* This post was updated on 30 November 2020

An Introduction

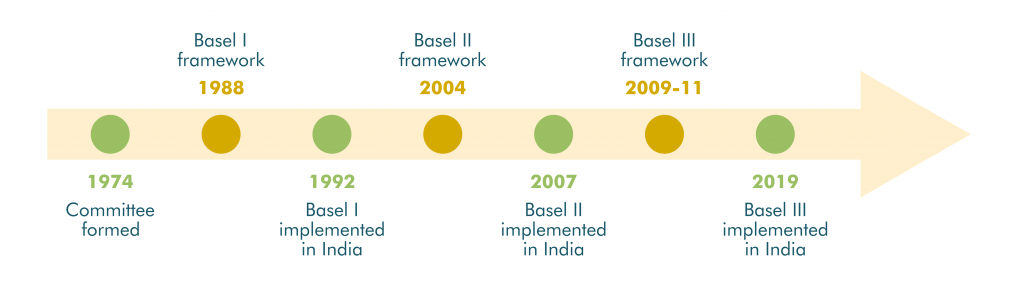

As banking systems in multiple countries evolved, the need to have an international agreement that bound them arose. The idea was to addresses regulation, supervision, and risk management for banks across the globe. The Basel Committee on Bank Supervision was set up in 1974 to create a framework.

Basel I & Basel II Norms

Every loan has an associated level of risk. Credit risk is the possibility that a borrower may not meet its obligations. Based on this, a risk value was assigned to each loan, making it a Risk-Weighted Asset (RWA). Capital provisions were set according to the RWA.

Basel II norms further focused on three pillars.

Pillar 1: Minimal Capital

‘Risk’ was modified to include market and operational risks. Minimal capital requirements for lending transactions was specified as 8% of RWAs. Banks’ capital was tiered according to its nature.

Pillar 2: Supervisor Review

Banking regulations varied drastically across member countries. However, the requirement for improved governance and regulation remained. The solution was to authorize the banking regulator of each country to implement these rules. In India, the RBI is the regulator for the banking sector.

Pillar 3: Market Discipline

Market Discipline simply means more transparency. Banks were subjected to more disclosure requirements. This provided more insight into their activities and allowed for more informed investment decisions.

Why Did We Need Basel III Norms?

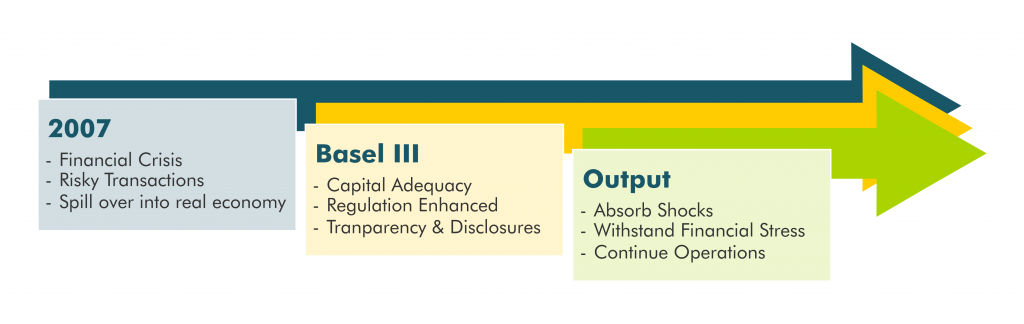

Global Financial Crisis

While the earlier norms addressed legitimate risks, gaps became apparent during the 2007 financial crisis. Any framework is robust only when it is modified to address new challenges and risks.

The focus moved to banks’ balance sheets. It aimed to reduce their size and limited the scope of activities. Both the quality and quantity of capital became important. The spotlight shifted to lowering risk rather than increasing profitability.

New metrics for risk management such as the liquidity coverage ratio (LCR)and leverage ratio were introduced. Banks are also subjected to standardized stress tests. This ensures that there is sufficient liquidity for banks to proceed with day-to-day activities during periods of financial stress. The capital requirements are adjusted according to prevailing market conditions. This move protects the economy during both recessions and booms.

Ultimately, the intent is to create a more resilient banking system by reducing and addressing potential financial or economic risks.

Basel III Framework

The Basel III framework improved capital adequacy requirements, enhanced regulation, and bettered transparency to address the issues arising from the financial crisis. In India, the RBI is responsible for regulating banks. It has been implementing the Basel III norms from 2013 in phases. This will ensure that Indian banks adhere to international standards. More importantly, they will be able to absorb losses, withstand financial/ economic stress, and continue operations.

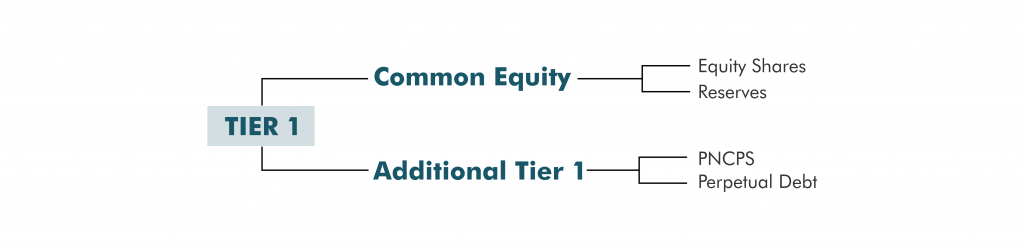

Capital Adequacy & Basel III Tier 1 Capital

Capital adequacy was a key feature in these norms. In simple terms, it measures the financial health of a bank. It is the ratio of capital (funds) to assets (i.e. loans and investments). Tier 1 Capital was dedicated to these requirements. Tier 1 Capital is further split into common equity capital and additional tier 1 Capital (AT1). Common equity capital consists of shares and reserves. AT1 consists of perpetual instruments.

AT1 Capital

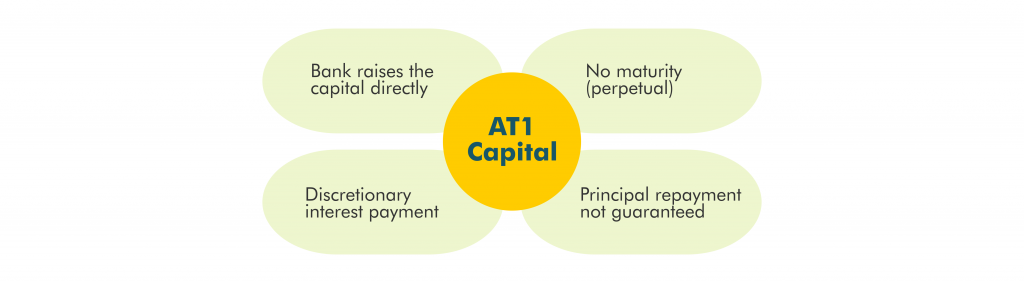

AT1 Capital is further classified into PNCPS (Perpetual Non-Convertible Preference Shares) and perpetual debt. Preference shares are similar to equity shares, however, owners are given a specific payout instead of a portion of the profits. In an insolvency scenario, preference shareholders will be paid before equity shareholders.

Both AT1 instruments have no maturity. These instruments are issued by the bank directly and not through other entities. The interest rate/ coupon may be fixed or floating. Interest and dividend payments are non-cumulative, i.e. if the bank’s finances don’t support this outflow it does not have to pay. Further, when it’s financial position improves, it is not obligated to pay unpaid interest from previous periods. As far as the perpetual debt is concerned, even the repayment of principal is not guaranteed.

Basel III Tier 2 Capital

Following from the capital adequacy requirements under the Basel III accord, banks’ capital was split into tier 1 and tier 2 capital. Tier 1 forms the bank’s core capital, while Tier 2 forms its supplementary capital. The instruments under Tier 2 capital are riskier as it is difficult to assess their quality and they are harder to liquidate. However, the purpose of tier 1 and tier 2 capital is to ensure that banks can absorb losses and continue functioning under periods of financial stress.

Tier 2 Capital

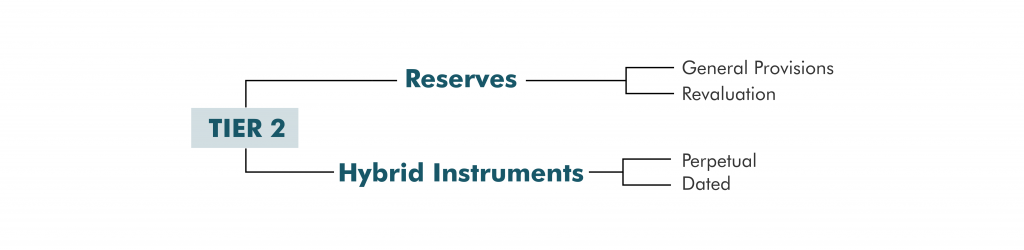

In India, tier 2 capital consists of reserves and hybrid securities. Reserves are capital provisions that a bank makes. Hybrid securities carry features of both debt and equity instruments and may further be classified into upper (perpetual instruments) and lower capital (dated instruments).

General Provisions & Loss Reserves: This reserve is created as a hedge against any unidentified losses.

Revaluation Reserves: A revaluation reserve is created by reassessing the value of an asset. The idea is to update the value of an asset from its historic cost to its current value. For instance, a bank may have one of its properties revalued to reflect appreciation in real estate.

Perpetual Instruments: Primarily this consists of perpetual cumulative preference shares (PCPS). Like AT1 instruments, these securities have no maturity.

Dated Securities: Dated securities are those that have a maturity. Tier 2 Capital instruments are redeemable and may be cumulative or non-cumulative preference shares (RCPS or RNCPS). These instruments have a minimum tenor of 5 years.

Investment Risks: Capital raised under Tier1 and Tier 2 requirements are riskier than standard debt or equity instruments. They are not equivalent to fixed deposits or bonds. These issues are not secured (i.e. backed by an asset) and are not covered by any guarantee. The returns are higher because they are not pure debt investments. In fact, they are quasi-equity instruments, as they could be converted into equity shares to absorb losses. Interest/ dividends and even principal repayment are not guaranteed. Their loss-absorption features may protect the economy, but not the individual investor.