Wrapping up the last quarter

A lot can happen in 3 months, let’s do a quick recap! This is an overview of:

- Mutual Fund Updates

- Flows in Mutual Funds

- Corporate Actions

- Global Monetary Policy,

- The Markets

- Global Headlines, and

- Tax

Mutual Fund Updates

Sebi had allowed mutual funds to introduce six new categories under ESG schemes namely- exclusion, integration, best-in-class and positive screening, impact investing, transition-related, and sustainable objectives.

Nirmala Sitharaman launched a backstop facility called Corporate Debt Market Development Fund, for debt MF Schemes to anchor liquidity during hard times and thereby induce confidence among the participants.

LIC MF had acquired schemes of IDBI MF. Half of the schemes of IDBI MF were merged with the existing schemes of LIC MF, while the remaining schemes were added to the LIC MF basket.

Inflows in Equity Mutual Fund Schemes

| Month | Inflow (in crores) |

| July 2023 | 7,625.96 |

| August 2023 | 20,245.00 |

| September 2023 | 14,091.26 |

The SIP contribution for August 2023 reached an all-time high of ₹15,813 Crores.

In September, there was a net outflow of Rs.1.01 Lakh Crores in Debt Mutual Funds. This decline could be attributed to advance tax requirements.

Corporate Actions

Following the merger of HDFC Ltd. and HDFC Bank in July, HDFC Bank became the largest bank in terms of market size in India, and the fourth largest in the world.

In July, ITC announced the demerger of its resort and hotel business.

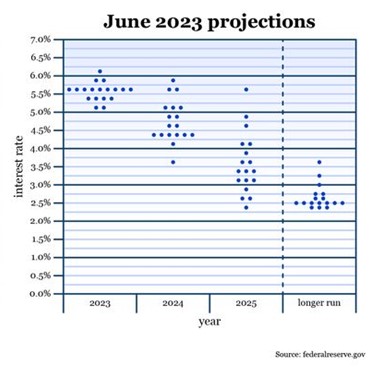

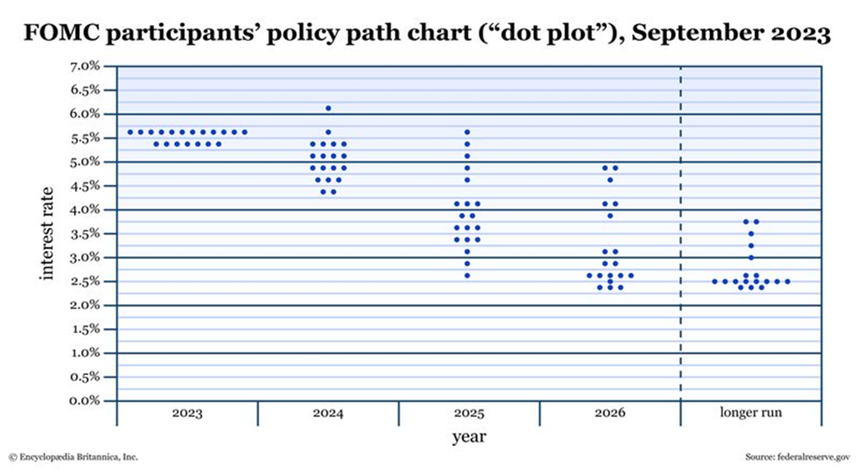

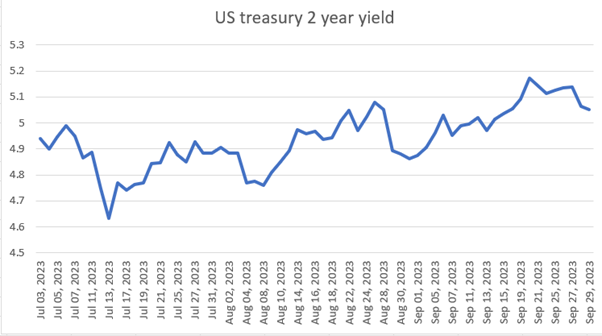

Global Monetary Policy

| Fed | RBI | |

| Stance | Wait and watch till data slows down | Resolute to commitment in aligning inflation to the 4% target |

| Interest rate | Raised interest rates by 0.25% | Interest rates unchanged at 6.5% |

| Commentary | could impose a 0.25% rate hike by the end of this year | 1.withdrawal of accommodation to suck out surplus liquidity2. discontinue ICRR in a gradual manner |

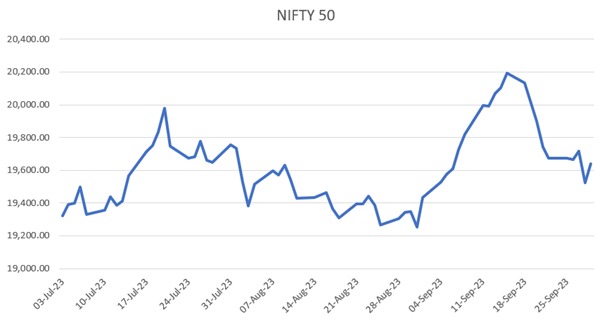

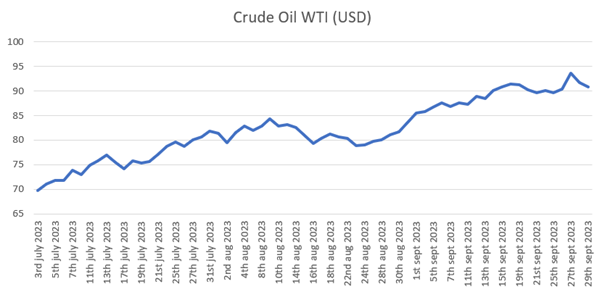

The Markets

Movement in the NIFTY 50 index

Movement in Crude Oil WTI prices through the quarter in USD

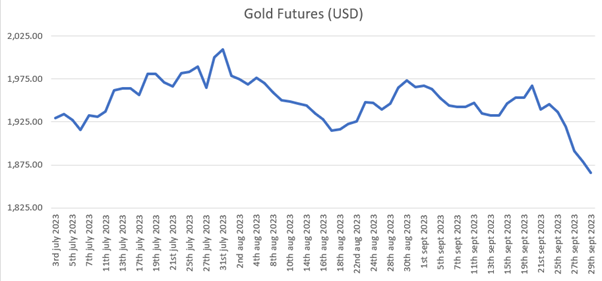

Movement in Gold prices through the quarter

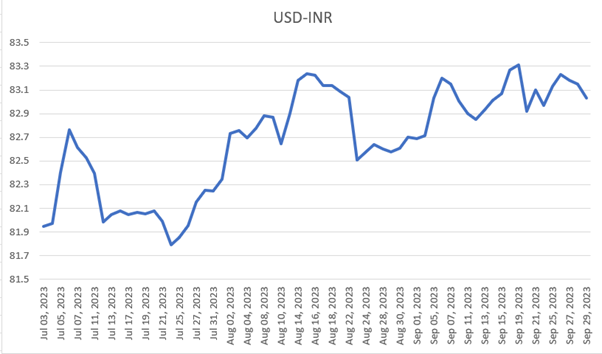

Movement in USD-INR exchange rate through the quarter

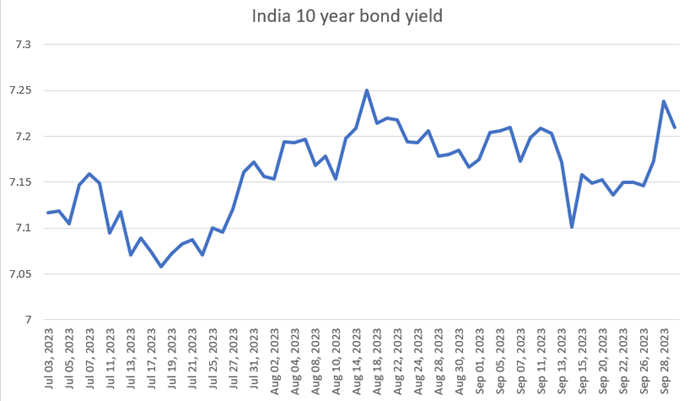

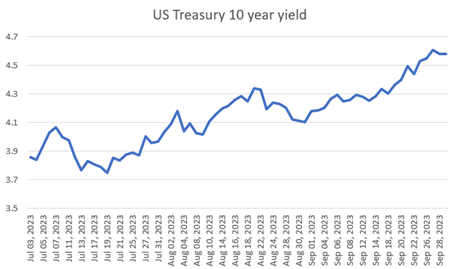

JP Morgan’s Bond Index Inclusion

JPMorgan Chase & Co. on September 22, 2023, said it would incorporate Indian government bonds into the Government Bond Index-Emerging Markets (GBI-EM) index from June 2024 for a period of 10 months, which could bring $23 billion worth inflows into the country.

Global Headlines

Fitch downgraded the US rating from AAA to AA+

Fitch remarked that over the last 20 years, there has been a steady deterioration in governances standards and fiscal discipline. This could culminate to fiscal deterioration over the next few years warranting a downgrade in credit rating.

BRICS announced that it would add 6 new members

BRICS announced – Iran, Saudi Arabia, Egypt, UAE, Argentina, and Ethiopia will join and will be granted full membership on Jan 1st, 2024. Speculations on a common gold-backed currency was doing the rounds this quarter.

G20 meeting

The G20 is an intergovernmental forum working towards resolving international economic issues and focusing on sustainable development.

India hosted the 18th G20 meeting on 9th and 10th September, 2023 at New Delhi. Highlights as follows:

The India Middle East Europe Economic Corridor (IMEC) which serves as a transnational rail and shipping route across Asia, the Arabian Gulf, and Europe.

The Global Biofuel Alliance will play a pivotal role in ensuring a sustainable green future, greenhouse gas reduction, and reshaping trade.

The Energy Transitions working group met in Goa from July 19-22nd to discuss challenges regarding the imminent threat of climate change, and policy actions and energy transitions aligned with achieving Sustainable Development Goals.

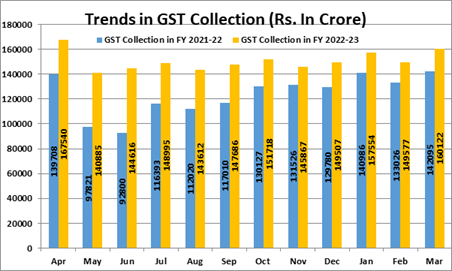

Tax: This Month It’s Different

- The Indian government released the final rules for Angel tax, which levies a 30% tax on unlisted companies that issues shares at a price higher than their fair market value from September 25,2023

- 28% GST will be levied on online gaming from October 1

- As per the budgetary announcement, the Tax Collection at Source (TCS) rates at 20% on payments with a threshold limit of 7 lakh under the Liberalized remittance scheme will be levied from October 1, but was initially supposed to be implemented from July 1, 2023.

Source: Press Information Bureau

This is what happened last quarter. What do you think will happen in this quarter?