If you feel like 2021 is proving to be more challenging than you expected, you’re not alone. At the start of the year, most of us believed that we could put the pandemic behind us. Now, we have found a way to coexist. Lockdowns are back, but this time is distinctly different from the last time. The real question is, will investing be different this time around?

For a fixed income investor, the challenge is steeper. For the first time in years, you’re combatting all the risks at the same time. In our last note, we talked about the different ways to earn returns. This time, we’re going to explore risks in fixed income.

Credit Risk

Credit risk is the possibility of not getting some or all of your money back. This happens when the entity you lend to is not financially stable or if your debt ranks lower in priority during insolvency. For instance, DHFL’s defaults happened because of financial stability. Meanwhile, Yes Bank had to write off its AT-1 bonds because they ranked lower in priority.

Credit risk is partly measured through credit ratings. But there are limitations to ratings. For example, ratings are given only when companies issue new debt. They usually aren’t updated in between unless there’s a default. Also, the debt issuer pays for the credit rating and this is a potential conflict of interest.

In this market, credit spreads are compressing. The spread is the gap between a credit asset (non-AAA bond) and government securities of a similar duration. When the spread compresses or reduces, you’re getting less return for higher risk.

Want to know how Finesse played credit risk – all while using the 5 steps to success? Click here to know!

Liquidity Risk

Towards the end of May, cryptocurrencies highlighted their liquidity risk. They are not an alternative to fiat currency or gold. But more importantly, investors need to watch flows and understand whether they’re investing in liquid or illiquid segments of the market.

AIFs and bonds are less liquid. In exchange, they offer the potential of significantly higher returns than debt mutual funds and deposits. In general, a debt mutual fund is as liquid as a fixed deposit. You could get your money back within a day. And with careful product selection, you can find a fund without a lock-in period/exit load. Fixed deposits usually come with a premature withdrawal penalty.

Investors must be nimble this year. When you don’t have liquidity, there’s an opportunity cost. The landscape of opportunities is shifting, and sometimes to unpredictable places. The most important weapon for an investor is liquidity. We’ve started encouraging investors to create a war chest of liquidity.

Interest Rate Risk

For the last few months, we’ve reiterated the risks in duration strategies. Both passive and active ones. Interest rates are at all-time lows. Economic growth in some geographies is looking up. Inflation has certainly reared its head. We’re headed into a phase of higher government borrowings and wider fiscal deficits. This means yields and interest rates will move only in one direction – upwards.

When interest rates move up, bond prices fall. And the longer the duration of your bond/portfolio, the steeper the fall. Rate changes can happen overnight leaving no time for investors to react. Fixed income is not an asset class where you want to experience this kind of volatility. Once you experience a fall, your options become limited. Make your move before markets tell you what to do.

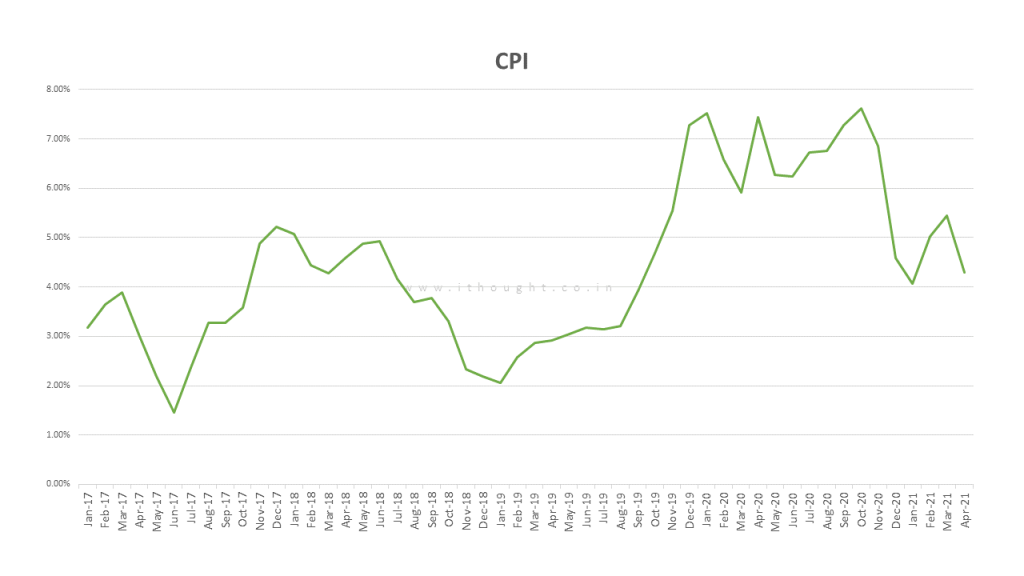

Inflation Risk

Inflation is the one risk that’s hiding in plain sight. We’ve seen commodity prices rally and this is only the start. At the same time, liquidity has remained in excess for a prolonged period. Stimulus and flows will add to this problem of high inflation. Funnily, it won’t be obvious. Last years inflation numbers were high meaning we’re starting at a higher base. What we need to look at is inflation over 2 years to decipher the trends.

With duration risk and credit risk, your money loses value in an obvious way – meaning you book a loss. With liquidity risk, you feel the pinch when you’re trying to take your money out. With inflation risk, you could have made a net profit and it could feel like you’re doing alright, but you lose purchasing power. And this loss is invisible.

Battling The Four Risks With Finesse

Most investors look at specific products to solve the problems posed by these risks. This approach simply won’t work anymore. We need to shift from a product-oriented approach to a portfolio approach. Previously, we’ve highlighted why ideal investments don’t exist. No one fixed income product ticks all the boxes. But each product has a purpose in your portfolio.

An AIF can generate higher income and higher returns than your bank FDs. But it comes at the cost of credit and liquidity risk. Similarly, debt funds can give you that liquidity cushion and tax efficiency, but it comes with volatility and moderate returns. Deposits can give you assured returns/income at the cost of tax efficiency and lower returns.

Why You Need An Investment Adviser Today

Today’s investment context is far more challenging for a fixed income investor than ever before. Let’s take a look at where the opportunities were in the last 4-5 years.

Fixed Income Investing in 2017

Equity was a performing asset class in 2017. It was a great time to build investments in medium and long-term debt. This is often a good strategy near the peak of an equity bull market. It’s also a good time to hold cash because the bargains will come as investment preferences change.

Fixed Income Investing in 2018

Inflation as a risk didn’t pose too much of a threat. There were plenty of opportunities in the markets after the NBFC crisis. Passive roll down funds worked exceedingly well as did FMPs and long-term fixed deposits. Credit risk was not in the investor’s favour.

Fixed Income Investing in 2019

Inflation risks were still tame. Interest rate risk would have taken some time to materialize, pandemic or otherwise. We were going through an economic slowdown which meant a period of lower interest rates. Credit risk started to become attractive.

Fixed Income Investing in 2020

In the early parts of 2020, tax-free bonds were trading at attractive valuations. The tables turned on credit risk and it became far more rewarding for investors. 2020 also gave bond investors decent investment opportunities. Inflation risk materialized, but interest rate risk was still behind the scenes. There was a decent carry in medium-term funds.

Fixed Income Investing in 2021

Last month we brought up your best investment options. 2021 is a portfolio construction year. The things you do today will pay off in the future. Creating liquidity from within your portfolio is essential. De-risking will pay off. Asset allocation is crucial. Analyse the merits of portfolios over products.

As advisers, our strengths are asset allocation and risk management. We’re helping our clients create investment portfolios that combat all four risks. We could do this for you if you’d like to add an edge to your investing.