Equity markets are battling bear sentiments in the backdrop of the COVID-19 pandemic. This is the steepest crash markets witnessed since the global financial crisis in 2008-09. Uncertainty looms over the way forward. In this post, we share basic bear market investment strategies.

Cashing Out

Bear markets spike fear and anxiety levels among investors. Many may be tempted to sellout their portfolios and wait it out. It is crucial to resist the urge to sell all your stocks. Selective exits are necessary. But blindly cashing out at low valuations is harmful. You may miss the upward rally when the tide turns.

Safe Investments In a Bear Market

A portfolio quality check is essential. Accounting for material long-term impacts on equity holdings as the market context evolves is vital. Investors must know how their stocks are positioned to weather the current turmoil. Significant changes to the portfolio construct may be crucial for long-term wealth creation. An investor must hold ample cash, sit tight on a quality portfolio, and let it recover as the broader market stabilises.

Buy low, sell high

Buying low and selling high strategy helps manage risks and protect the portfolio. Bear markets open many investment doors. Investors should capitalise on available opportunities. Acting now is equivalent to buying low. Low prices ensure better and swifter portfolio recovery. Market dips are a great place to pick up strong quality names and high conviction ideas. Patience will be rewarded when the tide turns allowing investors to exit at rich valuations.

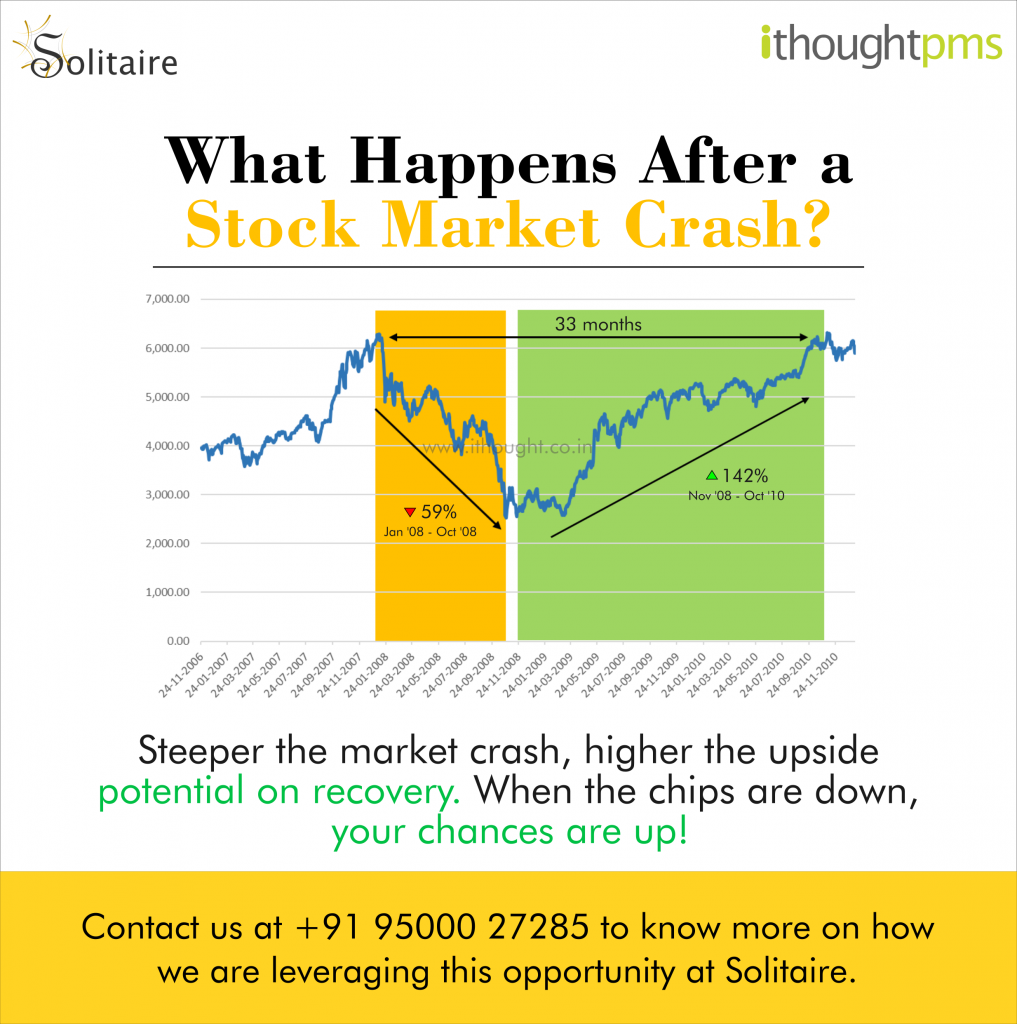

Importance of investing in a Bear Market

Bear markets are a scary place for many investors. In good time those who display patience will be rewarded. Research shows that the average duration of a bear market is 1/5th the duration of a bull market. The average decline in a bear market is 28%. However, the average gain in a bull market is over 128%. The most common mistakes investors make is to cash out because of losing 28%. Investors must look beyond losses and into potential gains in the next market cycle.

Timing the Market

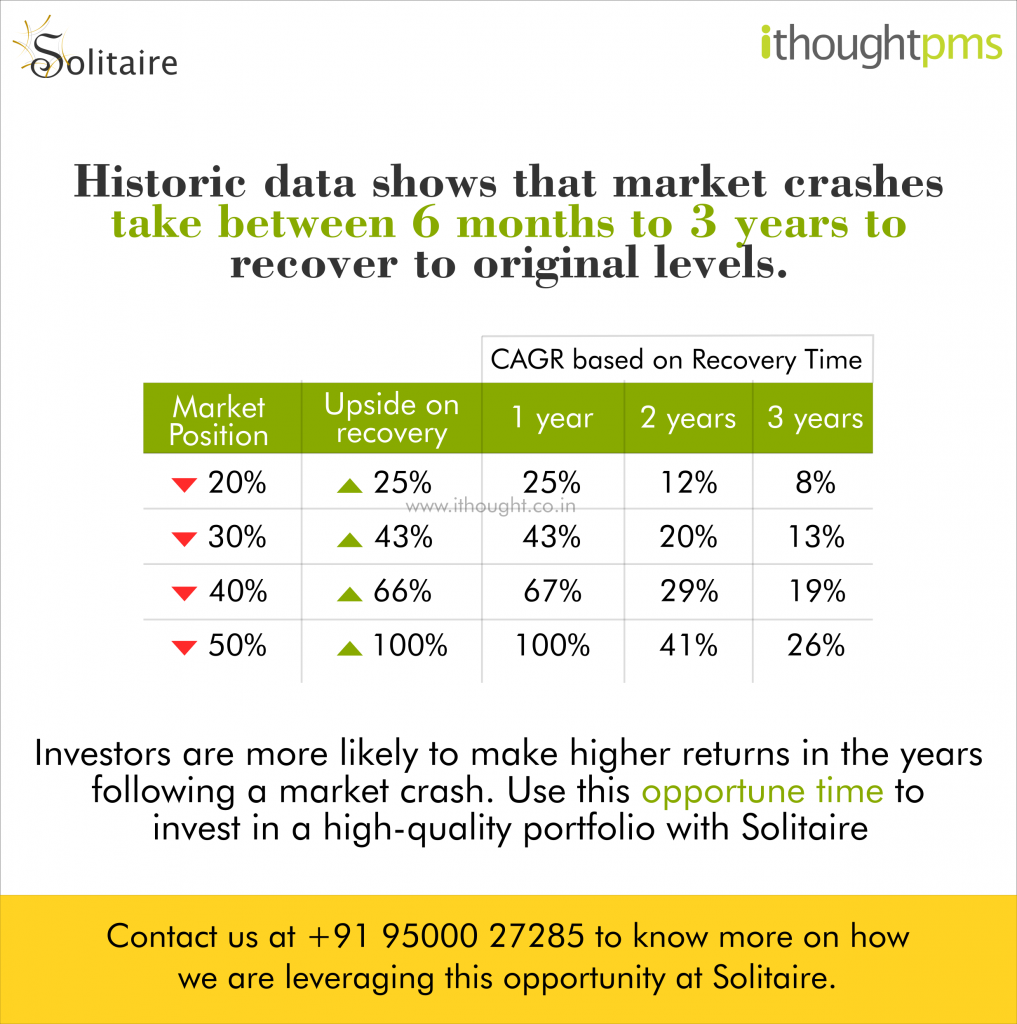

In most cases, investors can neither predict the crash nor the exact bottom. Gradual incremental investments ensure better results. The best chance at capturing a bottoming market is to stagger investments across dips. A good rule of thumb to follow is:

- Invest 20% of the portfolio when the markets fall 20%

- Invest 30% of the portfolio when the markets fall 30%

- Invest 40% of the portfolio when the markets fall 40%

Value investing in a bear market

Bear markets require careful and expert stock selection. A bear market thrashes nearly all sectors. So, many stocks start trading at historically low valuations. But, only a handful of quality stocks will emerge victorious at the end of the market cycle. Investors need to distinguish between value stocks and value traps.

Good investments in a bear market

Pockets of opportunities can be found even in the worst markets. Tactical investments in certain themes, sectors, and assets can even generate steady returns during a bear market. It is prudent to invest in quality companies. Other metrics include no/low debt, strong ROE and ROCE numbers, and quick cash cycles. Companies with excellent corporate governance practices are safe too.

Asset Management

Investing in a bear market is challenging. It demands expert advice and knowledge. Enlisting the services of a professional portfolio manager is a great way to stay on the right side of the market. Solitaire is successfully helping investors navigate bear markets. Mr Shyam Sekhar, a market veteran with over 3 decades of investing experience manages Solitaire.

Contact us at +91-95000 27285 to know more about Solitaire.