Investing is a dynamic process that requires careful decision-making, especially during market highs. When markets peak, managing risk becomes crucial, and selecting the right investment strategy can make all the difference.

This blog will discuss the features of Balanced Advantage and Multi-Asset Funds, and why they could be more suited to navigating market peaks. We’ll also dive into how these funds adjust to market conditions and help you balance growth and stability during volatile times.

Investing is not just parking your money in different funds or stocks and waiting for returns. It is a behavioural science. This behavioral gap (market vs human sentiment) arises when there is a seemingly large difference between the returns that an investment makes over the returns that an investor makes.

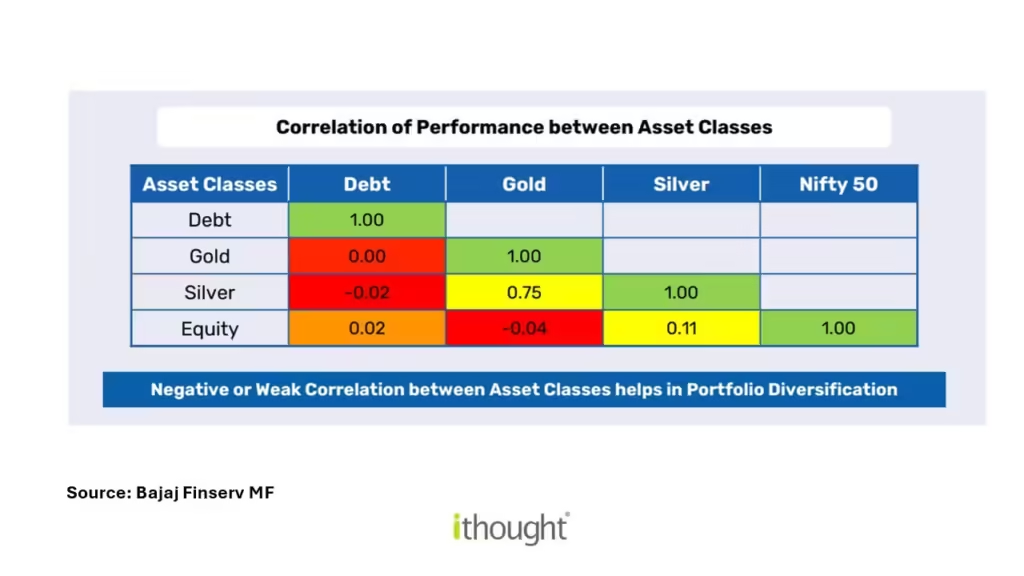

Before we discuss this, it is important to understand the concept of correlation among assets and how it is a metric to measure returns.

Essentially, asset correlation is the measurement of the relationship between two or more assets and their dependency. This is important because the goal of asset allocation is to combine assets with low correlation and lower portfolio volatility, i.e., if assets are not positively correlated, in a wider range, one will make less negative returns.

Multi Asset Allocation Funds-

These are hybrid mutual funds designed to invest in a mix of different asset classes such as equities, bonds, and commodities. The allocation to each asset class varies based on market conditions and the fund manager’s strategy. The primary objective is to achieve diversification across various asset classes and reduce the overall risk of the portfolio.

Features of multi-asset allocation funds:

- Adaptability to market conditions

- Convenience & Accessibility

- Diversification

- Risk Management

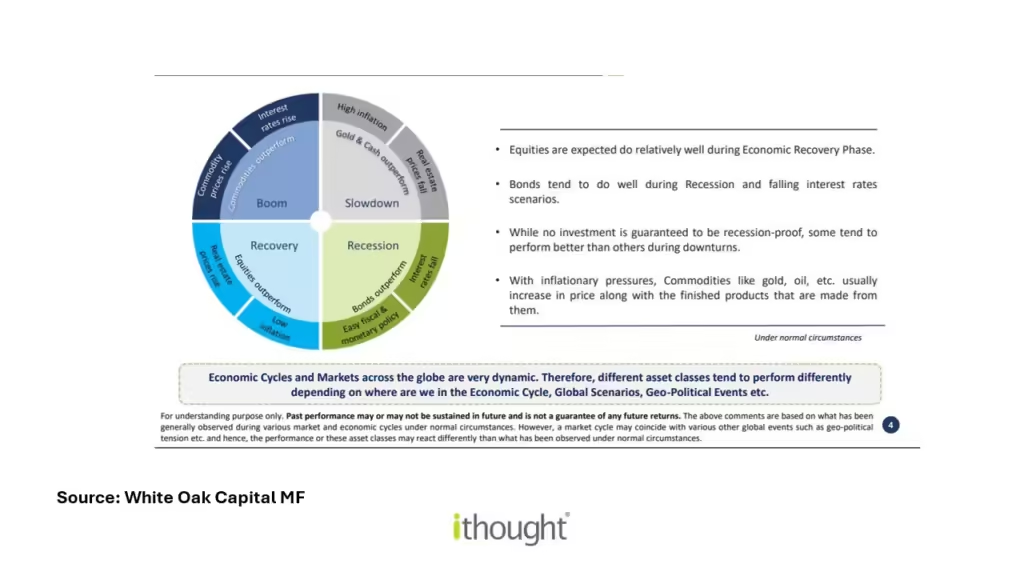

The picture below shows how different asset classes perform during varying economic cycles.

Balanced advantage funds-

These investments adjust their asset allocation (equity & debt) based on predefined valuation metrics or market indicators. The goal is to capitalize on opportunities while managing downside risk.

Features of balanced advantage funds:

- Dynamic asset allocation

- Participation in upside potential

- Manager skill and market assessment

- Transaction costs and overall returns

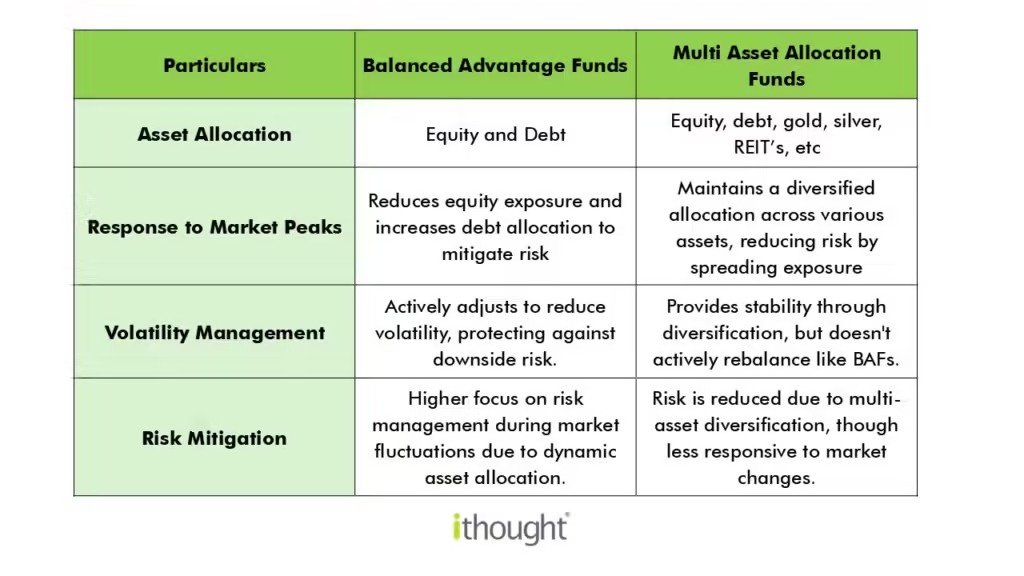

During market peaks, it can be prudent to choose funds that offer diversification and risk management. Here’s how these funds compare in such market conditions:

Balanced Advantage Funds are a better choice if you want dynamic asset allocation to respond to market fluctuations while Multi Asset Allocation Funds are suitable if you are looking for long term stability through diversification across different asset classes.