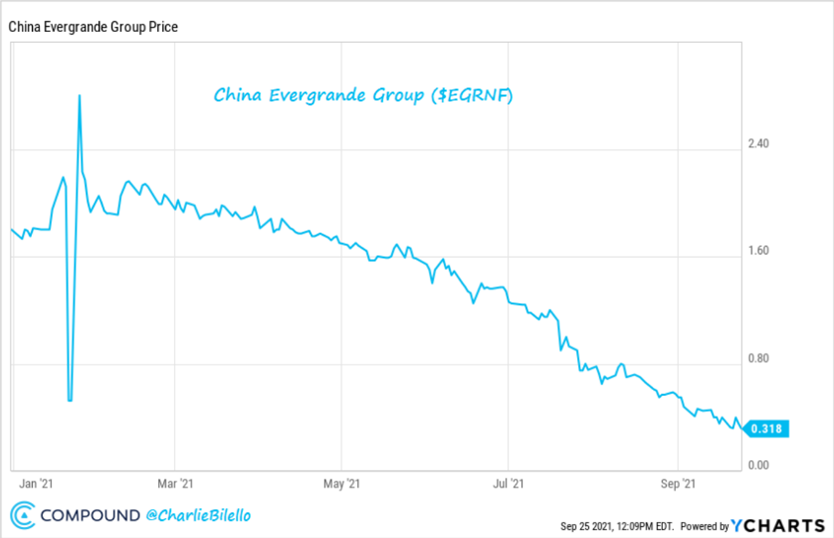

As of 21st September 2021, the company has around 2 trillion yuan or $310 billion in liabilities across all categories of creditors. This month, it was reported that Evergrande created and used retail financial instruments to plug funding gaps. The products were advertised and marketed with a 10% return number and investors were not made aware of the risks involved. The Chinese real estate sector was highly leveraged. The government introduced a rule to manage the leverage based on the debt-assets, debt-equity and debt-cash metrics. In 2021, Evergrande’s bond ratings were below investment grade. They were BB/B rated. From June to August 2021, different rating agencies further downgraded the bond ratings to CCC/CC. China’s most indebted real estate developer missed offshore bond payments of $83.5 million on 24th September.

Large western investment firms have significant exposure to Evergrande via their corporate bonds.

-

-

- Ashmore Group – $400 million

- UBS – $300 million

- HSBC – $31 million

- Blackrock – $18 million

-

Evergrande Stock Price

Evergrande Bond Price

Upcoming Debt

| Issuer | Maturity in 2022 | Amount Outstanding |

| China Evergrande Group | March 23 | $ 2.03 billion |

| China Evergrande Group | April 11 | $ 1.45 billion |

| Hengda Real Estate | July 08 | 8.2 billion yuan |

| Scenery Journey | October 24 | $ 2 billion |

| Scenery Journey | November 06 | $ 645 million |

Source: Bloomberg L.P. 2021

The fallout of this will definitely be felt in the global markets. Keep a close watch on this ever-developing situation over the next few months.