Before you begin reading this blog, spend a minute to list down your assets. Think about all the things you own and what they are worth – your house, your car, the stocks in your Demat account, etc. How far down in this list would you put your life and health? Most of us don’t recognize our biggest assets for what they are. So, we fail to insure them accordingly.

How Insurance Works

Insurance is a contract to manage risk between you and the insurance company. You agree to pay the insurance company a fixed premium for a specific period. If the risk materializes during this period, the insurance company provides financial compensation. If the risk does not materialize, you get nothing in return.

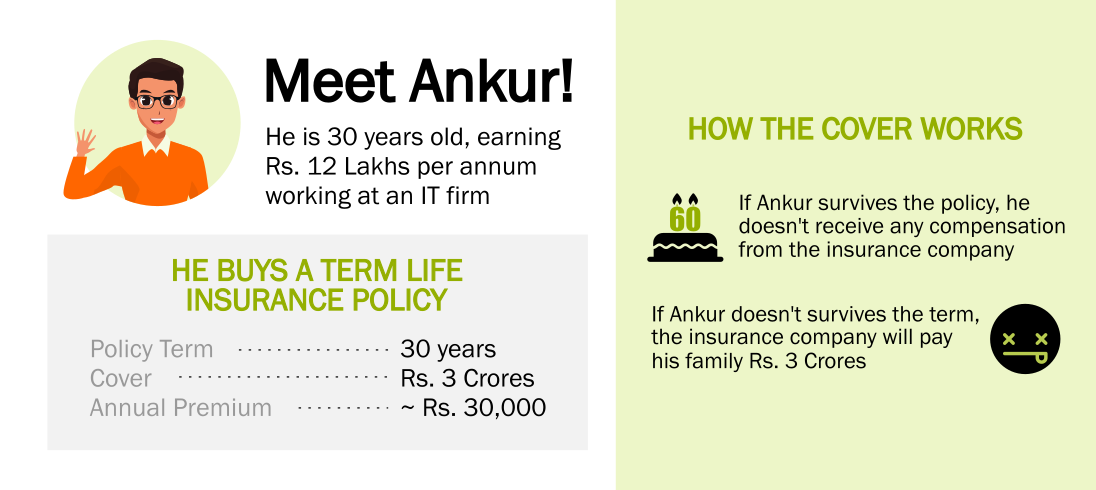

Here’s an illustrated example of how term life insurance works:

Do you know your human life value?

Why Life Insurance Is Important?

Life insurance is important only because life and death are unpredictable whereas financial commitments are constant. Life insurance is a great tool to replace the income of a lost loved one. It minimizes financial dependence between family members. It provides a comfortable exit strategy when there are liabilities involved. Life insurance also ensures that a family’s quality of life remains intact even after the loss of a loved one.

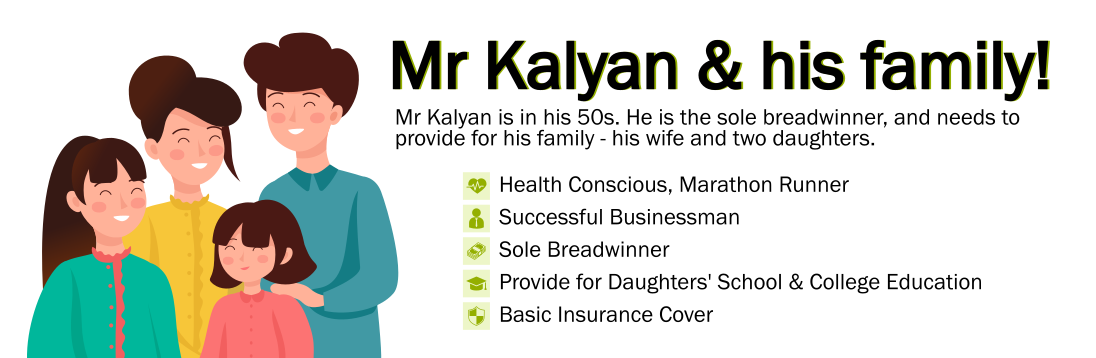

Kalyan was in his fifties and was health-conscious. He regularly trained for marathons had no lifestyle diseases. Kalyan built his career through entrepreneurship and was running a successful business. His wife Anitha stopped working after she had their second daughter. Their daughters Aditi, and Anisha were in school and college respectively, when tragedy struck.

Without any warning, Kalyan left behind a young family. He had no life insurance and his family was forced to fend for themselves. Anitha had no idea how complicated the business was and was constantly fending off false creditors. Despite being academically oriented, Anisha decided that she would work after she completed college. Anitha looked for a job so that they could meet their day-to-day expenses. There was no question of providing for the future.

When you choose to be underinsured, the people who suffer the most are the ones closest to you. Is that the legacy you want to leave behind?

Life Insurance & Its Types

Life insurance is important only because life and death are unpredictable whereas financial commitments are constant. Life insurance is a great tool to replace the income of a lost loved one. It minimizes financial dependence between family members. It provides a comfortable exit strategy when there are liabilities involved. Life insurance also ensures that a family’s quality of life remains intact even after the loss of a loved one.

Whole Life Insurance

A whole life insurance plan covers the entire duration of a person’s life. A payout will be made to the beneficiaries upon the death of the insured. From the insurance company’s perspective, whole life plans are the most expensive because there is a guaranteed settlement.

Unit Linked Insurance Policy

A unit-linked insurance plan or ULIP is a type of life insurance product that invests in the market. Unlike the endowment plan, returns from ULIPs are not guaranteed. ULIPs may offer a higher life insurance cover than endowment plans but are also significantly more expensive.

Endowment Policy of Money Back Plans

These life insurance plans mix insurance and investments. In an endowment insurance plan, there are regular guaranteed returns through the course of the policy. The policyholder may also be rewarded with bonuses. Endowment plans usually offer a life insurance cover of a few lakhs.

Term Life Insurance

Many of us have life insurance policies and oddly remain underinsured. Most of us don’t know or realize the value of our life. A term life insurance policy offers a cover for a specific period of time at a very affordable rate. As with any life insurance plan, it becomes more expensive as one gets older. There is no return component in a term plan, only a risk management one.

Are Life Insurance Policies Good Investments?

The long and short of it is – no. It’s primarily because insurance is a tool to manage risk. Term life insurance manages risk effectively but offers no return. Term policies are structured so that your return is zero/ negative if you survive and the pay off to your family is immense if you don’t. Whole life policies have a guaranteed cash benefit. Once you account for inflation, the returns don’t seem great. Rs. 25 Lakhs today is worth around Rs. 6 Lakhs 30 years from today. ULIPs invest in mutual funds and offer market-linked returns. The drawback is that they are significantly more expensive than mutual Funds. The expense ratio of mutual funds is capped at 2.5%, but ULIPs may charge you 4%-5%. Endowment or money back plans return your money over a span of 10-20 years. In this time frame, the time value of your money diminishes. And often, the net return can be lower than that of a fixed deposit. Want a detailed explanation? Listen to our podcast!

Return On Investment

Here’s a quick visual comparison of the different types of life insurance products:

| Policy | Premium | Risk Cover | Returns |

| Whole | Expensive | Moderate | Minimal |

| Term | Affordable | Maximum | None |

| ULIP | Most Expensive | Moderate | Market-Linked |

| Endowment | Expensive | Minimal | Moderate |

Do You Know Your Human Life Value?

Insurance companies use your “human life value” to determine how much insurance you are eligible for. This number is the monetary value of your life. It depends on your income levels and the time you will spend in the workforce. Every earning member in a family has a human life value.

You may also determine your insurance needs by examining your lifestyle, financial goals, assets, and liabilities.

Death benefits of Life Insurance

The reason we take life insurance is that we’re worried that an unexpected death that might impact our loved ones. Every life insurance policy has a death benefit that is often equal to the sum assured. Ideally, the death benefit should be equal to your human life value. The death benefit may come in two forms:

-

-

- Annuity: In this instance, the life insurance company manages the investments to generate regular income for the beneficiaries. An annuity is similar to a pension scheme. The beneficiaries will receive regular income based on the terms and conditions outlined in the life insurance policy.

- Lump-Sum: The insurance company may compensate the beneficiaries by paying a lump sum (equal to the sum assured) upon the death of the insured. The family could work with a professional financial planner to manage these investments to provide for their monthly expenses and financial goals. They could also use the life insurance proceeds to settle any outstanding loans.

-

Which Is Better And Why –Term Life Insurance Or Whole Life Insurance?

Term and whole life policies are pure risk management insurance products.

| Policy | Whole | Term |

| Validity | Whole Life | Specified term, typically working years |

| Sum Assured | Few Lakhs to Few Crores | 25 Lakhs – Multiple Crores |

| Premium | 3x more expensive than term policies | Most affordable life insurance product |

Term policies are better insurance products than whole life policies for the following reasons:

-

-

- Premiums are significantly cheaper

- You are insured when you need it the most

- Surplus money can be channelled towards investments

- You get a much higher insurance cover at a much lower price

-

ULIP vs Mutual Funds?

ULIPs seem like the one-stop solution to all needs. With one product you get insurance, investment, and tax benefits. So, should you consider a ULIP over a mutual fund? We’ll quickly compare how ULIPs fare against ELSS Mutual funds.

| Criteria | ULIP | ELSS |

| Tax-deductible | Yes | Yes |

| Tax Treatment | E-E-T* | E-E-T |

| Additional Investments | Not allowed | Allowed |

| Surrender | Lose invested capital | N/A |

| Paid-up Status/ Lock-in | Locked in for 5 years at savings bank return | Locked in for 3 years at market return |

| Fees | 4%-5% | <2.5% |

Who Needs Life Insurance

Since your human life value is linked to your income, any earning member of a family needs life insurance. Life insurance policies protect your family from the financial loss associated with your life. So, being insured through your working years is crucial. There are only three categories of people who don’t need insurance.

Life Insurance For Minors

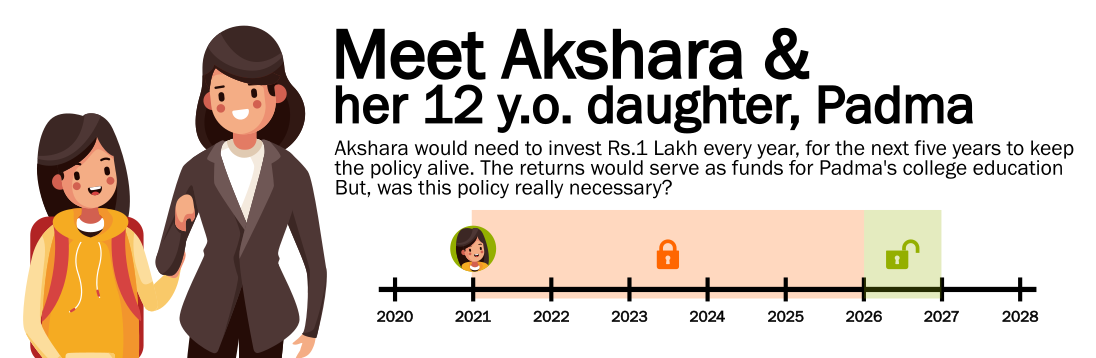

Akshara bought a ULIP for her 12-year-old daughter Padma. This policy was marketed as a saving plan for Padma’s college education. Akshara would invest Rs. 1 Lakh every year for the next five years to keep the policy active. And when Padma turned 18, she would receive this money for her college education. The policy was bought under Padma’s name. But was it necessary?

We buy life insurance products to replace the breadwinner’s income. In this case, Akshara was not financially dependent on Padma. In fact, Padma is the ‘dependent’ here. Funnily, Padma didn’t even have an active source of income. So there was no need to buy a life insurance policy in her name. To protect Padma’s financial security, Akshara should have taken an affordable a term-plan. She should have created a separate savings strategy for Padma’s college education.

Life Insurance For Senior Citizens

There is a common misconception that Seniors need life insurance. Life insurance premiums become more expensive as you age. Senior citizens may not be eligible to take new life insurance policies because they’re retired. For those who are still working, the premiums will be exorbitant.

| Age | Rs 1 Crore | Rs 2 Crore |

| Age 20 – 25 | Rs. 8,000 – Rs. 9,000 | Rs. 13,000 – Rs. 15,000 |

| Age 26 – 30 | Rs 9,000 – Rs. 10,500 | Rs 15,000 – Rs. 17,500 |

| Age 31 – 35 | Rs 10,500 – Rs. 12,500 | Rs 18,000 – Rs. 21,500 |

| Age 36 – 40 | Rs 12,500 – Rs. 16,000 | Rs 23,000 – Rs. 28,000 |

| Age 41 – 45 | Rs 16,500 – Rs. 21,000 | Rs 29,000 – Rs. 37,000 |

| Age 46 – 50 | Rs 22,000 – Rs. 28,500 | Rs 39,500 – Rs. 51,500 |

A retired person has no active source of income and doesn’t need a life insurance policy. The purpose of building a nest egg is to ensure that your financial dependents are secure through your golden years. This prepares the family for any uncertainties.

Life Insurance For Housewife

Kritika was a homemaker. She was up at the crack of dawn to ensure that her children got ready for school and that her husband’s meals were prepared. She worked harder than everyone else in her house. Yet, she wasn’t eligible for a term insurance policy.

Homemakers add immense value to our lives. However, if a housewife doesn’t have an active source of income, she would not qualify for a life insurance policy. Although Kritika ensured the smooth functioning of the household, she wasn’t paid to do it. While the family relied on Kritika for support, they weren’t dependent on her financially.

An active source of income is one that is linked to some form of employment. If Kritika was a homepreneur or worked part-time she becomes eligible for life insurance.

Can Life Insurance Premiums Be Tax Deductible?

Currently, there is a provision to deduct life insurance premiums from your taxable income. This is applicable under Section 80 C of the Income Tax Act for premiums (up to Rs. 1.5 Lakhs in a financial year) paid towards life insurance plans. This benefit can be used by taxpayers who opt for the old tax regime.

The Union Government introduced a new tax regime in 2020. One that doesn’t contain deductions but has lower tax rates. If you choose the new regime, then you cannot claim deductions from life insurance premiums. More importantly, taxpayers will be phased out of the old regime into the new one in the next few years. Which Regime Should You Choose? Check out this blog to know more!

Can Life Insurance Proceeds Be Taxed?

The proceeds received from an insurance policy, upon the death of the insured are normally from taxation under Section 10(10) of the Income-tax act. In Budget 2021, the government proposed to bring parity between ULIPs and Mutual Funds. Maturity proceeds from ULIP where the premium is above Rs. 2.5 Lakhs p.a. will be taxed the same way Mutual Funds are. Here are the highlights from Budget 20221, click here to download it now!

Financial Consequences

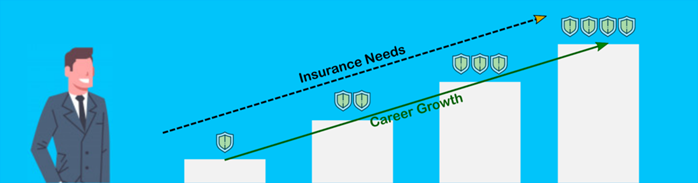

As you progress in your career, you will need more life insurance. So, it’s imperative that you review your life cover every few years according to the changes in your income and expense profile. Your life insurance cover also needs to be evaluated at every major milestone. For instance, if you get married it’s important to protect the financial interests of your spouse. When you have a child, there’s a new financial dependent that you need to care about. Or, if your parents retire you might want to look out for their financial interests. When you take on a large loan, make sure that the burden doesn’t fall on your family’s shoulders. A life insurance policy ensures that your family is not alone even when you aren’t there.

We all know of families that have seen tough times after the sudden death of a loved one. Life insurance safeguards against this kind of risk. It can provide financial stability during difficult times. The right amount of insurance could support your family’s expenses, help settle loans, and keep promises.