As we wrap up the year, it gives us the opportunity to reflect on what asset classes worked for investors in 2024. Despite all the volatility of late, equity has been a wealth creator. It’s of little surprise that the precious metal trade worked well too. What has gone unnoticed is that fixed income has been a performing asset class. It’s only when we benchmark debt performance relative to other classes that the performance seems unimpressive. Yet, fixed income will be a winning investment in 2025. Here are 5 reasons why.

Equity Market Reset

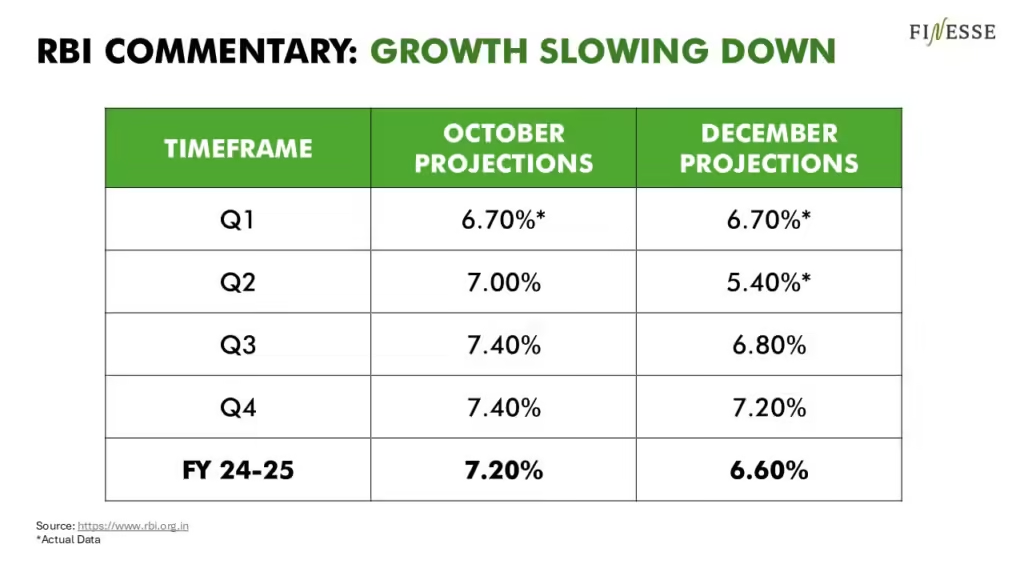

First off, equity markets are heading into a reset. The last two quarterly numbers from Corporate India can be described as average. Investor expectations and business fundamentals have been on different pages for much of 2024. As the two reconcile, India could see more outflows from FIIs and DIIs and a moderation in valuations as well as return expectations. Moreover, India is moving into a lower growth environment with the latest projections from the RBI coming in lower. Clearly, businesses are heading into more challenging territory and it will not be easy for equity markets to replicate past successes.

Interest Rate Cycle

Our next element is the interest rate cycle. Globally, central banks have turned into the rate cut cycle with the Bank of Canada, Bank of England, the ECB, and the Federal Reserve in the lead. Central banks across the board are expecting a slower growth environment, more geopolitical challenges, and an inflation problem that is refusing to go away quickly. India is still navigating the twin risks of higher inflation and slowing growth. Growth is slowing down, but still is at an acceptable level for neutral policy.

Global Risk Off Sentiment

2024 was fraught with geopolitical risks. Many countries went into elections this year and the political landscape has evolved considerably. Investors expected a neck-to-neck outcome with US elections and a decisive Trump victory has put some concerns to rest. Globally the sentiment is risk off due to the endless friction in the Middle East, the potential trade war with China, and no clear resolution for the Russia-Ukraine dispute. With respect to the United States, Trump’s agenda is to keep America focused on Americans. His policies are likely to be inflationary and the pace of rate cuts in the US could decelerate. This would push more money into haven assets like gold and the dollar.

Domestic Macros

Back home, the one thing we’ve got right is our fiscal glide path. The government has been committed to bringing the fiscal deficit down. Our macroeconomic parameters look strong. If the RBI succeeds in its inflation targeting mandate and we keep on this path, India is poised for a rating upgrade. FIIs have already shown a keen interest in participating in our sovereign bonds, the inclusion in global indices has only increased appetite for Indian government bonds.

Credit Cycle

The RBI has been proactive in managing systemic risk in the Indian bond markets. It has issued early warnings on unsecured lending, it has placed restrictions on NBFCs ahead of any issues, and is keeping a close eye on the evolving dynamics. The RBI’s response has been measured and proactive. Credit spreads have started to widen, creating more windows of opportunity for investors to participate in.

Investment Strategy

Investors may look to fixed income as a stop gap solution for volatile equity markets. Or else, they may consider the cyclical and structural benefits of fixed income allocations when the interest rate and credit cycle is changing. There are a wide range of tools to achieve the desired allocation including mutual funds, bonds, and AIFs.