Ever caught yourself daydreaming about that brand-new iPhone, a quick weekend getaway, or even revamping your living room? We all have short-term goals that make life exciting, but the important question is: How do you fund them? Should you dip into your savings, swipe that shiny credit card, or take out a loan? Let’s dive into the options and figure out what makes the most sense for you.

Before we look at how to fund short-term financial goals, let us understand what short-term goals are.

Financial goals can be categorized based on their timeline: short, medium, and long-term. Short-term goals are those that need to be achieved either immediately or in the near future typically within three months to three years. Given their shorter timelines, these goals often take precedence and demand prompt action.

Some examples of short-term goals are building an emergency fund, buying a term life insurance, buying a health insurance, buying gadgets like mobile, PlayStation, TV; home renovations, saving for a house downpayment or enjoying a vacation with your family.

Among these, priorities should usually be given to the first three goals—emergency funds, term life insurance, and health insurance—as they form the foundation of your financial security. Planning for these with your own funds is generally recommended as part of comprehensive financial planning. Once these are in place, you can address the other short-term goals. Now that we have seen what short-term goals are, let us look at the options of financing them.

Savings: Your Financial Cushion

Savings are like that trusty old friend who’s always there for you. Dipping into your savings means you’re using money you already own, so there’s no debt hanging over your head. This option is often the safest, especially for short-term goals.

Illustrative Calculation: Saving for a short-term goal Let’s say your goal is to save ₹1,00,000 for a vacation in one year. You decide to invest in a recurring deposit with a bank offering a 6% annual interest rate, then you’d need to deposit approximately ₹8,100 to reach ₹1,00,000 in one year.

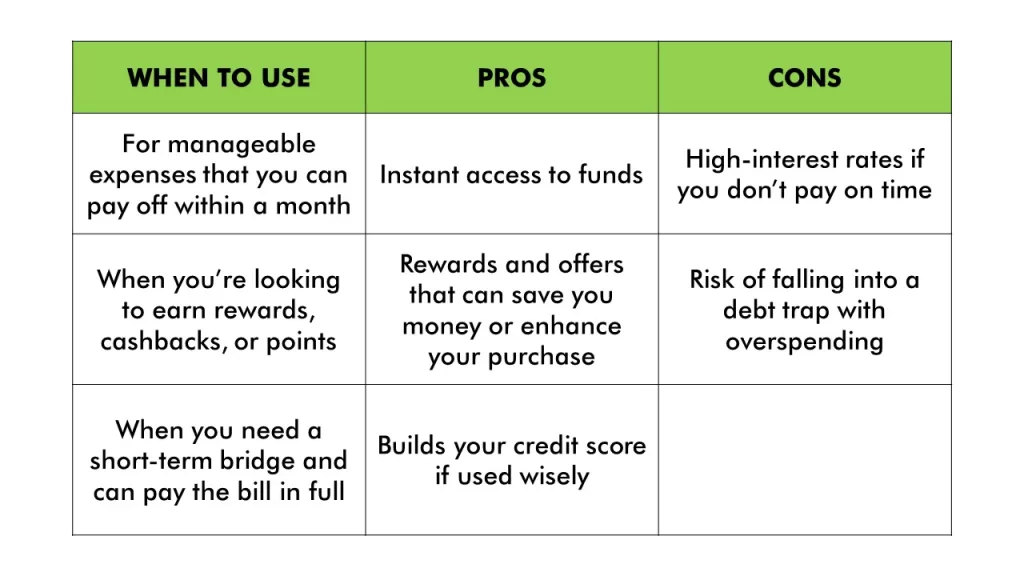

Credit Cards: Swipe, Pay, Repeat!

Credit cards can feel like a superpower when you swipe and walk away with what you want, no questions asked. But remember, with great power comes great responsibility! Credit cards are best used when you’re confident about paying off the balance quickly, ideally within the interest-free period.

Illustrative Calculation: Using a Credit Card Imagine you decide to use your credit card for a ₹1,00,000 vacation. If you pay the full amount within the interest-free period, there’s no additional cost. However, if you only pay the minimum due and carry the rest forward, the costs can escalate quickly.

Interest Rate: Most credit cards charge an interest rate of around 36% per annum (3% per month) on outstanding balances.

Monthly Interest Cost: On ₹1,00,000, that’s ₹3,000 in interest charges per month if you only pay the minimum due.

Total Cost Over 6 Months: If you take 6 months to pay off the full amount without converting it into an EMI, the total interest paid could be around ₹18,000, making the total cost ₹1,18,000.

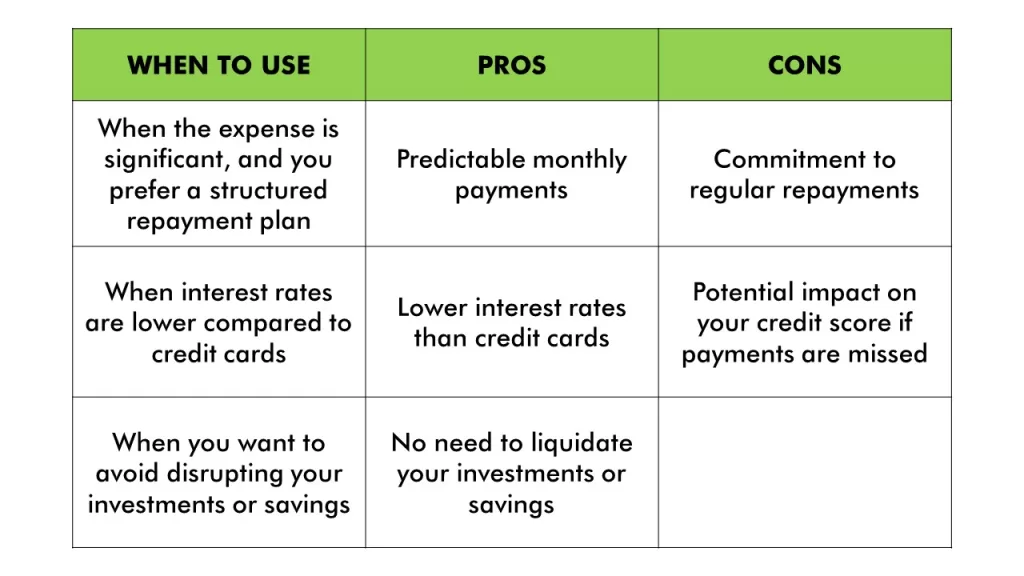

Loans: The Bigger Ask

Loans can be a more structured way of managing larger short-term goals—think home renovations or that dream vacation that costs a bit more. Personal loans offer flexibility with fixed repayment schedules and generally lower interest rates than credit cards.

Illustrative Calculation: Taking a personal loan Suppose you take a personal loan of ₹1,00,000 at a 12% annual interest rate for one year. The EMI would be approximately ₹8,885. Over 12 months, you’d pay about ₹1,06,620, making the total interest cost ₹6,620.

Deciding What’s Best for You

Here’s a quick thought exercise: Imagine a traffic light. Green is for savings, yellow for credit cards, and red for loans. For smaller, manageable expenses that you can fund directly, go green! For quick, repayable expenses with a perk, proceed with caution at yellow. And for bigger commitments that need structure, stop and assess red.

Key Takeaways:

Evaluate urgency and amount: Is it a want or a need? Can it wait?

Check your cash flow: Can you repay quickly without straining your budget?

Consider the cost of borrowing: Interest rates, fees, and potential penalties.

Remember, the smartest choice aligns with your financial health and peace of mind. Whether you’re saving, swiping, or signing a loan agreement, make sure it adds value to your life without complicating it.