In March, investors rushed to allocate money into fixed-income mutual funds due to a change in tax rules. The motivation behind these allocations had more to do with tax than merit.

The questions investors need to ask and answer in 2023 are:

-

-

- Is this the right time to invest in fixed income?

- Where do the investment opportunities lie?

- What is the best way to make fixed-income investments?

-

The answer to the first question is simple. Investors have few options before them: equity, gold, real estate, or fixed income. 2023 will be a tough year for equity in terms of performance but a brilliant year for participation. Gold is the best-performing asset of FY22-23. Investors must evaluate future performance potential and not latch onto what happened last year. Further, the tax change that applies to debt funds also applies to gold funds. With interest rates rising, real estate valuations should cool off. Returns from fixed income have improved significantly. On a relative and absolute level, allocations to fixed income make sense.

Finance Bill 2023

The Finance Bill changes how market-linked debentures and debt mutual funds will be taxed. Here’s a quick overview of how fixed-income investments are taxed going forward:

| Security | Interest Income Taxation | Capital Gains Taxation |

| Fixed Deposits | Slab rate every year | N/A |

| Debt Mutual Funds | N/A | Slab Rate on Sale |

| Market Linked Debentures | N/A | Slab Rate on Sale |

| Listed Bonds/ NCDs | Slab Rate | 10% for Long-Term (> 1 Year)

Slab Rate for Short-Term |

| Unlisted Bonds / NCDs | Slab Rate | 20% for Long Term (> 3 Year) ; Slab Rate for Short-Term |

The message of Budget 2023 is clear: investors should choose products based on merit rather than tax benefits. Yet, investors are chanting the old mantra of tax efficiency at any cost. This table summarizes how mutual funds will be taxed.

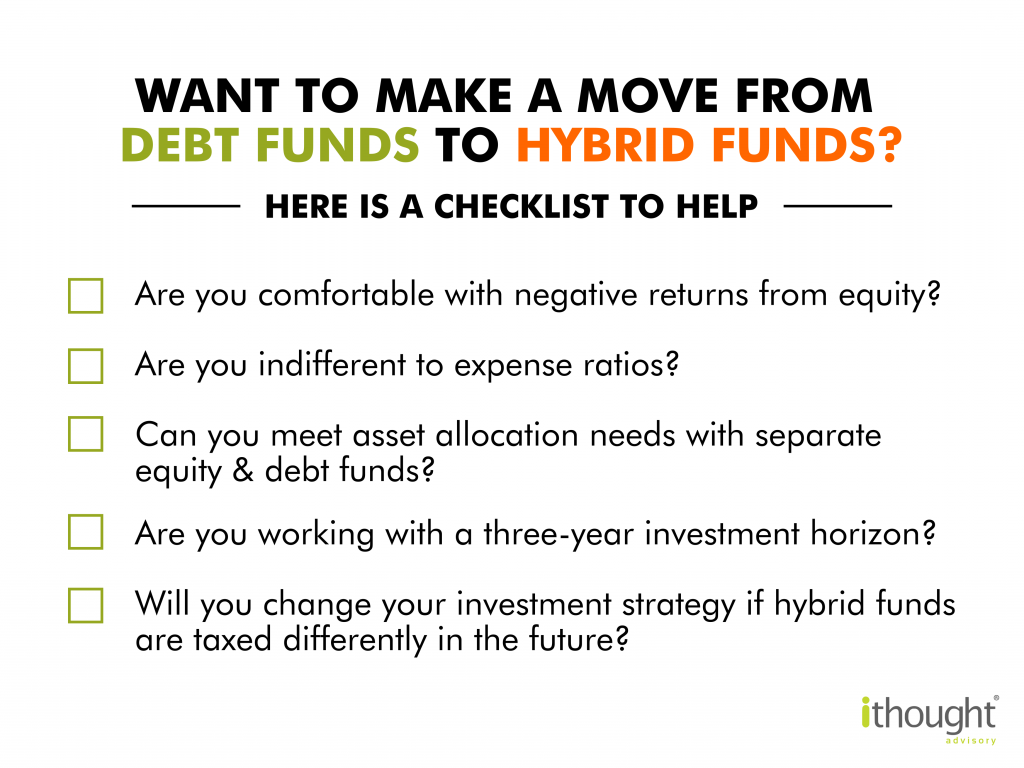

It seems like balanced hybrid funds are in the sweet spot. Investors get exposure to debt and equity within the same scheme, and long-term investments are eligible for indexation. What investors don’t know is:

-

-

- There are only a handful of schemes in this category

- The expense ratios are high

- Some schemes have long lock-in periods of 5 years

-

The industry is sure to launch newer products to compete in this category. The question is whether this is a sweet spot or a pain point. Here is a reflective checklist if you are considering moving away from debt funds to hybrid funds.

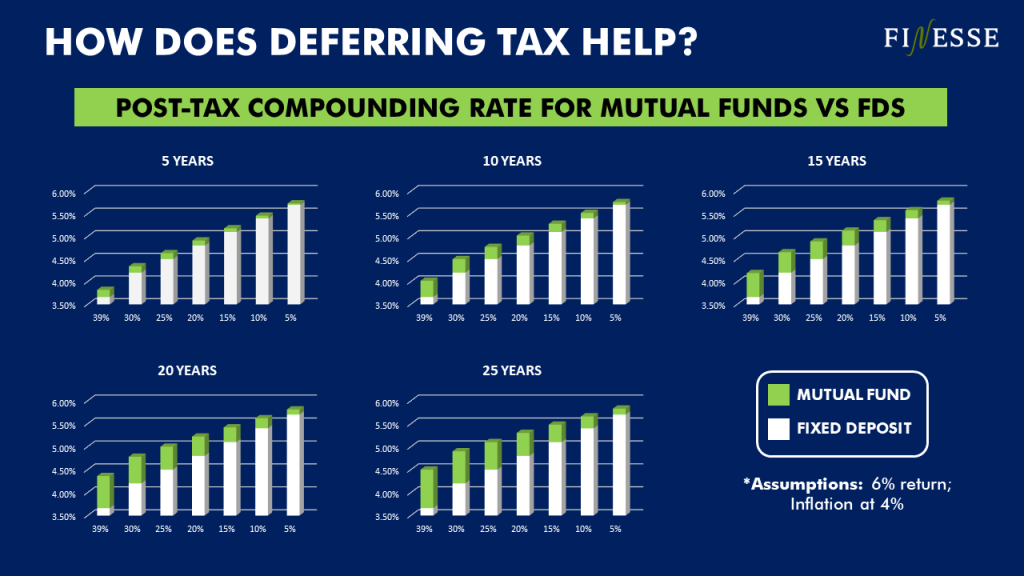

Fixed Deposits versus Mutual Funds?

Debt funds are taxed less attractively today than they were a month ago. But they are still taxed better than a fixed deposit. The key lies in the investor’s ability to defer taxes. On deposits, you pay tax every year regardless of whether or not you receive the income. With funds, you pay tax only when you sell your investment. At first, it may not seem like much, but every year makes a difference.

Why should buy and hold apply only to stocks? We’ve helped hundreds of investors make safe long-term investments.

Performing Credit

The Franklin fiasco taught us that taking credit risk in mutual funds is like walking on thin ice. AIFs and bonds certainly offer a better way to play credit. Here is a comparison:

| Parameter | AIF | Bonds |

| Concentration Risk | Managed within the fund | Managed by the investor |

| Minimum Investment | Rs. 1 Crore | Rs. 5 Lakhs – Rs. 10 Lakhs |

| Credit Ratings | A and below / Unrated | AAA-BBB |

| Structure | Covenants are customised | Issuer specific |

| Fees | High | Low |

The AIF route works for aggressive investors with a shorter investment time frame seeking higher returns with larger sums of capital and willing to pay higher fees. The bond route works for investors with a lower risk appetite and a need for higher portfolio control.

RBI Monetary Policy Meeting

The governor summarised the policy in one sentence “It’s a pause, not a pivot.” The RBI is still wary of inflation. It knows that the external environment is dynamic, and that global growth is slowing down. A pause reflects the RBI’s approach: wait and respond.

Here are the highlights from the RBI Monetary Policy Meeting – April 2023.

The good news is that in a year filled with uncertainty, investors will be spoilt for choice.