Abhishek has been working with an MNC for 10 years now. He recently got an offer from a start-up company, which provides a lot of perks including ESOPs to its employees. Abhishek is confused, though his present company pays a good salary and provides decent perks, he is looking for a little challenge in his career and want to work for a company he can grow with and increase his wealth in the process. He wants to understand ESOP and its benefits.

What are ESOPs?

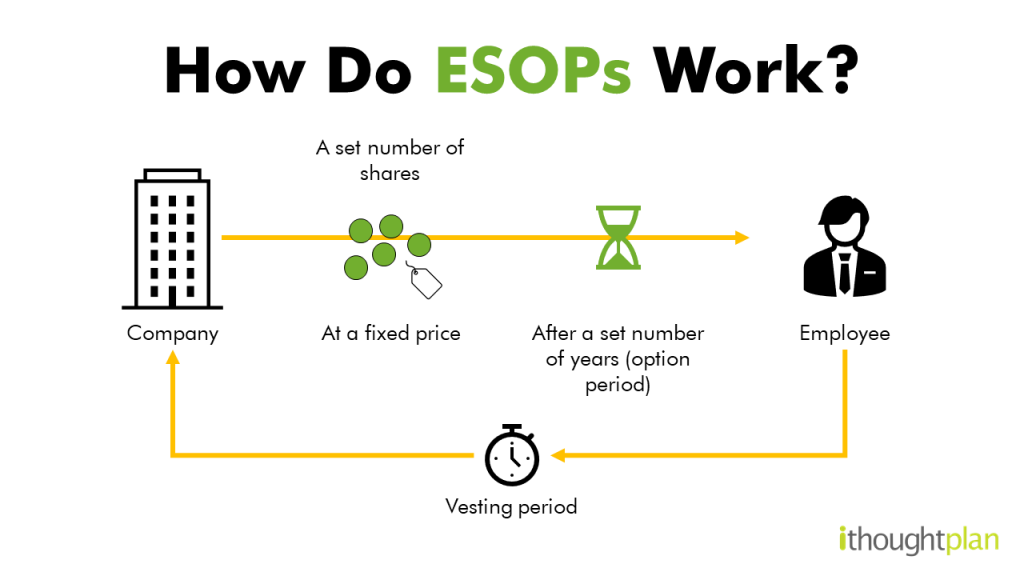

Employee Stock Option Plan (ESOP) is an employee benefit plan offering employees the ownership interest in the organization. Under this option, an employee must work in the organization for a pre-defined period. The stock options are typically provided at a price that is lower than the current market price of the share and an employee could choose not to exercise the stock option. ESOPs have become common in India as startups are gaining popularity. Several MNCs also provide ESOPs to their employees in India. So, it is important to understand whether it is advantageous to have ESOP and its taxation in India.

Having ESOP in Your Investment Kitty

ESOPs are a great way for encouraging and rewarding employees, and most companies have started issuing ESOP to retain talent. ESOPs are typically provided as a part of retirement planning or as a long-term wealth creation strategy. So, what benefits do you get from holding ESOPs?

-

-

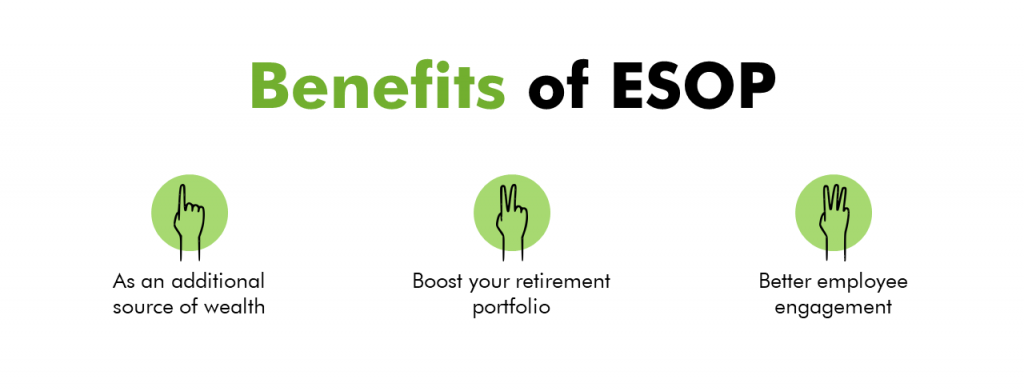

- As an additional source of wealth: Companies offer ESOPs to employees typically at a price lower than market price. Thus, the cost of acquiring an ESOP is lower but it provides upside linked to holding the shares. ESOPs can be an effective wealth creation strategy when held for the long term.

- Boost your retirement portfolio: As ESOPs are equity instruments, they offer a better rate of return as compared to traditional retirement products such as PF, PPF, NPS, etc. So, it makes sense to add ESOP to your retirement portfolio, but care should be taken to avoid portfolio concentration risk. Systematic withdrawal from ESOP should also be followed to gradually decrease equity exposure closer to retirement.

- Better employee engagement: As ESOPs are linked to the performance of the company, providing ESOPs will boost employee morale and motivates them to work towards the company’s growth. From the employee’s perspective also this is advantageous, as you hold ownership rights to the company you are working for, you can also participate in profit sharing.

-

Though this might seem really attractive, from an individual wealth creation/retirement strategy, few things must be kept in mind before adding ESOP to your investment kitty.

-

-

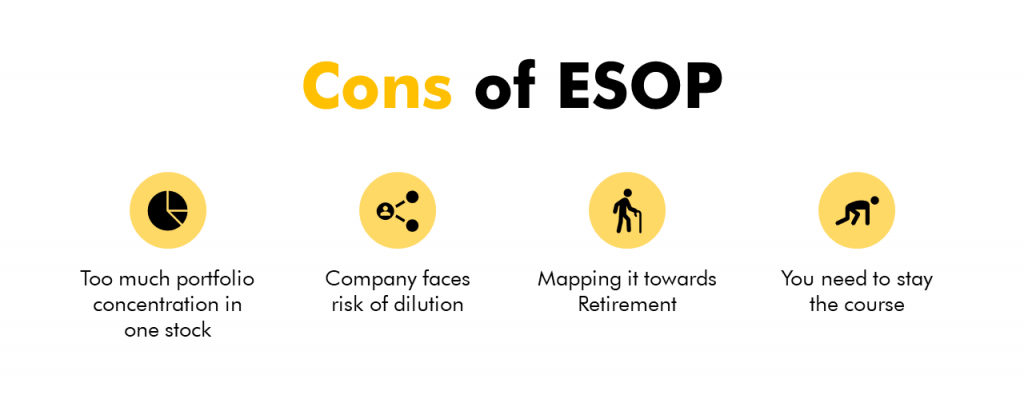

- Avoid portfolio concentration risk: For most individuals, salary constitutes the primary source of income, and they are entirely dependent on their employers for their financial wellbeing. By taking on ESOP options, employees are tying themselves closely to the company’s financials. This poses an increased risk for the employee if the company does not perform well. One must keep his investment basket well diversified to absorb any unexpected financial shocks. Thus, a high concentration of ESOPs in one’s portfolio increases the risk of loss when the company performs poorly.

- Increases risk associated with employer profitability: Few companies offer ESOP as a retirement benefit to their employees. Considering ESOP as the only source of post-retirement fund is highly risky for the individual as his post-retirement lifestyle is linked to the performance of his employer. Considering that the employee is dependent on the employer for his PF, superannuation, gratuity and other benefits, ESOPs only add to the employer concentration risk. If the employer organization faces losses or goes bankrupt when the employee is close to retirement, the employee might lose significant retirement corpus due to high ESOP exposure. Retirement portfolio concentration in ESOPs must be maintained at a balanced level throughout one’s life and should be brought down significantly before reaching retirement.

- Needs long term commitment with employer: Typically, companies keep in place certain criteria such as duration of employees stay with the company, employees’ designation, etc. before granting ESOPs. So, an employee deciding to exercise the option is committing to a long-term relationship with the company. An employee might decide to stick with an employer only for this reason and this might affect the mental wellbeing of the employee.

-

ESOP vs Sweat Equity

Sweat Equity Shares, as per the Companies Act 2013, are those shares issued by a company to its directors or employees at a discount or for consideration other than cash, for providing know-how, or IPR, or value additions, by whatever name called while, an ESOP, on the other hand, is an option given to the employees to buy a certain number of shares of the company at a pre-determined price.

In short, sweat equity can be issued for consideration other than cash while ESOP must be issued in lieu of cash.

ESOP Taxation

In India, ESOPs are taxed at two instances:

-

-

- At time of exercise (as a perquisite) – The employee is taxed when he/she has exercised the option (i.e.) buys the share underlying the option. The difference between the exercise price and the current market price is taxed as a perquisite. This is added under the head “income from salary” and tax is deducted at the employee’s slab rate as TDS by the employer.

-

Budget 2020 amendment was made relating to the ESOP taxation. From the FY 2020-21, an employee receiving ESOPs from an eligible start-up need not pay tax in the year of exercising the option. The TDS on the ‘perquisite’ stands deferred to earlier of the following events:

-

-

-

-

- Expiry of five years from the year of allotment of ESOPs

- Date of sale of the ESOPs by the employee

- Date of termination of employment

-

-

-

-

-

- At the time of sale by the employee (as a capital gain) – When the employee sells the share is a later date after exercising the option, the gain is taxed as capital gain. The taxation depends on the term for which the shares are held and the listing status of the company.

-

| Employer Status | Short Term Capital Gain | Long Term Capital Gain |

| Company listed in Indian stock exchange | Shares are held for less than a year, gains are taxed at a rate of 15%. | Shares held for more than one year, then the gains above 1 lakh are taxed at 10%. |

| Indian company not listed in Indian stock exchange | Shares held for less than a 24-month period will be taxed as per the employee’s slab rate. | Shares are held for more than 24 months, then gains are taxed at 20% with indexation benefits. |

| Foreign company not listed in Indian stock exchange | Shares held for less than a 24-month period will be taxed as per the employee’s slab rate. | Shares are held for more than 24 months, then gains are taxed at 20% with indexation benefits. |

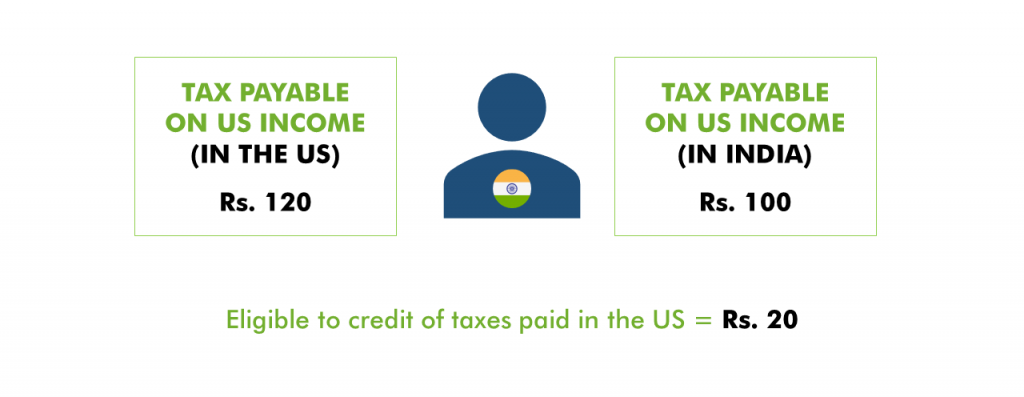

Note: If the country where the foreign company is incorporated has a DTAA treaty with India, then the employee in India, though he is a resident, can claim a deduction in India, specific to the taxes paid by him abroad.

Do you find ESOP to be rewarding but complex to understand? Our in-house financial planners have vast experience helping clients with ESOP planning and we can make your journey to wealth creation with ESOP easy and hassle-free.